Sales, Gas and Excise Taxes

An Anti-Affordability Agenda: Trump’s Advisors Call on States to Raise Taxes on the Working Class and Drastically Cut Taxes for the Rich

January 29, 2026 • By Carl Davis

The Trump administration’s Council of Economic Advisors suggests that states consider drastically raising sales taxes and using those new revenues to pay for repealing taxes on corporate and personal income. Working-class families would face dramatic tax increases while the nation’s wealthiest families would see their state tax bills plummet.

Historical State Tax Rate Data

January 14, 2026 • By ITEP Staff

Download the Data Overview This historical dataset of state tax rates includes data on top personal income tax rates, top corporate income tax rates, and sales tax rates for all 50 states and the District of Columbia, back to the adoption of modern forms of state taxation at the start of the 20th century. The […]

In 2025, Voters Said Yes to Public Resources and Community Investments

November 6, 2025 • By Rita Jefferson

Important tax measures were on the ballot this week, and the outcomes are clear: many voters support new state and local spending to support critical services in their communities.

Sales Tax Holidays Miss the Mark When it Comes to Effective Sales Tax Reform

July 17, 2025 • By Miles Trinidad

Sales tax holidays are often marketed as relief for everyday families, but they do little to address the deeper inequities of regressive sales taxes. In 2025, 18 states offer these holidays at a collective cost of $1.3 billion.

Two in Three Americans Live in States with Variable-Rate Gas Taxes

July 16, 2025 • By Carl Davis

As inflation and fuel efficiency undercut traditional gas tax revenue, many states are rethinking how they fund transportation. Lawmakers across the country are beginning to modernize outdated gas tax systems to keep pace with rising infrastructure costs and changing driving habits.

Policymakers Unwisely Propose Cutting Property Taxes in Favor of Sales Taxes

January 14, 2025 • By Rita Jefferson

Lawmakers across the country are taking aim at property taxes with a new strategy: raising sales taxes instead. Doing so would create a regressive tax shift that puts unfair burdens on renters and reduces the strength of local government revenues.

Average Louisianans Will Pay for Gov. Landry’s Tax Break for the Rich

November 26, 2024 • By Neva Butkus

Tax cuts for the wealthy and corporations will not make Louisiana more competitive. Rather, they will blow a hole in the state budget while asking low- and middle-income working families to make up the difference. Gov. Landry and the Louisiana legislature would make much better use of their time looking for ways to make Louisiana’s tax structure fairer and more capable of adequately funding important priorities.

Taxing Transportation Is One Great Way to Reduce Carbon Emissions

November 12, 2024 • By Amy Hanauer

Federal, state, and local tax codes are important but underused tools that can create a more climate-resilient, less carbon-emitting America. A modernized tax code would stop subsidizing emissions and instead encourage lower-carbon design. Because cars and trucks produce roughly one-fourth of US greenhouse gas emissions, transportation taxation is a great starting point.

2024 State Tax Ballot Questions: Voters to Weigh in on Tax Changes Big and Small

October 17, 2024 • By Jon Whiten

As we approach November’s election, voters in several states will be weighing in on tax policy changes. The outcomes will impact the equity of state and local tax systems and the adequacy of the revenue those systems are able to raise to fund public services.

Sales Tax Holidays Miss the Mark When it Comes to Effective Sales Tax Reform

August 6, 2024 • By Marco Guzman

Nineteen states have sales tax holidays on the books in 2024. These suspensions combined will cost states and localities over $1.3 billion in lost revenue this year. Sales tax holidays are poorly targeted and too temporary to meaningfully change the regressive nature of a state’s tax system.

Major tax cuts were largely rejected this year, but states continue to chip away at income taxes. And while property tax cuts were a hot topic across the country, many states failed to deliver effective solutions to affordability issues.

Key Findings For families of modest means, California is not a high-tax state. California taxes are close to the national average for families in the bottom 80 percent of the income scale. For the bottom 40 percent of families, California taxes are lower than states like Florida and Texas. The highest earners usually pay higher […]

Eliminating Indiana’s Income Tax Would Jeopardize Public Services & Create a Windfall for the Well-Off

October 19, 2023 • By Neva Butkus

Meaningful investments in Indiana’s future require a smart, and fair, tax code that recognizes current economic realities and can raise a sustainable stream of funding from those most able to pay.

A Lot for A Little: Gimmicky Sales Tax Holidays Are an Ineffective Substitute for Real Sales Tax Reform

August 3, 2023 • By Marco Guzman

This year, 19 states will forgo a combined $1.6 billion in tax revenue on sales tax holidays—politically popular, yet ultimately ineffective gimmicks with minimal benefits and significant downsides.

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

August 2, 2023 • By Marco Guzman

Nineteen states have sales tax holidays on the books in 2023, and these suspensions will cost nearly $1.6 billion in lost revenue this year. Sales tax holidays are poorly targeted and too temporary to meaningfully change the regressive nature of a state’s tax system. Overall, the benefits of sales tax holidays are minimal while their downsides are significant.

New ITEP Brief Shows How State Sales Tax Holidays Fail to Live Up to the Hype

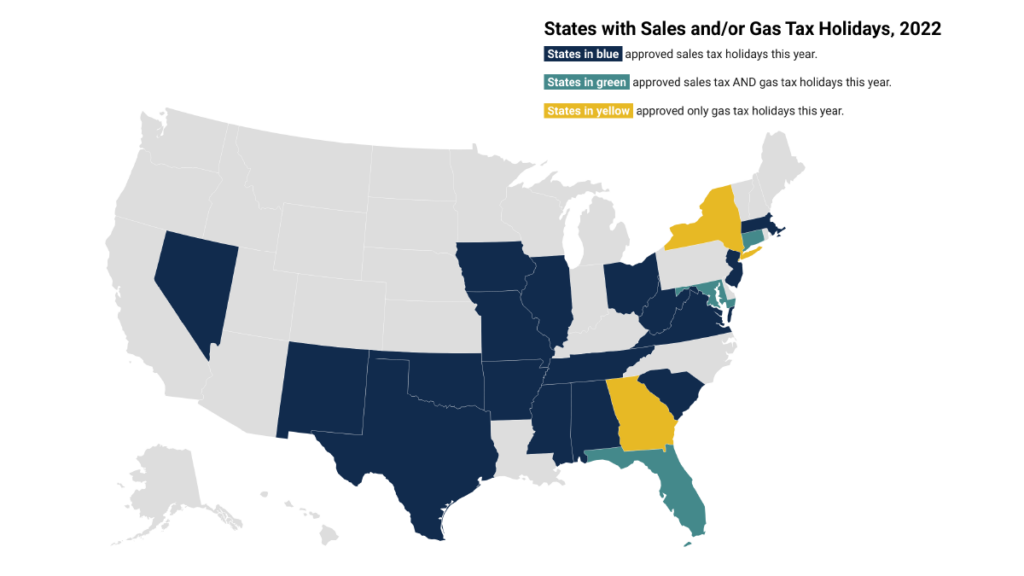

July 20, 2022 • By Marco Guzman

Twenty states this year have decided to go so far as to forgo a combined $1 billion in vital tax revenue in favor of conveniently popular yet ultimately ineffective sales tax holidays. Whether it’s a state looking for a way to help families manage the rising cost of goods or to celebrate back-to-school shopping season, these policy options are poorly targeted and an inadequate use of state tax revenue that could be doing more to make childcare more affordable, health care more accessible and high-quality education available to everyone.

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 20, 2022 • By Marco Guzman

Lawmakers in many states have enacted “sales tax holidays” (20 states will hold them in 2022) to temporarily suspend the tax on purchases of clothing, school supplies, and other items. These holidays may seem to lessen the regressive impacts of the sales tax, but their benefits are minimal while their downsides are significant—particularly as lawmakers have sought to apply the concept as a substitute for more meaningful, permanent reform or arbitrarily reward people with specific hobbies or in certain professions. This policy brief looks at sales tax holidays as a tax reduction device.

Cannabis Taxes Outraised Alcohol by 20 Percent in States with Legal Sales Last Year

April 19, 2022 • By Carl Davis

In 2021, the 11 states that allowed legal sales within their borders raised nearly $3 billion in cannabis excise tax revenue, an increase of 33 percent compared to a year earlier. While the tax remains a small part of state budgets, it’s beginning to eclipse other “sin taxes” that states have long had on the books.

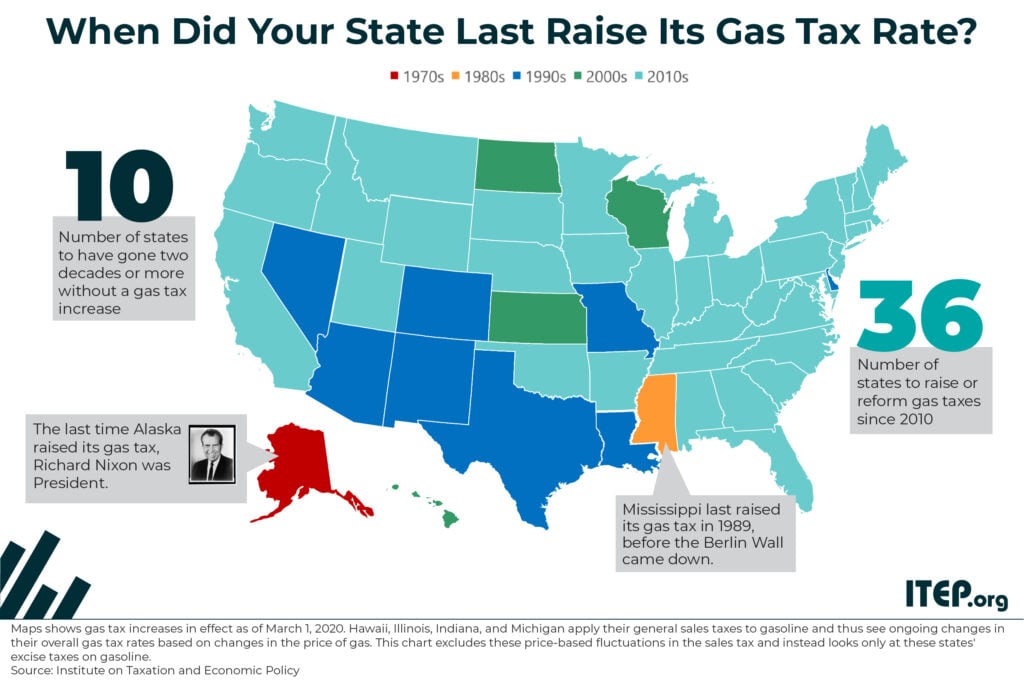

Many state governments are struggling to repair and expand their transportation infrastructure because they are attempting to cover the rising cost of asphalt, machinery, and other construction materials with fixed-rate gasoline taxes that are rarely increased.

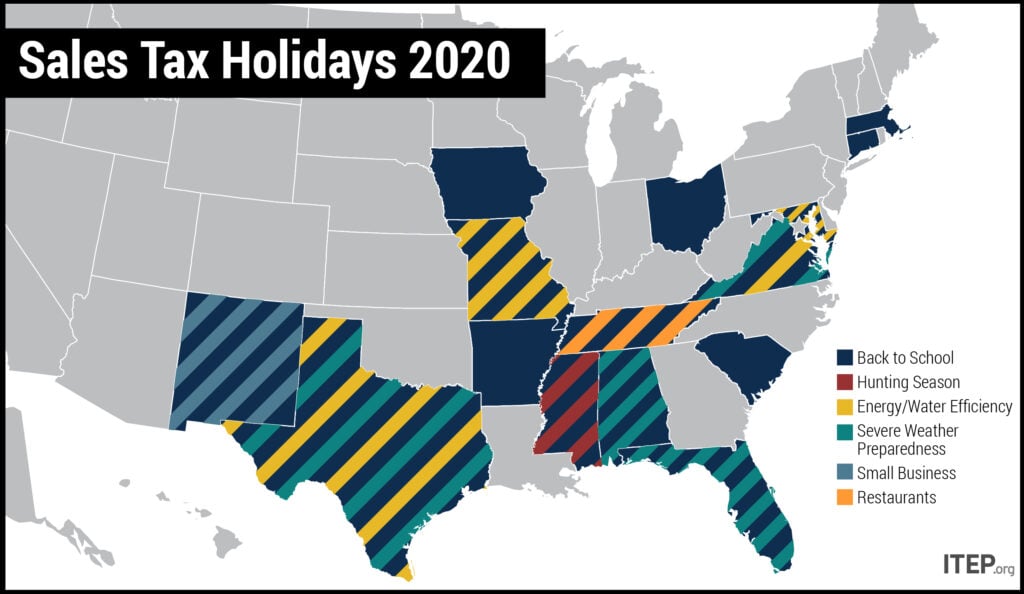

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 29, 2020 • By Dylan Grundman O'Neill

Lawmakers in many states have enacted “sales tax holidays” (16 states will hold them in 2020) to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. These holidays may seem to lessen the regressive impacts of the sales tax, but their benefits are minimal while their downsides are significant—and amplified in the context of the COVID-19 pandemic. This policy brief looks at sales tax holidays as a tax reduction device.

Sales Tax Policy in a Pandemic: Exemptions for Digital Goods and Services Are More Outdated Than Ever

April 29, 2020 • By Estefan Hernandez Escoto

Many states are making the decline in sales tax collection worse by failing to apply their sales taxes to digital goods (such as downloads of music, movies, or software) and services (such as digital streaming). A state that taxes movie theater tickets but not digital streaming, for instance, is needlessly hastening the decline of its own sales tax.

Sales Taxes and Social Distancing: State and Local Governments May Face Their Steepest Sales Tax Decline Ever

April 2, 2020 • By Carl Davis, ITEP Staff, Meg Wiehe

One pressing question is what will an economic downturn in which consumers are anxious, facing job loss, or simply spending their time sheltering in place and not spending money in typical ways, mean for states’ ability to raise revenue?

Alaska’s tax system underwent major changes in the 1970s when oil was found at Prudhoe Bay. Lawmakers repealed the state’s personal income tax (making Alaska the only state ever to do so) and began balancing the state’s budget primarily with oil tax and royalty revenue instead. But as oil prices and production levels have declined, a yawning gap has opened between state revenues and the cost of providing vital public services.

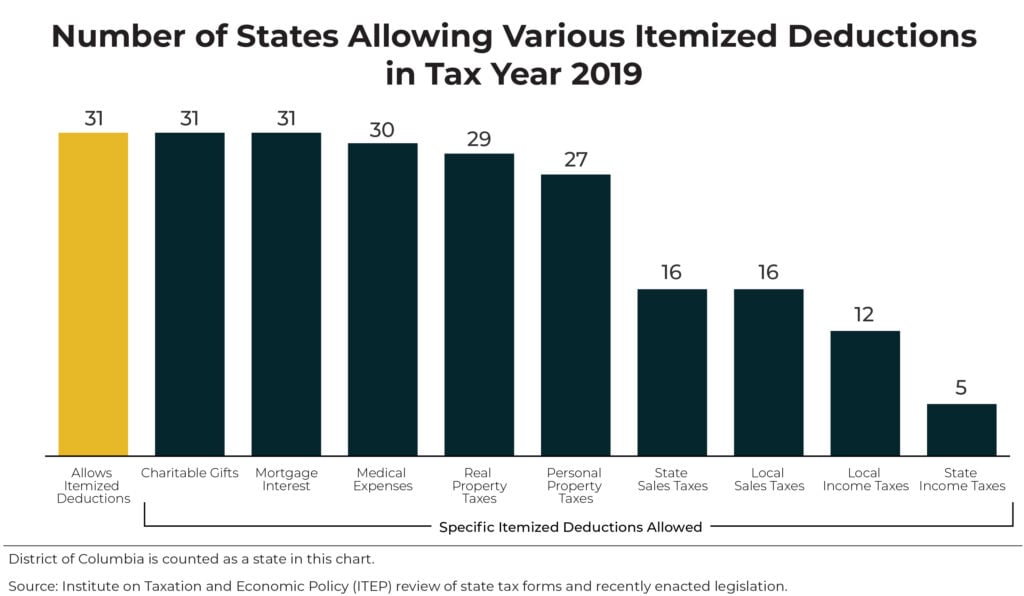

States Can Make Their Tax Systems Less Regressive by Reforming or Repealing Itemized Deductions

February 5, 2020 • By Carl Davis

Itemized deductions are problematic tax subsidies that need to close. The mortgage interest deduction, for instance, is often lauded as a way to help middle-class families afford homes and charitable deductions are touted as incentivizing gifts to charitable organizations. But the dirty little secret is that itemized deductions primarily benefit higher-income households while largely failing to achieve their purported goals.

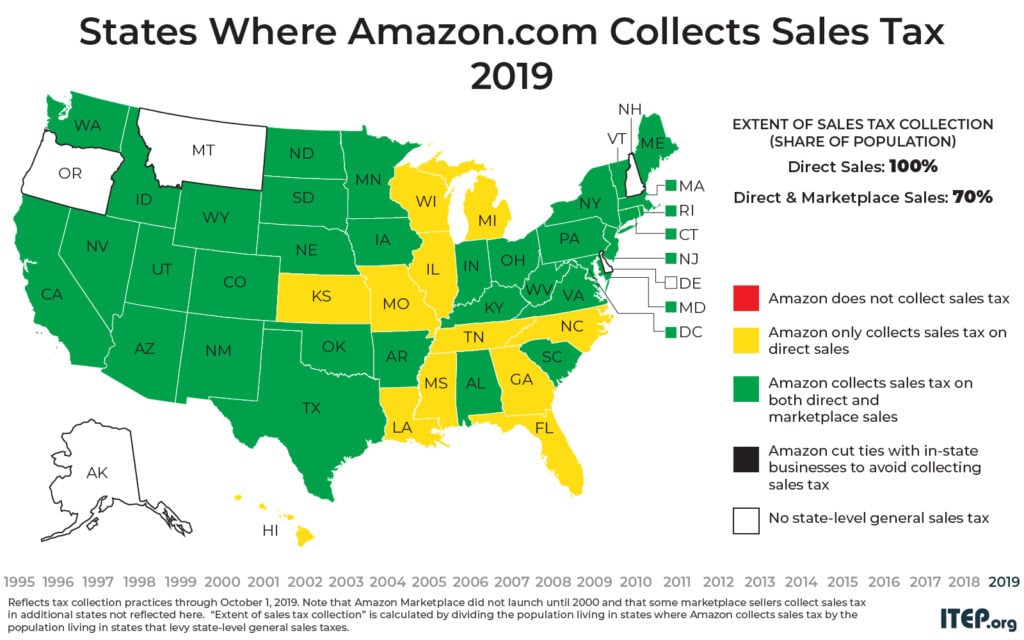

A Lump of Coal for 12 States Not Collecting Marketplace Sales Taxes this Holiday Season

November 25, 2019 • By Carl Davis

The last few years have brought major improvements in how states enforce their sales tax laws on purchases made over the Internet. Less than a decade ago, e-retailers almost never collected the sales taxes owed by their customers. The result was a multi-billion dollar drain on state coffers and a competitive disadvantage for local businesses. But this holiday season looks a bit different.

Sales, excise, and gas taxes are an important source of revenue for states. The sales tax, in fact accounts for half of all state tax revenue. Forty-five states levy broad-based sales taxes, every state levies at least some type of tax on consumption, and all states have a tax on gasoline. But these taxes aren’t without problems.

Sales taxes are inherently regressive—requiring lower- and middle-income taxpayers to spend a larger share of their household budgets in tax than their wealthier neighbors. The gas tax provides funding for infrastructure, but many states have not modernized their gas tax, meaning it no longer raises adequate revenue. ITEP resources on sales, excise and gas taxes provide general and state-specific information about the mechanics of these taxes and options for reform.