Taxing Wealth and Income from Wealth

How the Inflation Reduction Act’s Tax Reforms Can Help Close the Racial Wealth Gap

September 20, 2022 • By Brakeyshia Samms, Joe Hughes

Lawmakers have many opportunities to pass reforms that will make our tax code fairer and further reduce racial inequity in our economy. The Inflation Reduction Act is a great step forward; better taxing wealth and income from wealth and expanding targeted refundable tax credits would build on this progress.

Billionaires Should Pay Taxes on Their Income Every Year Like the Rest of Us

September 13, 2022 • By Steve Wamhoff

The Inflation Reduction Act signed by President Biden last month will crack down on corporate tax dodgers and strengthen enforcement of tax laws already on the books, raising hundreds of billions of dollars to be spent on climate, health and other priorities. But these reforms will not directly raise taxes on even the wealthiest individuals. […]

Revenue-Raising Proposals in President Biden’s Fiscal Year 2023 Budget Plan

April 26, 2022 • By Steve Wamhoff

President Biden's latest budget plan includes proposals that would raise $2.5 trillion in new revenue. While many of these reforms appeared in his previous budget, some of them are brand new, such as his proposal to prevent basis-shifting in partnerships and his Billionaires Minimum Income Tax.

President Biden’s Proposed Billionaires’ Minimum Income Tax Would Ensure the Wealthiest Pay a Reasonable Amount of Income Tax

April 6, 2022 • By Steve Wamhoff

The Billionaires’ Minimum Income Tax included in President Biden's budget plan would limit an unfair tax break for capital gains income and complement proposals the president has offered previously to limit other tax breaks for capital gains.

Frequently Asked Questions and Concerns About the President Billionaires’ Minimum Income Tax

April 6, 2022 • By Steve Wamhoff

Find the answers to some frequently asked questions about President Biden's Billionaires’ Minimum Income Tax, which would limit very wealthy individuals’ ability to put off paying income taxes on capital gains until they sell assets.

In this country, wealthier than any other and wealthier than we’ve ever been, we can create a smarter, more equitable tax code that better taxes those most able to pay.

Revenue-Raising Proposals in the Evolving Build Back Better Debate

January 25, 2022 • By Steve Wamhoff

The United States needs to raise more tax revenue to fund investments in the American people. This revenue can be obtained with reforms that would require the richest and wealthiest Americans to pay their fair share to support the society that makes their fortunes possible.

America’s Richest Would Finally Pay Taxes on Most of Their Income Under Wyden’s Billionaires Income Tax

October 27, 2021 • By Steve Wamhoff

While the Ways and Means bill includes many helpful tax reforms, people like Jeff Bezos and Elon Musk would still pay an effective tax rate of zero percent on most of their income if it was enacted without this change. Sen. Wyden’s proposal would finally end this injustice.

Federal Tax Reform Would be a Step in the Right Direction for Millennials of Color

October 18, 2021 • By Brakeyshia Samms

Currently, millennials of color are worse off than their parents when it comes to wealth expectations. So, if one of the goals of federal policymakers is to reduce racial income and wealth disparities, the proposals outlined are a good start. Tax reforms included in the budget package making its way through Congress would help by boosting incomes and making raising children more affordable—two things that would help millennials of color thrive in today’s economy.

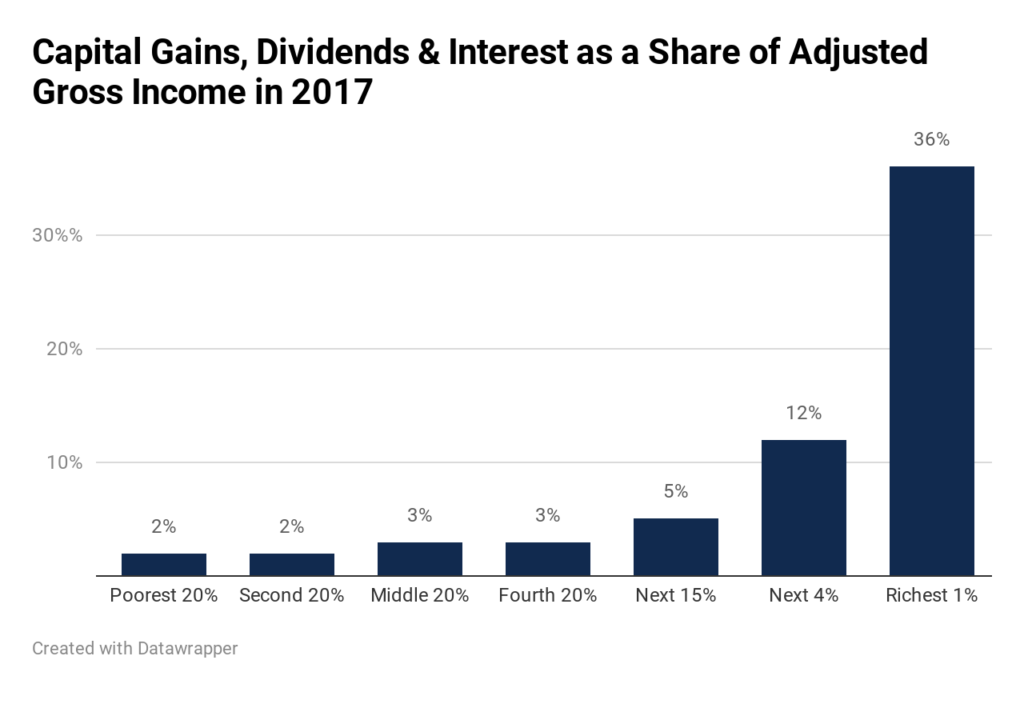

Investment Income and Racial Inequality

October 14, 2021 • By Emma Sifre, ITEP Staff, Joe Hughes

Congress has a historic opportunity to fix the way the preferential treatment of investment income widens the racial wealth gap and to strive toward a racially equitable tax code.

Limiting Tax Breaks for Capital Gains Would Mitigate the Racial Wealth Gap

October 14, 2021 • By Joe Hughes

The racial wealth and income gaps are the results of centuries of government policies favoring the accumulation of wealth among white communities while marginalizing communities of color. Policy solutions that are race-forward, meaning they remedy past and ongoing racial inequities, can also address broader social inequities.

The Billionaires’ Income Tax Is the Latest Proposal to Reform How We Tax Capital Gains

September 28, 2021 • By Steve Wamhoff

When people first hear about proposals to tax unrealized capital gains, they often ask, “Is this income, and if so, should we tax it?” The answers to those questions are “yes” and “yes, when we are talking about the very rich.”

Reforming Federal Capital Gains Taxes Would Benefit States, Too

September 28, 2021 • By Carl Davis

Congress’s action or inaction on federal tax changes under consideration in the Build Back Better plan could have important implications for states on many fronts. One critical area of note is at the foundation of income tax law: setting the definition of income that most states will use in administering their own income taxes.

House Ways and Means Provisions to Raise Revenue Would Significantly Improve Our Tax System But Fall Short of the President’s Plan

September 15, 2021 • By Steve Wamhoff

High-income people and corporations would pay more than they do today, which is a monumental change. But some wealthy billionaires like Jeff Bezos would continue to pay an effective rate of zero percent on most of their income, and American corporations would still have some incentives to shift profits offshore.

Income Tax Increases in the President’s American Families Plan

May 25, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

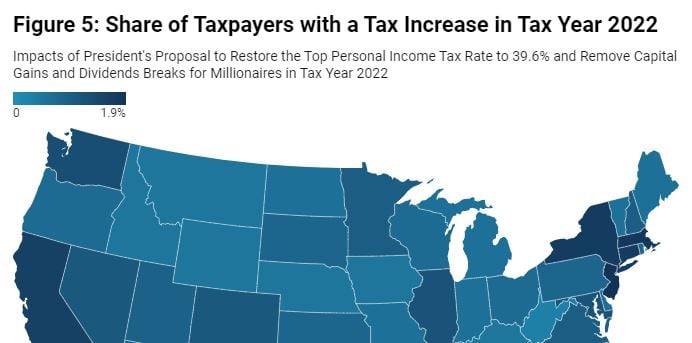

President Biden’s American Families Plan includes revenue-raising proposals that would affect only very high-income taxpayers.[1] The two most prominent of these proposals would restore the top personal income tax rate to 39.6 percent and eliminate tax breaks related to capital gains for millionaires. As this report explains, these proposals would affect less than 1 percent of taxpayers and would be confined almost exclusively to the richest 1 percent of Americans. The plan includes other tax increases that would also target the very well-off and would make our tax system fairer. It would raise additional revenue by more effectively enforcing tax…

Effects of the President’s Capital Gains and Dividends Tax Proposals by State

May 6, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

President Biden’s proposal to eliminate the lower income tax rate on capital gains (profits from selling assets) and stock dividends for millionaires would affect less than half of one percent (0.4 percent) of U.S. taxpayers if it goes into effect in 2022. The share of taxpayers affected would be less than 1 percent in every state.

A Proposal to Simplify President Biden’s Campaign Plan for Personal Income Taxes and Replace the Cap on SALT Deductions

April 8, 2021 • By Steve Wamhoff

In this paper, we describe a tax policy idea that would simplify the proposals President Biden presented during his campaign to raise personal income taxes for those with annual incomes greater than $400,000. Our proposal would replace the cap on state and local tax (SALT) deductions with a broader limit on tax breaks for the rich that would raise more revenue than the personal income tax hikes that Biden proposed during his campaign. Our proposal would also achieve Biden’s goals of setting the top rate at 39.6 percent and raising taxes only on those with income exceeding $400,000.

With the onslaught of news about billionaire wealth soaring while low- and moderate-income families have trouble making ends meet, a federal wealth tax makes good economic and fiscal sense—and the public supports it. One poll found that 64 percent of respondents favor the idea, including a majority of Republicans.

Should lawmakers enact laws that they believe are sensible and constitutional, or should they shape their legislative agenda around what they believe ideological Supreme Court justices will allow? This is a dilemma facing Americans who support a federal wealth tax.

Anti-tax activists’ convoluted claims that the rich pay too much in taxes broke new ground with an op-ed published last week in the Wall Street Journal. Penned by former Texas Sen. Phil Gramm and John Early, a former official of the Bureau of Labor Statistics, the piece is particularly misleading. The so-called evidence in support of their argument against raising taxes on the rich fails to correctly calculate effective tax rates.

How Democratic Presidential Candidates Would Raise Revenue

February 19, 2020 • By Steve Wamhoff

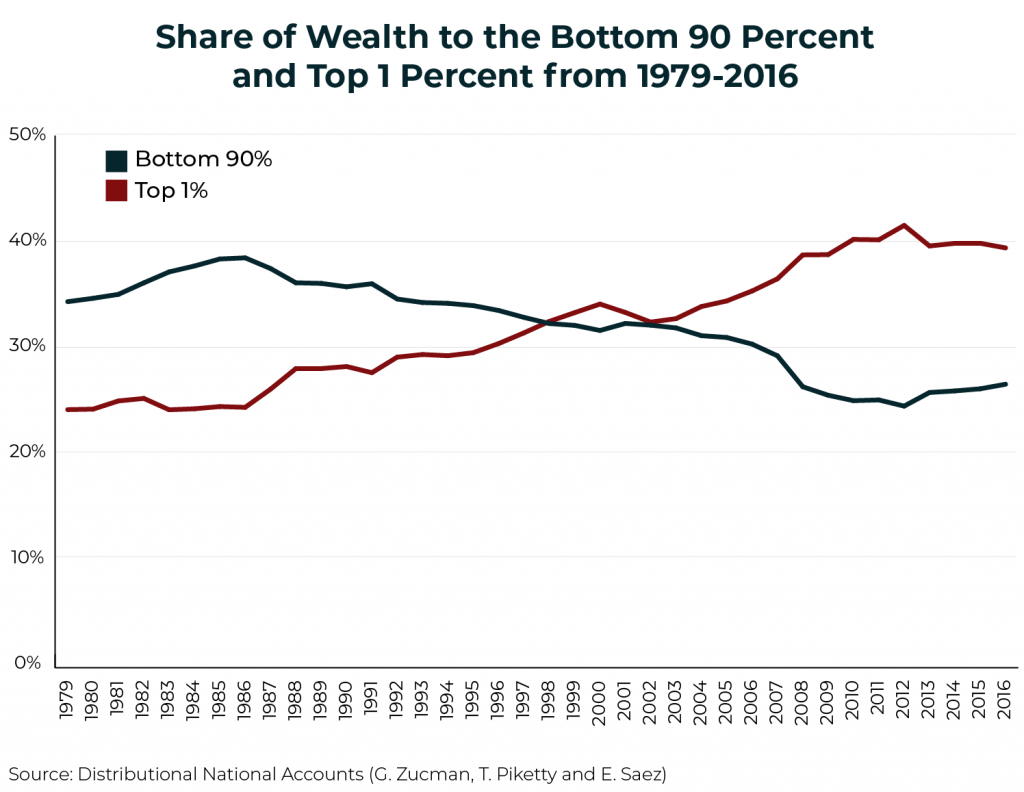

One of the biggest problems with the U.S. tax code in terms of fairness is that investment income, which mostly flows to the rich, is taxed less than the earned income that makes up all or almost all of the income that working people live on.

A basic understanding and idea of fairness is a trait we share with intelligent primates, which is precisely why more than two years ago as Congress was debating the Tax Cuts and Jobs Act, the American public disapproved of the tax bill.

Emmanuel Saez and Gabriel Zucman’s New Book Reminds Us that Tax Injustice Is a Choice

October 15, 2019 • By Steve Wamhoff

Cue Emmanuel Saez and Gabriel Zucman. In their new book, The Triumph of Injustice, the economists, who already jolted the world with their shocking data on exploding income inequality and wealth inequality, tell us to stop acting like we are paralyzed when it comes to tax policy. There are answers and solutions. And in about 200 surprisingly readable pages, they provide them.

A New York Times article explained that proponents of a federal wealth tax hope to address exploding inequality but then went on to list the fears of billionaires and economic policymakers, finding that “the idea of redistributing wealth by targeting billionaires is stirring fierce debates at the highest ranks of academia and business, with opponents arguing it would cripple economic growth, sap the motivation of entrepreneurs who aspire to be multimillionaires and set off a search for loopholes.” A wealth tax will not damage our economy and instead would likely improve it. Here’s why.

Wealth Tax Proposals from Warren and Sanders: What You Should Know

September 25, 2019 • By Steve Wamhoff

Earlier this year, Sen. Elizabeth Warren proposed a federal wealth tax on a handful of U.S. households with the highest net worth. Sen. Bernie Sanders has just announced his own wealth tax proposal, which is similar to Warren’s. A few other presidential candidates say they support the concept although they have not provided any details. Here's what you need to know about the potential for a federal wealth tax.

ITEP analyzes proposals to address the many special breaks in loopholes for income from wealth, such as capital gains and stock dividends. We also analyze the federal estate tax, which is a tax on wealth itself, as well as proposals to create a comprehensive federal wealth tax.