February 16, 2024

February 16, 2024

Two events this week highlighted the importance of the increased funding to the IRS under the 2022 Inflation Reduction Act (IRA).

First, the Government Accountability Office (GAO) – Congress’s official “watchdog,” responsible for ensuring government agencies are accountable to the American people – released a report examining the impact of audits on high-income individuals. The study found that the IRS can raise significant revenue through unpaid but legally owed taxes by auditing the most well-off households.

Second, IRS Commissioner Daniel Werfel testified to the House of Representatives’ main tax committee. In his testimony, Commissioner Werfel highlighted the successful implementation of new taxpayer services and increased audits of high-income individuals that were made possible through increased funding provided by the IRA.

The GAO report and Commissioner Werfel’s testimony highlight the value and necessity of a well-funded and functioning IRS. Most families and businesses do their best to pay taxes accurately and on time. The nation benefits from a modern revenue agency that can make this process as easy and simple as possible and identify complex tax schemes that deprive the country of revenues.

Despite this, some lawmakers have called for cuts to IRS funding. The first bill passed by the Republican House majority last January would have eliminated more than $70 billion in IRS funding and stalled or reversed the positive changes seen in the past two years. The bill would have been a significant drain on the federal budget as well, as the rescission would have led to an additional $186 billion in uncollected taxes. Meanwhile, honest taxpayers would have been left with an outdated, understaffed, and poorly functioning IRS.

GAO Points to Enormous Savings in Auditing High-Income Tax Cheats

The tax gap – or the amount of taxes that is legally owed but not collected – has grown to about $600 billion every year. More than half of that comes from the top 5 percent of taxpayers by income and a full 28 percent from just the top 1 percent. Congress unwisely spent decades cutting IRS funding, driving the agency closer and closer to failure. In 2011, the IRS audited 7.2 percent of million-dollar earners. By 2019, the audit rate had fallen to just 0.7 percent.

Since 2020, the agency has received several directives to lower the tax gap by increasing tax enforcement on high-income households and big, complex businesses. Most recently, the IRA provided $80 billion in additional funds to be spent over the following decade improving taxpayer services, modernizing business systems, and ensuring that multinational corporations and well-off families pay what they legally owe.

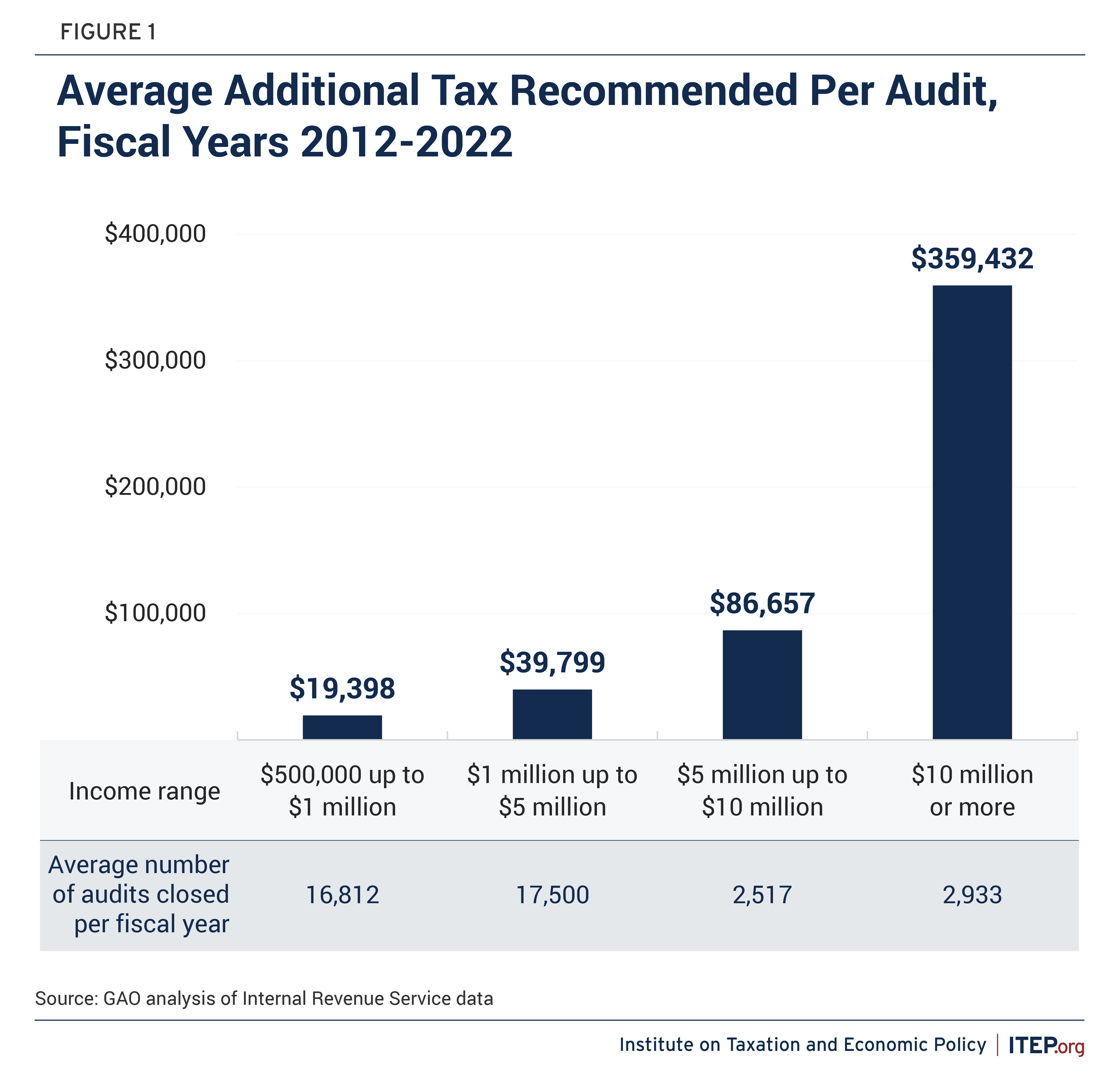

GAO examined the impacts of audits of households making $500,000 and up. The findings are astonishing. On average, each audit of a household earning more than $10 million resulted in the agency finding $359,432 in unpaid taxes. Even for households between $500,000 and $1 million, the average audit found nearly $20,000 in unpaid taxes. And this is all before the additional funding from the IRA, which increased the agency’s staff and technology systems to help dissect more complex, high-income tax returns.

It’s helpful to look toward the appendix of the report to put these numbers into perspective. GAO finds that for every hour spent auditing these returns, the IRS found thousands of dollars in unpaid taxes. For the most well-off families making $10 million or more, the IRS found $13,000 every hour. The hourly rate suggests the IRS could hire the most expensive tax accountants in the country and still come out positive. It is a return on investment that would leave Wall Street hedge fund managers drooling.

IRS Commissioner Confirms the Agency is Turning the Corner

In his testimony to Congress, IRS Commissioner Werfel – who took the job soon after the IRA funding was secured – assured lawmakers the agency is using the increased capacity to tackle the tax gap at the high end of the income distribution, as well as ensuring that all taxpayers have access to resources necessary to pay their taxes – and receive their refunds – quickly and accurately.

The agency is still in the process of building capacity, but the early signs are promising. In the past year, the IRS focused new enforcement efforts on individuals making more than $1 million. It collected half a billion dollars from fewer than 1,000 millionaires and billionaires. This indicates that as the agency’s capacity grows, it may even exceed the huge return on investment that GAO estimated. And of course, the agency is not only focusing on enforcement on high-income individuals but also expanding its ability to dissect the complex returns of large businesses with droves of accountants and billions in assets.

The expanded capacity is already resulting in fewer headaches for regular taxpayers, though the commissioner acknowledged the agency still has much work to do to reverse decades of underfunding. Prior to the IRA funding, the IRS satisfactorily resolved just 15 percent of phone calls. Last year, the trend reversed with 85 percent being resolved.

Two years ago, IRS walk-in centers were dreadfully understaffed and underfunded. Many closed altogether, and those that were open had grueling lines and wait times. The agency used the IRA funding to open or re-open 54 different in-person centers.

It also expanded digital capacity and implemented basic customer support that the private industry has utilized for years. Commissioner Werfel gave the example of the new scheduled callback option for taxpayers waiting more than 15 minutes to speak with the IRS. When phone wait times grow too long, the IRS now has the same ability as private call service centers to call customers back at a scheduled time. This is a no-brainer solution that Congress should have empowered the agency to implement years ago rather than cutting agency funds and allowing taxpayer support to deteriorate.

Lawmakers also gave great attention to the new direct file pilot program. This tax season, for the first time, taxpayers are able to file taxes online for free directly with the IRS. This is a much-needed expansion of the agency’s capability, as taxpayers currently pay private preparers billions of dollars annually and spend an average of 13 hours filing individual income tax returns.

Unfortunately, IRS direct file is not yet an option for taxpayers with more complicated types of income – including gig economy or business income – or for taxpayers wishing to itemize their deductions. It’s also only available this year in states with no income tax and in four other states – Arizona, California, Massachusetts, and New York – where the IRS has partnered with state agencies.

The final priority Commissioner Werfel highlighted is improving data security and cracking down on tax preparation and identity fraud scams that target honest taxpayers. As the agency is responsible for processing returns for hundreds of millions of Americans, most of which are electronic, it is essential for the agency to have the most up-to-date methods for protecting taxpayer privacy. Further, the agency is making increased efforts to stop tax scams, which largely involve private tax preparers retaining onerous portions of a family’s tax refund, or in the worst cases, putting families in legal and financial jeopardy by claiming credits on their behalf which they are not actually eligible to receive.

Paired together, the new GAO report and Commissioner Werfel’s testimony underline the real impact of the additional IRS funding and the necessity of maintaining funding in the future. For every $100 million cut from IRS, the country loses $600 million to tax cheats. And regular, hardworking Americans who try their best to pay their taxes correctly are left with long waits and headaches.