Education Tax Breaks

Re-Examining 529 Plans: Stopping State Subsidies to Private Schools After New Trump Tax Law

November 20, 2025 • By Miles Trinidad, Nick Johnson

The 2025 federal tax law risks making 529 plans more costly for states by increasing tax avoidance and allowing wealthy families to use these funds for private and religious K-12 schools.

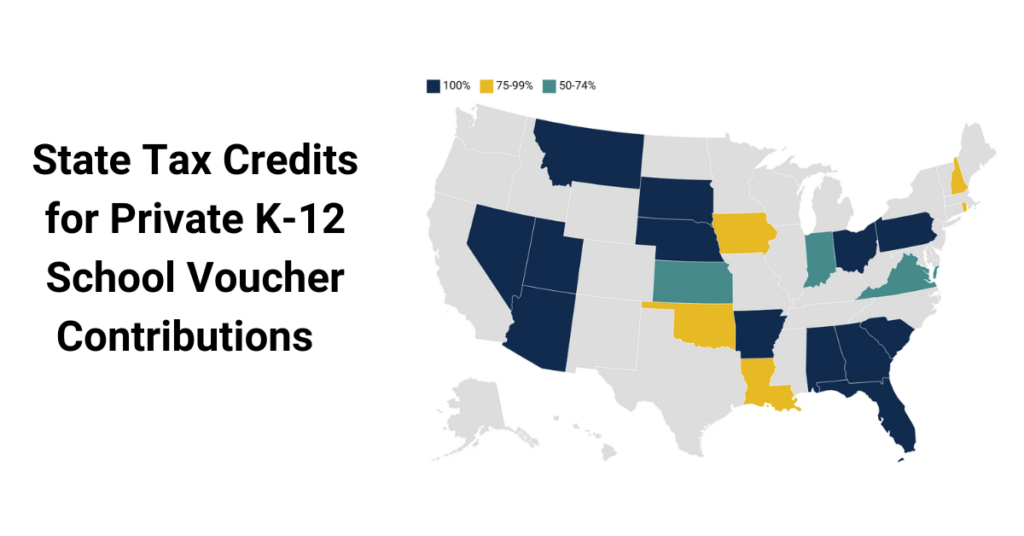

Does Your State Offer Tax Credits for Private K-12 School Voucher Contributions?

August 15, 2023 • By Carl Davis

Twenty-one states provide public support to private and religious K-12 schools through school voucher tax credits.

Illinois Voucher Tax Credits Don’t ‘Invest in Kids,’ They Invest in Inequality

June 12, 2023 • By Carl Davis

By allowing their school privatization tax credit to expire at the end of the year, Illinois lawmakers can take a meaningful step toward better tax and education policy, and a clear show of support for our nation’s public education system.

Wealthy families are overwhelmingly the ones using school voucher tax credits to opt out of paying for public education and other public services and to redirect their tax dollars to private and religious institutions instead. Most of these credits are being claimed by families with incomes over $200,000.

School’s In: Tackling College Affordability Through State Tax Codes

January 11, 2022 • By Brakeyshia Samms

Given that a sweeping federal solution to the college affordability crisis does not appear to be on the immediate horizon, it is even more important that states take whatever steps they can to expand college access and affordability. While most of that effort will need to occur on the spending side of the ledger—such as through lowering tuition costs, expanding financial aid, or perhaps even funding free college outright—tax policy also has a role to play.

A new IRS proposal could once again allow wealthy business owners to use state charitable tax credits–including tax credits for donating to support private and religious K-12 schools–to dodge the federal government’s $10,000 cap on state and local tax (SALT) deductions.

ITEP Comments and Recommendations on REG-107431-19

January 29, 2020 • By Carl Davis

Comments regarding the possibility that owners of passthrough businesses may be able to circumvent the $10,000 SALT deduction cap of section 164(b)(6) by recharacterizing the nondeductible portion of their state and local income tax payments as deductible expenses associated with carrying on a trade or business.

IRS’s SALT Workaround Regulations Should be Strengthened, Not Rejected

August 13, 2019 • By Carl Davis

Lawmakers are seeking to achieve a backdoor repeal of the $10,000 cap on deductions for state and local taxes paid (SALT) by invalidating recent IRS regulations that cracked down on schemes that let taxpayers dodge the cap. If successful, their efforts would drain tens of billions of dollars from federal coffers each year, with the vast majority of the benefits going to the nation’s wealthiest families.

New SALT Workaround Regulations Narrow a Tax Shelter, but Work Remains to Close it Entirely

June 11, 2019 • By Carl Davis

Today the Internal Revenue Service (IRS) released its final regulations cracking down on a tax shelter long favored by private and religious K-12 schools, and more recently adopted by some “blue state” lawmakers in the wake of the 2017 Trump tax cut. The regulations come more than a year after the IRS first announced the […]

After states implemented laws that allow taxpayers to circumvent the new $10,000 cap on deductions for state and local taxes (SALT), the IRS has proposed regulations to address this practice. It’s a safe bet the IRS will try to crack down on the newest policies that provide tax credits for donations to public education and other public services, but it remains to be seen whether new regulations will put an end to a longer-running practice of exploiting tax loopholes in some states that allow public money to be funneled to private schools.

What to Watch for When the IRS Releases Its SALT Workaround Regulations

April 1, 2019 • By Carl Davis

The Treasury Department and IRS last summer proposed regulations that would make it more difficult for taxpayers to avoid the $10,000 cap on deductions for state and local taxes (SALT). Now, likely days away from the unveiling of the final version of IRS regulations on SALT cap workarounds, Carl Davis recaps the finer points ITEP will be watching for when the regulations become public.

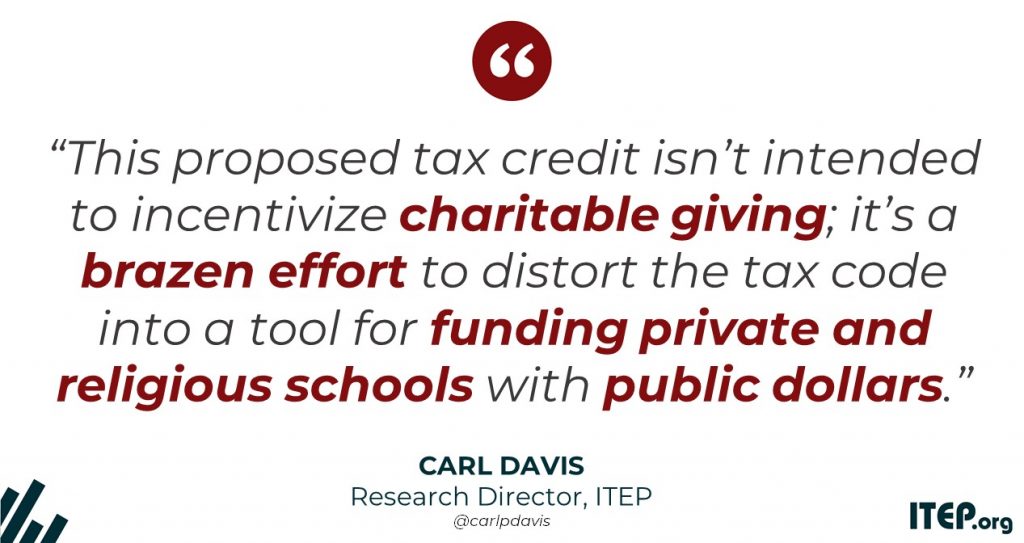

Education Department Tax Credit Proposal Would Undermine Public Schools

February 28, 2019 • By Carl Davis

The Education Department today announced a proposed new federal tax credit for so-called school choice. The $5 billion proposal would give those who donate to private school voucher programs a tax credit. Following is a statement by Carl Davis, research director at the Institute on Taxation and Economic Policy.

Comments to be delivered during IRS hearing on “Contributions in Exchange for State or Local Tax Credits” (REG-112176-18)

November 5, 2018 • By Carl Davis

ITEP views this proposal as a sensible improvement, and one that is actually overdue, to the way the charitable deduction is administered. At the end of my remarks I will discuss a few ways that the regulation could be improved. But the core point I want to emphasize is that the general approach taken here, where quid pro quo rules are applied in a broad-based fashion to all significant state and local tax credits, is the correct one.

ITEP Comments and Recommendations on Proposed Section 170 Regulation (REG-112176-18)

October 11, 2018 • By Carl Davis

The IRS recently proposed a commonsense improvement to the federal charitable deduction. If finalized, the regulation would prevent not just the newest workarounds to the $10,000 deduction for state and local taxes (SALT), but also a longer-running tax shelter abused by wealthy donors to private K-12 school voucher programs. ITEP has submitted official comments outlining four key recommendations related to the proposed regulation.

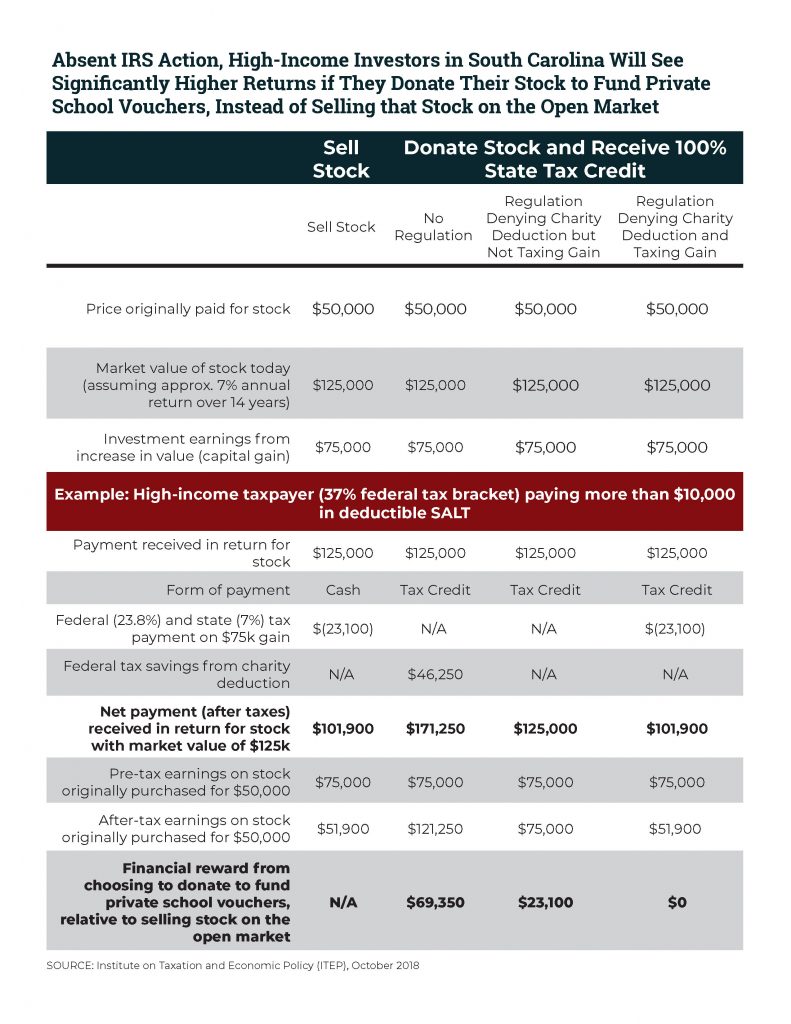

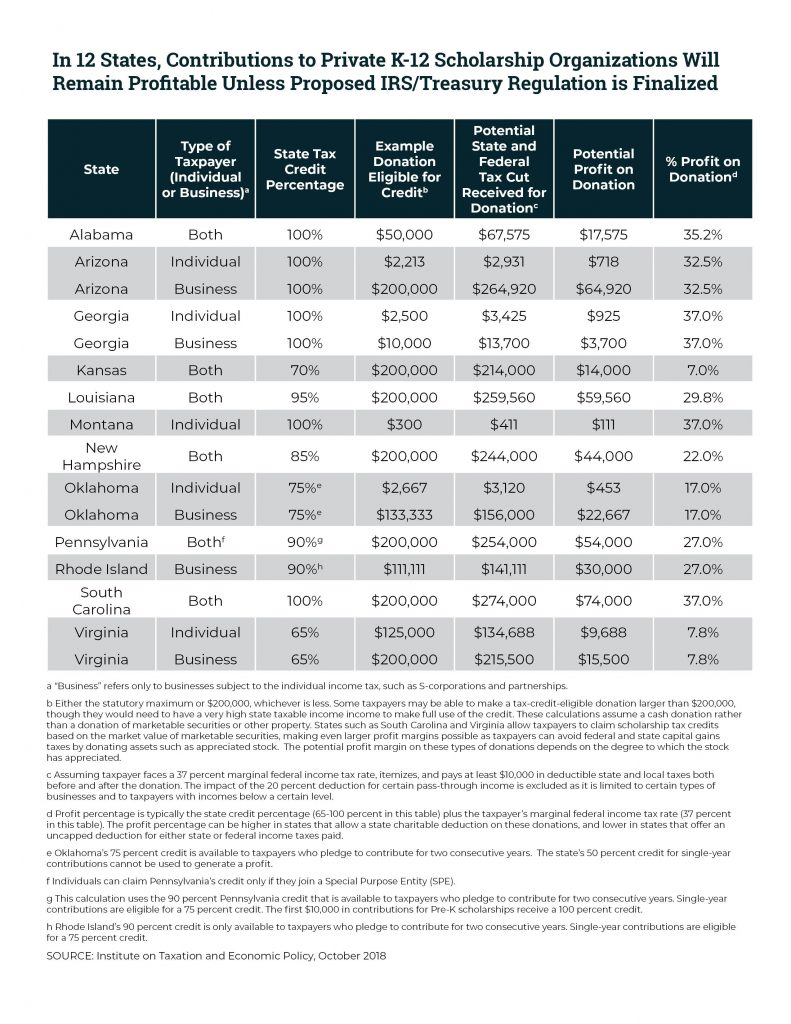

Twelve States Offer Profitable Tax Shelter to Private School Voucher Donors; IRS Proposal Could Fix This

October 2, 2018 • By Carl Davis

A proposed IRS regulation would eliminate a tax shelter for private school donors in twelve states by making a commonsense improvement to the federal tax deduction for charitable gifts. For years, some affluent taxpayers who donate to private K-12 school voucher programs have managed to turn a profit by claiming state tax credits and federal tax deductions that, taken together, are worth more than the amount donated. This practice could soon come to an end under the IRS’s broader goal of ending misuse of the charitable deduction by people seeking to dodge the federal SALT deduction cap.

IRS Reopens Tax Loophole Sought by Sen. Toomey, but it Won’t Work in Pennsylvania

September 20, 2018 • By Carl Davis

A recent IRS clarification, which appears to have been a pet project of Sen. Pat Toomey (R-PA), has been widely interpreted as reopening a loophole the agency had proposed closing just weeks earlier. But while the announcement creates an opening for aggressive tax avoidance in many states, Pennsylvania, ironically enough, isn’t one of them.

The Other SALT Cap Workaround: Accountants Steer Clients Toward Private K-12 Voucher Tax Credits

June 27, 2018 • By Carl Davis

On May 23, 2018, the IRS and Treasury Department announced that they “intend to propose regulations addressing the federal income tax treatment of certain payments made by taxpayers for which taxpayers receive a credit against their state and local taxes.” They made the announcement in response to new “workaround tax credits” enacted in New York […]

As IRS Prepares to Act, Red-State Taxpayers Profit from Use of SALT “Workaround Credits”

May 24, 2018 • By Carl Davis

A new ITEP report explains the close parallels between the new workaround credits and existing state tax credits, including those benefiting private schools. The report comes the same day that the IRS and Treasury Department announced they would seek new regulations related to these tax credits. It notes that the SALT workarounds are emblematic of a broader weakness with the federal charitable deduction. And it cautions regulators to avoid a “narrow fix” that will only address the newest SALT workarounds (which, so far, have only been enacted in blue states) without also addressing other abuses of the deduction, which have…

SALT/Charitable Workaround Credits Require a Broad Fix, Not a Narrow One

May 23, 2018 • By Carl Davis

The federal Tax Cuts and Jobs Act (TCJA) enacted last year temporarily capped deductions for state and local tax (SALT) payments at $10,000 per year. The cap, which expires at the end of 2025, disproportionately impacts taxpayers in higher-income states and in states and localities more reliant on income or property taxes, as opposed to sales taxes. Increasingly, lawmakers in those states who feel their residents were unfairly targeted by the federal law are debating and enacting tax credits that can help some of their residents circumvent this cap.

New Tax Subsidy for Private K-12 Tuition in Massachusetts Creates a Host of Problems

May 9, 2018 • By Carl Davis

Last year’s federal tax cut bill changed 529 college savings accounts in a major way, expanding them so that they can be used as tax shelters by higher-income families who choose to send their children to private K-12 schools. This controversial change was added in the Senate by the slimmest of margins—requiring a tie-breaking vote […]

Why the Minute Federal 529 Provision Has Huge Consequences for States

February 23, 2018 • By Ronald Mak

When Republican leaders rushed through an overhaul to the federal tax code over a seven-week legislative period, they failed to acknowledge that many provisions in their bill would have negative consequences for states. One such provision of the Tax Cuts and Jobs Act that undermines state laws is the expansion of federal tax breaks that now allows taxpayers to use 529 savings plans to pay for private K-12 education.

Preventing State Tax Subsidies for Private K-12 Education in the Wake of the New Federal 529 Law

February 23, 2018 • By Ronald Mak

This policy brief explains the federal and various state-level breaks for 529 plans and explores the potential impact that the change in federal treatment of 529 plans will have on state revenues.

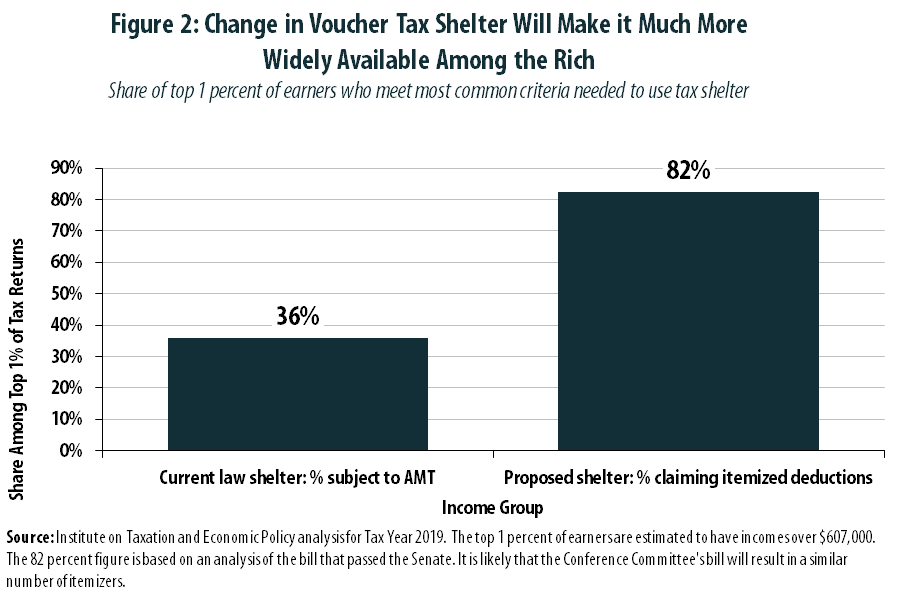

Private Schools Donors Likely to Win Big from Expanded Loophole in Tax Bill

December 14, 2017 • By Carl Davis

For years, private schools around the country have been making an unusual pitch to prospective donors: give us your money, and you’ll get so many state and federal tax breaks in return that you may end up turning a profit. Under tax legislation being considered in Congress right now, that pitch is about to become even more persuasive.

Tax Bill Would Increase Abuse of Charitable Giving Deduction, with Private K-12 Schools as the Biggest Winners

December 14, 2017 • By Carl Davis

In its rush to pass a major rewrite of the tax code before year’s end, Congress appears likely to enact a “tax reform” that creates, or expands, a significant number of tax loopholes.[1] One such loophole would reward some of the nation’s wealthiest individuals with a strategy for padding their own bank accounts by “donating” to support private K-12 schools. While a similar loophole exists under current law, its size and scope would be dramatically expanded by the legislation working its way through Congress.[2]

Private School Voucher Credits Offer a Windfall to Wealthy Investors in Some States

August 30, 2017 • By Carl Davis

State lawmakers who want to send public dollars to private schools have devised a shrewd tactic for getting around political and constitutional obstacles that make it difficult to do so. These lawmakers found a way to pay high-income taxpayers to fund those schools on states’ behalf, sometimes even offering those taxpayers a tidy profit in […]

Education tax credits are an emerging area of research for ITEP. In 2016, ITEP released a noteworthy report that examined how states are subverting public will and, in some cases, their state constitutions by funneling public money to private and parochial schools via controversial and generous tax credits. A surprising finding was that in at least nine states, these tax credits are so incredibly generous that upper-income taxpayers can turn a profit. Because public, taxpayer dollars remain critical for high quality public education, ITEP continues to explore the effect education tax credits are having on state budgets and public school funding.