Illinois

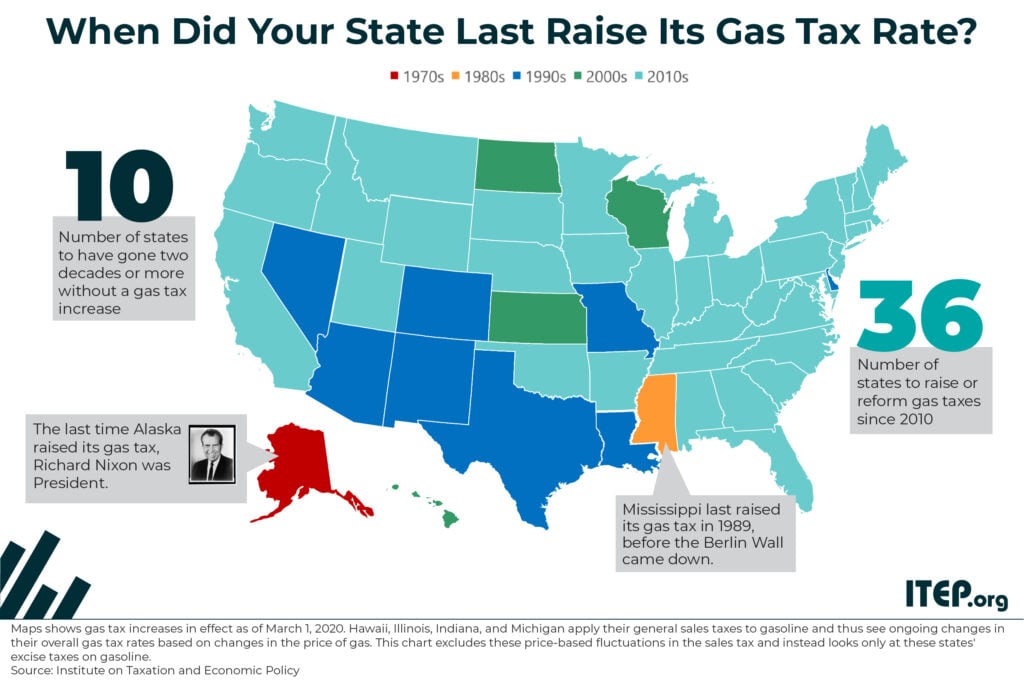

It’s unlikely that state gas tax holidays will meaningfully benefit consumers, and they come with risks for states’ infrastructure quality.

While record state revenue surpluses have led to big pushes in red states to make unnecessary permanent income and corporate tax cuts, Democrats are also getting in on the tax-cut mania...

One-time payments have become a common theme around the country, as Idaho is one of roughly eleven states with plans to provide tax relief in a similar fashion...

Here at ITEP we want to give thanks and say we’re grateful for all of the hard work that advocates in states across the country are doing to secure progressive tax policy victories...

New Study: Increase in Working from Home Could Depress Commercial Real Estate Prices, Reduce Local Tax Revenue

November 4, 2021 • By ITEP Staff

Covid-19 dramatically altered how and where many employees work, a shift that could have a long-term negative effect on commercial real estate occupancy rates and, ultimately, on local governments’ tax revenue base, a new study reveals. The Impact of Work from Home on Commercial Property Values and the Property Tax in U.S. Cities concludes that even as the recovery strengthens, if […]

The Impact of Work From Home on Commercial Property Values and the Property Tax in U.S. Cities

November 4, 2021 • By ITEP Staff

The fiscal implications of a decline in commercial property values are important because the property tax is the dominant local source of taxes, and commercial property makes up a significant portion of the property base in cities.

State Income Taxes and Racial Equity: Narrowing Racial Income and Wealth Gaps with State Personal Income Taxes

October 4, 2021 • By Carl Davis, Jessica Schieder, Marco Guzman

10 state personal income tax reforms that offer the most promising routes toward narrowing racial income and wealth gaps through the tax code.

Labor Day is around the corner and in the spirit of celebrating the achievements of workers around the country, we here at ITEP want to call attention to the states (and territories) that are using tax policy to support workers and residents alike...

Options to Reduce the Revenue Loss from Adjusting the SALT Cap

August 26, 2021 • By Carl Davis, ITEP Staff, Matthew Gardner, Steve Wamhoff

If lawmakers are unwilling to replace the SALT cap with a new limit on tax breaks that raises revenue, then any modification they make to the cap in the current environment will lose revenue and make the federal tax code less progressive. Given this, lawmakers should choose a policy option that loses as little revenue as possible and that does the smallest amount of damage possible to the progressivity of the federal tax code.

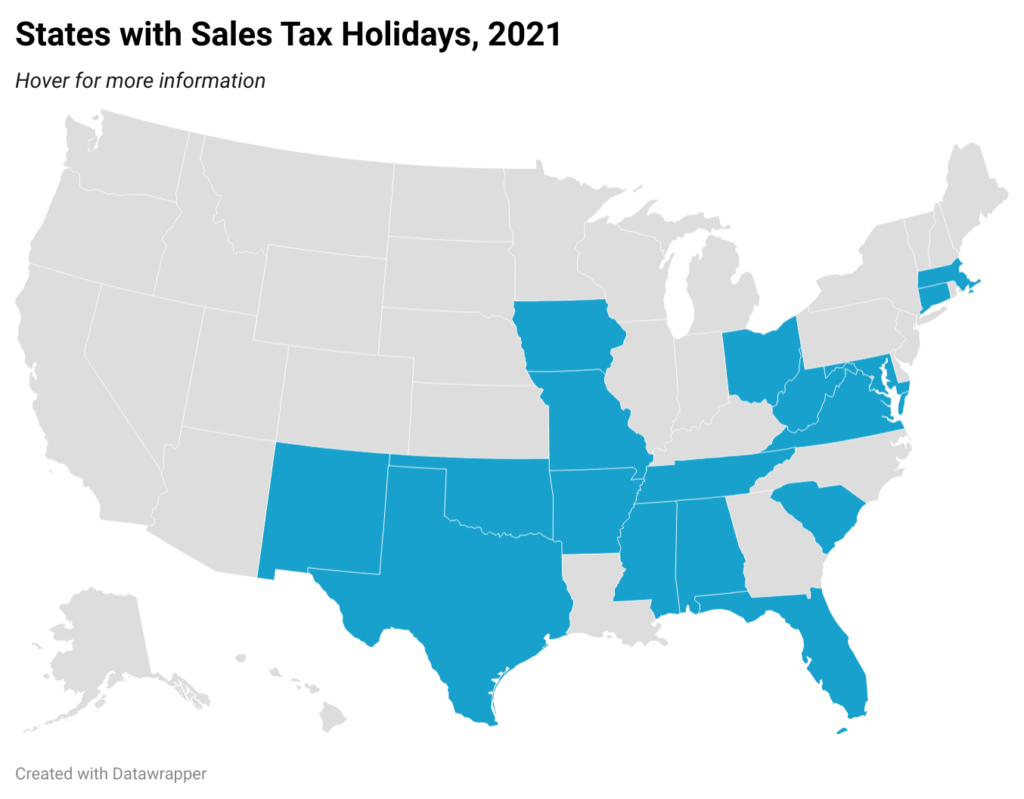

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

August 6, 2021 • By Dylan Grundman O'Neill

Policymakers tout sales tax holidays as a way for families to save money while shopping for “essential” goods. On the surface, this sounds good. However, a two- to three-day sales tax holiday for selected items does nothing to reduce taxes for low- and moderate-income taxpayers during the other 362 days of the year. Sales taxes are inherently regressive. In the long run, sales tax holidays leave a regressive tax system unchanged, and the benefits of these holidays for working families are minimal. Sales tax holidays also fall short because they are poorly targeted, cost revenue, can easily be exploited, and…

State Rundown 6/7: Remaining State Legislative Sessions Are Heating up as Budget Deadlines Loom

June 7, 2021 • By ITEP Staff

Just as an early summer heatwave brought soaring temperatures this past weekend through much of the lower 48 states, several state legislative sessions are heating up as legislators scramble to make tough budget decisions. Massachusetts lawmakers are voting on a fiery new "millionaires' tax" that would support transportation and education revenue needs, and Connecticut will likely restore its state Earned Income Tax Credit (EITC) back to 30 percent. Illinois’s decision to cut back corporate tax breaks also provided a breath of fresh air. Unfortunately, we'd give other state tax proposals a more lukewarm reception: New Hampshire, North Carolina, and Ohio…

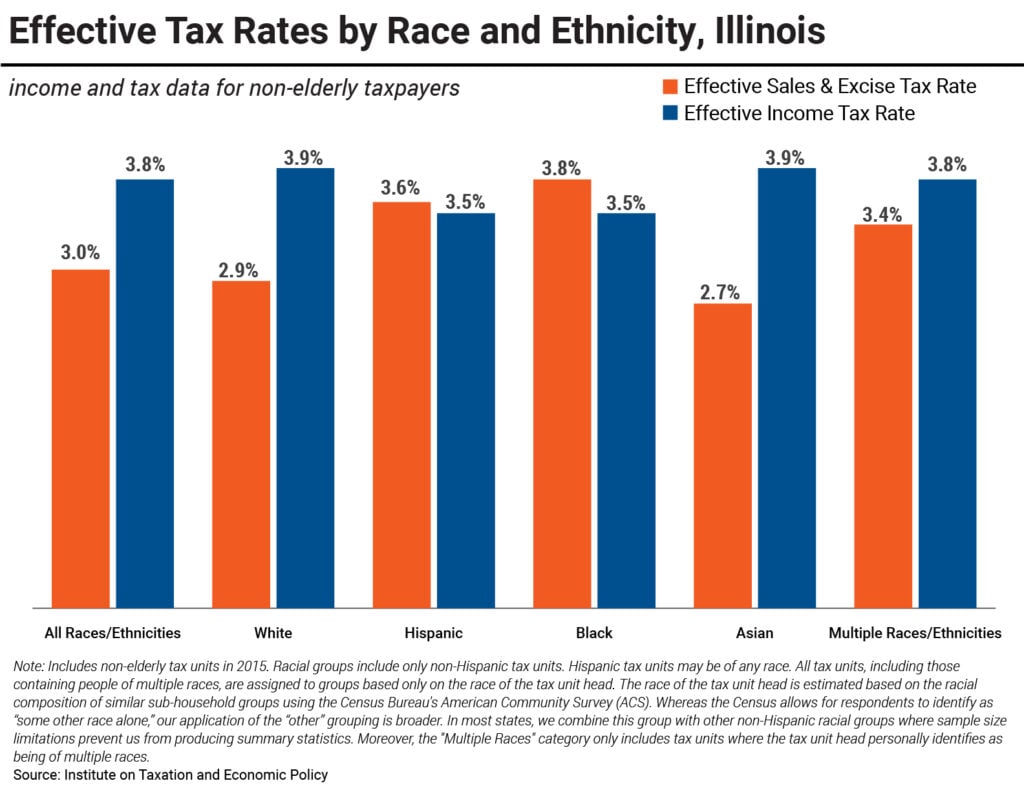

State Tax Codes & Racial Inequities: An Illinois Case Study

May 14, 2021 • By Lisa Christensen Gee

Earlier this year, ITEP released a report providing an overview of the impacts of state and local tax policies on race equity. Against a backdrop of vast racial disparities in income and wealth resulting from historical and current injustices both in public policy and in broader society, the report highlights that how states raise revenue to invest in disparity-reducing investments like education, health, and childcare has important implications for race equity.

Not Worth Its SALT: Tax Cut Proposal Overwhelmingly Benefits Wealthy, White Households

April 20, 2021 • By Carl Davis, ITEP Staff, Jessica Schieder

A previous ITEP analysis showed the lopsided distribution of SALT cap repeal by income level. The vast majority of families would not benefit financially from repeal and most of the tax cuts would flow to families with incomes above $200,000. This report builds on that work by using a mix of tax return and survey data within our microsimulation tax model to estimate the distribution of SALT cap repeal across race and ethnicity. It shows that repealing the SALT cap would be the latest in a long string of inequitable policies that have conspired to create the vast racial income…

WTTW: Proposals Could Expand Eligibility for Earned Income Tax Credit

March 29, 2021

“[Illinois] just piggybacks off of that by saying if you got the federal credit you get 18% of that for state purposes,” said Lisa Christensen Gee, the director of special initiatives at the Institute of Taxation and Economic Policy. The credit offsets state income tax liability, and if an individual has more credit than the […]

Chicago Sun-Times: A New Push to Expand the State’s Earned Income Credit Could Include Immigrants

March 21, 2021

Economic Security for Illinois, working with the Institute in Taxation and Economic Policy, estimates that as many as 500,000 households would benefit from the expansion, including 110,000 immigrant households. Read more

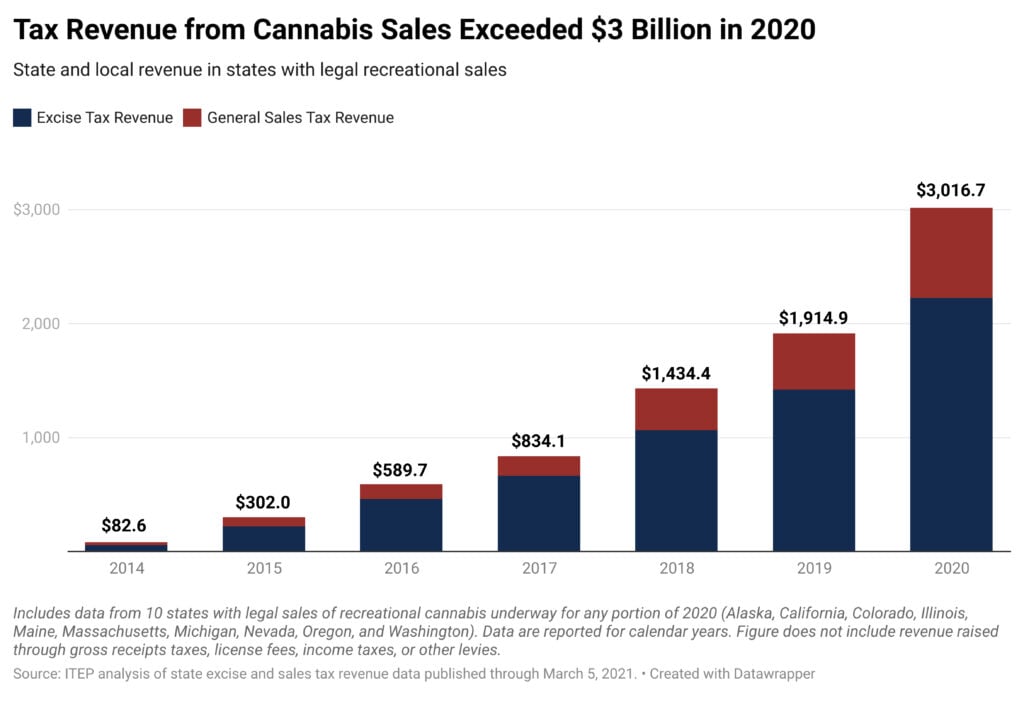

State and Local Cannabis Tax Revenue Jumps 58%, Surpassing $3 Billion in 2020

March 15, 2021 • By Carl Davis

Cannabis taxes are a small part of state and local budgets, clocking in at less than 2 percent of tax revenue in the states with legal adult-use sales. But they’re also one of states’ fastest-growing revenue sources. Powered by an expanding legal market and a pandemic-driven boost in cannabis use, excise and sales taxes on […]

Many state governments are struggling to repair and expand their transportation infrastructure because they are attempting to cover the rising cost of asphalt, machinery, and other construction materials with fixed-rate gasoline taxes that are rarely increased.

State Rundown 2/17: Friction Over Tax Policy Still Generating Heat in Some Statehouses

February 17, 2021 • By ITEP Staff

Cold-hearted regressive tax proposals were pushed this week to cut income taxes on high-income households in states including Idaho, Montana, and West Virginia, while advocates for fair taxes and well-funded services continue to turn up the heat on taxing the richest residents in states like Connecticut and Pennsylvania.

The Daily Northwestern: Advocates Against Income Inequality Reassess After the Fair Tax Act’s Failure

January 20, 2021

The Fair Tax Amendment would have introduced a progressive income tax to Illinois. The state currently mandates a flat income tax of 4.95 percent. Illinois ranks eighth in the country for tax inequality, according to the Institute on Taxation and Economic Policy. Throughout the state, the lowest-income 20 percent contribute over 14.4 percent of total […]

As states kick off their 2021 legislative sessions, it’s clear that many governors and lawmakers are attempting to “take a mulligan” on the last year and recycle tax-slashing ideas that were already bad in 2020 and are even worse now as states try to recover from the Covid-19 pandemic and accompanying downturn...On a brighter note, Illinois leaders showed they did learn from the events of 2020, passing a major criminal justice reform bill and payday loan protections intended to reduce racial inequities.

After the Dust Has Settled: How Progressive Tax Policy Fared in the General Election

November 30, 2020 • By Marco Guzman

While the results of the 2020 presidential election are all but set in stone—and a sign of life for progressive policy—the results of state tax ballot initiatives are more of a mixed bag. However, the overall fight for tax equity and raising more revenue to invest in people and communities is trending in the right direction.

State Rundown 11/13: States Can Find Inspiration in Arizona Ballot Success; Must Look to Congress for More Immediate Help

November 13, 2020 • By ITEP Staff

Although progressive tax policy doesn’t always succeed in in statehouses or voting booths, Arizona voters showed once again that when offered a clear choice, most people resoundingly support requiring fairer tax contributions from rich individuals and highly profitable corporations over allowing their schools and other shared priorities to wither and decay. Still, a similar effort in Illinois and a more complicated measure in California were defeated, and anti-tax zealots in West Virginia and many other states will continue to push for tax cuts for the rich and defunding public investments, leaving much work to be done to advance tax justice.

Stateline: Budget Holes Loom After Voters Reject Some Tax Hikes

November 12, 2020

But Meg Wiehe, deputy executive director of the progressive Institute on Taxation and Economic Policy, said that is an oversimplification. She said wild speculation in opposition ads about what Illinois might do with the extra money, as well as ads that used the “nose under the tent” metaphor to imply that the income tax hike […]

Chicago Tribune: Commentary: How Illinois’ Small Businesses Will Benefit from a Graduated-rate Income Tax

October 30, 2020

Recent studies have shown that for decades, the current flat tax structure has only worsened income inequality throughout the state, stunting much-needed revenue and consumer spending. The Institute on Taxation and Economic Policy found that over the last 20 years, Black and Hispanic households in Illinois that make less than $250,000 per year paid $4 billion […]

State Rundown 10/28: Anti-Tax Horror Stories Proving Less Spooky in 2020

October 28, 2020 • By ITEP Staff

Even with Halloween coming up this weekend, months of dealing with the horrors of the Covid-19 pandemic have made it hard to scare anyone in the closing months of 2020, which state lawmakers and residents are showing by voting in droves and supporting policies they had been more trepidatious about in recent years.