Who Does the Tax Plan Really Help?

National and 50-State Impacts of Final GOP-Trump Tax Bill in 2019 and 2027

The final tax bill that Republicans in Congress are poised to approve would provide most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. National and 50-State data available to download.

Final GOP-Trump Bill Still Forces California and New York to Shoulder a Larger Share of Federal Taxes Under Final GOP-Trump Tax Bill; Texas, Florida, and Other States Will Pay Less

Residents of California and New York pay a large amount of the nation’s federal personal income taxes relative to their share of the population. The final GOP-Trump tax bill would substantially increase the share of total federal personal income taxes (PIT) paid by both states. Connecticut, Maryland, Massachusetts, and New Jersey would also see their share of federal PIT increase. At the same time, it would reduce total federal personal income taxes paid by Florida and Texas (and most other states), which would receive a larger share of the tax cuts relative to what they pay to the federal government today.

Who Is “America First” Under the Tax Plan? The Rich First, Foreign Investors Second, Then the Rest of Us.

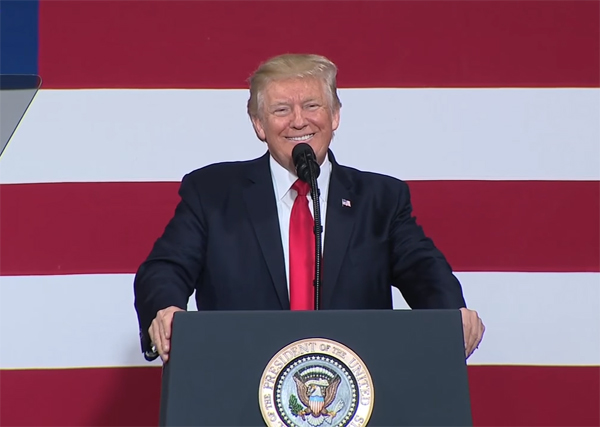

In his inaugural speech, President Trump told the world that Washington would be driven by a principle of “America First.” But the tax plans moving through Congress only put the richest Americans first. Everyone else comes after foreign investors.

A Corporate Tax Cut Would Benefit Coastal Investors, Not the Heartland

The centerpiece of the House and Senate tax plans is a major tax cut for profitable corporations that the American public does not want, and that will overwhelmingly benefit a small number of wealthy investors living in traditionally “blue” states. New ITEP research shows that poorer states such as West Virginia, Oklahoma, Alabama, and Tennessee would be largely left behind by a corporate tax cut, while the lion’s share of the benefits would remain with a relatively small number of wealthy investors who tend to be concentrated in larger cities near the nation’s coasts.

Proposed “Compromises” to Address Problems in Tax Plan Accomplish Little But Increase Costs

GOP Leaders Scrounge Up Money to Lower Top Tax Rate for the Rich But Not to Help Low-Income Working Families with Children

Republican leaders who rejected a proposal to have corporations pay a single percentage point higher tax rate to benefit families with children have tapped the exact same source of savings to provide more breaks for the richest 1 percent of taxpayers.

Latest “Compromise” for Tax Plan Is Even Worse than Previous Proposals, Would Reduce the Plans’ “Losers” by Less than 17,000 Taxpayers

Earlier this week, ITEP explained that two possible “compromises” to improve the Senate tax bill would accomplish very little other than make the plan more expensive. Incredibly, Republican leaders are now discussing a third possible “compromise” that is even worse — a further reduction in the top personal income tax rate to 37%.

“Compromises” Under Discussion for the State and Local Tax Deduction Do Not Fix Flawed Tax Bills

Republicans in Congress are reported to be considering two versions of a change they claim would “improve” the current bills by making them more generous to residents of higher-taxed states. As illustrated by these estimates, the reality is that these proposals would make little difference on those states and taxpayers hit hardest.

Even with Potential SALT Compromises, Senate Bill Forces California and New York to Shoulder a Larger Share of Federal Taxes While Texas, Florida, and Other States Will Pay Less

The Senate tax bill, with or without either of the compromises that could be added to it, would shift personal income taxes away from Florida and Texas to states like California and New York, which are already paying a high share relative to their populations.

Charitable, Property Tax, and Mortgage Interest Deductions Would Be Wiped Out for Two-Thirds of Current Claimants Under Congressional Tax Plans

In the ongoing debate over major federal tax legislation, there is significant focus on how House and Senate bills would eliminate the deduction for state income tax payments and cap the deduction for property taxes at $10,000 per year. At the same time, tax writers have retained deductions for charitable gifts and mortgage interest with what appear to be comparatively minor changes, at least at first glance.

The Tax Plan Is Even Worse for Education than You Thought

Private Schools Donors Likely to Win Big from Expanded Loophole in Tax Bill

For years, private schools around the country have been making an unusual pitch to prospective donors: give us your money, and you’ll get so many state and federal tax breaks in return that you may end up turning a profit. Under tax legislation being considered in Congress right now, that pitch is about to become even more persuasive.

Parents of College Students: The Tax Plans’ Losers that No One Is Talking About

Parents of college students or kids in their last years of high school are more likely to face a tax hike than others under the tax legislation moving through Congress. Higher education has entered the tax debate because the House bill (but not the Senate bill) would repeal several provisions that make college and graduate education more accessible. But little thought has been given to how the tax bills would affect the parents of college students in more direct ways and make it difficult for them to finance college for their kids.

Real Tax Reform Would Close the Loopholes that Benefit Donald Trump Personally — But This Plan Expands Them

How Donald Trump Fought the Last Tax Reform

As Congress debates an overhaul of the federal tax system, many look to the Tax Reform Act of 1986, bipartisan legislation signed into law by President Ronald Reagan, as the model for simplifying the tax code. But in 1991 Donald Trump testified before a Congressional committee that “this tax act was just an absolute catastrophe for the country and for the real estate industry.” He called it “the 1986 catastrophe of the tax reform act.”

Report: How True Tax Reform Would Eliminate Breaks for Real Estate Investors Like Donald Trump

The federal tax code includes several loopholes and special breaks that advantage wealthy real estate investors like President Donald Trump. Under current law, real estate investors can claim losses much more quickly and easily than other taxpayers, but they also have several methods to delay or avoid reporting any profits to the IRS.

Senator Sanders’ Video: The Mother of All Tax Dodges

Experts from ITEP and another think-tank explain how the tax legislation will expand the sort of loopholes used by Donald Trump in his business ventures.

Remember How One Senator Agreed to Support the Tax Bill Because of a Vague Promise Related to DACA? More on That.

All I Want for Christmas is a Clean DREAM Act

Congress has yet to take legislative action to protect Dreamers. The young undocumented immigrants who were brought to the United States as children, and are largely working or in school, were protected by President Obama’s 2012 executive action, Deferred Action for Childhood Arrivals (DACA). But in September, President Trump announced that he would end DACA in March 2018. President Trump punted their lives and livelihood to a woefully divided Congress which is expected to take up legislation to address the issue this month.