Recent Work

2146 items

Women’s History Month is a Reminder that Sensible Tax Policy is Central to Women’s Economic Security

March 24, 2022 • By Brakeyshia Samms

Women’s History Month is a chance to remember what happens for women when tax policy becomes more progressive, boosts income, and helps make raising a family more affordable.

Spring is around the corner and like those pesky allergies that come along with it, equally pesky tax proposals continue to pop up in states across the U.S....

New Hampshire Fiscal Policy Institute: Expansions of the Earned Income Tax Credit and Child Tax Credit in New Hampshire

March 23, 2022 • By ITEP Staff

Prior to the temporary expansions, nearly one in five likely eligible Granite Staters did not claim the EITC, and approximately 7,745 children were estimated to be eligible for the CTC while the credit was not claimed on their household’s tax return. The potential under enrollment in key assistance programs, along with underutilization of the EITC […]

Arizona Ruling Preserves High-Income Interests Over Education Investments, Popular Vote

March 17, 2022 • By Marco Guzman

An Arizona court decision delivered an unfortunate blow to voters and those in the state who favor a progressive, adequate tax system that can fund critical priorities including K-12 education.

State Rundown 3/16: The Scramble to Curb Rising Gas Prices is On

March 16, 2022 • By ITEP Staff

Rising gas prices have lawmakers around the country searching for ways to ease the pressure on consumers and almost half the states are considering reducing or temporarily repealing their gas tax, but another idea is taking hold...

It’s unlikely that state gas tax holidays will meaningfully benefit consumers, and they come with risks for states’ infrastructure quality.

Georgia Budget and Policy Institute: House Proposes Massive Tax Cuts for Wealthiest, Slashing State Revenues

March 14, 2022 • By ITEP Staff

Members of the Georgia General Assembly are considering legislation that would fundamentally change the structure of the tax code and result in disproportionately large tax cuts for the wealthiest while hundreds of thousands of families would see tax increases or few benefits. This is due to the package’s proposed flat personal income tax rate and […]

What We Can Learn Today from the American Rescue Plan – and Sen. Rick Scott’s Proposed Tax Increases

March 11, 2022 • By Steve Wamhoff

The success of the American Rescue Plan Act is worth revisiting today. Instead of pursuing Sen. Rick Scott’s agenda of making life more difficult for those already working the hardest, Congress should extend or make permanent some of the beneficial policies in ARPA.

California Budget & Policy Center: California’s Tax & Revenue System Isn’t Fair for All

March 10, 2022 • By ITEP Staff

Californians need quality public health and schools, access to affordable housing and clean water, and safe roads and neighborhoods along with many more services to live and thrive – no matter one’s zip code. Accordingly, the state’s tax and revenue system must raise adequate revenue to cover the services provided by state and local governments and make […]

State Rundown 3/9: One State Stands Out Amid the Avalanche of Tax Cuts

March 9, 2022 • By ITEP Staff

The avalanche of regressive tax-cut proposals coming out of state legislatures has not slowed over the course of the winter months, but one state has provided a shot of hope to advocates of tax equity...

A Better Alternative: New Mexico Prioritizes Targeted, Temporary Tax Cuts

March 9, 2022 • By Marco Guzman

New Mexico stands in stark contrast to the many examples of poorly targeted tax-cut proposals currently being considered around the country.

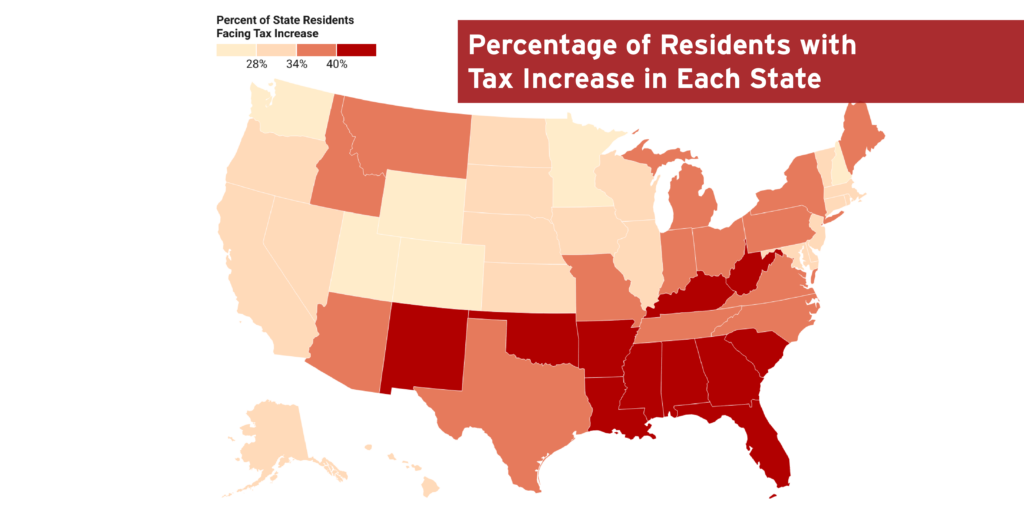

State-by-State Estimates of Sen. Rick Scott’s “Skin in the Game” Proposal

March 7, 2022 • By Steve Wamhoff

A proposal from Sen. Rick Scott would increase taxes for more than 35% of Americans, with the poorest fifth of Americans paying 34% of the tax increase.

Reality Check: Drastic Income Tax Cuts Are Dangerous Despite What Anti-Tax Supporters Say

March 3, 2022 • By Brakeyshia Samms

Income taxes are the backbone of most state budgets, but you wouldn't gather this fact based on the current trend to cut or eliminate them. A recent, cheerful Wall Street Journal op-ed from anti-government advocate Grover Norquist offers a clear sign that tax-cutting states are taking the wrong approach. The long-time proponent of anti-tax pledges wrote favorably about the legislative and gubernatorial plans to cut income tax cuts across the country. As usual, he failed to address that income taxes support state investments in education, infrastructure, health care and other important public services.

ITEP is happy to announce the launch of our new State Tax Watch page, where you can find out about the most up-to-date tax proposals and permanent legislative changes happening across the country...

SOTU and GOP Response Highlight Dramatic Difference in Parties’ Tax Policy Approach

March 2, 2022 • By Aidan Davis, ITEP Staff, Jenice Robinson

Since last year, multiple states across the country have proposed or are pursuing costly income and other tax cuts that are heavily tilted toward the highest-income households. State advocates have worked to beat back these proposals and sounded the alarm about the long-term consequences of tax cuts, but legislatures (most GOP-led) continue to introduce and approve top-heavy and permanent tax cuts. This state tax-cut fervor took center stage last night when Gov. Kim Reynolds of Iowa gave the Republican response to President Biden's SOTU address.