Recent Work

2162 items

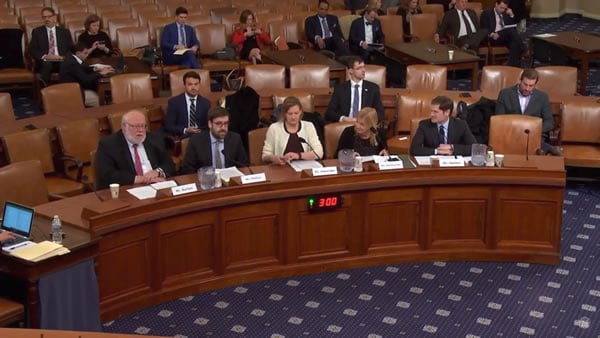

The Heritage Foundation, the Institute on Taxation and Economic Policy (ITEP), and the Committee for a Responsible Federal Budget (CRFB) routinely disagree on a wide range of policy issues, but a recent Ways and Means Tax Policy Subcommittee hearing revealed they all agree that the continual and unpaid-for extension of temporary tax breaks needs to end.

With many state legislative sessions about halfway through, the ripple effects of the federal tax-cut bill took a back seat this week as states focused their energies on their own tax and budget issues. Major proposals were released in Nebraska and New Jersey, one advanced in Missouri, and debates wrapped up in Florida, Utah, and Washington. Oklahoma and Vermont are considering ways to improve education funding, while California, New York, and Vermont look to require more of their most fortunate residents. And check in on "what we're reading" for resources on the online sales tax debate, the role of property…

ITEP Testimony on “Post Tax Reform Evaluation of Recently Expired Tax Provisions”

March 14, 2018 • By Richard Phillips

Statement of Richard Phillips, Senior Policy Analyst Institute on Taxation and Economic Policy Before the Committee on Ways and Means Subcommittee on Tax Policy Hearing on “Post Tax Reform Evaluation of Recently Expired Tax Provisions”

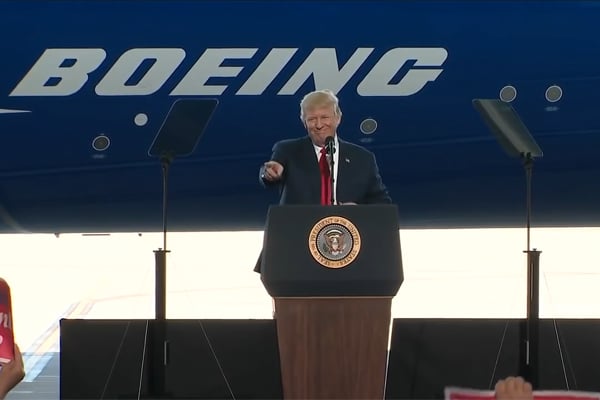

Boeing Paid Tax Rate of 8.4% in Previous Decade, But Trump to Speak About Why It Needed His Corporate Tax Cut

March 14, 2018 • By Matthew Gardner

For the second time in seven months, President Trump will visit a Boeing factory to hype corporate tax cuts. He’s chosen the wrong poster child. If there was something preventing the aerospace giant from expanding its business before the Trump-GOP tax law, it certainly wasn’t taxes. Boeing made headlines in 2016 only because after years of paying zero in federal taxes, it finally paid something. Over 10 years (2008 to 2017), the company paid an effective federal tax rate of 8.4 percent on $54.7 billion of U.S. profits.

Trends We’re Watching in 2018, Part 2: State Revenue Shortfalls and the Impact on Education and Other Services

March 12, 2018 • By Aidan Davis

Many states struggle with a need for revenue, yet their lawmakers show little will to raise taxes to fund public services. Revenue shortfalls can prove to be a moving target. Some states with expected shortfalls are now seeing rosier forecasts. But as estimates come in above or below projections, states continue to grapple with how and whether to raise the revenue necessary to adequately fund key programs. Here are a few trends that are leading to less than cushy state coffers this year.

The tobacco company Reynolds American announced this week that its full-time employees will receive a one-time bonus of $1,000 in the wake of a sharp reduction in its British parent company’s tax bill.

This week was very active for state tax debates. Georgia, Idaho, and Oregon passed bills reacting to the federal tax cut, as Maryland and other states made headway on their own responses. Florida lawmakers sent a harmful "supermajority" constitutional amendment to voters. New Jersey now has two progressive revenue raising proposals on the table (and a need for both). Louisiana ended one special session with talks of yet another. And online sales taxes continued to make news nationally and in Kansas, Nebraska, and Pennsylvania.

Trends We’re Watching in 2018, Part 1: State Responses to Federal Tax Cut Bill

March 5, 2018 • By Dylan Grundman O'Neill

Over the next few weeks we will be blogging about what we’re watching in state tax policy during 2018 legislative sessions. And there is no trend more pervasive in states this year than the need to sort through and react to the state-level impact of federal tax changes enacted late last year.

Five Ways States Can Recoup Corporations’ Massive Federal Tax Giveaway

March 2, 2018 • By Aidan Davis

Corporate America is doing alright. Corporate profits soared last year, and 2018 has already brought a major windfall in the form of the Trump-GOP tax law, which dramatically cut the federal corporate tax rate from 35 percent to 21 percent and shifted to a territorial tax system, giving income earned offshore by U.S. companies a free pass by no longer making it subject to U.S. taxes.

State Rundown 2/28: February a Long Month for State Tax Debates

February 28, 2018 • By ITEP Staff

February may be the shortest month but it has been a long one for state lawmakers. This week saw Arizona, Idaho, Oregon, and Utah seemingly approaching final decisions on how to respond to the federal tax-cut bill, while a bill that appeared cleared for take-off in Georgia hit some unexpected turbulence. Other states are still studying what the federal bill means for them, and many more continue to debate tax and budget proposals independently of the federal changes. And be sure to check our "What We're Reading" section for news on corporate tax credits from multiple states.

Why the Minute Federal 529 Provision Has Huge Consequences for States

February 23, 2018 • By Ronald Mak

When Republican leaders rushed through an overhaul to the federal tax code over a seven-week legislative period, they failed to acknowledge that many provisions in their bill would have negative consequences for states. One such provision of the Tax Cuts and Jobs Act that undermines state laws is the expansion of federal tax breaks that now allows taxpayers to use 529 savings plans to pay for private K-12 education.

Preventing State Tax Subsidies for Private K-12 Education in the Wake of the New Federal 529 Law

February 23, 2018 • By Ronald Mak

This policy brief explains the federal and various state-level breaks for 529 plans and explores the potential impact that the change in federal treatment of 529 plans will have on state revenues.

This week, major tax packages relating to the federal tax-cut bill made news in Georgia, Iowa, and Louisiana, as Minnesota and Oregon lawmakers also continue to work out how their states will be affected. New Mexico's legislative session has finished without significant tax changes, while Idaho and Illinois's sessions are beginning to heat up, and Vermont's school funding system is under the microscope.

Any politician can score points by railing against President Trump and his wildly unfair, loophole-ridden tax law. But if New York’s working people find out they will be subjected to a new and complicated set of state tax rules all to help the richest 5 percent, they’ll wonder why a better solution that targets corporations and high-income earners who just received a sizable federal tax break, was not found. In the wake of the Trump-GOP tax law, this is a missed opportunity for lawmakers in New York to increase taxes on those who just benefited from a substantial tax cut.

Two narratives that intentionally obscure who benefits from the tax law are emerging. One focuses on the personal income tax cuts that will result in an increase in net take-home pay for many employees once their employers adjust withholding. Anecdotes abound of working people getting a $100 or more increase, after taxes, per paycheck, but the reality is that most workers will receive a lot less than that. Meanwhile, the wealthiest 1 percent of households will receive an average annual tax break of $55,000, an amount that nearly eclipses the nation’s median household income.