Child Tax Credit

Congress Should Not Leave Children Out of Possible Year-End Tax Deal

October 3, 2022 • By Steve Wamhoff

If lawmakers believe it’s worthwhile to extend corporate tax breaks, then it would be entirely unreasonable for them to not conclude the same about tax provisions that help low-income children.

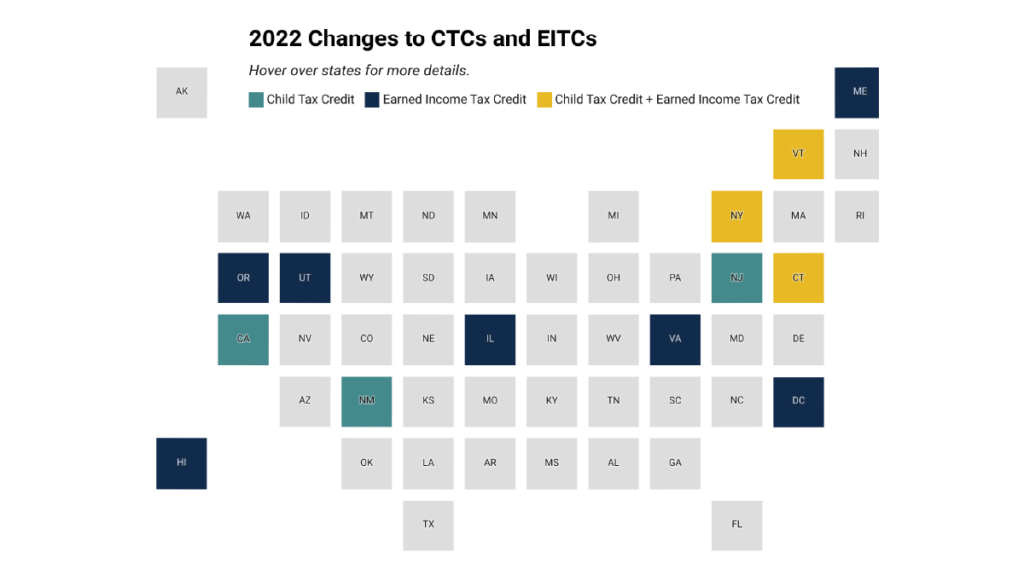

More States are Boosting Economic Security with Child Tax Credits in 2022

September 15, 2022 • By Aidan Davis

After years of being limited in reach, there is increasing momentum at the state level to adopt and expand Child Tax Credits. Today ten states are lifting the household incomes of families with children through yearly multi-million-dollar investments in the form of targeted, and usually refundable, CTCs.

Census Data Shows Need to Make 2021 Child Tax Credit Expansion Permanent

September 14, 2022 • By Joe Hughes

The Child Tax Credit expansion led to a 46 percent decline in childhood poverty. That it could be accomplished during the largest economic disruption in most of our lifetimes underscores a basic fact: thoughtful, decisive government action to combat poverty works.

Romney Child Tax Credit Plan Would Leave Millions of Children Worse Off and Raise Taxes for the Average Black Family

September 7, 2022 • By Steve Wamhoff

Sen. Romney’s plan would expand the Child Tax Credit and offset the costs by scaling back other tax benefits. All told, it would raise taxes on a fourth of all kids in the U.S. This includes about a fourth of the children among the poorest fifth of U.S. families.

National and State-by-State Estimates of Two Approaches to Expanding the Child Tax Credit

September 7, 2022 • By Emma Sifre, Joe Hughes, Steve Wamhoff

The Romney Child Tax Credit plan would leave a quarter of children worse off compared to current law and help half as many low-income children as the 2021 expansion of the credit.

Legislative Momentum in 2022: New and Expanded Child Tax Credits and EITCs

July 22, 2022 • By Neva Butkus

State legislatures across the country made investments in their future, centering children, families, and workers by enacting and expanding state Earned Income Tax Credits (EITCs), Child Tax Credits (CTCs), and other refundable credits this session. In total, seven states either expanded or created CTCs this session. Connecticut, New Mexico, New Jersey, Rhode Island and Vermont […]

Abortion-Restricting States Do Least for Children

July 13, 2022 • By Amy Hanauer

Lawmakers have passed laws in 22 states that either immediately or soon will greatly restrict women’s rights to decide whether and when to have children. These states have some of the worst tax, spending and labor market policies for families in the U.S.

Long-term troubles for this country and this planet now demand our attention. Progressive tax policy would transform our ability to tackle them.

Women’s History Month is a Reminder that Sensible Tax Policy is Central to Women’s Economic Security

March 24, 2022 • By Brakeyshia Samms

Women’s History Month is a chance to remember what happens for women when tax policy becomes more progressive, boosts income, and helps make raising a family more affordable.

What We Can Learn Today from the American Rescue Plan – and Sen. Rick Scott’s Proposed Tax Increases

March 11, 2022 • By Steve Wamhoff

The success of the American Rescue Plan Act is worth revisiting today. Instead of pursuing Sen. Rick Scott’s agenda of making life more difficult for those already working the hardest, Congress should extend or make permanent some of the beneficial policies in ARPA.

A Better Alternative: New Mexico Prioritizes Targeted, Temporary Tax Cuts

March 9, 2022 • By Marco Guzman

New Mexico stands in stark contrast to the many examples of poorly targeted tax-cut proposals currently being considered around the country.

The Compelling Data and Moral Case for Continuing the Child Tax Credit Expansion

January 14, 2022 • By Alex Welch, ITEP Staff, Jenice Robinson

In just six short months, the enhanced Child Tax Credit (CTC), enacted as part of the American Rescue Plan (ARP), decreased the number of children living in poverty by 40 percent. ITEP estimated that the lowest-income 20 percent of households with children would receive a 35 percent income boost from this policy alone in 2021. This is a meaningful, life-changing sum.

The Problem with Returning to a $2,000 Non-Refundable Child Tax Credit

January 13, 2022 • By Joe Hughes

Prior to last year, more than one in three children lived in households with incomes too low to receive the full $2,000 credit because it is not fully refundable. This means earnings requirements and other limits reduce the amount tax filers can receive as a refund. In fact, the maximum refundable portion is reduced to $1,400 (less than half of the maximum refundable credit available in 2021).

Pandemic Policies Demonstrate Government Can Address Widening Economic Inequality If Policymakers So Choose

December 17, 2021 • By ITEP Staff, Jenice Robinson, Joe Hughes

We are surrounded by evidence that economic inequality is spinning out of control, yet we also see straightforward examples of how government can stop the downward spiral should it choose to do so. The Build Back Better Act, which invests in communities and ensures the wealthy and corporations pay their fair share, is one such example. Congress should pass it.

ITEP Data on Child Tax Credit and Earned Income Tax Credit Provisions Before Congress

December 14, 2021 • By Steve Wamhoff

Congress expanded the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) for 2021 as part of the American Rescue Plan Act (ARP). The additional benefits that millions of families and workers received under that law will end this month if Congress does not act soon. The CTC expansion boosted the annual tax credit […]

The EITC and CTC are proven poverty-fighting tools. The monthly CTC payments alone kept 3.6 million people out of poverty in October. This policy success is worth repeating.

Tax Credit Reforms in Build Back Better Would Benefit a Diverse Group of Families

November 18, 2021 • By Aidan Davis

The CTC and EITC provisions would have a particularly profound effect on the poorest 20 percent of Americans, who all will have incomes of less than $22,000 in 2022. Taken together, the EITC and CTC changes would lift the average income of these households by more than 10 percent.

New Census Data Highlight Need for Permanent Child Tax Credit Expansion

September 14, 2021 • By Neva Butkus

The status quo was a choice, but the Census data released today shows that different policy choices can create drastically different outcomes for children and families. It is time for our state and federal legislators to put people first when it comes to recovery.

A Data-Driven Case for the CTC Expansion in the Ways & Means Committee’s Recent Proposal

September 13, 2021 • By Aidan Davis

The move toward permanent full refundability and inclusion of all immigrant children are crucial components of the future of the CTC. Together they will help ensure that the credit reaches the children most in need, making a vital dent in our nation’s unacceptably high rate of child poverty.

Child Tax Credit Expansion Acknowledges There Is More We Can Do for Children

July 20, 2021 • By Aidan Davis

For the next six months, low-, middle- and upper-middle-income families with children are eligible to receive part of their 2021 Child Tax Credit (CTC) in advanced monthly payments. More than putting money in people’s pockets, this policy recognizes “the dignity of working-class families and middle-class families,” as President Biden said last week.

Experts Weigh in on the Payoffs of Advanced Child Tax Credit Payments

July 15, 2021 • By Jenice Robinson

During a Tuesday webinar (The Child Tax Credit in Practice: What We Know about the Payoffs of Payments) hosted by ITEP and the Economic Security Project, panelists explained why the expanded Child Tax Credit is a transformative policy that should be extended beyond 2021. They highlighted tax policy and anti-poverty research and discussed lessons learned from demonstration projects that have provided a guaranteed income to low-income families.

The Child Tax Credit in Practice: What We Know About the Payoffs of Payments (Webinar)

July 7, 2021 • By ITEP Staff

Join us for a discussion on why tax credits like the Child Tax Credit (CTC) expansion are good economic policy. You’ll hear from anti-poverty experts on why Congress should extend the policy beyond 2021 and what we can learn from an initiative providing low-income mothers in Jackson, Miss., $1,000 cash on a monthly basis, no strings attached. From theory to practice and what it means for American families, this CTC webinar will provide a unique angle through which to view this transformative policy.

On July 15, the U.S. Treasury will begin mailing monthly checks to families with children who are eligible for the Child Tax Credit. Previously, the maximum credit was $2,000 per child, but for 2021, President Biden’s American Rescue Plan broadened the credit to $3,600 for each child under six and $3,000 for children over six. The expansion also made eligible children whose parents' incomes were too low to qualify for the previous credit, both addressing a fundamental policy flaw and taking a significant step to reduce child poverty. This is the first time that the federal government is sending advanced…

Child Tax Credit Is a Critical Component of Biden Administration’s Recovery Package

June 11, 2021 • By Aidan Davis

Nearly one in seven children in the United States live in poverty and about 6 percent of all children live in deep poverty. President Joe Biden’s American Families Plan would tackle child poverty in an immediate, meaningful way. It is expected to extend the one-year Child Tax Credit (CTC) enhancements included in the March 2021 American Rescue Plan (ARP) through 2025. Next year alone, this would provide around a $110 billion collective income boost to roughly 88 percent of children in the United States.

Inclusive Child Tax Credit Reform Would Restore Benefit to 1 Million Young ‘Dreamers’

April 27, 2021 • By Marco Guzman

As the Biden administration maps out the next steps in America’s response to the coronavirus pandemic—through what is now being called the American Families Plan—it should make sure a proposed expansion of the Child Tax Credit (CTC) includes undocumented children who have largely been left out of federal relief packages this past year. Prior to 2017 Tax Cut and Jobs Act, all children regardless of their immigration status received the credit as long as their parents met the income eligibility requirements. This change essentially excluded around 1 million children and their families.