Georgia

How the House Tax Proposal Would Affect Georgia Residents’ Federal Taxes

November 6, 2017 • By ITEP Staff

The Tax Cuts and Jobs Act, which was introduced on November 2 in the House of Representatives, includes some provisions that raise taxes and some that cut taxes, so the net effect for any particular family’s federal tax bill depends on their situation. Some of the provisions that benefit the middle class — like lower tax rates, an increased standard deduction, and a $300 tax credit for each adult in a household — are designed to expire or become less generous over time. Some of the provisions that benefit the wealthy, such as the reduction and eventual repeal of the estate…

Analysis of the House Tax Cuts and Jobs Act

November 6, 2017 • By Matthew Gardner, Meg Wiehe, Steve Wamhoff

The Tax Cuts and Jobs Act, which was introduced on Nov. 2 in the House of Representatives, would raise taxes on some Americans and cut taxes on others while also providing significant savings to foreign investors.

Bloomberg: GOP Tax Plan Seen Hurting Middle Class in N.Y., 8 Other States

October 5, 2017 • By ITEP Staff

The ITEP report concludes that many of the most affected people would be middle-income and upper-middle income taxpayers. For example, in Maryland, about one-third of those making from $48,700 to $73,700 would face a tax hike, while 41 percent of those between $73,700 and $126,500, would face an increase, the study says. And almost 65 […]

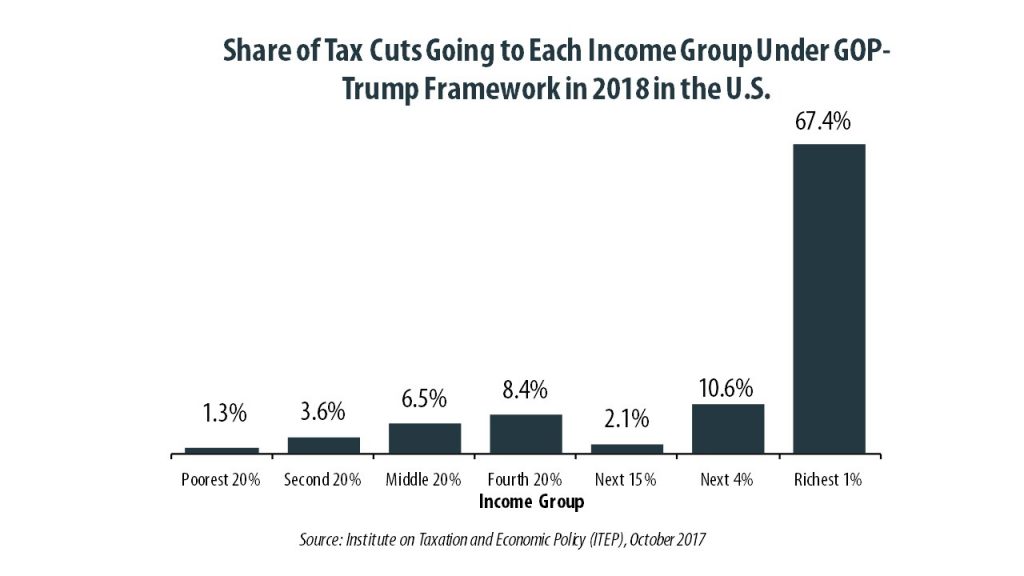

50-State Analysis: GOP-Trump Tax Proposal Would Give the Store Away to the Wealthy, Exacerbate the Income Divide

October 4, 2017 • By Alan Essig

A 50-state analysis of the GOP tax framework reveals the top 1 percent of taxpayers would receive a substantial tax cut while middle- and upper-middle-income taxpayers in many states would pay more, the Institute on Taxation and Economic Policy said today. The GOP continues to tout its tax plan as “beneficial to the middle class.” […]

Benefits of GOP-Trump Framework Tilted Toward the Richest Taxpayers in Each State

October 4, 2017 • By Steve Wamhoff

The “tax reform framework” released by the Trump administration and Congressional Republican leaders on September 27 would affect states differently, but every state would see its richest residents grow richer if it is enacted. In all but a handful of states, at least half of the tax cuts would flow to the richest one percent of residents if the framework took effect.

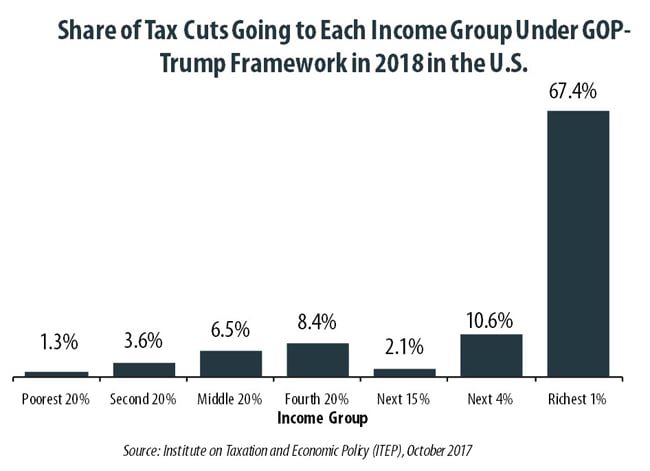

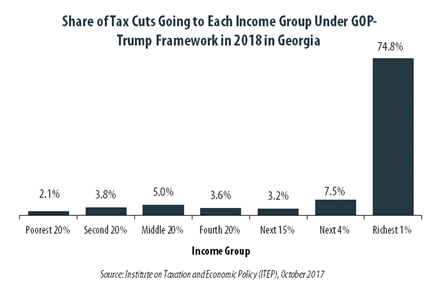

GOP-Trump Tax Framework Would Provide Richest One Percent in Georgia with 74.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Georgia equally. The richest one percent of Georgia residents would receive 74.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $552,200 next year. The framework would provide them an average tax cut of $83,070 in 2018, which would increase their income by an average of 4.0 percent.

Astonishingly, tax policies in virtually every state make it harder for those living in poverty to make ends meet. When all the taxes imposed by state and local governments are taken into account, every state imposes higher effective tax rates on poor families than on the richest taxpayers.

The Oklahoman: Tax Holiday Debate Splits Those on the Left

August 31, 2017

The liberal Institute on Taxation and Economic Policy has been among those urging repeal of sales tax holidays. In Georgia, the liberal Georgia Budget and Policy Institute promoted repeal. In an interview with Governing magazine, Wesley Tharpe, research director of the Georgia Budget and Policy Institute, appeared dismissive of the savings the holiday provided low-income […]

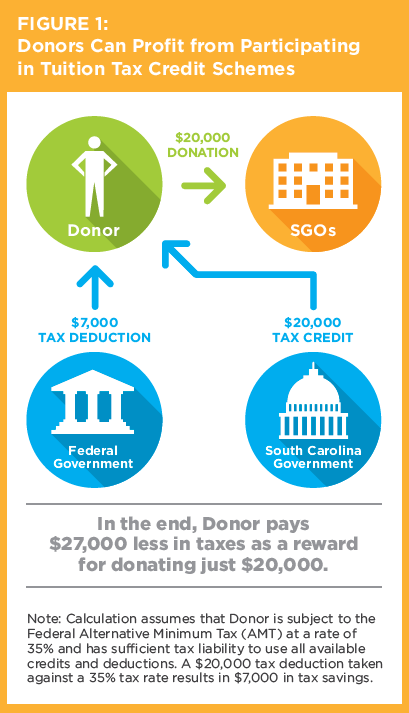

Chicago Tribune: Put the Brakes on GOP’s Backdoor Voucher Idea

August 24, 2017

Donors to the scholarship funds are also allowed to count that donation as a standard charitable donation for federal income tax purposes, meaning, as one Georgia agency that distributes to schools enthuses on its website, “You will end with more money than when you started.” And the higher your tax bracket, the higher your risk-free […]

Nearly Half of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million Annually

August 17, 2017 • By ITEP Staff

A tiny fraction of the U.S. population (one-half of one percent) earns more than $1 million annually. But in 2018 this elite group would receive 48.8 percent of the tax cuts proposed by the Trump administration. A much larger group, 44.6 percent of Americans, earn less than $45,000, but would receive just 4.4 percent of the tax cuts.

In Georgia 50.0 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Georgia population (0.6 percent) earns more than $1 million annually. But this elite group would receive 50.0 percent of the tax cuts that go to Georgia residents under the tax proposals from the Trump administration. A much larger group, 50.0 percent of the state, earns less than $45,000, but would receive just 5.6 percent of the tax cuts.

2017 marked a sea change in state tax policy and a stark departure from the current federal tax debate as dubious supply-side economic theories began to lose their grip on statehouses. Compared to the predominant trend in recent years of emphasizing top-heavy income tax cuts and shifting to more regressive consumption taxes in the hopes […]

States May Be Finally Learning Their Lesson on Back-To-School Sales Tax Holidays

July 21, 2017 • By Dylan Grundman O'Neill

State lawmakers face a dilemma when it comes to sales tax holidays, an attractive and popular policy that nonetheless proves to be a poor choice compared to developing thoughtful, targeted tax policies or investing in well-executed public services. Luckily, word seems to be getting out that the costs associated with these holidays far outweigh their purported benefits.

Trump Tax Proposals Would Provide Richest One Percent in Georgia with 58.5 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Georgia would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,892,900 in 2018. They would receive 58.5 percent of the tax cuts that go to Georgia’s residents and would enjoy an average cut of $120,130 in 2018 alone.

Trump’s $4.8 Trillion Tax Proposals Would Not Benefit All States or Taxpayers Equally

July 20, 2017 • By Matthew Gardner, Steve Wamhoff

The broadly outlined tax proposals released by the Trump administration would not benefit all taxpayers equally and they would not benefit all states equally either. Several states would receive a share of the total resulting tax cuts that is less than their share of the U.S. population. Of the dozen states receiving the least by this measure, seven are in the South. The others are New Mexico, Oregon, Maine, Idaho and Hawaii.

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 12, 2017 • By ITEP Staff

Sales taxes are an important revenue source, composing close to half of all state tax revenues. But sales taxes are also inherently regressive because the lower a family’s income, the more the family must spend on goods and services subject to the tax. Lawmakers in many states have enacted “sales tax holidays” (at least 16 states will hold them in 2017), to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. While these holidays may seem to lessen the regressive impacts of the sales tax, their benefits are minimal. This policy brief…

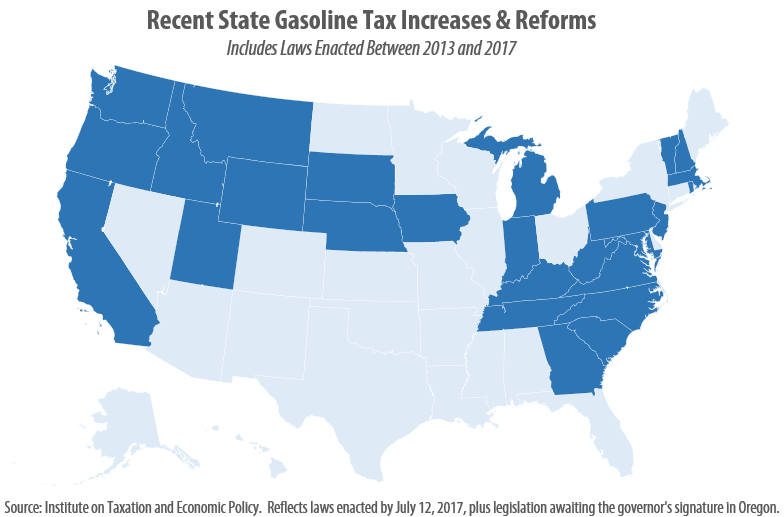

The flawed design of federal and state gasoline taxes has made it exceedingly difficult to raise adequate funds to maintain the nation’s transportation infrastructure. Thirty states and the federal government levy fixed-rate gas taxes where the tax rate does not change even when the cost of infrastructure materials rises or when drivers transition toward more fuel-efficient vehicles and pay less in gas tax. The federal government’s 18.4 cent gas tax, for example, has not increased in over twenty-three years. Likewise, nineteen states have waited a decade or more since last raising their own gas tax rates.

Scripps News Service: Money Diverted from Public Schools?

June 26, 2017

All the programs basically work this way: Individuals and businesses make cash or stock donations to scholarship granting organizations. The organizations award scholarships to qualifying families with K-12 students, primarily children in failing public schools or whose families’ income meets the state’s poverty threshold. Students can then attend a private or religious school of their […]

Atlanta Journal-Constitution: Georgia’s Tax Credit Program Is Profitable for the Rich

May 22, 2017

The national School Superintendents Association, which opposes the tax-based tuition subsidies because they leave less money on the table for public schools, published the report Public Loss, Private Gain, with the Institute on Taxation and Economic Policy. It describes the “double-dipping” tax benefits gained by those who donate to such programs in Georgia and eight […]

Investors and Corporations Would Profit from a Federal Private School Voucher Tax Credit

May 17, 2017 • By Carl Davis

A new report by the Institute on Taxation and Economic Policy (ITEP) and AASA, the School Superintendents Association, details how tax subsidies that funnel money toward private schools are being used as profitable tax shelters by high-income taxpayers. By exploiting interactions between federal and state tax law, high-income taxpayers in nine states are currently able […]

Public Loss Private Gain: How School Voucher Tax Shelters Undermine Public Education

May 17, 2017 • By Carl Davis, Sasha Pudelski

One of the most important functions of government is to maintain a high-quality public education system. In many states, however, this objective is being undermined by tax policies that redirect public dollars for K-12 education toward private schools.

This post was updated July 12, 2017 to reflect recent gas tax increases in Oregon and West Virginia. As expected, 2017 has brought a flurry of action relating to state gasoline taxes. As of this writing, eight states (California, Indiana, Montana, Oregon, South Carolina, Tennessee, Utah, and West Virginia) have enacted gas tax increases this year, bringing the total number of states that have raised or reformed their gas taxes to 26 since 2013.

3 Percent and Dropping: State Corporate Tax Avoidance in the Fortune 500, 2008 to 2015

April 27, 2017 • By Aidan Davis, Matthew Gardner, Richard Phillips

The trend is clear: states are experiencing a rapid decline in state corporate income tax revenue. Despite rebounding and even booming bottom lines for many corporations, this downward trend has become increasingly apparent in recent years. Since our last analysis of these data, in 2014, the state effective corporate tax rate paid by profitable Fortune 500 corporations has declined, dropping from 3.1 percent to 2.9 percent of their U.S. profits. A number of factors are driving this decline, including: a race to the bottom by states providing significant “incentives” for specific companies to relocate or stay put; blatant manipulation of…

State Rundown 4/12: Season in Transition as Some States Close, Others Open Tax Debates

April 12, 2017 • By ITEP Staff

This week in state tax news we see Louisiana‘s session getting started, budgets passed in New York and West Virginia, Kansas lawmakers taking a rest after defeating a harmful flat tax proposal, and Nebraska legislators preparing for full debate on major tax cuts. Nevada lawmakers may make tax decisions related to tampons, diapers, marijuana, and […]

Atlanta Journal Constitution: Is a flat tax right for Georgia?

April 11, 2017

That’s the problem Tharpe has with studies like the Wallethub.com survey. That 50-state look at state taxes found Georgia has a tax burden of 8.2 percent of individual personal income. The Washington, DC,-based financial services website ranked Georgia slightly better than Arizona and just behind Washington state. When I tweeted out those findings, Tharpe was quick to […]