Wealth Tax

Billionaires Should Pay Taxes on Their Income Every Year Like the Rest of Us

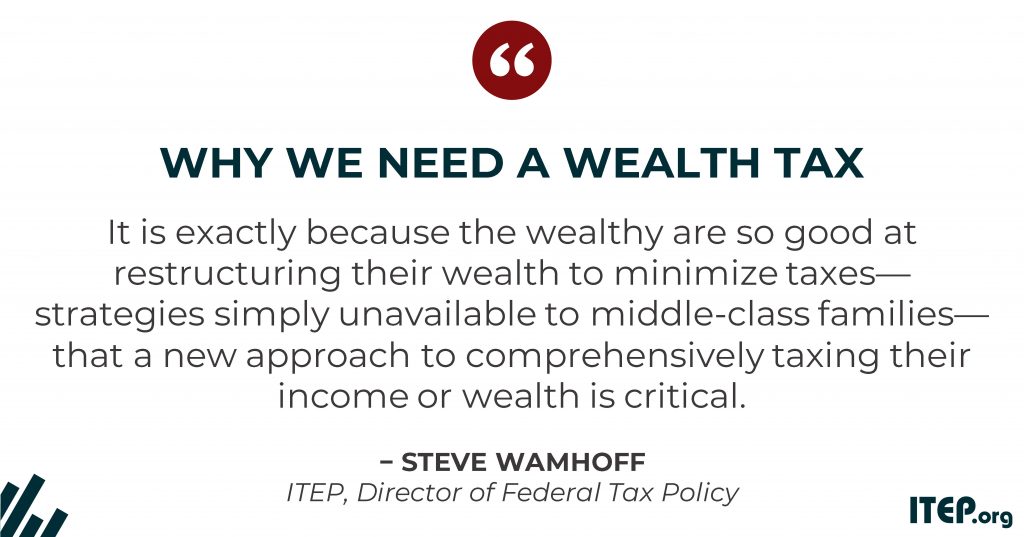

September 13, 2022 • By Steve Wamhoff

The Inflation Reduction Act signed by President Biden last month will crack down on corporate tax dodgers and strengthen enforcement of tax laws already on the books, raising hundreds of billions of dollars to be spent on climate, health and other priorities. But these reforms will not directly raise taxes on even the wealthiest individuals. […]

Revenue-Raising Proposals in the Evolving Build Back Better Debate

January 25, 2022 • By Steve Wamhoff

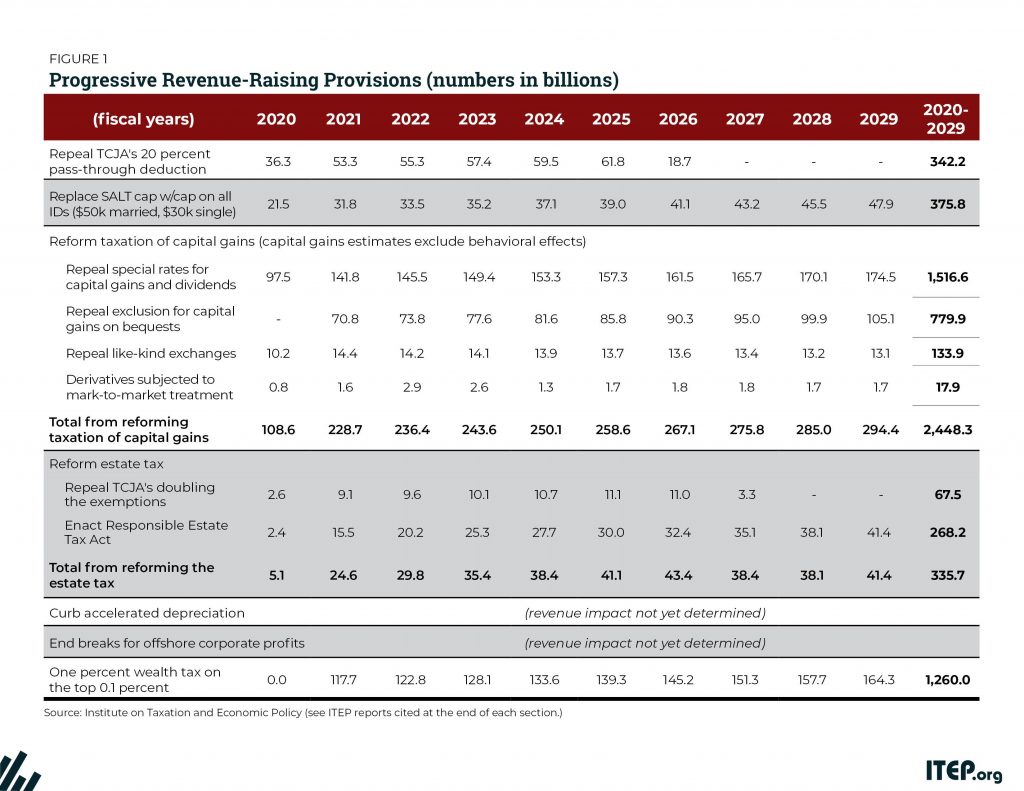

The United States needs to raise more tax revenue to fund investments in the American people. This revenue can be obtained with reforms that would require the richest and wealthiest Americans to pay their fair share to support the society that makes their fortunes possible.

America’s Richest Would Finally Pay Taxes on Most of Their Income Under Wyden’s Billionaires Income Tax

October 27, 2021 • By Steve Wamhoff

While the Ways and Means bill includes many helpful tax reforms, people like Jeff Bezos and Elon Musk would still pay an effective tax rate of zero percent on most of their income if it was enacted without this change. Sen. Wyden’s proposal would finally end this injustice.

A Proposal to Simplify President Biden’s Campaign Plan for Personal Income Taxes and Replace the Cap on SALT Deductions

April 8, 2021 • By Steve Wamhoff

In this paper, we describe a tax policy idea that would simplify the proposals President Biden presented during his campaign to raise personal income taxes for those with annual incomes greater than $400,000. Our proposal would replace the cap on state and local tax (SALT) deductions with a broader limit on tax breaks for the rich that would raise more revenue than the personal income tax hikes that Biden proposed during his campaign. Our proposal would also achieve Biden’s goals of setting the top rate at 39.6 percent and raising taxes only on those with income exceeding $400,000.

With the onslaught of news about billionaire wealth soaring while low- and moderate-income families have trouble making ends meet, a federal wealth tax makes good economic and fiscal sense—and the public supports it. One poll found that 64 percent of respondents favor the idea, including a majority of Republicans.

Should lawmakers enact laws that they believe are sensible and constitutional, or should they shape their legislative agenda around what they believe ideological Supreme Court justices will allow? This is a dilemma facing Americans who support a federal wealth tax.

What Biden Means By No Tax Increases on Anyone “Making Under $400,000”

May 22, 2020 • By Steve Wamhoff

Presidential candidate Joe Biden said on Friday that under his proposals, no one with income below $400,000 would pay higher taxes than they do now. Does this make sense? It is true that Congress and the next president have many options to raise trillions of dollars from people who have incomes even higher than that. […]

How Democratic Presidential Candidates Would Raise Revenue

February 19, 2020 • By Steve Wamhoff

One of the biggest problems with the U.S. tax code in terms of fairness is that investment income, which mostly flows to the rich, is taxed less than the earned income that makes up all or almost all of the income that working people live on.

A basic understanding and idea of fairness is a trait we share with intelligent primates, which is precisely why more than two years ago as Congress was debating the Tax Cuts and Jobs Act, the American public disapproved of the tax bill.

Emmanuel Saez and Gabriel Zucman’s New Book Reminds Us that Tax Injustice Is a Choice

October 15, 2019 • By Steve Wamhoff

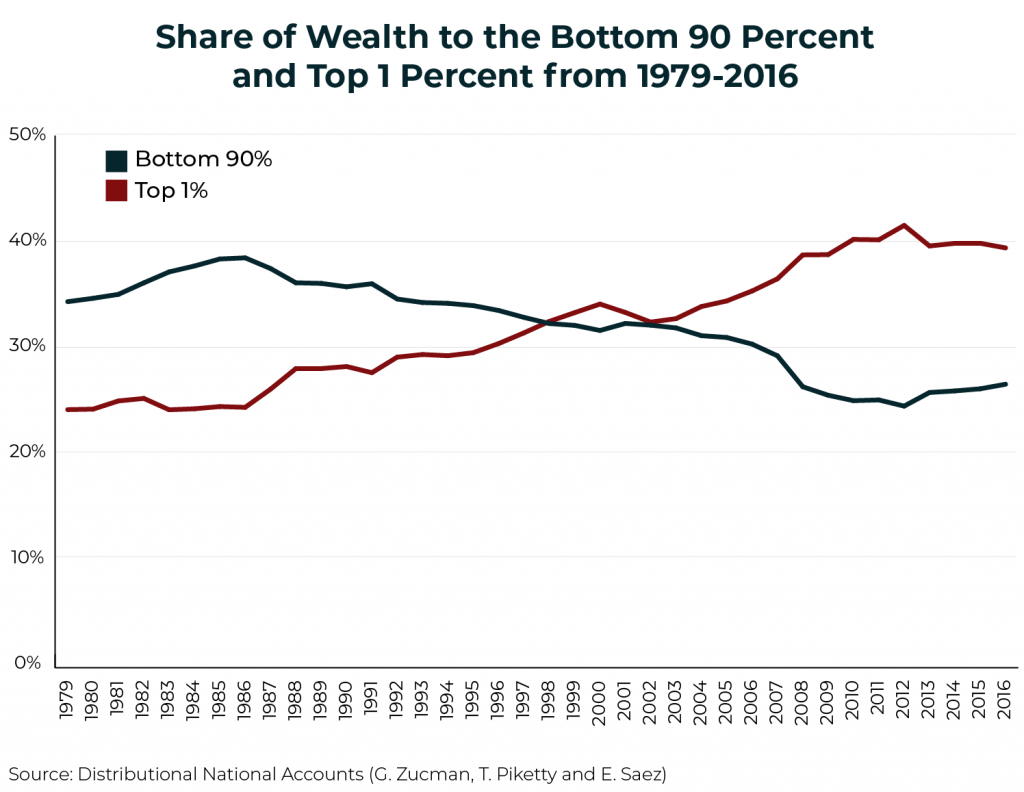

Cue Emmanuel Saez and Gabriel Zucman. In their new book, The Triumph of Injustice, the economists, who already jolted the world with their shocking data on exploding income inequality and wealth inequality, tell us to stop acting like we are paralyzed when it comes to tax policy. There are answers and solutions. And in about 200 surprisingly readable pages, they provide them.

The Fiscal Times: Would a Warren/Sanders Wealth Tax Kill the Economy?

October 3, 2019

Steve Wamhoff, director of federal tax policy at the liberal Institute on Taxation and Economic Policy, said Wednesday cited the public investments that could be financed with revenues from the wealth tax, providing the economy with a much-needed boost. “Industrialized nations with thriving economies all over the world collect far more in tax revenue and […]

A New York Times article explained that proponents of a federal wealth tax hope to address exploding inequality but then went on to list the fears of billionaires and economic policymakers, finding that “the idea of redistributing wealth by targeting billionaires is stirring fierce debates at the highest ranks of academia and business, with opponents arguing it would cripple economic growth, sap the motivation of entrepreneurs who aspire to be multimillionaires and set off a search for loopholes.” A wealth tax will not damage our economy and instead would likely improve it. Here’s why.

Wealth Tax Proposals from Warren and Sanders: What You Should Know

September 25, 2019 • By Steve Wamhoff

Earlier this year, Sen. Elizabeth Warren proposed a federal wealth tax on a handful of U.S. households with the highest net worth. Sen. Bernie Sanders has just announced his own wealth tax proposal, which is similar to Warren’s. A few other presidential candidates say they support the concept although they have not provided any details. Here's what you need to know about the potential for a federal wealth tax.

A federal wealth tax on the richest 0.1 percent of Americans is a viable approach for Congress to raise revenue and address economic inequality. This new video from ITEP makes the case for a federal wealth tax.

How Tax Policy Can Help Mitigate Poverty, Address Income Inequality

September 10, 2019 • By ITEP Staff

Analysts at the Institute on Taxation and Economic Policy have produced multiple recent briefs and reports that provide insight on how current and proposed tax policies affect family economic security and income inequality.

A direct federal tax on wealth, as described in a January report from ITEP and proposed by Sen. Elizabeth Warren, could raise substantial revenue to make public investments, curb rising inequality, and is supported by a large majority of Americans. But would it work? Recent research highlighted in a new academic paper outlines approaches that would make it easier than you might think.

The nation’s tax policies and their role in economic inequality are front and center during this election cycle. For those interested in how the nation can move toward a fairer tax system and or more detailed information about progressive tax policy ideas, ITEP created this quick guide.

Wealth Tax Is Supported by Basically Everyone Who Is Not a Politician

June 27, 2019 • By Steve Wamhoff

A February survey found that 61 percent of registered voters supported a wealth tax proposal, including 51 percent of Republican voters. And it’s not just the non-rich wanting to tax the very rich. A June survey found that 60 percent of millionaires support the idea.

What to Watch for on Tax Policy During the Presidential Primary

June 25, 2019 • By Steve Wamhoff

America needs a new tax code. The Democratic presidential debates beginning this week present an opportunity for candidates to make clear how they would address inequality or to raise enough revenue to make public investments that make the economy work for everyone. Here are some of the big tax issues that we hope they will touch on.

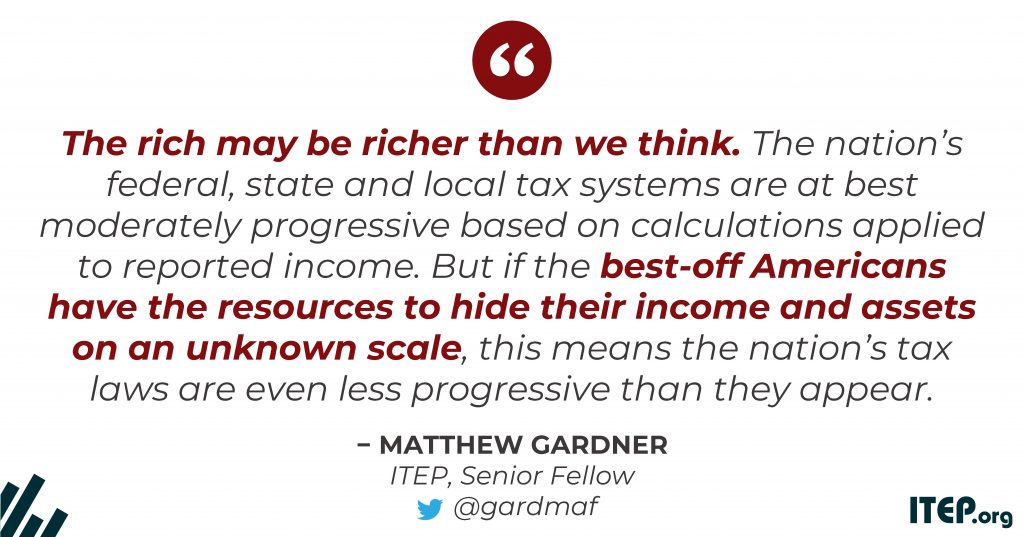

File Under “No Surprise”: Wealthiest Taxpayers Use Offshore Tax Shelters More Than the Rest of Us, New Research Finds

June 4, 2019 • By Matthew Gardner

Tax evasion matters. It drains needed revenues from the public treasury, and saps public confidence in rules of the game. A recent Pew Research poll finds that 60 percent of Americans are bothered “a lot” by the feeling that the best-off don’t pay their fair share of taxes. And now, thanks to a new report, […]

America has long needed a more equitable tax code that raises enough revenue to invest in building shared prosperity. The Tax Cuts and Jobs Act (TCJA), enacted at the end of 2017, moved the federal tax code in the opposite direction, reducing revenue by $1.9 trillion over a decade, opening new loopholes, and providing its most significant benefits to the well-off. The law cut taxes on the wealthy directly by reducing their personal income taxes and estate taxes, and indirectly by reducing corporate taxes.

Why We Should Talk about Progressive Taxes Despite Billionaires’ Objections

January 30, 2019 • By Jenice Robinson

It was the tone-deaf remark heard ‘round the world. Last week on CNBC’s Squawk Box, Commerce Secretary Wilbur Ross suggested that furloughed government employees who hadn’t been paid in a month could go to a bank and get a loan to make ends meet. This was not a gaffe. It’s hard to fathom how a […]