Blog - Corporate Taxes

151 posts

Oxfam Report Finds Pharmaceuticals Profiteering Off Crises in Developing Countries

September 20, 2018 • By Peter Della-Rocca

The report indicates, pharmaceutical companies have taken steps to hide their profits in low-tax countries, sapping billions in revenue from the governments that invest in the science that drives their products and safeguard the patents that undergird their business. Pharmaceutical companies made use of a familiar battery of methods to exploit the international system this way, including inversions to disguise an American company as a foreign one and passing profits into low-tax jurisdictions through artificial usage fees on intangible assets like intellectual property.

New Study Confirms Offshore Earnings are Flowing into Stock Buybacks, Not Jobs and Investments

September 7, 2018 • By Richard Phillips

A new study by the Federal Reserve found that the evidence so far suggests that the new repatriation tax break has resulted in a surge in stock buybacks and little discernable impact in investment by its biggest beneficiaries, just as critics predicted.

How should lawmakers fix the system? A new ITEP report breaks down how the international corporate tax code under the TCJA works, and how lawmakers can fix it. The report lays out three key principles for reform: equalize the rates, eliminate inversions, and create transparency.

New Legislation Would Close Significant Offshore Loopholes in the Tax Cuts and Jobs Act

June 6, 2018 • By Richard Phillips

One simple rule should drive the nation’s international tax policies: tax the offshore profits of American companies the same way their domestic profits are taxed. The latest legislation to approach that ideal is the Per-Country Minimum Act (H.R. 6015), from Rep. Peter DeFazio (D-OR). The DeFazio bill closes the loophole that allows corporations to use foreign tax credits to shelter profits in tax havens from U.S. taxes. No other bill addresses this.

Facebook Facing Shareholder Scrutiny for Its Offshore Tax Avoidance

May 30, 2018 • By Richard Phillips

In advance of its annual shareholders meeting on May 31, Facebook was confronted with a shareholder resolution asking it to endorse a set of principles to guide its tax policy and to ensure that such principles consider the impact of its tax strategies on local economies and public services. The resolution is a signal from a group of concerned shareholders that Facebook’s tax avoidance hurts its reputation, the communities in which it operates, and creates financial risks to the company’s shareholders.

Apple’s Three-Month Tax Savings under President Trump’s New Tax Law: $1.68 Billion

May 2, 2018 • By Matthew Gardner

By now, it should come as no shock that profitable Fortune 500 corporations are reaping huge benefits from the corporate tax cuts enacted last December. But as first quarter earnings reports are released, we’re learning just how big.

15 Companies Report Tax Savings of $6.2 Billion in First Three Months of 2018

April 26, 2018 • By Matthew Gardner

In reports released over the past week, covering the first three months of 2018, a few of the biggest and most profitable Fortune 500 corporations acknowledge receiving billions in tax cuts in the first quarter of 2018 alone. Fifteen of these companies collectively disclosed reducing their effective tax rates by $6.2 billion compared to the rates they faced in the first quarter of last year.

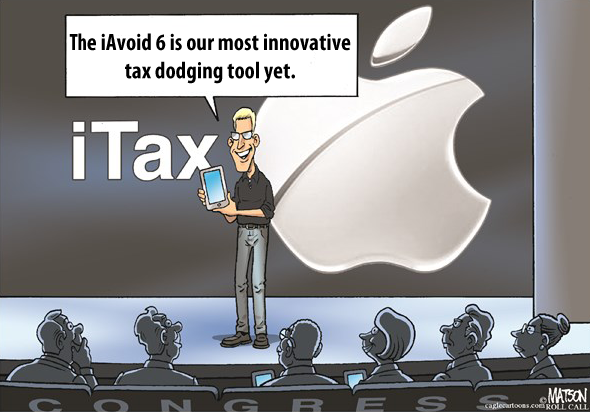

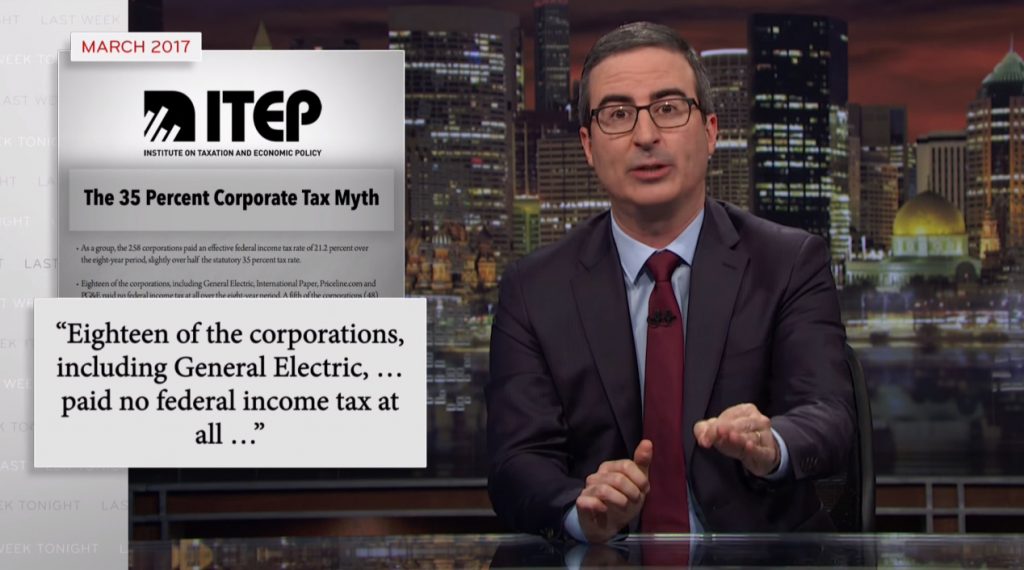

Key Takeaways from John Oliver’s Segment on Corporate Tax Avoidance

April 16, 2018 • By Richard Phillips

The HBO television show Last Week Tonight with John Oliver has become known for its longer segments that examine important issues facing the country. In its latest segment on Sunday, the show took a deep dive into corporate taxes and how many companies manage to avoid paying their fair share. Between its hilarious interludes, the segment painted a striking portrait of problems in our corporate tax code and how the Tax Cuts and Jobs Act (TCJA) failed to address them.

The U.S. Supreme Court is scheduled to consider a case next week (South Dakota v. Wayfair, Inc.) that has the potential to significantly improve states and localities’ ability to enforce their sales tax laws on Internet purchases.

President Trump’s latest Twitter target, the Amazon Corporation, is now under the microscope for its state and local tax avoidance. In a Thursday tweet, the President claimed that “[u]nlike others, they pay little or no taxes to state & local governments.” Such a statement is a startling reversal for a president who previously said his own ability to avoid paying income taxes “makes me smart.”

Boeing Paid Tax Rate of 8.4% in Previous Decade, But Trump to Speak About Why It Needed His Corporate Tax Cut

March 14, 2018 • By Matthew Gardner

For the second time in seven months, President Trump will visit a Boeing factory to hype corporate tax cuts. He’s chosen the wrong poster child. If there was something preventing the aerospace giant from expanding its business before the Trump-GOP tax law, it certainly wasn’t taxes. Boeing made headlines in 2016 only because after years of paying zero in federal taxes, it finally paid something. Over 10 years (2008 to 2017), the company paid an effective federal tax rate of 8.4 percent on $54.7 billion of U.S. profits.

The tobacco company Reynolds American announced this week that its full-time employees will receive a one-time bonus of $1,000 in the wake of a sharp reduction in its British parent company’s tax bill.

Five Ways States Can Recoup Corporations’ Massive Federal Tax Giveaway

March 2, 2018 • By Aidan Davis

Corporate America is doing alright. Corporate profits soared last year, and 2018 has already brought a major windfall in the form of the Trump-GOP tax law, which dramatically cut the federal corporate tax rate from 35 percent to 21 percent and shifted to a territorial tax system, giving income earned offshore by U.S. companies a free pass by no longer making it subject to U.S. taxes.

Amazon Inc. Paid Zero in Federal Taxes in 2017, Gets $789 Million Windfall from New Tax Law

February 13, 2018 • By Matthew Gardner

The online retail giant has built its business model on tax avoidance, and its latest financial filing makes it clear that Amazon continues to be insulated from the nation’s tax system. In 2017, Amazon reported $5.6 billion of U.S. profits and didn’t pay a dime of federal income taxes on it. The company’s financial statement suggests that various tax credits and tax breaks for executive stock options are responsible for zeroing out the company’s tax this year.

The More Things Change: PG&E Records a Tenth Straight Year of No Federal Income Taxes

February 9, 2018 • By Matthew Gardner

In the runup to last fall’s tax debate, it was commonly observed that corporate tax reform is both easy and hard: the easy part is cutting the rate, and the hard part is paying for it by closing loopholes. The real test of Congress’ determination to achieve tax reform would be whether they would stand up to corporate lobbyists and shut down loopholes like accelerated depreciation that allow profitable companies to pay little or no income tax. As is now widely known, Congress was not especially determined: lawmakers aggressively cut the corporate rate from 35 to 21 percent, but then…

How Exxon’s Empty $50 Billion Promise Made Its Way into Trump’s SOTU

January 31, 2018 • By Matthew Gardner

Never one to let the truth get in the way of a good story, House Speaker Paul Ryan immediately published a press release with the headline, “ExxonMobil to Invest an Additional $50 Billion in the U.S. Due to Tax Reform.” The statement was completely faithful to ExxonMobil’s statement, except for the words “additional” and “due to tax reform.” Not to be outdone, President Trump implied during his State of the Union address that the company was investing $50 billion in response to the new tax law. But a closer examination of ExxonMobil’s recent history of domestic spending finds that the…

Fact-Checking Trump’s State of the Union Address on Tax Issues

January 31, 2018 • By Steve Wamhoff

Here are some claims the President made during his State of the Union address, along with the facts.

Moody’s and Conservative Economists Agree: The Trump Corporate Tax Cut Is Not Helping Workers

January 26, 2018 • By Steve Wamhoff

Moody’s does not believe that corporate tax cuts are trickling down to working people as bonuses and pay raises. The real problem with the corporate PR campaign is that even those economists who supported Trump’s corporate tax cut and claimed it would help workers do not believe that it works this way.

The Walt Disney Corporation announced this week that in the wake of the new tax bill’s passage, it will spend $125 million on one-time bonuses and $50 million on an education program for some employees, all in 2018. This $175 million spending commitment is notable for two reasons: it’s temporary, and it’s a drop in the bucket for a company that’s likely to see annual tax savings of $1.2 billion a year and has already committed to a $50 billion-plus corporate acquisition of 21st Century Fox’s assets.

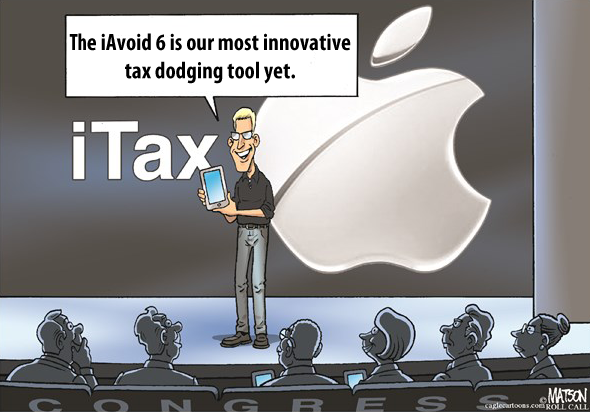

Apple Gambled on Congressional Spinelessness on Tax Policy— and Won

January 18, 2018 • By Matthew Gardner

Now, Apple Inc. would like the American public to know that it has “a deep sense of responsibility to give back to our country” a small fraction of its multi-billion-dollar tax cut haul. However, the company’s splashy press release is devoid of any specifics on the jobs it will create as a result of the tax bill. Like other corporate announcements, the company’s recent proclamation of newfound patriotism should be viewed as a public relations ploy designed to convince a skeptical public that working families will see some trickle-down benefit from this historic corporate giveaway.

The Walmart Smiley Face Is Lying: Corporate Tax Cuts Are Not Causing Pay Raises and Bonuses

January 12, 2018 • By Steve Wamhoff

Last night, Yahoo reported that 81 corporations had announced pay raises and bonuses that they claim result from the Trump-GOP tax law’s reduction in the official corporate tax rate from 35 percent to 21 percent. Of these 81 corporations, 13 were included in ITEP’s most recent corporate tax study, which focuses on the Fortune 500 companies that were profitable every year from 2008 through 2015. These 13 companies had a combined effective tax rate of just 19.1 percent, which undermines the idea that the federal corporate tax rate was holding back their ability to pay workers.

Walmart’s Minimum Wage Hike: Did the Tax System Make Them Do It?

January 12, 2018 • By Matthew Gardner

The Walmart corporation announced this week that it will increase its minimum wage to $11 an hour, in a move that the company attributed to the major corporate tax cut signed into law by President Trump last month. The $300 million the company will spend on the wage boost is just a fraction of the more than $2 billion a year ITEP estimates Walmart could net from the corporate tax rate cuts that took effect January 1—but even so, the company felt the need to make the wage boost more affordable by simultaneously closing 63 Sam’s Club stores and laying…

Corporate America, You Just Got a $650 Billion Tax Cut! What Are You Going to Do Next?

December 22, 2017 • By Matthew Gardner

While many Fortune 500 CEO’s likely had to restrain themselves from preemptively shouting “we’re going to Disneyland” in an homage to the Disney Corporation’s trademark ad spot involving the winner of each year’s Super Bowl, it’s pretty understandable that several of them—including known tax avoiders AT&T, Boeing, Comcast and Wells Fargo—would preemptively make grandiose promises that they will reserve part of their tax cuts for the little people who made it all possible.

The Trump-GOP’s Big Giveaway to Multinational Corporations

December 19, 2017 • By Richard Phillips

The tax bill just approved by Congress was a golden opportunity to solve these problems for good—but turned out to be a colossal missed opportunity. Instead of addressing the hundreds of billions in lost federal tax revenue due to offshore tax avoidance schemes, the Trump-GOP tax bill would forgive most of the taxes owed on the profits held offshore right now and open the floodgates to even more offshore profit-shifting in the future.

The Senate Tax Plan’s Big Giveaway to Multinational Corporations

November 21, 2017 • By Richard Phillips

Instead of addressing the hundreds of billions in lost federal tax revenue due to offshore tax avoidance schemes, the Senate tax bill would forgive most of the taxes owed on these profits and open the floodgates to even more offshore profit-shifting in the future.