Blog

1298 posts

Washington Post Confirms that Corporations Are Bolder than Ever in Claiming Dubious Tax Breaks

July 16, 2021 • By Steve Wamhoff

IRS budget cuts starting in 2010 have forced the agency to reduce its audit rate for corporations with $20 billion or more in assets from 98 percent to 50 percent. The Washington Post found that during the decade, the amount of “uncertain tax benefits” claimed by corporations increased 43 percent, from $164 billion in 2010 to $235 billion in 2020.

Comparing athletes to inanimate objects, of course, is incredibly degrading. It’s also standard fare in the sports talk world to compare athletes to stocks in which you want to buy low and trade high to maximize your returns—the greatest return usually being championship trophies. It wasn’t until ProPublica released its latest report, The Billionaire Playbook: How Sports Owners Use Their Teams to Avoid Millions in Taxes, that we were able to see so clearly how the athlete as a stock is not just a dehumanizing concept in team sports at the individual level, but also how owners of sports teams…

Experts Weigh in on the Payoffs of Advanced Child Tax Credit Payments

July 15, 2021 • By Jenice Robinson

During a Tuesday webinar (The Child Tax Credit in Practice: What We Know about the Payoffs of Payments) hosted by ITEP and the Economic Security Project, panelists explained why the expanded Child Tax Credit is a transformative policy that should be extended beyond 2021. They highlighted tax policy and anti-poverty research and discussed lessons learned from demonstration projects that have provided a guaranteed income to low-income families.

“It’s not just condominium buildings that are showing their age,” Peter Coy writes in a piece critiquing the condominium form of ownership for underinvesting in maintenance. Coy just as easily could have been describing American democracy that is showing its age in similar ways.

State Rundown 7/7: The New Fiscal Year Starts off With a Bang, And Not Just Fireworks

July 7, 2021 • By ITEP Staff

States were busy over the past week despite the Fourth of July holiday. Many are gearing up for upcoming tax and budget clashes that could shape their futures for some time...

In Drive to Cut Taxes, States Blow an Opportunity to Invest in Underfunded Services

July 7, 2021 • By Marco Guzman

Many states find themselves in a peculiar fiscal situation right now: federal pandemic relief money has been dispersed to states and revenue projections have exceeded expectations set during the pandemic. Meanwhile, more and more workers are returning to jobs as vaccines roll out and typical economic activity resumes. Some states, however, have decided to squander their unexpected fiscal strength on tax cuts.

President Joe Biden's American Families and Jobs plans intend to “build back better” and create a more inclusive economy. To fully live up to this ideal, the final plan must include undocumented people and their families.

State Rundown 6/30: Resolutions Are in Order for the New Fiscal Year

June 30, 2021 • By ITEP Staff

Today is the last day of the fiscal year in many states, and some lawmakers might want to take the opportunity to make some new fiscal year resolutions. Legislators in Arizona, New Hampshire, Ohio, North Carolina, and Wisconsin, for example, should really cut back on the trickle-down tax-cut Kool-Aid, which may make parties with rich donors more fun but tends to be both harmful and habit-forming...

A growing group of state lawmakers are recognizing the extent to which low- and middle-income Americans are struggling and the ways in which their state and local tax systems can do more to ensure the economic security of their residents over the long run. To that end, lawmakers across the country have made strides in enacting, increasing, or expanding tax credits that benefit low- and middle-income families. Here is a summary of those changes and a celebration of those successes.

When Tax Breaks for Retirement Savings Enrich the Already Rich

June 25, 2021 • By Steve Wamhoff

Members of Congress frequently claim they want to make it easier for working people to scrape together enough savings to have some financial security in retirement. But lawmakers’ preferred method to (ostensibly) achieve this goal is through tax breaks that have allowed the tech mogul Peter Thiel to avoid taxes on $5 billion. This is just one of the eye-popping revelations in the latest expose from ProPublica.

State Rundown 6/24: Late June State Fiscal Debates Unusually Active

June 24, 2021 • By ITEP Staff

Delayed legislative sessions and protracted federal aid debates have made for a busier June than normal for state fiscal debates. Arizona, New Hampshire, and North Carolina legislators, for example, are still pushing for expensive and regressive tax cuts in their states while they remain in session...

On July 15, the U.S. Treasury will begin mailing monthly checks to families with children who are eligible for the Child Tax Credit. Previously, the maximum credit was $2,000 per child, but for 2021, President Biden’s American Rescue Plan broadened the credit to $3,600 for each child under six and $3,000 for children over six. The expansion also made eligible children whose parents' incomes were too low to qualify for the previous credit, both addressing a fundamental policy flaw and taking a significant step to reduce child poverty. This is the first time that the federal government is sending advanced…

Taxing rich households and large corporations to fund vital investments in education and other shared priorities has long been a winner in the eyes of the American public, and more recently has also enjoyed a string of victories in state legislatures and at the ballot box. That win streak continued this week as Arizona’s voter-approved tax surcharge on the rich and Seattle, Washington’s payroll tax on high-profit, high-salary businesses both survived court challenges, and Massachusetts leaders approved a millionaires tax to go before voters next year.

Child Tax Credit Is a Critical Component of Biden Administration’s Recovery Package

June 11, 2021 • By Aidan Davis

Nearly one in seven children in the United States live in poverty and about 6 percent of all children live in deep poverty. President Joe Biden’s American Families Plan would tackle child poverty in an immediate, meaningful way. It is expected to extend the one-year Child Tax Credit (CTC) enhancements included in the March 2021 American Rescue Plan (ARP) through 2025. Next year alone, this would provide around a $110 billion collective income boost to roughly 88 percent of children in the United States.

U.S. Should Pursue Biden’s Tax Legislation and International Tax Agreement on Separate Tracks

June 9, 2021 • By Steve Wamhoff

The agreement announced over the weekend from the finance leaders of the Group of 7 (G7) countries to allow governments to tax some corporate profits based on the location of sales and to implement a 15 percent global minimum tax is a major step forward—but in no way changes the need for Congress to enact President Joe Biden’s tax reforms right now.

State Rundown 6/7: Remaining State Legislative Sessions Are Heating up as Budget Deadlines Loom

June 7, 2021 • By ITEP Staff

Just as an early summer heatwave brought soaring temperatures this past weekend through much of the lower 48 states, several state legislative sessions are heating up as legislators scramble to make tough budget decisions. Massachusetts lawmakers are voting on a fiery new "millionaires' tax" that would support transportation and education revenue needs, and Connecticut will likely restore its state Earned Income Tax Credit (EITC) back to 30 percent. Illinois’s decision to cut back corporate tax breaks also provided a breath of fresh air. Unfortunately, we'd give other state tax proposals a more lukewarm reception: New Hampshire, North Carolina, and Ohio…

State Rundown 5/27: State Legislatures Step Back, Advocates Push Forward

May 27, 2021 • By ITEP Staff

As more and more state legislatures wrap up their sessions and we reflect on the whirlwind that is this past year, it’s easy to focus on the steps back that states like Oklahoma have taken and Nebraska, North Carolina, and Arizona are trying to take. We have had some significant wins in states over the course of the year, but not every development will be a good one. However, we know advocates are on the ground, working tirelessly to help states maintain equity and progressivity in their tax codes. And for that, we have many of you—our intrepid readers of…

The Treasury Department released a report explaining what the administration’s tax enforcement plan would do—and how it fits into the president’s overall plan to collect more revenue from profitable corporations and individuals making more than $400,000 a year.

“Tax Day” was earlier this week but the debates, research, and advocacy that determine our taxes and how they are used take place every day of the year...

IRS Clock Runs Out, Saving 14 Large Companies $1.3 Billion

May 18, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

Each year, corporations publicly state that some of the tax breaks they claim are unlikely to withstand scrutiny from tax authorities. And each year, corporations report that they will keep some of the dubious tax breaks they declared in previous years simply because the statute of limitations ran out before tax authorities made any conclusions. This suggests that, perhaps because of cuts to its enforcement budget, the IRS is not even investigating corporations that publicly announce they have claimed tax breaks that tax authorities would likely find illegal.

Take a minute on this Tax Day to reflect on all that you survived, accomplished, and contributed to the collective good this past year, and be proud. There is always more work to be done to build the communities we desire, and paying your share is what allows that work to continue.

Taxes not only provide revenue so we can have a functioning government, they also shape broader society. Currently economic inequality is one of the most pressing challenges of our time. ITEP has produced research over the years that shows the nation’s overall tax system (local, state and federal combined) is barely progressive. With real tax reform that centers ordinary people, tax policy can help create a more equitable society.

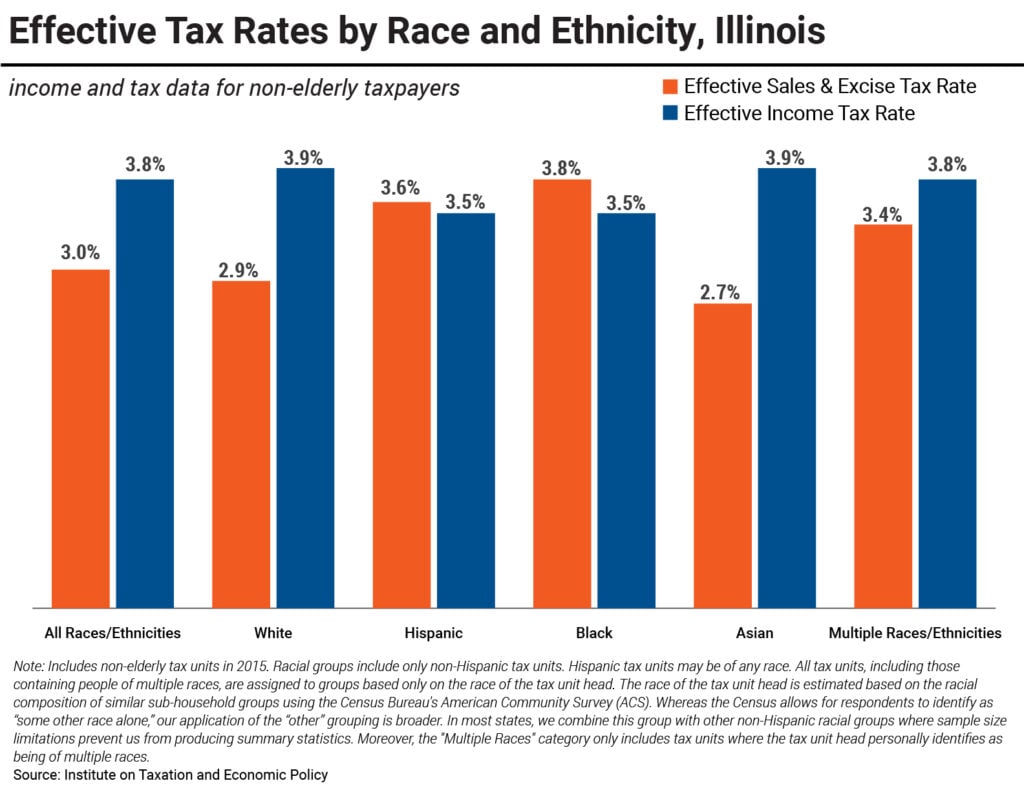

State Tax Codes & Racial Inequities: An Illinois Case Study

May 14, 2021 • By Lisa Christensen Gee

Earlier this year, ITEP released a report providing an overview of the impacts of state and local tax policies on race equity. Against a backdrop of vast racial disparities in income and wealth resulting from historical and current injustices both in public policy and in broader society, the report highlights that how states raise revenue to invest in disparity-reducing investments like education, health, and childcare has important implications for race equity.

State Rundown 5/13: States Get Federal Aid and Guidance as Many Sessions Wind Down

May 13, 2021 • By ITEP Staff

We had our noses buried in new American Rescue Plan guidance...when we heard the refreshing news that Missouri leaders are on the verge of modernizing their tax code, not only by becoming the final state to apply sales taxes to online purchases, but also by enacting an Earned Income Tax Credit (EITC)...Meanwhile, tax debates are also highly active in California, Colorado, Louisiana, Maine, and Nebraska. We also share some of our own reporting on recent efforts in Arizona and several other states to undermine voter-approved reforms and democratic institutions themselves.

Nearly 20 Million Will Benefit if Congress Makes the EITC Enhancement Permanent

May 13, 2021 • By Aidan Davis

Overall, the EITC enhancement would provide a $12.4 billion boost in 2022 if made permanent, benefiting 19.5 million workers. It would have a particularly meaningful impact on the bottom 20 percent of eligible households who would receive more than three-fourths of the total benefit. Forty-one percent of households in the bottom 20 percent of earners would benefit, receiving an average income boost of 6.3 percent, or $740 dollars.