Personal Income Taxes

Newly Unveiled Ballot Initiative Aims to Tax Arizona’s Top 1 Percent to Fund Education

May 1, 2018 • By Aidan Davis

Today marks Day 4 of the Arizona teachers’ walkout. After decades of tax cuts and underfunding of public education, education advocates are now driving the debate and urging lawmakers to act. Their newest proposal would raise taxes on incomes above half a million dollars for married couples, or above $250,000 for single taxpayers—that is, the same wealthy taxpayers that just received a generous tax cuts under last year’s federal tax overhaul.

Trickle-Down Dries Up: States without personal income taxes lag behind states with the highest top tax rates

October 26, 2017 • By Carl Davis, Nick Buffie

Lawmakers who support reducing or eliminating state personal income taxes typically claim that doing so will spur economic growth. Often, this claim is accompanied by the assertion that states without income taxes are booming, and that their success could be replicated by any state that abandons its income tax. To help evaluate these arguments, this study compares the economic performance of the nine states without broad-based personal income taxes to their mirror opposites—the nine states levying the highest top marginal personal income tax rates throughout the last decade.

Astonishingly, tax policies in virtually every state make it harder for those living in poverty to make ends meet. When all the taxes imposed by state and local governments are taken into account, every state imposes higher effective tax rates on poor families than on the richest taxpayers.

2017 marked a sea change in state tax policy and a stark departure from the current federal tax debate as dubious supply-side economic theories began to lose their grip on statehouses. Compared to the predominant trend in recent years of emphasizing top-heavy income tax cuts and shifting to more regressive consumption taxes in the hopes […]

Failed Tax-Cut Experiment (in North Carolina) Will Continue Under Final Budget Agreement, Pushes Fiscal Reckoning Down the Line

June 21, 2017

The final budget agreement from leaders of the House and Senate puts North Carolina on precarious fiscal footing, The tax changes that leaders agreed to—which were less a compromise and more of a decision to combine the tax cuts in both chambers’ proposals—make the cost of these tax cuts bigger than what either chamber proposed. Including the new tax cuts,approximately 80 percent of the net tax cut since 2013 will have gone to the top 20 percent. More than half of the net tax cut will go to the top 1 percent.

Gov. Sam Brownback’s tax experiment in Kansas was a failure. His radical tax cuts for the rich eventually had to be partly paid for through tax hikes on low- and middle-income families and also failed to deliver on promises of economic growth. Meanwhile, the tax cuts decimated the state’s budget, diminished its credit rating, and compromised its ability to meet the state’s constitutional standard of adequacy for public education.

The Cost Of Trickle-Down Economics For North Carolina

May 26, 2017

Since 2013, state lawmakers have passed significant income tax cuts that largely benefit the state’s highest income earners and profitable corporations. These costly tax cuts have made the state’s tax system more upside-down by delivering the greatest income tax cuts to the state’s highest income taxpayers, while maintaining a heavier tax load on low- and […]

Investors and Corporations Would Profit from a Federal Private School Voucher Tax Credit

May 17, 2017 • By Carl Davis

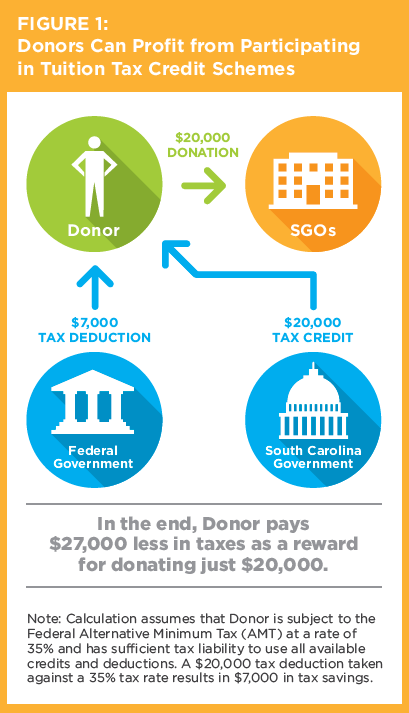

A new report by the Institute on Taxation and Economic Policy (ITEP) and AASA, the School Superintendents Association, details how tax subsidies that funnel money toward private schools are being used as profitable tax shelters by high-income taxpayers. By exploiting interactions between federal and state tax law, high-income taxpayers in nine states are currently able […]

Public Loss Private Gain: How School Voucher Tax Shelters Undermine Public Education

May 17, 2017 • By Carl Davis, Sasha Pudelski

One of the most important functions of government is to maintain a high-quality public education system. In many states, however, this objective is being undermined by tax policies that redirect public dollars for K-12 education toward private schools.

Nebraska Vote Is Latest Defeat for Tax-Cut “Trigger” Gimmick

May 4, 2017 • By Dylan Grundman O'Neill

Nebraska lawmakers had a long and contentious tax-cut debate this session but ultimately chose the wise path and rejected attempts to give a massive tax cut to the wealthy at the expense of the state’s schools, other public services, low- and middle-income families, and property tax payers. Tax cut efforts in Nebraska last year ended […]

Time to Repeal State Deductions for Federal Income Taxes

May 1, 2017 • By Dylan Grundman O'Neill

Three of the biggest needs facing state policymakers right now are new revenues to fund their priorities in the face of budget shortfalls and federal funding cuts, ways to insulate those revenue streams from unpredictable tax changes at the federal level, and approaches to meet these needs without leaning even more heavily on low- and […]

Why States That Offer the Deduction for Federal Income Taxes Paid Get It Wrong

May 1, 2017 • By Dylan Grundman O'Neill

With many states currently facing budget shortfalls—whether due to weak economic recovery after the Great Recession, struggling commodity prices, or self-inflicted tax cuts—and all states bracing for possible federal budget cuts in areas from education to health care to infrastructure, states are unlikely to be able to continue providing high-quality services to their residents without raising new revenue. In this context, states must find ways to generate additional revenue without increasing taxes on individuals and families who are already struggling to make ends meet and may bear the biggest brunt of federal funding cuts.

Earlier this month the Alaska House of Representatives voted 22-17 in favor of implementing a personal income tax for the first time in over 35 years. Gov. Bill Walker praised the bill shortly after passage, citing its ability to “provide a steady source of funding for essential services like public education and state troopers,” and […]

Dodging Tough Fiscal Decisions with State Tax Cut Triggers and Phase-Ins

February 6, 2017 • By Carl Davis

The most challenging problem that tax-cutting state lawmakers face is dealing with the budgetary tradeoffs that tax cuts require. Should education spending be reduced? Should investments in infrastructure be halted? Should the state cut back on transfers to local governments and require them to pick up the slack? Or should other taxes and fees be […]

What to Watch in the States: Further Attempts to Weaken or Eliminate Progressive Taxes

February 2, 2017 • By Aidan Davis

This is the third installment of our six-part series on 2017 state tax trends. The introduction to this series is available here. As we described last week, many states are gearing up for challenging budget debates this year. But the need to address revenue shortfalls has not stopped lawmakers in many states from pursuing harmful […]

State governments provide a wide array of tax breaks for their elderly residents. Almost every state that levies an income tax allows some form of income tax exemption or credit for citizens over age 65 that is unavailable to non-elderly taxpayers. Most states also provide special property tax breaks to the elderly. Unfortunately, too many of these breaks are poorly-targeted, unsustainable, and unfair. This policy brief surveys federal and state approaches to reducing taxes for older adults and suggests options for designing less costly and better targeted tax breaks.

Reducing the Cost of Child Care Through State Tax Codes

September 14, 2016 • By Aidan Davis, Meg Wiehe

Low- and middle-income working parents spend a significant portion of their income on child care. As the number of parents working outside of the home continues to rise, child care expenses have become an unavoidable and increasingly unaffordable expense. This policy brief examines state tax policy tools that can be used to make child care more affordable: a dependent care tax credit modeled after the federal program and a deduction for child care expenses.

Indexing Income Taxes for Inflation: Why It Matters

August 22, 2016 • By Dylan Grundman O'Neill

Read brief in PDF here. All of us experience the effects of inflation as the price of the goods and services we buy gradually goes up over time. Fortunately, as the cost of living goes up, our incomes often tend to rise as well in order to keep pace. But many state tax systems are […]

The Folly of State Capital Gains Tax Cuts

August 17, 2016 • By Dylan Grundman O'Neill, Meg Wiehe

Read the brief in a PDF here. The federal tax system treats income from capital gains more favorably than income from work. A number of state tax systems do as well, offering tax breaks for profits realized from local investments and, in some instances, from investments around the world. As states struggle to cope with […]

Read this report in PDF. This month, Alaska legislators regroup in yet another special session where they will consider legislation to address a yawning budget gap created by declining oil tax and royalty revenues. Through the use of his veto pen, Gov. Bill Walker has partially addressed the gap with cuts to state spending and […]

Read this Policy Brief in PDF Form Map of State Treatment of Itemized Deductions Thirty-one states and the District of Columbia allow a group of income tax breaks known as “itemized deductions.” [1] Itemized deductions are designed to help defray a wide variety of personal expenditures that affect a taxpayer’s ability to pay taxes, including charitable […]

Distributional Analyses of Revenue Options for Alaska

April 13, 2016 • By Aidan Davis, Carl Davis

Alaskans are faced with a stark fiscal reality. Following the discovery of oil in the 1960s and 1970s, state lawmakers repealed their personal income tax and began funding government primarily through oil tax and royalty revenues. For decades, oil revenues filled roughly 90 percent of the state's general fund.

Tennessee Hall Tax Repeal Would Overwhelmingly Benefit the Wealthy, Raise Tennesseans’ Federal Tax Bills by $85 Million

February 23, 2016 • By Dylan Grundman O'Neill

Read PDF of report. Tennessee lawmakers are giving serious consideration to repealing their state’s “Hall Tax” on investment income (so named for the state senator who sponsored the legislation creating the tax more than eighty years ago). But the Hall Tax is an important revenue source for both state and local governments, and is a […]

Rewarding Work Through State Earned Income Tax Credits

February 11, 2016 • By Aidan Davis, Lisa Christensen Gee, Meg Wiehe

See the 2016 Updated Brief Here Read the brief in a PDF here. that time, the EITC has been improved to lift and keep more working families out of poverty. The most recent improvements enhanced the credit for families with three or more children and for married couples. First enacted temporarily as part of the […]

Major tax overhauls are on the agenda in a record number of states, and “Who Pays?” documents in state-by-state detail the precise distribution of state income taxes, sales and excise taxes and property taxes paid by each income group as of January 2013. It is a critical baseline against which future proposals can be measured. […]

The personal income tax is typically the fairest revenue source relied on by federal and state governments. A properly structured personal income tax could offer an important boost in progressivity to what are otherwise overwhelmingly regressive state tax structures.

Forty-one states and the District of Columbia levy broad-based personal income taxes. ITEP’s personal income tax resources provide both general and state-specific information about the impact as well as the mechanics and merits of personal income taxes.