Inequality

How the Wealthy Exploit the Tax Code: Q&A with Professor Ray Madoff, Author of ‘The Second Estate’

January 26, 2026 • By Brakeyshia Samms

Her timely book, The Second Estate: How the Tax Code Made an American Aristocracy, walks readers through federal tax policy history and the modern-day legal maneuvers the wealthy use to pay little to no taxes

Curbing Tax Deductions for Executive Pay is a Federal Tax Change States Should Get Behind

January 9, 2026 • By Matthew Gardner

This provision in last summer’s tax law could actually make budget-balancing a little bit easier for states if they follow suit.

Excessive CEO Pay Makes Inequality Worse. Shareholders and the Public Deserve to Know About Compensation Disparities

July 30, 2025 • By Matthew Gardner

Huge executive pay packages are a prime driver of income inequality. Shareholders and the public deserve to know about how CEOs are compensated, but new SEC leadership seems to think otherwise.

The final budget adopted by the Maryland General Assembly shows progress in advancing tax equity in the state while boosting state revenues to address the state’s budget deficit. To help close a $3.3 billion budget deficit, Maryland legislators enacted much-needed tax reforms and progressive revenue raisers that help meet the state’s needs while making the […]

It’s Tax Day. You’ve Paid Your Share, but the Billionaires Haven’t.

April 15, 2025 • By Amy Hanauer

You likely had most of your federal taxes deducted from your paychecks throughout the year. This is not true, however, for mega-millionaires and billionaires, some of whom are practically running our government right now.

The U.S. needs a tax code that is more adequate, meaning any major tax legislation should increase revenue, not reduce it. The U.S. also needs a tax code that is more progressive, meaning any significant tax legislation should require more, not less, from those most able to pay.

In last night’s address to Congress, President Trump spent more time insulting Americans, lying, and bragging than he did talking about taxes. But regardless of what President Trump and Elon Musk talk about most loudly and angrily, there is one clear policy that they and the corporations and billionaires that support them will try hardest […]

While most states have a graduated rate income tax, some state lawmakers have recently become enamored with the idea of moving toward flat rate taxes instead. What’s the difference? And are states well served by the transition? In short: A flat tax is one where each taxpayer pays the same percentage of their income whereas […]

As we close out 2024, we want to lift up the tax charts we published this year that received the most engagement from readers. Covering federal, state, and local tax work, here are our top charts of 2024.

Tax the Wealthy and Reject Austerity for a More Just and Thriving Democracy

July 1, 2024 • By Amy Hanauer

Two of the last five presidents won office over the objection of the majority of the people; California, with 65 times more people, has the same voting power in the U.S Senate as Wyoming; and the U.S. Supreme Court just permitted South Carolina lawmakers to dilute Black votes in drawing districts. These obvious flaws undermine our claim to be a strong democracy. One less appreciated but similarly undemocratic trend is our extreme inequality that supercharges the power and wealth of corporations and the uber-rich, weakens what the public sector can deliver, and often feeds on itself.

Some states have improved tax equity by raising new revenue from the well-off and creating or expanding refundable tax credits for low- and moderate-income families in recent years. Others, however, have gone the opposite direction, pushing through deep and damaging tax cuts that disproportionately help the rich. Many of these negative developments are quantified in […]

Everything! Taxing wealthy people and corporations and using the revenue for paid leave, child care, education, health care and college would transform America for girls and women of every race and family type, in every corner of this country.

Long-term troubles for this country and this planet now demand our attention. Progressive tax policy would transform our ability to tackle them.

SOTU and GOP Response Highlight Dramatic Difference in Parties’ Tax Policy Approach

March 2, 2022 • By Aidan Davis, ITEP Staff, Jenice Robinson

Since last year, multiple states across the country have proposed or are pursuing costly income and other tax cuts that are heavily tilted toward the highest-income households. State advocates have worked to beat back these proposals and sounded the alarm about the long-term consequences of tax cuts, but legislatures (most GOP-led) continue to introduce and approve top-heavy and permanent tax cuts. This state tax-cut fervor took center stage last night when Gov. Kim Reynolds of Iowa gave the Republican response to President Biden's SOTU address.

The Compelling Data and Moral Case for Continuing the Child Tax Credit Expansion

January 14, 2022 • By Alex Welch, ITEP Staff, Jenice Robinson

In just six short months, the enhanced Child Tax Credit (CTC), enacted as part of the American Rescue Plan (ARP), decreased the number of children living in poverty by 40 percent. ITEP estimated that the lowest-income 20 percent of households with children would receive a 35 percent income boost from this policy alone in 2021. This is a meaningful, life-changing sum.

The Pendulum Is Swinging Toward Tax Justice

January 5, 2022 • By ITEP Staff, Jenice Robinson, Kamolika Das

Tax justice is deeply connected to the movements for equality and racial justice. Progressive tax policy can ensure more of us share in the prosperous economy that our collective tax dollars make possible. It can mitigate economic disparities by class and race. And it can make sure the government has the resources it needs to function for all of us.

Why Treasury’s Pending Race-Based Analysis of Stimulus Payments is Important

December 21, 2021 • By Emma Sifre

One important data inadequacy is the lack of demographic information in tax data. While the IRS data offers rich data on taxpayer income, it does not collect information on important demographic characteristics like race and ethnicity. This presents a challenge for researchers interested in the racialized impacts of the U.S. tax system and has prompted many researchers and organizations to advocate for public-use tax data that is disaggregated by race and ethnicity.

Pandemic Policies Demonstrate Government Can Address Widening Economic Inequality If Policymakers So Choose

December 17, 2021 • By ITEP Staff, Jenice Robinson, Joe Hughes

We are surrounded by evidence that economic inequality is spinning out of control, yet we also see straightforward examples of how government can stop the downward spiral should it choose to do so. The Build Back Better Act, which invests in communities and ensures the wealthy and corporations pay their fair share, is one such example. Congress should pass it.

Paying The Estate Tax Shouldn’t Be Optional for the Super Rich

November 9, 2021 • By Carl Davis

ProPublica this year released multiple exposés revealing how the nation’s wealthiest individuals and families avoid taxes on an unimaginable scale. Most recently, it uncovered Republican and Democratic elected officials and political appointees who used complex strategies to avoid taxes. Richard Painter, a White House ethics lawyer under George W. Bush, said these revelations should be “troubling […]

Experts Weigh in on the Payoffs of Advanced Child Tax Credit Payments

July 15, 2021 • By Jenice Robinson

During a Tuesday webinar (The Child Tax Credit in Practice: What We Know about the Payoffs of Payments) hosted by ITEP and the Economic Security Project, panelists explained why the expanded Child Tax Credit is a transformative policy that should be extended beyond 2021. They highlighted tax policy and anti-poverty research and discussed lessons learned from demonstration projects that have provided a guaranteed income to low-income families.

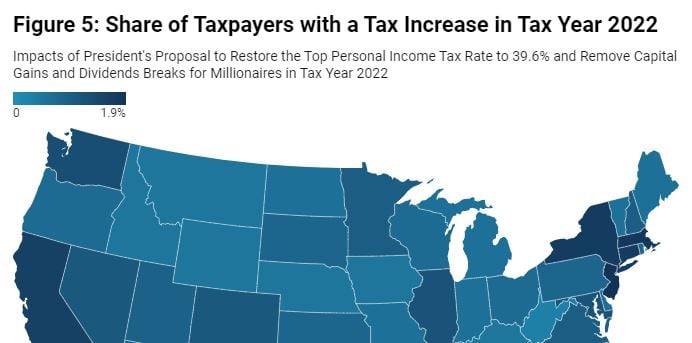

Income Tax Increases in the President’s American Families Plan

May 25, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

President Biden’s American Families Plan includes revenue-raising proposals that would affect only very high-income taxpayers.[1] The two most prominent of these proposals would restore the top personal income tax rate to 39.6 percent and eliminate tax breaks related to capital gains for millionaires. As this report explains, these proposals would affect less than 1 percent of taxpayers and would be confined almost exclusively to the richest 1 percent of Americans. The plan includes other tax increases that would also target the very well-off and would make our tax system fairer. It would raise additional revenue by more effectively enforcing tax…

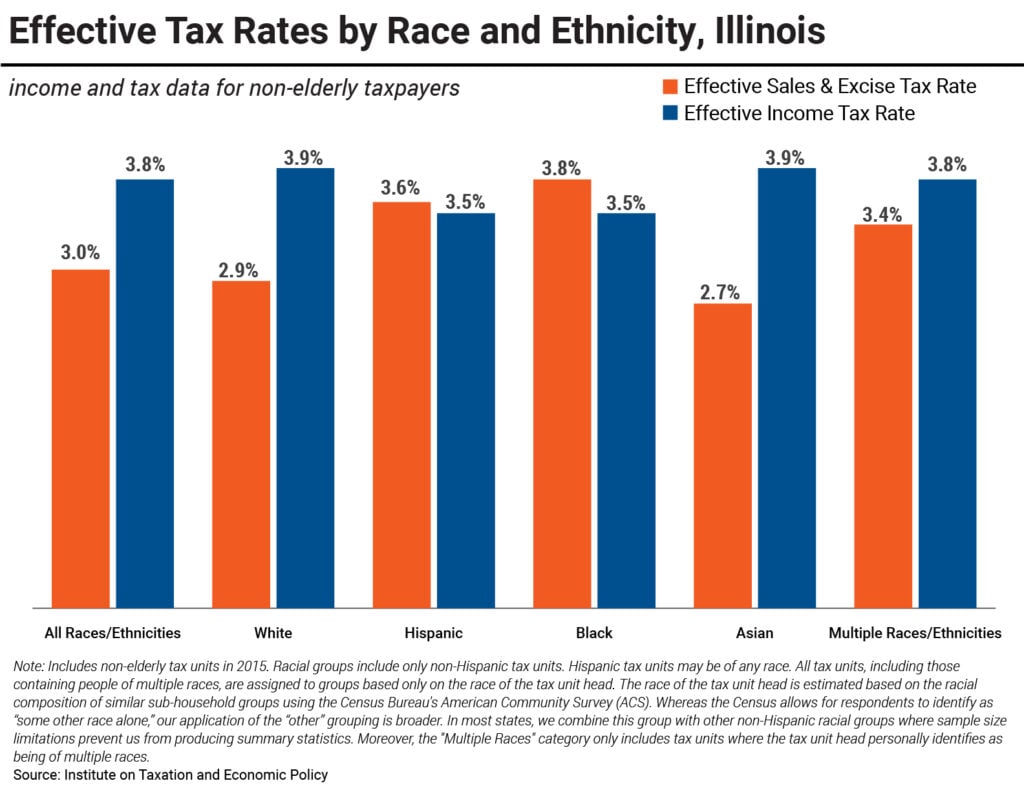

State Tax Codes & Racial Inequities: An Illinois Case Study

May 14, 2021 • By Lisa Christensen Gee

Earlier this year, ITEP released a report providing an overview of the impacts of state and local tax policies on race equity. Against a backdrop of vast racial disparities in income and wealth resulting from historical and current injustices both in public policy and in broader society, the report highlights that how states raise revenue to invest in disparity-reducing investments like education, health, and childcare has important implications for race equity.

Attacks on Voting Rights, Secret Tax-Cut Negotiations in Arizona Reflect Broader Trend to Undermine Democracy

May 13, 2021 • By Carl Davis, ITEP Staff, Jenice Robinson

The onslaught of news about multiple states introducing or passing legislation to make it harder to vote is a clear signal that our democracy is in crisis. Decades of policymaking and judicial rulings have created a system in which the voices of the wealthy and powerful have more weight, and some lawmakers are determined to further rig the system and keep it that way.

Taxes and Racial Equity: An Overview of State and Local Policy Impacts

March 31, 2021 • By ITEP Staff

Historic and current injustices, both in public policy and in broader society, have resulted in vast disparities in income and wealth across race and ethnicity. Employment discrimination has denied good job opportunities to people of color. An uneven system of public education funding advantages wealthier white people and produces unequal educational outcomes. Racist policies such as redlining and discrimination in lending practices have denied countless Black families the opportunity to become homeowners or business owners, creating extraordinary differences in intergenerational wealth. These inequities have long-lasting effects that compound over time.

The Biden administration has made clear that its top priorities include a major recovery package with critical investments to boost the nation’s economy and tax increases for corporations and the wealthy. Adequately funding the IRS must be part of that agenda. It seems every week, a new study, data set or research-driven commentary reveals how […]