North Carolina

As 2017 draws to close, Congress has yet to take legislative action to protect Dreamers. The young undocumented immigrants who were brought to the United States as children, and are largely working or in school, were protected by President Obama’s 2012 executive action, Deferred Action for Childhood Arrivals (DACA). But in September, President Trump announced that he would end DACA in March 2018. Instead of honoring the work authorizations and protection from deportation that currently shields more than 685,000 young people, President Trump punted their lives and livelihood to a woefully divided Congress which is expected to take up legislation…

How the House and Senate Tax Bills Would Affect North Carolina Residents’ Federal Taxes

December 6, 2017 • By ITEP Staff

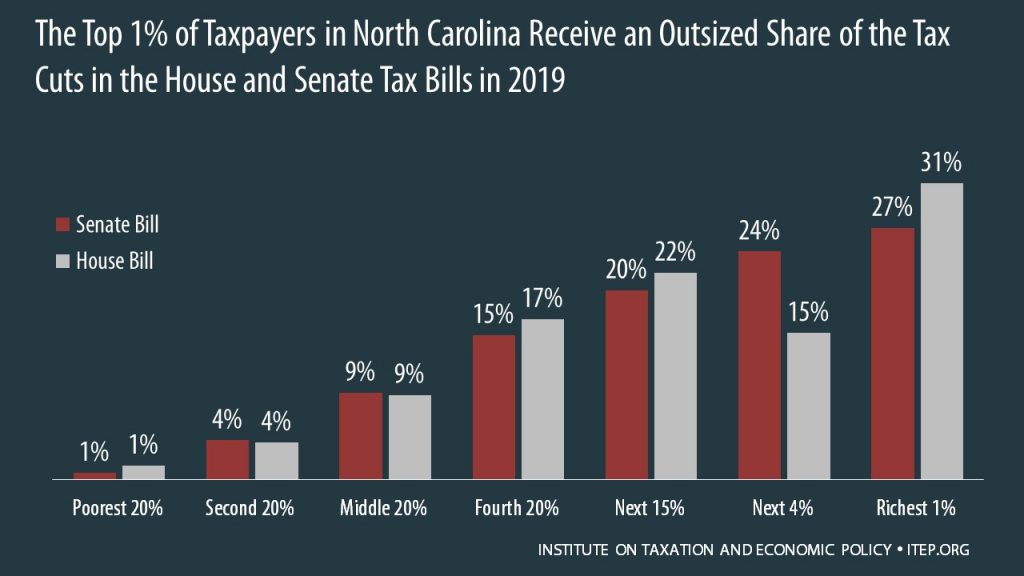

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. The graph below shows that both bills are skewed to the richest 1 percent of North Carolina residents.

National and 50-State Impacts of House and Senate Tax Bills in 2019 and 2027

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. National and 50-State data available to download.

Revised Senate Plan Would Raise Taxes on at Least 29% of Americans and Cause 19 States to Pay More Overall

November 18, 2017 • By ITEP Staff

The tax bill reported out of the Senate Finance Committee on Nov. 16 would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today.

How the Revised Senate Tax Bill Would Affect North Carolina Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In North Carolina, 50 percent of the federal tax cuts would go to the richest 5 percent of residents, and 13 percent of households would face a tax increase, once the bill is fully implemented.

Analysis of the House Tax Cuts and Jobs Act

November 6, 2017 • By Matthew Gardner, Meg Wiehe, Steve Wamhoff

The Tax Cuts and Jobs Act, which was introduced on Nov. 2 in the House of Representatives, would raise taxes on some Americans and cut taxes on others while also providing significant savings to foreign investors.

How the House Tax Proposal Would Affect North Carolina Residents’ Federal Taxes

November 6, 2017 • By ITEP Staff

The Tax Cuts and Jobs Act, which was introduced on November 2 in the House of Representatives, includes some provisions that raise taxes and some that cut taxes, so the net effect for any particular family’s federal tax bill depends on their situation. Some of the provisions that benefit the middle class — like lower tax rates, an increased standard deduction, and a $300 tax credit for each adult in a household — are designed to expire or become less generous over time. Some of the provisions that benefit the wealthy, such as the reduction and eventual repeal of the estate…

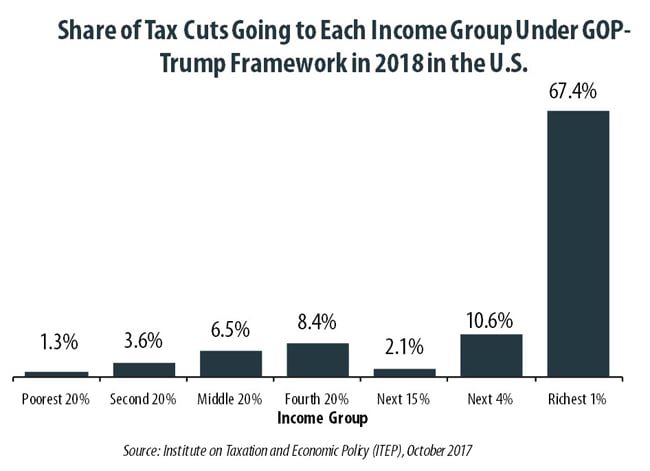

Benefits of GOP-Trump Framework Tilted Toward the Richest Taxpayers in Each State

October 4, 2017 • By Steve Wamhoff

The “tax reform framework” released by the Trump administration and Congressional Republican leaders on September 27 would affect states differently, but every state would see its richest residents grow richer if it is enacted. In all but a handful of states, at least half of the tax cuts would flow to the richest one percent of residents if the framework took effect.

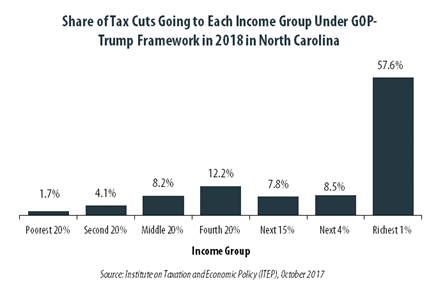

GOP-Trump Tax Framework Would Provide Richest One Percent in North Carolina with 57.6 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in North Carolina equally. The richest one percent of North Carolina residents would receive 57.6 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $512,000 next year. The framework would provide them an average tax cut of $50,440 in 2018, which would increase their income by an average of 3.2 percent.

Astonishingly, tax policies in virtually every state make it harder for those living in poverty to make ends meet. When all the taxes imposed by state and local governments are taken into account, every state imposes higher effective tax rates on poor families than on the richest taxpayers.

State Rundown 9/6: Most Statehouses Quiet, Many Pondering Harvey’s Impacts

September 7, 2017 • By ITEP Staff

It's been a quiet week for tax policy in most states, though lawmakers are still making noise in Pennsylvania, where a budget agreement is still needed, and in Wisconsin, where legislators are searching for the will to raise revenue for the state's ailing transportation infrastructure. In our "What We're Reading" section you'll find interesting reading on the fiscal fallout of Hurricane Harvey, as well as an in-depth series on how states' disaster response needs are likely to continue to increase.

NC Policy Watch: In N.C., 42% of Trump’s proposed tax cuts would go to the few making more than $1 million

August 25, 2017

A newly released report confirms that the White House is not really interested in tax reform that helps “ordinary Americans”. Instead, under President Trump’s proposed tax cut plan, “ordinary Americans” will hardly benefit at all, as nearly half of Trump’s proposed tax cuts would go to people making more than $1 million annually.

Budget and Tax Center: Costly Tax Cuts in New State Budget Continue Precarious Road Ahead for North Carolina

August 21, 2017

The new two-year state budget passed by lawmakers included another package of tax cuts that will further limit the amount of revenue available for public investments. The latest tax cuts will reduce annual available revenue by $900 million and, when combined with tax cuts passed since 2013, result in an estimated $3.5 billion in less annual revenue compared to the tax system that was in place prior to tax changes in 2013.

In North Carolina 42.4 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the North Carolina population (0.5 percent) earns more than $1 million annually. But this elite group would receive 42.4 percent of the tax cuts that go to North Carolina residents under the tax proposals from the Trump administration. A much larger group, 50.8 percent of the state, earns less than $45,000, but would receive just 5.9 percent of the tax cuts.

Nearly Half of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million Annually

August 17, 2017 • By ITEP Staff

A tiny fraction of the U.S. population (one-half of one percent) earns more than $1 million annually. But in 2018 this elite group would receive 48.8 percent of the tax cuts proposed by the Trump administration. A much larger group, 44.6 percent of Americans, earn less than $45,000, but would receive just 4.4 percent of the tax cuts.

Trump Touts Tax Cuts for the Wealthy as a Plan for Working People

July 26, 2017 • By Steve Wamhoff

Unless the administration takes a radically different direction on tax reform from what it has already proposed, its tax plan would be a monumental giveaway to the top 1 percent. The wealthiest one percent of households would receive 61 percent of all the Trump tax breaks, and would receive an average of $145,400 in 2018 alone.

2017 marked a sea change in state tax policy and a stark departure from the current federal tax debate as dubious supply-side economic theories began to lose their grip on statehouses. Compared to the predominant trend in recent years of emphasizing top-heavy income tax cuts and shifting to more regressive consumption taxes in the hopes […]

States May Be Finally Learning Their Lesson on Back-To-School Sales Tax Holidays

July 21, 2017 • By Dylan Grundman O'Neill

State lawmakers face a dilemma when it comes to sales tax holidays, an attractive and popular policy that nonetheless proves to be a poor choice compared to developing thoughtful, targeted tax policies or investing in well-executed public services. Luckily, word seems to be getting out that the costs associated with these holidays far outweigh their purported benefits.

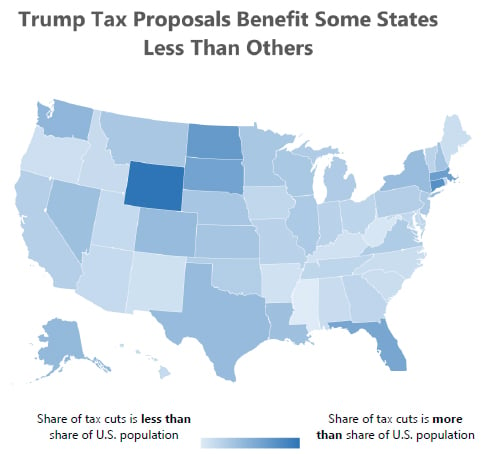

50-State Analysis of Trump’s Tax Outline: Poorer Taxpayers and Poorer States are Disadvantaged

July 20, 2017 • By Alan Essig

Not only would President Trump’s proposed tax plan fail to deliver on its promise of largely helping middle-class taxpayers, it also would shower a disproportionate share of the total tax cut on taxpayers in some of the richest states while southern and a few other states would receive a smaller share of the tax cut […]

Trump Tax Proposals Would Provide Richest One Percent in North Carolina with 46.5 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in North Carolina would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,541,500 in 2018. They would receive 46.5 percent of the tax cuts that go to North Carolina’s residents and would enjoy an average cut of $78,880 in 2018 alone.

Trump’s $4.8 Trillion Tax Proposals Would Not Benefit All States or Taxpayers Equally

July 20, 2017 • By Matthew Gardner, Steve Wamhoff

The broadly outlined tax proposals released by the Trump administration would not benefit all taxpayers equally and they would not benefit all states equally either. Several states would receive a share of the total resulting tax cuts that is less than their share of the U.S. population. Of the dozen states receiving the least by this measure, seven are in the South. The others are New Mexico, Oregon, Maine, Idaho and Hawaii.

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 12, 2017 • By ITEP Staff

Sales taxes are an important revenue source, composing close to half of all state tax revenues. But sales taxes are also inherently regressive because the lower a family’s income, the more the family must spend on goods and services subject to the tax. Lawmakers in many states have enacted “sales tax holidays” (at least 16 states will hold them in 2017), to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. While these holidays may seem to lessen the regressive impacts of the sales tax, their benefits are minimal. This policy brief…

State Rundown 6/28: States Scramble to Finish Budgets Before July Deadlines

June 28, 2017 • By ITEP Staff

This week, several states attempt to wrap up their budget debates before new fiscal years (and holiday vacations) begin in July. Lawmakers reached at least short-term agreement on budgets in Alaska, New Hampshire, Rhode Island, and Vermont, but such resolution remains elusive in Connecticut, Delaware, Illinois, Maine, Pennsylvania, Washington, and Wisconsin.

The flawed design of federal and state gasoline taxes has made it exceedingly difficult to raise adequate funds to maintain the nation’s transportation infrastructure. Thirty states and the federal government levy fixed-rate gas taxes where the tax rate does not change even when the cost of infrastructure materials rises or when drivers transition toward more fuel-efficient vehicles and pay less in gas tax. The federal government’s 18.4 cent gas tax, for example, has not increased in over twenty-three years. Likewise, nineteen states have waited a decade or more since last raising their own gas tax rates.

State Rundown 6/21: Crunch Time for Many States with New Fiscal Year on Horizon

June 21, 2017 • By Meg Wiehe

This week several states rush to finalize their budget and tax debates before the start of most state fiscal years on July 1. West Virginia lawmakers considered tax increases as part of a balanced approach to closing the state’s budget gap but took a funding-cuts-only approach in the end. Delaware legislators face a similar choice, […]