Tax Reform

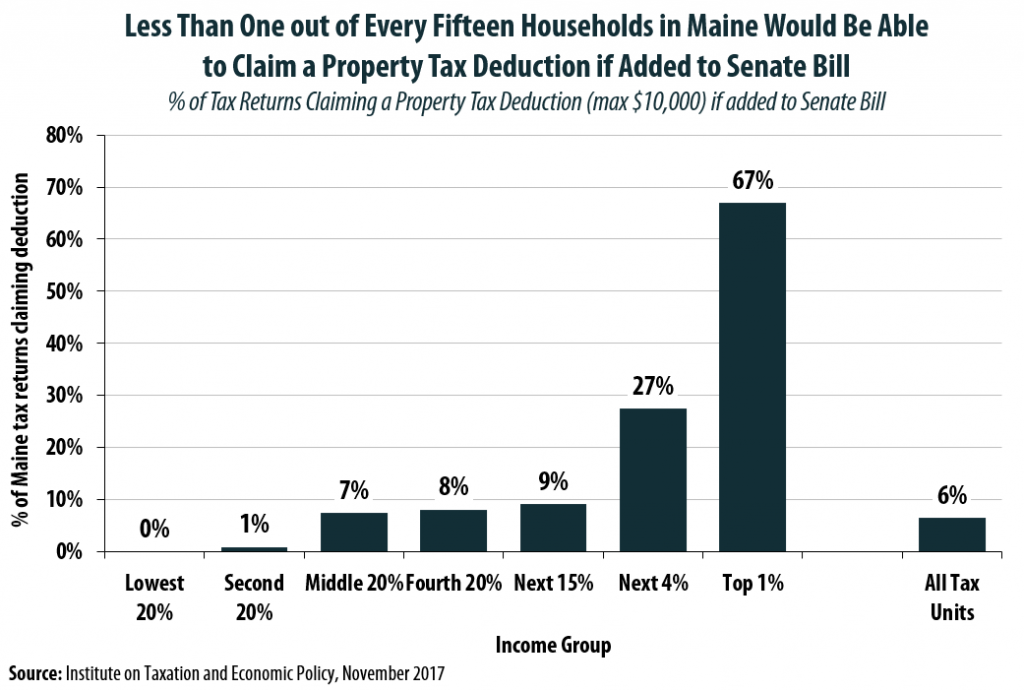

Senator Collins Pushes Hard for a Property Tax Deduction that Very Few of Her Constituents Will Be Able to Claim

December 1, 2017 • By Carl Davis

Adding a property tax deduction back into the Senate bill may sound like a compromise, but a new analysis performed using the ITEP Microsimulation Tax Model reveals that the amount of state and local taxes deducted by Maine residents would plummet by 90 percent under this change, from $2.58 billion to just $262 million in 2019. In short, this change is much more symbolic than substantive.

Lawmakers Are Allowing Monied Interests to Trump the Voices of Their Constituents

November 30, 2017 • By Alan Essig

George Washington is said to have described the U.S. Senate as the body that cools the passions of an impulsive House of Representatives just as a saucer cools tea. But current Senate leaders appear to think of themselves as more of a Bunsen burner.

Chained CPI Would Raise Everyone’s Personal Income Taxes in the Future, Would Hurt the Poor Right Away

November 30, 2017 • By Steve Wamhoff

One of the findings is that every income group would face higher personal income taxes in years after 2025 (including 2027). Chained CPI would gradually push taxpayers into higher income tax brackets and make the standard deduction, the Earned Income Tax Credit, and several other breaks less generous over time. The switch to chained CPI would cause some low-income people to face a tax hike starting in 2019, the second year the plan would be in effect.

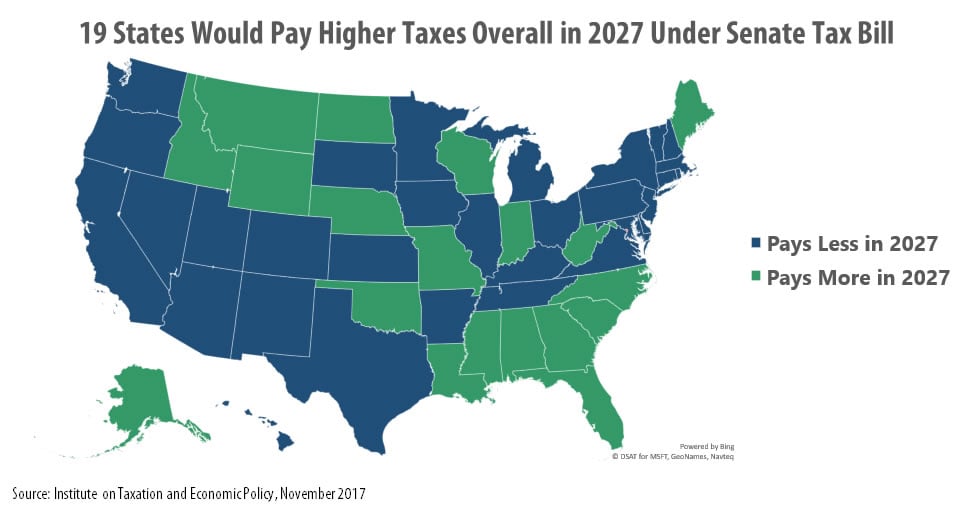

Mick Mulvaney and the 19 States Paying Higher Taxes Under the Senate Tax Bill

November 22, 2017 • By Steve Wamhoff

One of the more surprising findings of ITEP’s recent estimates on the Senate tax bill is that 19 states would pay more overall in federal taxes if the bill becomes law. This is not just an increase in the personal income taxes paid (which would happen in some states under the House bill). This is an increase in their net federal taxes overall, even including the assumed benefits of corporate tax cuts and estate tax cuts.

The Bottom 40 Percent Has Grown Poorer, So Why Are Tax Cut Plans Focused on the Rich and Corporations?

November 14, 2017 • By Jenice Robinson

The bottom line is that the rich and corporations are doing fine. We don’t need legislative solutions that fix non-existent problems. Only in a world of alternative facts does the top 0.2 percent of estates need to be exempt from the estate tax, for example.

Analysis of the House Tax Cuts and Jobs Act

November 6, 2017 • By Matthew Gardner, Meg Wiehe, Steve Wamhoff

The Tax Cuts and Jobs Act, which was introduced on Nov. 2 in the House of Representatives, would raise taxes on some Americans and cut taxes on others while also providing significant savings to foreign investors.

A Chart Book on the U.S. Tax System

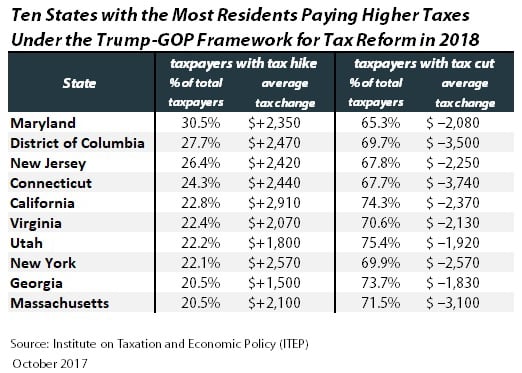

As our report on the Trump-GOP tax framework explained, in nine states plus the District of Columbia, more than a fifth of households would pay higher taxes under the framework.

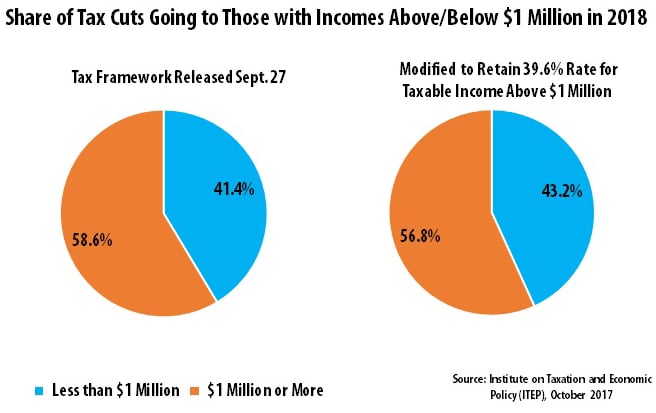

GOP Tax Plan Will Mainly Benefit Millionaires Even If Top Rate Remains 39.6 Percent

October 24, 2017 • By Steve Wamhoff

The Trump-GOP taxframework would reduce the top personal income tax rate from 39.6 percent to 35 percent, but now lawmakers are discussing keeping the top personal income tax rate at 39.6 percent for those with taxable income of more than $1 million. This modification would barely change the proposal’s overall impact.

The Jig Is Up: Republican Budget Resolution Finally Admits That Deficit Will Soar Under GOP Tax Plan

October 20, 2017 • By Alan Essig

For some lawmakers, annual deficits matter a lot—unless the nation is paying for tax cuts for the wealthy via deficit spending. Last night, Republican lawmakers demonstrated that previous grandstanding about the nation’s debt is much ado about nothing. The Senate approved a budget resolution on a party-line vote that would 1. fast-track legislation adding $1.5 trillion to the deficit over 10 years by cutting taxes, and 2. make it easy to enact this measure without a single Democratic vote.

Real tax reform would mean raising more revenue to make public investments and increasing the progressivity of the tax code. Many conservatives strongly disagree with this and insist that a substantial tax cut for the wealthiest Americans will grow the economy. Rather than engage in this policy debate based on policy ideals and principles, President Trump, other White House officials and GOP leaders have peppered their sales pitch for tax cuts with false claims about the amount of taxes that Americans pay and the effect the current GOP tax proposal would have on the tax system.

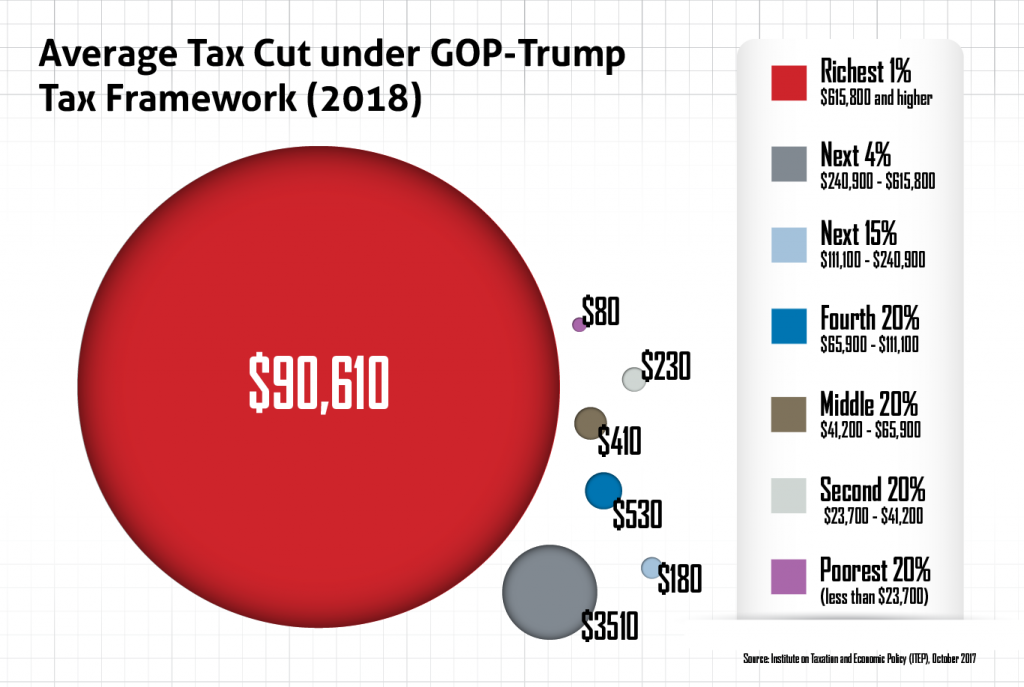

Middle-Income More Likely Than the Rich to Pay More Under Trump-GOP Tax Plan

October 11, 2017 • By Jenice Robinson

The Trump Administration and GOP leaders continue to wrap their multi-trillion tax cut gift to the wealthy in easily refutable rhetoric about boosting the nation’s middle class. Later today, trucks and truck drivers will serve as a backdrop for a Pennsylvania speech in which Trump is anticipated to talk about how proposed tax changes that […]

The Trump-GOP tax plan is touted as plan for the middle-class but delivers a boon to the wealthy, throws a comparative pittance to everyone else and even includes a dose of tax increases for some middle- and upper-middle-income taxpayers. The data belie the rhetoric.

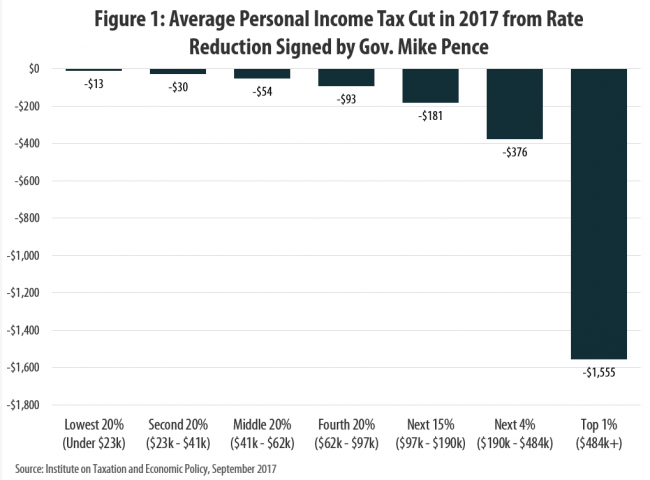

Indiana’s Tax Cuts Under Mike Pence Are Not a Model for the Nation

September 29, 2017 • By Carl Davis

In announcing a new tax cut framework this week in Indianapolis that was negotiated with House and Senate leaders, President Trump claimed that “Indiana is a tremendous example of the prosperity that is unleashed when we cut taxes and set free the dreams of our citizens …. In Indiana, you have seen firsthand that cutting taxes on businesses makes your state more competitive and leads to more jobs and higher paychecks for your workers.”

Fact Sheet: The Consequences of Adopting a Territorial Tax System

September 18, 2017 • By Steve Wamhoff

President Trump and Republican leaders in Congress have proposed a “territorial” tax system, which would allow American corporations to pay no U.S. taxes on most profits they book offshore. This would worsen the already substantial problem of corporate tax avoidance and result in more jobs and investment leaving the U.S. Lawmakers should know some key facts about the territorial approach.

Census Data Reveal Modest Gains for Working People; GOP Tax Overhaul Could Reverse These Gains

September 14, 2017 • By Jenice Robinson

On the surface, census poverty and income data released Tuesday reveal the nation’s economic conditions are improving for working families. The federal poverty rate declined for the second consecutive year and is now on par with the pre-recession rate. For the first time, median household income surpassed the peak it reached in 1999 and is […]

Today, the economic climate is starkly different, but it seems GOP leaders are relying on messaging and luck to push through the biggest tax package since 1986. The White House, Republican leaders and anti-tax advocates all have been toeing the same erroneous line: their plans to cut individual and corporate taxes will benefit middle class families and grow the economy. This is, of course, baloney.

The Problems with the Multi-Million-Dollar Effort to Secure Millionaire and Corporate Tax Cuts

July 31, 2017 • By Alan Essig

Until GOP leaders put forth a detailed tax proposal, we will not know for certain whether the plan will focus on the middle-class and create jobs. But what we do know is that unless the plan is a radical departure from the principles outlined by President Trump earlier this year or laid out by Paul Ryan last year in his “Better Way,” plan, GOP-led tax “reform” efforts will be a tax break bonanza for the wealthiest Americans while delivering a pittance to working people.

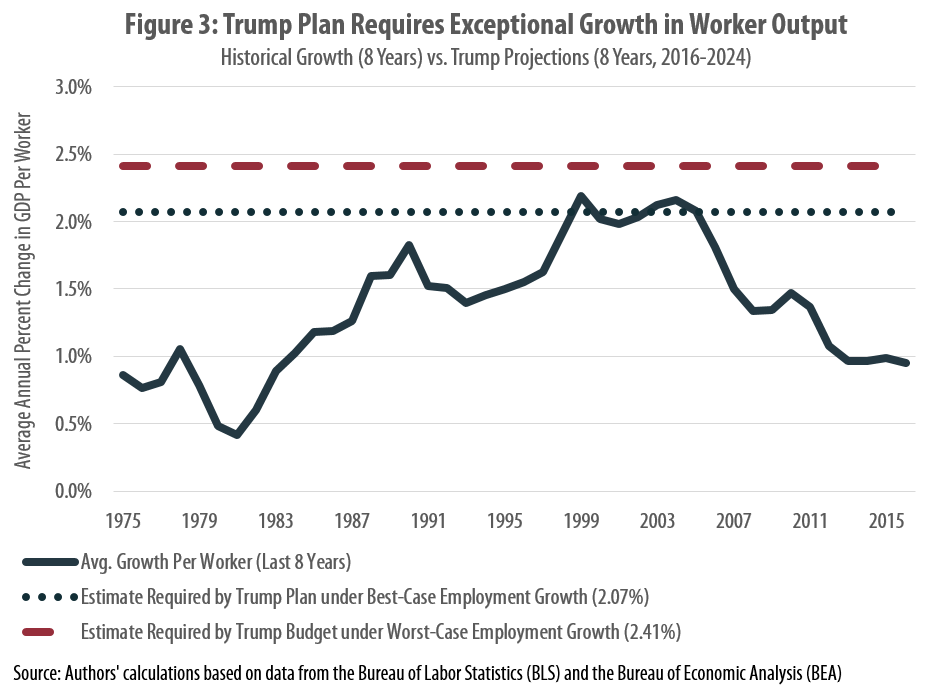

Art Laffer and Stephen Moore’s Misleading Case for the Trump Tax Cuts

July 28, 2017 • By Nick Buffie

Art Laffer and Stephen Moore recently penned an op-ed in the Wall Street Journal in which they called on state and local policymakers to support the Trump tax cuts. They claimed that the Trump plan would provide a significant boost to state and local tax revenues, thereby allowing states with large budget deficits to “regain fiscal health.” State and local lawmakers should not be fooled by these claims. The reality is that Trump’s tax cuts are more likely to worsen state and local fiscal health than improve it.

GOP Leaders in Congress and the White House Set Out Goals for Tax Reform that Their Plans Fail to Meet

July 27, 2017 • By Alan Essig

Today Republican leaders in Congress and officials from the White House released a joint statement on tax reform, claiming that “the single most important action we can take to grow our economy and help the middle class get ahead is to fix our broken tax code for families, small business, and American job creators competing at home and around the globe.” Unfortunately, the proposals they have put forward so far do not address any such goals.

This letter outlines ITEP’s two broad objectives for meaningful federal tax reform and discusses six recommendations that would achieve them.

What do terrorists, opioid and human traffickers, corrupt government officials and tax evaders have in common? They all depend on the secrecy provided by anonymous shell corporations to allow them to finance and profit from their crimes. Momentum is building in the House and Senate to pass legislation that would strike against illicit finance in the United States and around the world by bringing an end to the anonymity provided by U.S. incorporation.

Senate Health Care Reform Bill Just as “Mean” as the House Version

June 26, 2017 • By Alan Essig

The Congressional Budget Office today released its score of the Senate Health Care proposal and the news is not good. It’s no wonder a narrow group of 13 lawmakers cobbled together the bill behind closed doors. Now that the measure has seen the light of day, we know that it epitomizes Robin Hood in reverse policies by snatching health coverage from 22 million people by 2026 (15 million in 2018) while showering tax cuts on the already wealthy.

Speaker Ryan’s “Bold Agenda” for the Country Boils Down to Tax Breaks for the Wealthy

June 20, 2017 • By Alan Essig

Speaker Paul Ryan today correctly outlined some of working people’s concerns, including the desire for more good jobs and access to the training required to secure those jobs. But his bottom line policy prescriptions for addressing the concerns of working people are the same old trickle-down economic policies that time after time have proven to primarily benefit the wealthy.

One of the supposed selling points of the House GOP’s “Better Way” tax plan is that it will make the tax system so simple that you could do your taxes on a postcard. The reality, however, is that their promised postcard is a deception that would require numerous additional pages of worksheets to fill out. A better solution to making tax preparation simpler is called “return-free filing.” It does not just reduce your work to filling out a postcard, it could eliminate it altogether.