House SALT Proposal is Expensive, Unneeded, and Poorly Designed

briefDownload National and State-by-State Estimates of Proposed SALT Cap Increase Here

Key findings:

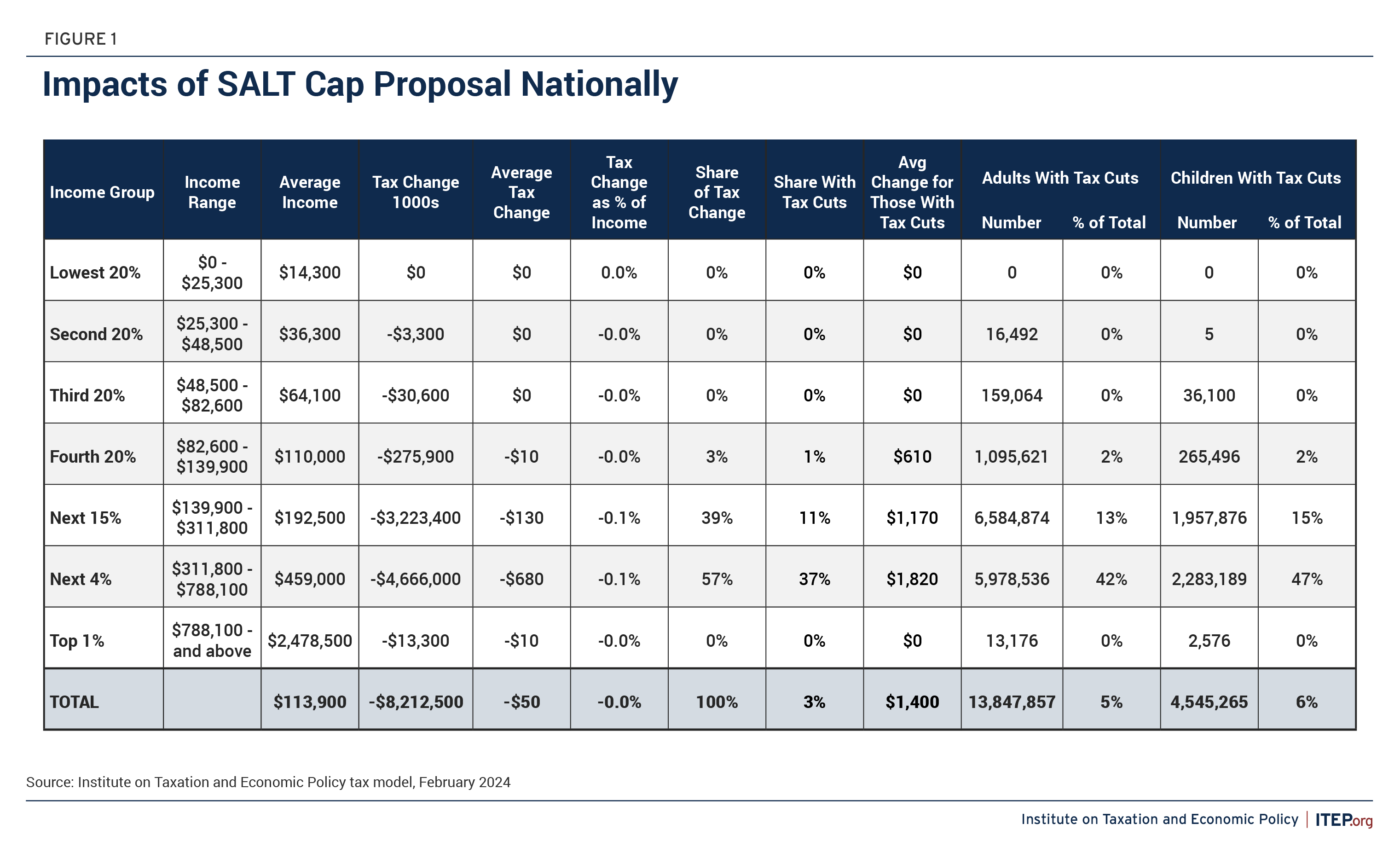

- The SALT Marriage Penalty Elimination Act passed by the House Rules Committee on February 1 is costly, decreasing tax revenue by about $8 billion in 2023.

- It also, for the most part, only helps taxpayers who are already well off. Nearly all (96 percent) of the tax cuts from the proposal would go to Americans in the top 20 percent of earners.

- The proposal would deliver tax cuts for just 3 percent of households, giving them an average annual cut of $1,400.

- The proposal creates a “cliff” because a taxpayer with around $500,000 of income (and thus a $10,000 SALT cap) would have a strong incentive to somehow reduce their reported income slightly to receive a large tax cut (an increase in their SALT cap to $20,000).

At the request of House Republicans from a handful of blue states, Speaker Johnson has agreed to hold a vote next week on a proposal to increase the amount of deductions taxpayers can claim for state and local taxes (SALT). It is the latest plan to expand the 2017 Trump tax cuts (the Tax Cuts and Jobs Act, or TCJA) for corporations and high-income households. The proposal is costly, decreasing tax revenue by about $8 billion in 2023, and mostly only helps taxpayers who are already well off.

The proposal, which would apply only to taxes filed for 2023, would double the amount of state and local taxes that a married household can deduct from $10,000 to $20,000. It would only apply to households making less than $500,000.

The tax cuts resulting from the legislation would generally flow to the richest fifth of taxpayers, except for the richest 1 percent who would be mostly excluded by the proposal’s $500,000 income limit. The proposal would cost around $8 billion for the one year it would be in effect, 2023, but of course proponents, if successful, would hope to extend this provision or make it permanent, costing much more.

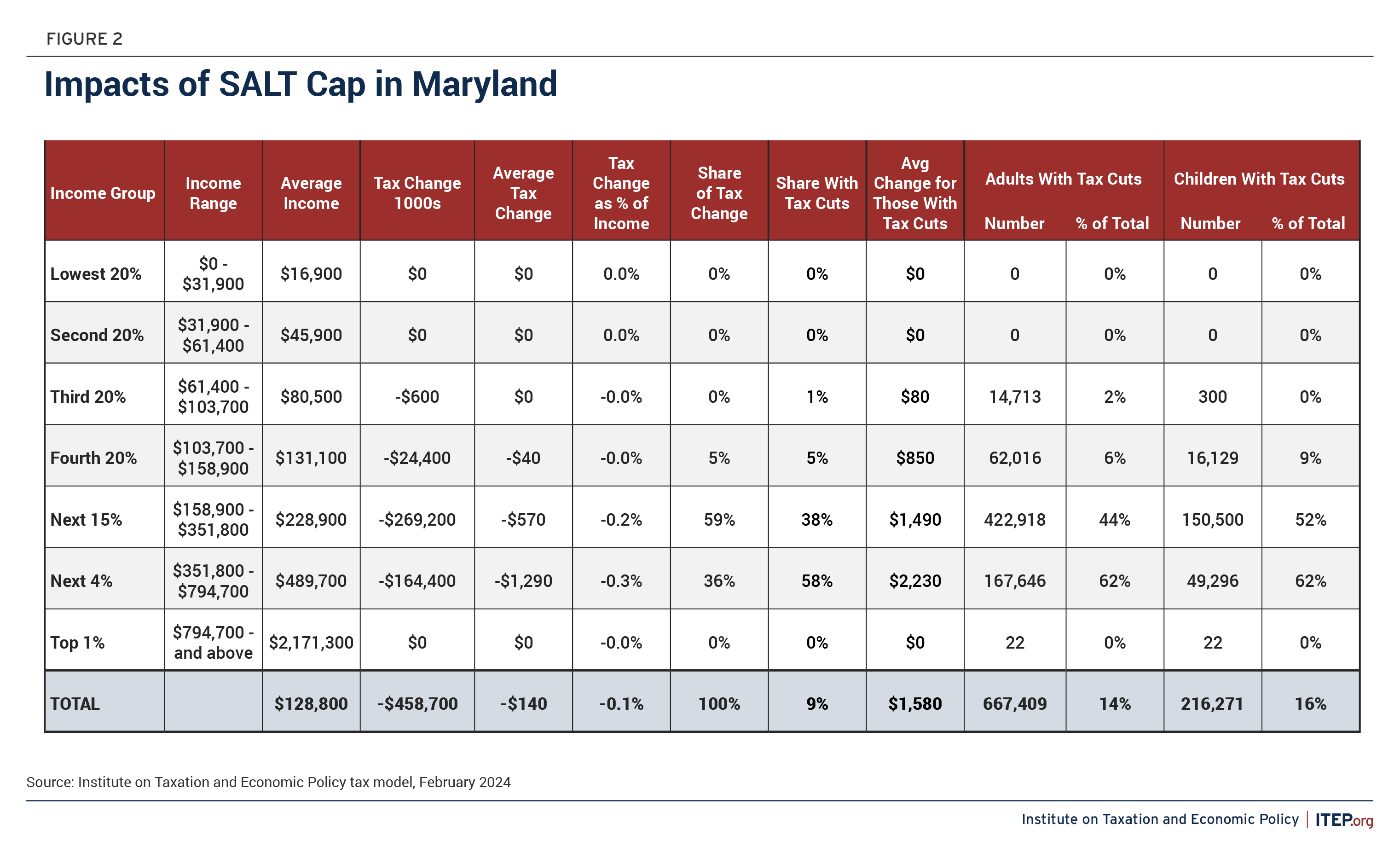

This cost is of a similar scale to the Child Tax Credit expansion recently passed by the House and which is targeted to low-income families, helping more than 14 million children. The SALT proposal helps only 3 percent of households, almost entirely those making more than $140,000. Even in the most affected states like Maryland and California, less than 10 percent of households benefit from the proposal.

What is the SALT cap?

Taxpayers have the option of itemizing their deductions or taking a preset “standard deduction.” For most families, the standard deduction ($27,700 for married couples in 2023) is larger than the amount of itemized deductions – including state and local taxes, charitable contributions, and mortgage interest expense – they would be able to claim. But for many well-off families, their itemized deductions exceed the standard deduction.

While the 2017 tax package overall mostly cut taxes for the rich and for big corporations, it offset some of the tax cuts by creating a cap of $10,000 on the amount of state and local taxes that a household could deduct in calculating their federal taxable income.

An all-inclusive reform of itemized deductions would have been sensible, since itemized deductions mostly cut the tax bills of households that are already doing quite well. But the TCJA only took aim at the SALT deduction. The drafters of the legislation hardly hid their reasoning. Capping SALT deductions at $10,000 would hit blue states that tend to rely more on progressive income taxes more than red states that rely more on regressive sales and property taxes. Speaker Paul Ryan stated at the time that the SALT cap would discourage “big government states” from levying higher income taxes.

House Republicans in those states objected to the cap, and a cadre of lawmakers from both parties have continually fought to raise or eliminate the cap. As ITEP has written in the past, although the rationale behind SALT cap was flawed, simply raising it without taking a wider approach to limiting itemized deductions would provide a windfall to the rich.

This current proposal would double the cap for married couples to $20,000 and would limit the benefits of the higher cap to households making less than $500,000. The result is that the benefits go almost entirely to families making between $140,000 and $500,000.

Even in the most affected states – those with progressive income taxes – most residents would see no benefit. Maryland has the highest percentage of residents who would benefit at 9 percent, but more than half the benefit goes to people making between $150,000 and $500,000. The bottom 40 percent of Marylanders would get nothing.

Flaw in the Design

The bill was hastily drafted as the House moved forward with a separate bipartisan tax bill, and it appears that little thought was given to how exactly the proposal would work. It includes a steep cutoff of benefits – often referred to as a cliff – at $500,000. A married couple with an income of $499,999 can claim up to $20,000 in SALT deductions. A couple with an income of $500,000 can only claim up to $10,000 in SALT deductions.

This means that for some families, their after-tax income would fall as they earned more money. Households with income right above the cap would be induced to lower their reported income and retain the $20,000 deduction. In fact, the tax rate on the 500 thousandth dollar of income would be 350,000 percent, since by earning the extra dollar, they would lose $10,000 in deductions times their marginal tax rate of 35 percent.

Reforming itemized deductions is a reasonable endeavor. But this proposal is not well designed. It is a hastily drafted bill to give tax cuts to well-off families and create absurd tax cliffs. If Congress acts to raise the SALT cap, it should only be as part of a wider reform of itemized deductions.