ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Associated Press: IRS to the rescue? Tax audits eyed for infrastructure cash

May 15, 2021

The Internal Revenue Service has estimated the tax gap is $440 billion per year. But IRS Commissioner Charles Rettig stunned his audience at a recent Senate hearing when he offered a new number: about $1 trillion annually. The old estimates don’t take into account the recent boom in income made by self-employed “gig” workers, which […]

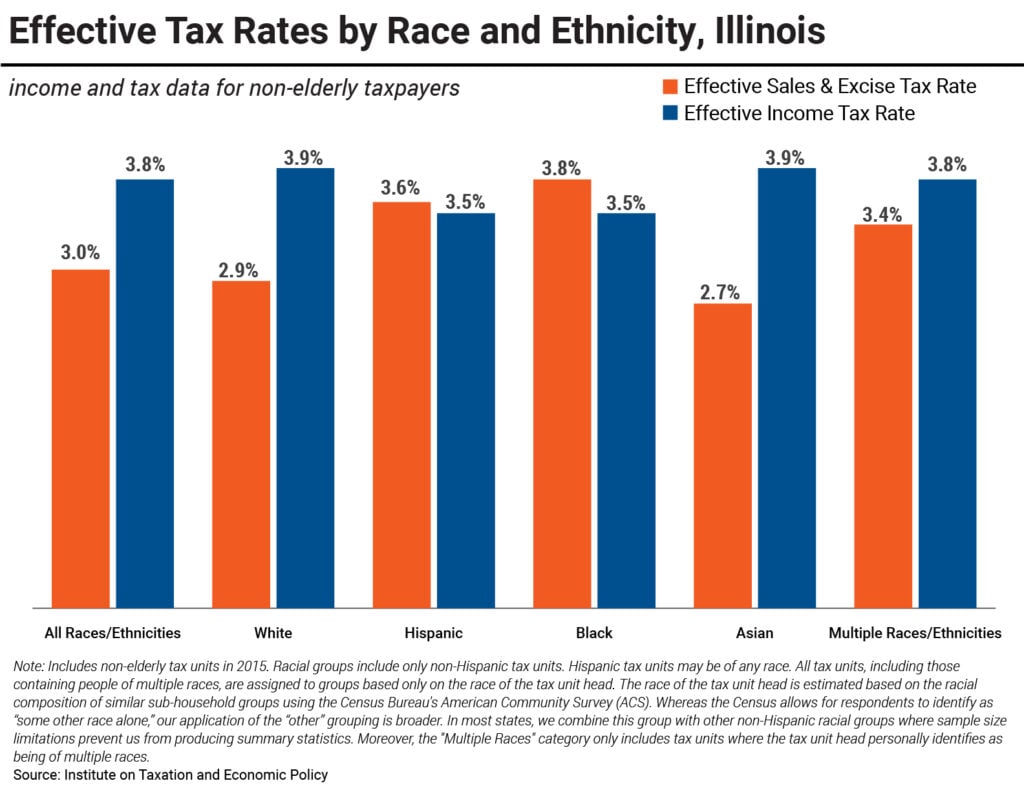

State Tax Codes & Racial Inequities: An Illinois Case Study

May 14, 2021 • By Lisa Christensen Gee

Earlier this year, ITEP released a report providing an overview of the impacts of state and local tax policies on race equity. Against a backdrop of vast racial disparities in income and wealth resulting from historical and current injustices both in public policy and in broader society, the report highlights that how states raise revenue to invest in disparity-reducing investments like education, health, and childcare has important implications for race equity.

Jacobin: In Washington State, the Left Won a Major Victory for Taxing the Rich

May 14, 2021

Last week, Washington State passed a capital gains tax aimed at the state’s ultra-wealthy. The tax is historic because Washington, despite its progressive reputation, until now had the worst tax code in the nation when it comes to fairness, behind Texas, Florida, and South Dakota. A landmark 2018 report by the Institute on Taxation and […]

Nearly 20 Million Will Benefit if Congress Makes the EITC Enhancement Permanent

May 13, 2021 • By Aidan Davis

Overall, the EITC enhancement would provide a $12.4 billion boost in 2022 if made permanent, benefiting 19.5 million workers. It would have a particularly meaningful impact on the bottom 20 percent of eligible households who would receive more than three-fourths of the total benefit. Forty-one percent of households in the bottom 20 percent of earners would benefit, receiving an average income boost of 6.3 percent, or $740 dollars.

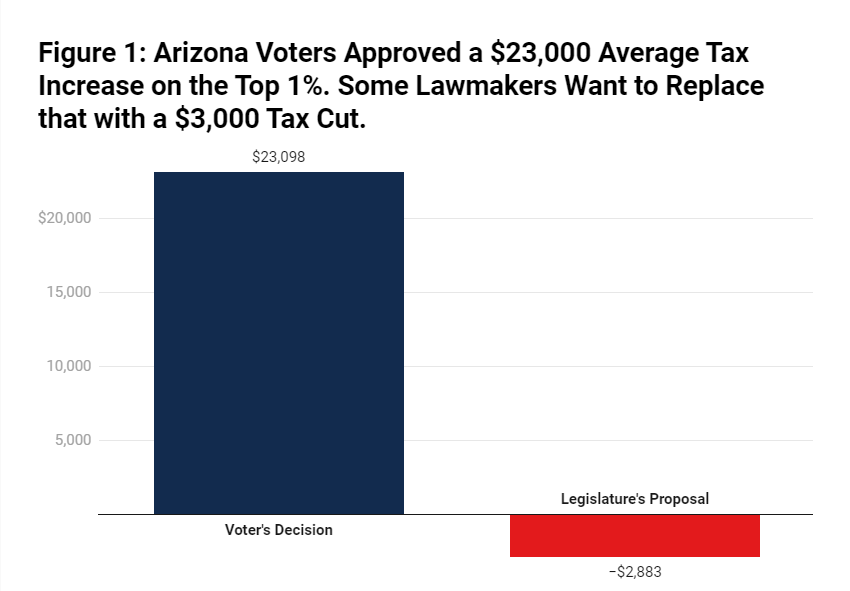

Arizonans Voted to Tax the Rich. Now Lawmakers Want to Undo Most of That.

May 12, 2021 • By Carl Davis

In 2018, Arizona teachers took part in a national wave of teacher walkouts, protesting inadequate education funding and some of the lowest teacher pay in the nation—direct results of the state’s penchant for deep tax cuts and its decision to levy some of the lowest tax rates in the country on high-income families.

Open Sky Policy Institute: LB 64: A costly measure that is unlikely to impact retiree migration

May 11, 2021

LB 64, a bill slated for second-round debate on today’s legislative agenda, is a costly measure that would give wealthy retirees a sizable tax break under the premise of keeping them from fleeing to other states. Few retirees, however, are likely to flee regardless of what happens to our tax code and those who do […]

Effects of the President’s Capital Gains and Dividends Tax Proposals by State

May 6, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

President Biden’s proposal to eliminate the lower income tax rate on capital gains (profits from selling assets) and stock dividends for millionaires would affect less than half of one percent (0.4 percent) of U.S. taxpayers if it goes into effect in 2022. The share of taxpayers affected would be less than 1 percent in every state.

Open Sky Policy Institute: Policy brief — LB 432: A big tax cut for corporations

May 6, 2021

LB 432, which will soon be up for debate on select file, would give a sizable tax cut to corporations and their shareholders. The vast majority of the tax cut would go out of state and the revenue losses created by the bill would threaten services that Nebraskans need. Read more

Open Sky Policy Institute: Policy Brief — LR 11CA presents a dangerous, untested proposal

May 5, 2021

Under the proposed 10.64% tax rate, and with the allowance, the Institute on Taxation and Economic Policy (ITEP) finds that all income groups would receive a tax cut on average, with the exception of the second-lowest quintile — those with incomes between $24,000 and $38,800 — who would pay 2.4% more of their income in […]

Forbes: President Biden’s Capital Gains Tax Plan

May 5, 2021

So, what’s the problem? What could be the downside of raising the taxes on a small portion of Americans to help needy children and kids go to college? Just 0.7% of households would face a tax hike, according to the Institute on Taxation and Economic Policy, with almost the entire burden being felt by the richest […]

Washington Governor’s Office: Inslee signs economic justice legislation to help working families

May 4, 2021

Gov. Jay Inslee today signed an economic justice legislative package, including the Working Families Tax Credit and the capital gains excise tax, that starts the process of making Washington’s upside-down tax system fairer and more equitable. Read more

Idaho Center for Fiscal Policy: House Bill 389 and Idaho’s Property Tax Circuit Breaker

May 4, 2021

House Bill 389 is a complicated bill that would affect many different components of the Idaho property tax statute. Revenue from property taxes, both for real property and business personal property, support local public services – such as roads, courts, and schools. Property taxes are regressive, meaning they fall harder on lower-income Idahoans than others. […]

OPB: Washington Gov. Jay Inslee signs capital gains tax into law even as legal challenges loom

May 4, 2021

While Democrats and Republicans came together around the tax credit, the capital gains tax fiercely divided the two parties. Throughout the legislative session, Democrats insisted a tax on capital gains is an excise tax that will make Washington’s tax code less regressive. They often point to a report by the left-leaning Institute on Taxation and […]

New York Times: Amazon Had a Big Year, but Paid No Tax to Luxembourg

May 4, 2021

Matthew Gardner, a senior fellow at the Institute on Taxation and Economic Policy, a left-leaning research group in Washington, said Amazon’s Luxembourg filing showed why there was such urgency, not only in the European Union but also in the United States, to require a global minimum tax. “This is a stark reminder of the high […]

Daily Kos: Study: Non-wealthy to benefit most from Biden’s tax and spending plans, especially in red states

May 4, 2021

For those who aren’t policy wonks—and who somehow can’t decide whether Joe Biden is a compassionate family man or a rapacious baby’s blood aficionado—it can be difficult to suss out the real benefits of Biden’s recent economic proposals. Luckily, new analysis from the Institute on Taxation and Economic Policy (ITEP) spells out the pluses (for […]

Yahoo! Finance: Only the ‘lucky few’ will pay higher taxes under Biden’s plan, analysis finds

May 4, 2021

President Joe Biden is planning to raise revenue to fund his infrastructure plans through numerous tax hikes that would mostly hit the top 0.7% of Americans, a new analysis found. “The vast, vast majority of the population will not see any tax increases,” Steve Wamhoff, director of federal tax policy at the Institute on Taxation […]

MarketWatch: The fight over SALT is heating up. What’s next?

May 3, 2021

“I’m surprised that it just continues to come up,” said Tracy Gordon, acting director of the Urban-Brookings Tax Policy Center. “In Washington there seems to be this broad consensus that repealing it would be a bad idea and yet people in affected areas feel it in a visceral way.” A “bad idea,” analysts say, not […]

New York Times: Why a $10,000 Tax Deduction Could Hold Up Trillions in Stimulus Funds

May 1, 2021

There’s no debate that the SALT deduction goes mostly to wealthier taxpayers. About 85% of its benefits accrue to the richest 5% of households, according to an analysis by the Institute on Taxation and Economic Policy in Washington. Were the cap to be repealed, about two-thirds of the benefits — about $67 billion — would […]

Business Insider: America’s wealthiest added $195 billion to their fortunes in Biden’s first 100 days

May 1, 2021

While the richest Americans saw gains under Biden, he’s making moves to tax them more heavily to offset the cost of his next big expenditure: an infrastructure package that encompasses everything from universal pre-K to affordable childcare and education. … While that may not impact the stock market much, Biden’s proposals do have some wealthier Americans scrambling and calling […]

The Sacramento Bee: California parents would get big tax breaks under Biden proposal. Here’s how much to expect

May 1, 2021

Low and middle income families struggling to pay for child care and other expenses would see big new tax breaks through 2025 under the White House’s new child tax credit plan, according to a new analysis. Most of the breaks would go to households with incomes less than $51,700, but even those with lower six […]

Coinspeaker: Joe Biden to Fund Education and Childcare by Implementing American Families Plan

April 30, 2021

According to a report by ITEP (institute On Taxation And Economic Policy), the top part of the scheme will restore the top personal income tax rate to 39.6%. The plan intends to eliminate tax breaks associated with capital gains for millionaires and make the tax process more equitable. The report shows that the proposal would […]

NBC News: The soul of the post-Trump GOP isn’t in D.C., it’s in the nation’s statehouses

April 30, 2021

All in all, the proposed capital gains and income tax hikes would affect less than 1 percent of taxpayers, according to an analysis by the Institute on Taxation and Economic Policy. Some relatively high-earning professionals might even get a tax cut. Democrats think the politics favor them as a result — so much so that […]

Associated Press: A Look At How US Corporations Manage the Tax System

April 30, 2021

Last year, more than 50 of the largest U.S. companies actually paid nothing in federal income taxes, even though they reported $40 billion in pretax profits as a group, according to the Institute on Taxation and Economic Policy. Companies can deploy many tools to avoid taxes — from deducting costs related to stock options they […]

NBC News: Venture capitalists spar over Biden plan to raise their taxes

April 30, 2021

President Barack Obama’s White House put out a proposal similar to the one Biden’s White House is now offering, according to Steve Wamhoff, the director of federal tax policy at the Institute on Taxation and Economic Policy, who formerly worked on tax policy for Sen. Bernie Sanders, I-Vt. “Biden proposes to eliminate that break for […]

Fox Business: Biden’s tax plan would cost wealthiest 1% an extra $160K per year, study shows

April 30, 2021

That’s according to a new analysis published this week by the Institute on Taxation and Economic Policy, which found that the wealthiest 1% of Americans would pay an extra $159,010 in taxes each year if Congress passes the Biden administration’s newest $1.8 trillion economic initiative. By comparison, the top 4% of households – or those […]