ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Business Insider: Biden offers to ditch his rollback of Trump-era tax cuts in major infrastructure concession to GOP

June 3, 2021

Instead, Biden put forward a 15% minimum corporate tax as a possible solution, a levy that would be squarely aimed at corporations paying little to no taxes. The president has previously cited a report from the left-leaning Institute on Taxation and Economic Policy indicating 55 major American companies paid nothing in federal income taxes in […]

Vox: You should be suspicious of benevolent big business

May 28, 2021

Amazon, like a lot of big companies, is good at keeping its tax bill low. In some recent years, it’s paid zero federal income tax; it’s managed to pay very little in other years, even as its profits soared. According to the left-leaning Institute on Taxation and Economic Policy (ITEP), Amazon’s effective federal tax rate […]

Phoenix Business Journal: Arizona flat tax proponents point to survey showing residents’ support

May 22, 2021

The Republic also reported that an Institute on Taxation and Economic Policy analysis found that 20% of Arizona taxpayers would get 91% of the reductions. The report said the switch would cut state revenues by $1.5 billion per year. The plan has drawn opposition from cities in the state. They say the reduced revenue will […]

NJ.Com: Live in N.J.? You’ll pay more in taxes over a lifetime than anywhere else, study says

May 22, 2021

Five states, including New Jersey, would be the only states where more than 1% of their taxpayers would face a higher tax bill under Biden’s proposals, according to the progressive Institute on Taxation and Economic Policy. Read more

KOIN: ‘Nike, just pay it’: Ad tells Nike to pay federal tax

May 20, 2021

“Last year you made $2.9 billion in profit but paid zero federal income tax,” the ad states. “Nike, thanks to your ads, I’m unstoppable. I have power. I am a change maker. You inspired us to step up. Now, it’s your turn. Nike, just pay it.” The claim is based on a report by the […]

CNBC: Taxes would likely rise for the wealthy regardless of Biden’s plans

May 19, 2021

Two-thirds of taxpayers in the top 1% would see their taxes increase as a result of the Biden proposal, according to the Institute on Taxation and Economic Policy. (This group has an average income of $2.2 million, according to the analysis.) Read more

Vice: These 55 Companies Kick Ass at Avoiding Taxes. Congratulations!

May 19, 2021

That’s exactly what many big corporations did this year, once again. At least fifty-five companies managed to book a combined total of more than $40 billion in pre-tax profits in their most recent fiscal year, while reducing their corporate income tax bill to zero, according to the Institute on Taxation and Economic Policy (ITEP). Those […]

The Guardian: Millionaires who support taxing the rich protest in front of Jeff Bezos’s homes

May 17, 2021

Bezos has said he supports raising the corporate tax rate. But Amazon has long been the subject of protests about tax avoidance. According to calculations by the progressive Institute on Taxation and Economic Policy in February, in 2020 Amazon only paid a 9.4% federal income tax rate, less than half the statutory 21%. Read more

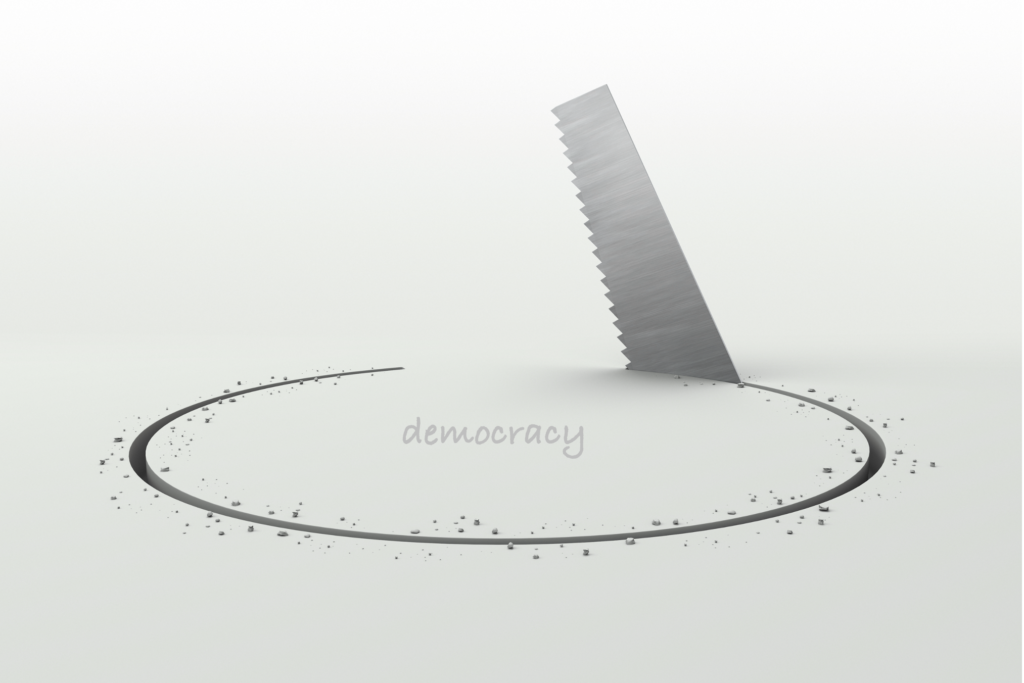

Attacks on Voting Rights, Secret Tax-Cut Negotiations in Arizona Reflect Broader Trend to Undermine Democracy

May 13, 2021 • By Carl Davis, ITEP Staff, Jenice Robinson

The onslaught of news about multiple states introducing or passing legislation to make it harder to vote is a clear signal that our democracy is in crisis. Decades of policymaking and judicial rulings have created a system in which the voices of the wealthy and powerful have more weight, and some lawmakers are determined to further rig the system and keep it that way.

The New York Times: How to collect a trillion dollars

May 11, 2021

It’s difficult to quantify just how much money goes uncollected each year, officials say. Corporate tax collections in the U.S. are “at historic lows and well below what other countries collect,” according to a recent Treasury report. U.S. multinational companies can be taxed at a 50 percent discount compared with their domestic peers, an incentive […]

Commonwealth Magazine: Mass. delegation not jumping on SALT bandwagon

May 11, 2021

The politics of SALT are tricky. While the SALT deduction benefits a wide swath of taxpayers across many states, the biggest beneficiaries tend to be wealthy people with big homes who pay a lot of state income and property tax. The Institute on Taxation and Economic Policy estimates the richest 5 percent would receive 85 […]

Toledo Blade: Ohio urged to spend surplus on children, pregnant women

May 11, 2021

A study by the Institute on Taxation and Economic Policy for Policy Matters estimates that those making between $40,000 and $61,000 a year would on average see a $7 reduction in their annual tax bills from the latest proposal. Those earning at least $490,000 would average a $612 break. Through April, with just two months […]

NBC Chicago: Child Tax Credit: Parents Must File Tax Returns by May 17 Deadline to Qualify

May 7, 2021

About 83 million children live in households that would benefit from the expansion of the child tax credit, according to a study from the Institute on Taxation and Economic Policy. In addition, the poorest 20% of families would see income increase by more than 37% during the year that the policy is in place. Read more

WFAE: Duke Energy Among 55 Companies That Paid No U.S. Taxes Last Year

May 5, 2021

An analysis by the Institute on Taxation and Economic Policy, a progressive think tank, finds that Duke and other large companies used lower tax rates and tax incentives to eliminate their federal liability. In Duke’s case, those measures turned what could have been a $176 million income tax bill into a tax credit. When companies […]

The Motley Fool: Stimulus Check Update: Direct Payments Worth $3,600 May be Headed Your Way Soon

May 5, 2021

There are also restrictions to who you can claim under the expanded child tax credit. In order to claim your child or children, you must: Have a valid Social Security number for your child Be related to the child Have had your child live with you for at least half the year Provide more than […]

US News: Americans Are OK With Biden’s Spending Plans: Poll

April 27, 2021

Biden has repeatedly lamented that corporations do not pay their fair share of taxes, using legal loopholes to avoid taxes. A report earlier this month by the Institute on Taxation and Economic Policy found that at least 55 of the nation’s top companies paid no corporate income taxes in 2020, despite collecting $40.5 billion in […]

CNBC: Elizabeth Warren takes aim at FedEx, Nike, Amazon in push for corporate tax hike

April 27, 2021

FedEx and Nike were mentioned in an April report by the Institute on Taxation and Economic Policy as companies that recently paid little-to-no federal corporate income taxes. “The delivery giant FedEx zeroed out its federal income tax on $1.2 billion of U.S. pretax income in 2020 and received a rebate of $230 million,” the report said. “The […]

CNBC: Calls to end $10,000 SALT deduction cap threaten Biden’s tax plan ahead of its release

April 27, 2021

In addition, most of the families that would benefit from doing away with the SALT cap would be wealthy white ones, according to a recent analysis from the left-leaning Institute on Taxation and Economic Policy. Black families are 42% less likely and Hispanic families are 33% less likely than white ones to see a tax break […]

CBS Philadelphia: Child Tax Credit: How Much Money Can Parents Expect In Monthly Payments?

April 27, 2021

he Institute on Taxation and Economic Policy believes that households accounting for 83 million children would benefit to some degree. Anywhere from eight to 12 million children live in households facing food insecurity due to lack of money, according to recent Census data from late 2020. Estimates suggest that expanding the Child Tax Credit would […]

Associated Press: Should states set pot policy by its potency? Some say yes

April 20, 2021

Potency taxes have an upside for states: more stable revenue than sales taxes, says Carl Davis of the Institute on Taxation and Economic Policy, a progressive think tank. That’s because sales tax totals can fall with prices in a maturing market. Read more

The Washington Post: Biden Wants to Crack Down on Corporate Tax Loopholes, Resuming a Battle His Predecessors Lost

April 20, 2021

More than 60 percent of U.S. multinationals’ reported foreign income is booked in seven small countries that promise to only nibble at corporate profits, about twice the share as in 2000, according to Bank of America. The tax avoidance efforts — entirely legal under U.S. law — resulted in 55 of the nation’s largest corporations […]

New York Times: Make Tax-Dodging Companies Pay for Biden’s Infrastructure Plan

April 18, 2021

American companies and companies that make money in the United States are not paying enough money in taxes. Even as profits have soared, tax payments have declined. Fifty-five of the nation’s largest corporations — including FedEx, Nike and the agribusiness giant Archer Daniels Midland — paid nothing in federal income taxes in 2020, despite collectively […]

The Guardian: US CEOs think Biden’s corporate tax rate hike will have negative impact – survey

April 12, 2021

A report released earlier this month from the progressive Institute on Taxation and Economic Policy found that at least 55 of America’s top companies, including FedEx and Nike, paid no federal corporate income tax because of loopholes and substitutes. The report found that the tax breaks cost $8.5bn in potential tax revenue. Read more

CNBC: Progressive group targets FedEx, Nike in campaign calling for higher corporate taxes

April 12, 2021

A report by the Institute on Taxation and Economic Policy says FedEx “zeroed out its federal income tax on $1.2 billion of U.S. pretax income in 2020 and received a rebate of $230 million.” The report says the lack of payments in taxes by some corporations is likely linked to historic tax breaks as well […]