Blog - State Policy

651 posts

State Rundown 1/19: ITEP Provides a Roadmap for Equitable Tax Goals in 2023

January 19, 2023 • By ITEP Staff

State legislatures are buzzing as leaders and lawmakers jockey to advance their 2023 goals...

Lawmakers in seven states will introduce legislation this week to tax wealth in a new coordinated effort to combat ever-increasing income and wealth inequality. The bills couldn’t come at a better time, as those at the very top continue to pull apart from the rest of us and far too many states contemplate piling on to this runaway inequality with seemingly endless tax cuts for those at the top.

State Lawmakers Should Break the 2023 Tax Cut Fever Before It’s Too Late

January 18, 2023 • By Miles Trinidad

Despite mixed economic signals for 2023, including a possible recession, many state lawmakers plan to use temporary budget surpluses to forge ahead with permanent, regressive tax cuts that would disproportionately benefit the wealthy at the expense of low- and middle-income households. These cuts would put state finances in a precarious position and further erode public investments in education, transportation and health, all of which are crucial for creating inclusive, vibrant communities where everyone, not just the rich, can achieve economic security and thrive. In the event of an economic downturn, these results would be accelerated and amplified.

Momentum Behind State Tax Credits for Workers and Families Continues in 2023

January 18, 2023 • By Miles Trinidad

Refundable tax credits are an important tool for improving family economic security and advancing racial equity, and there is incredible momentum heading into 2023 to boost two key state credits: the Child Tax Credit and the Earned Income Tax Credit.

State Rundown 1/11: Governors Ready to Talk Tax in 2023 State Addresses

January 11, 2023 • By ITEP Staff

Governors have begun their annual trek to the podium in statehouses across the U.S. to lay out their visions for 2023, and so far, taxes look like they will play a major role in debates throughout state legislative sessions...

The new year often brings with it new goals and a desire to take on complex problems with a fresh perspective. Unfortunately, that doesn’t always apply to state lawmakers when considering tax policy...

State Rundown 12/15: State Priorities for 2023 Begin to Take Shape

December 15, 2022 • By ITEP Staff

State leaders have begun to release budget projections for 2023 and a familiar theme has emerged once again: big revenue surpluses, which have many state lawmakers pushing for another round of tax cuts despite the monumental challenges that we as a country face that call for sustainable revenues...

State Rundown 11/30: ‘Lame Duck’ December Could Have Major Tax Implications

November 30, 2022 • By ITEP Staff

As federal lawmakers begin their lame duck deliberations, the revival of the expanded child tax credit remains a strong possibility...

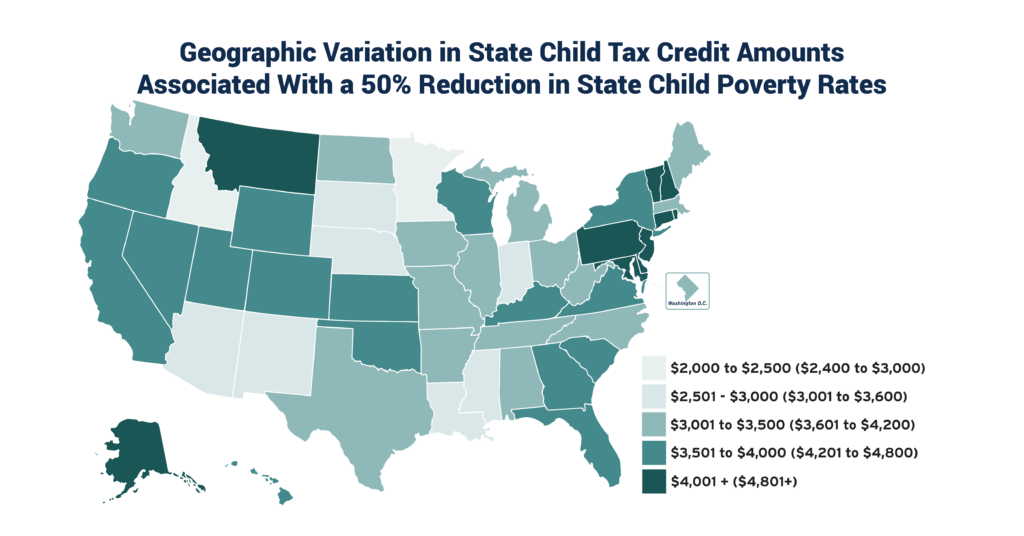

State policymakers have the tools they need to drastically reduce child poverty within their borders. A new ITEP report, coauthored with Columbia University’s Center on Poverty and Social Policy, explores state Child Tax Credit (CTC) options that would reduce child poverty by up to 50 percent. Temporary expansion of the federal CTC in 2021 reduced […]

As states continue to tally the remaining votes and the news stories roll out at a breakneck pace, the unofficial results of the 2022 midterm elections have brought with it significant changes across the state tax policy landscape...

Election Day in the States: Voters Deliver Important Victories for Tax Justice

November 10, 2022 • By Jon Whiten

Voters in Massachusetts and Colorado raised taxes on their wealthiest residents to fund schools, public transportation and school lunches for kids while making their tax codes more equitable. And voters in West Virginia defeated a proposal to deeply cut taxes, mostly for businesses, and drain the coffers of county and local governments.

Massachusetts Voters Score Win for Tax Fairness with ‘Fair Share Amendment’

November 9, 2022 • By Marco Guzman

In a significant victory for tax fairness, Massachusetts voters approved Question 1—commonly known as the Fair Share Amendment—Tuesday night with 52 percent of the vote. The new constitutional amendment creates a 4 percent surcharge on income over $1 million, and the revenue will specifically fund education and transportation projects in the Bay State.

Next Tuesday, voters will head to the polls to not only elect local and national leaders, but also let their voices be heard on a range of tax policy issues that could improve or worsen their state tax codes...

Tax Foundation’s ‘State Business Tax Climate Index’ Bears Little Connection to Business Reality

October 31, 2022 • By Carl Davis, Matthew Gardner

The big problem with the Index is that it peddles a solution that not only falls short of the goal of generating business investment, but one that actively harms state lawmakers’ ability to provide the kinds of public goods – like good schools and modern, efficient transportation networks – that businesses need and want.

Measures on the November Ballot Could Improve or Worsen State Tax Codes

October 26, 2022 • By Jon Whiten

In a couple of weeks, voters in a handful of states will weigh in on several tax-related ballot measures that could make state tax codes more equitable and raise money for public services, or take states in the opposite direction, making tax systems less fair and draining state coffers of dollars needed to maintain critical […]

Although the weather is beginning to cool down in parts of the country, the same cannot be said for many state economies, which are still running hot. That, however, doesn’t mean that the good times are guaranteed to last...

Do you remember/the big tax news innn September? Well, if not, we at ITEP got you covered...

State Rundown 9/7: Labor Day Week Provides Sobering Reminder of Steps Forward, Back

September 7, 2022 • By ITEP Staff

Though Labor Day has passed, advocates on the ground in states across the country are continuing to uphold the spirit of the labor movement...

Everyone loves a deal, so it’s no surprise why the appeal of the state sales tax holiday continues to persist. This year, 20 states will forgo more than $1 billion in combined revenue to enact a variety of sales tax holidays that—like most things that are too good to be true—will do little to provide meaningful benefits and instead undermine funding for public services.

State Rundown 8/10: States Still Talking Taxes as IRA Dominates Headlines

August 10, 2022 • By ITEP Staff

While federal tax policy has dominated the headlines with the Senate’s recent approval of the Inflation Reduction Act, lawmakers in statehouses across the country...

State Rundown 7/27: It’s (Sales Tax) Holiday Season, But Who’s Really Celebrating?

July 27, 2022 • By ITEP Staff

It’s the holiday season – well, the sales tax holiday season, that is. But after taking a closer look, you may notice that there is little to celebrate...

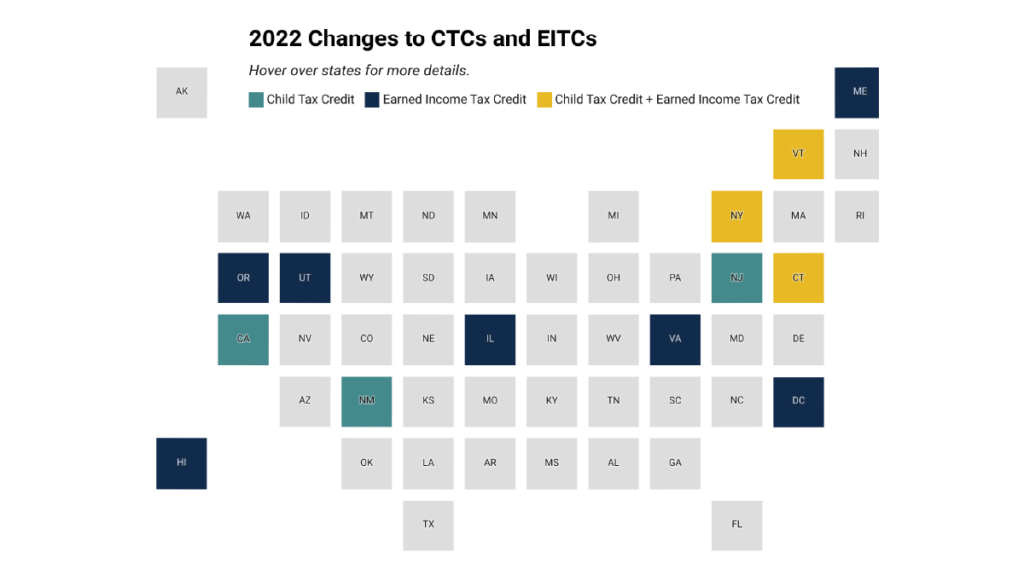

Legislative Momentum in 2022: New and Expanded Child Tax Credits and EITCs

July 22, 2022 • By Neva Butkus

State legislatures across the country made investments in their future, centering children, families, and workers by enacting and expanding state Earned Income Tax Credits (EITCs), Child Tax Credits (CTCs), and other refundable credits this session. In total, seven states either expanded or created CTCs this session. Connecticut, New Mexico, New Jersey, Rhode Island and Vermont […]

Most States Used Surpluses to Reduce Taxes But Not in Sustainable or Progressive Ways

July 22, 2022 • By Kamolika Das

The average person on the street would have no idea that many states experienced unprecedented budget surpluses this year. Iowa, for instance, has the most structurally deficient bridges of any state with nearly 1 in 5 falling apart. The Iowa Board of Regents proposed a 4.25 percent tuition increase for all three state universities and […]

New ITEP Brief Shows How State Sales Tax Holidays Fail to Live Up to the Hype

July 20, 2022 • By Marco Guzman

Twenty states this year have decided to go so far as to forgo a combined $1 billion in vital tax revenue in favor of conveniently popular yet ultimately ineffective sales tax holidays. Whether it’s a state looking for a way to help families manage the rising cost of goods or to celebrate back-to-school shopping season, these policy options are poorly targeted and an inadequate use of state tax revenue that could be doing more to make childcare more affordable, health care more accessible and high-quality education available to everyone.

From the Bay State to the Golden State, lawmakers across the nation are making deals and negotiating budgets with major tax implications...