Blog - Refundable Tax Credits

39 posts

Nearly 20 Million Will Benefit if Congress Makes the EITC Enhancement Permanent

May 13, 2021 • By Aidan Davis

Overall, the EITC enhancement would provide a $12.4 billion boost in 2022 if made permanent, benefiting 19.5 million workers. It would have a particularly meaningful impact on the bottom 20 percent of eligible households who would receive more than three-fourths of the total benefit. Forty-one percent of households in the bottom 20 percent of earners would benefit, receiving an average income boost of 6.3 percent, or $740 dollars.

Inclusive Child Tax Credit Reform Would Restore Benefit to 1 Million Young ‘Dreamers’

April 27, 2021 • By Marco Guzman

As the Biden administration maps out the next steps in America’s response to the coronavirus pandemic—through what is now being called the American Families Plan—it should make sure a proposed expansion of the Child Tax Credit (CTC) includes undocumented children who have largely been left out of federal relief packages this past year. Prior to 2017 Tax Cut and Jobs Act, all children regardless of their immigration status received the credit as long as their parents met the income eligibility requirements. This change essentially excluded around 1 million children and their families.

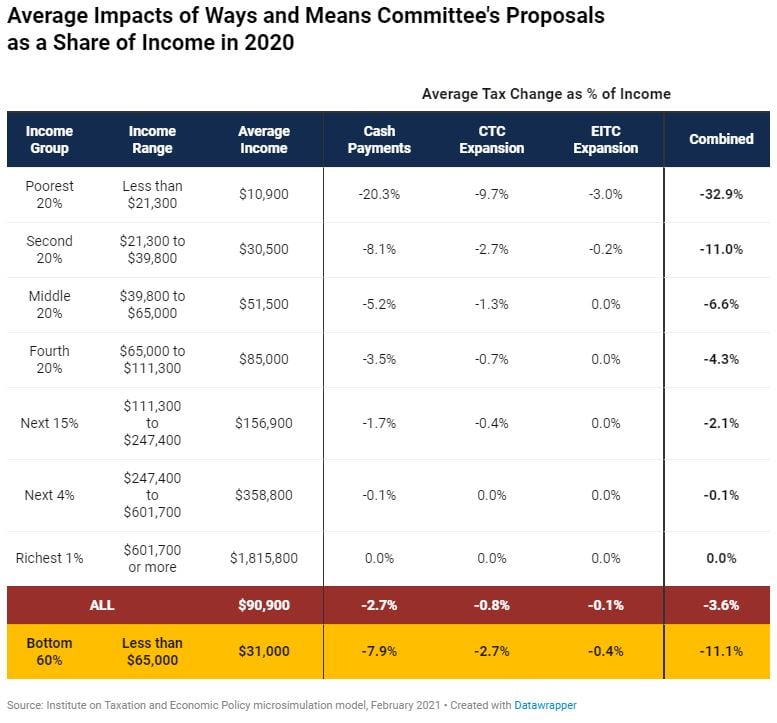

Details of House Democrats’ Cash Payments and Tax Credit Expansions

February 9, 2021 • By Steve Wamhoff

The House Ways and Means Committee published its proposal for the cash payments, tax provisions and other changes that would make up part of the $1.9 trillion COVID relief legislation that President Joe Biden called for a few weeks ago.

Temporarily modifying the structure of the EITC to reflect the realities of our current economy could provide a vital lifeline to low-income workers who have seen their incomes disappear during this crisis. What follows are a few such ideas which could be implemented at either the federal or state levels, or both.

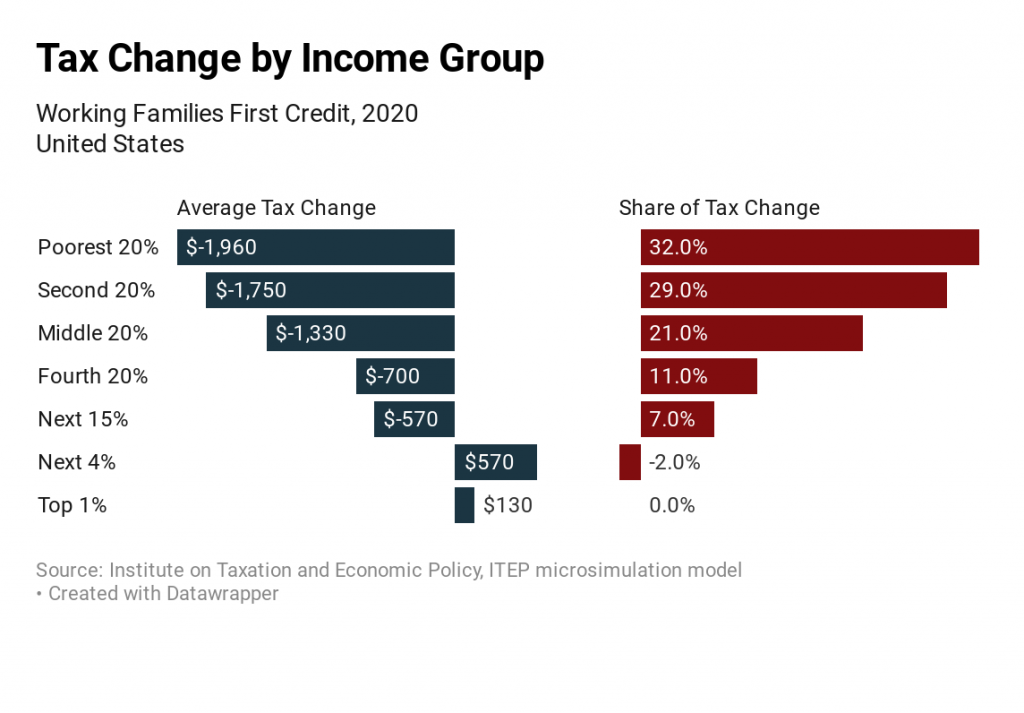

NEW ANALYSIS: House Democratic Stimulus Bill Explained

March 24, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

Breaking ITEP analysis explains how a newly-introduced House Democrats' proposal—far more comprehensive and better targeted than the recently failed GOP Senate bill—combines overdue expansion of the Earned Income Tax Credit and Child Tax Credit with direct rebates to reach workers and families across all income groups.

Julián Castro Provides the Latest Proposal to Expand Refundable Tax Credits

September 17, 2019 • By Steve Wamhoff

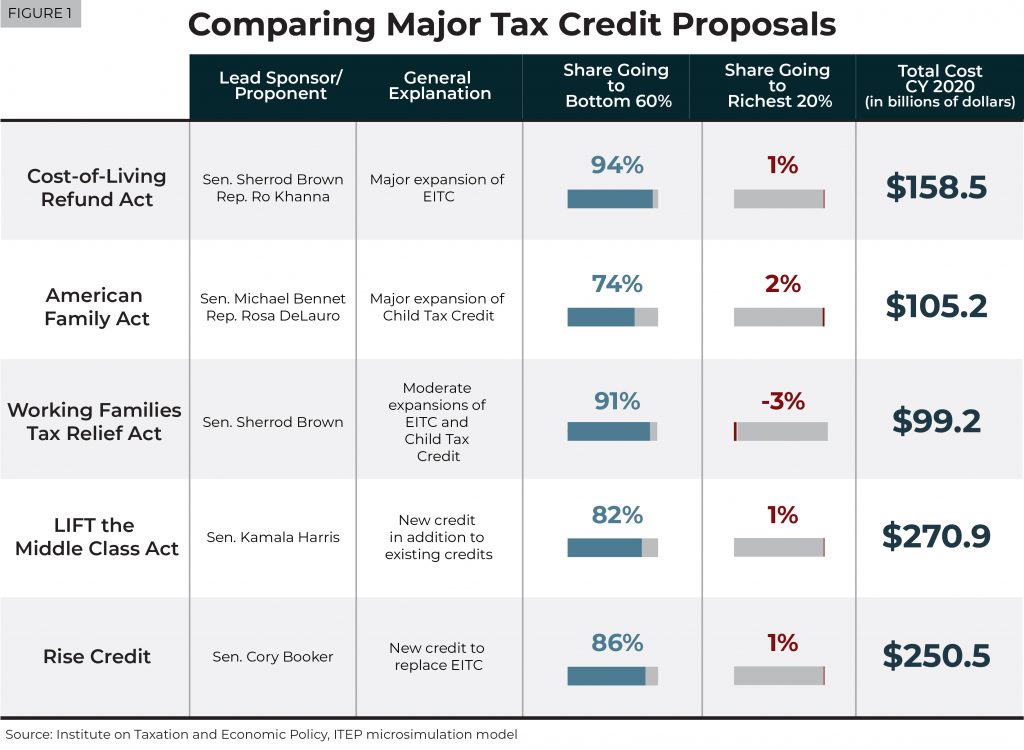

New estimates from ITEP show that Julián Castro’s refundable tax credit proposal would mostly benefit the bottom 60 percent of households and would have a cost ($195 billion in 2020) that places it roughly in the middle of the different tax credit proposals that Democrats have offered over the past several months.

Census Numbers Show the Power of the Tax Code to Direct Resources to Low-Income Families

September 10, 2019 • By Jessica Schieder

Refundable federal tax credits, including the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC), lifted 7.9 million people out of poverty in 2018. This latest analysis from the U.S. Census Bureau demonstrates the power of federal programs to alleviate poverty and help low-income families keep up with the increasing cost of living.

A refundable tax credit proposed by Rep. Rashida Tlaib (D-MI) would be more expansive than other recent tax credit proposals, new estimates from ITEP show. Rep. Tlaib’s proposal, unlike others, does not require households to work to receive the benefit.

Unlike Trump-GOP Tax Law, There Are Tax Plans That Would Actually Deliver on Promise to Help Working People

May 24, 2019 • By Alan Essig

Using the tax code to boost the economic security of low- and moderate-income families is a proven strategy. These bold proposals would go much further than any policy currently on the books, and their approach directly contrasts with longstanding supply-side theories that call for continual tax cuts to those who are already economically faring far better than everyone else.

Proposals for Refundable Tax Credits Are Light Years from Tax Policies Enacted in Recent Years

May 22, 2019 • By Steve Wamhoff

A new ITEP report examines five big proposals that have been announced this year to create or expand tax credits to address inequality and help low- and middle-income households.

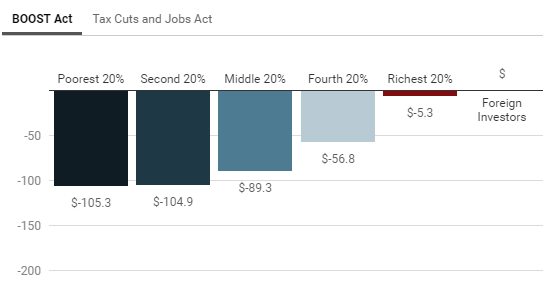

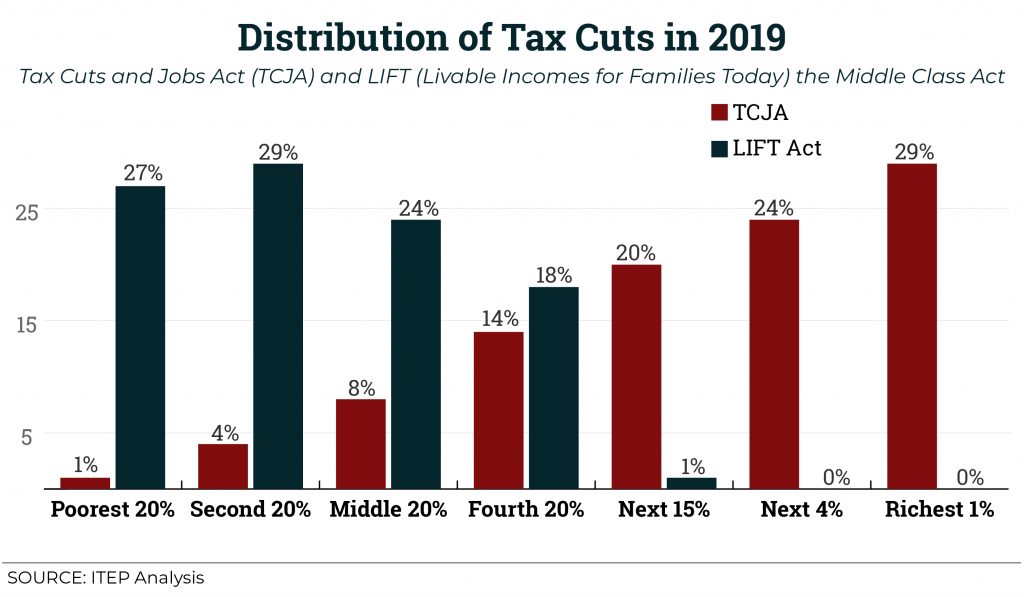

Shaking up TCJA: How a Proposed New Credit Could Shift Federal Tax Cuts from the Wealthy and Corporations to Working People

October 24, 2018 • By Aidan Davis

A new federal proposal, the Livable Incomes for Families Today (LIFT) the Middle Class Act, would create a new refundable tax credit for low- and middle-income working families who were little more than an afterthought in last year’s federal tax overhaul. This proposal would take the place of TCJA, providing tax cuts similar in cost to the recent federal tax law but targeted toward working people rather than the wealthy. ITEP analyzed the bill, proposed by California Senator Kamala Harris, and compared its potential impact to TCJA.

Final Tax Bill Reported to Provide Senator Rubio With Much Smaller Improvement for Children than He Demanded

December 15, 2017 • By Steve Wamhoff

The latest news on the GOP tax bill is that, in order to secure the vote of Senator Marco Rubio, Republican leaders have agreed to expand the child tax credit — but only by a fraction of the amount that Rubio initially demanded.

Chained CPI Would Raise Everyone’s Personal Income Taxes in the Future, Would Hurt the Poor Right Away

November 30, 2017 • By Steve Wamhoff

One of the findings is that every income group would face higher personal income taxes in years after 2025 (including 2027). Chained CPI would gradually push taxpayers into higher income tax brackets and make the standard deduction, the Earned Income Tax Credit, and several other breaks less generous over time. The switch to chained CPI would cause some low-income people to face a tax hike starting in 2019, the second year the plan would be in effect.

Poverty is Down, But State Tax Codes Could Bring It Even Lower

September 15, 2017 • By Misha Hill

The U.S. Census Bureau released its annual data on income, poverty and health insurance coverage this week. For the second consecutive year, the national poverty rate declined and the well-being of America’s most economically vulnerable has generally improved. In 2016, the year of the latest available data, 40.6 million (or nearly 1 in 8) Americans were living in poverty.