Blog

1298 posts

State Rundown 11/1: Connecticut Balances Budget, Leaves Tax Code Out of Whack

November 1, 2017 • By ITEP Staff

This week a "historic" but highly problematic budget agreement was finally reached in Connecticut, Michigan lawmakers banned localities from taxing any food or beverages, and Nebraska and North Dakota both got unpleasant news about future revenues. Also see our "what we're reading" section for news on 11 states that have run up long-term fiscal deficits since 2002 and the impacts of flooding on local tax bases.

Trump Administration Might Propose a Long-Overdue Gas Tax Increase

October 31, 2017 • By Carl Davis

The Trump Administration is reportedly considering backing a 7-cent increase in the federal gas tax next year to pay for improvements in the nation's infrastructure. While most of the tax policy ideas coming from the administration in recent weeks would undermine the nation's ability to fund core public services, this one is a notable exception.

The Manufacturing Deduction Is a Case Study in Tax Policy Gone Wrong

October 30, 2017 • By Richard Phillips

When you think of manufacturing, what comes to mind? According to the U.S. Congress, manufacturing may include things like the production of wrestling-rated films, assembling bouquets of flowers and even slicing cheesecake. These unusual definitions of manufacturing come from the domestic production activities deduction (better known as the manufacturing deduction), a tax break Congress created to encourage manufacturing in the United States.

State Rundown 10/25: Marijuana Taxes a Bright Spot amid Underperforming State Revenues

October 25, 2017 • By ITEP Staff

This week in state tax news saw Alaska begin yet another special session, Louisiana lawmakers holding meetings to begin preparing for the state’s looming (self-imposed) fiscal cliff, and Alabama policymakers beginning a study of school finance (in)adequacy and (in)equity. Meanwhile, state revenue performance is poor well into 2017 in many states, though Montana, Nevada, and Oregon are all enjoying modest but welcome revenue bumps from legalized marijuana.

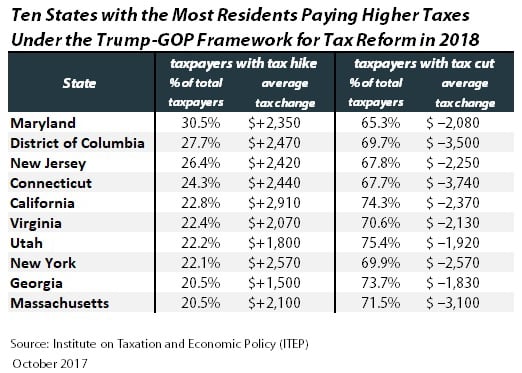

As our report on the Trump-GOP tax framework explained, in nine states plus the District of Columbia, more than a fifth of households would pay higher taxes under the framework.

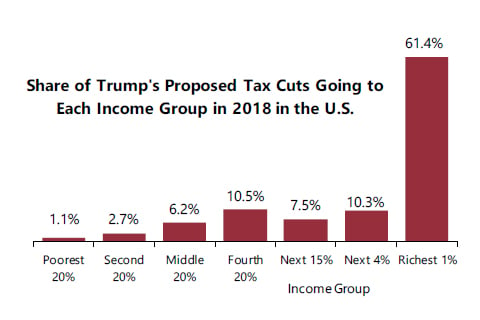

GOP Tax Plan Will Mainly Benefit Millionaires Even If Top Rate Remains 39.6 Percent

October 24, 2017 • By Steve Wamhoff

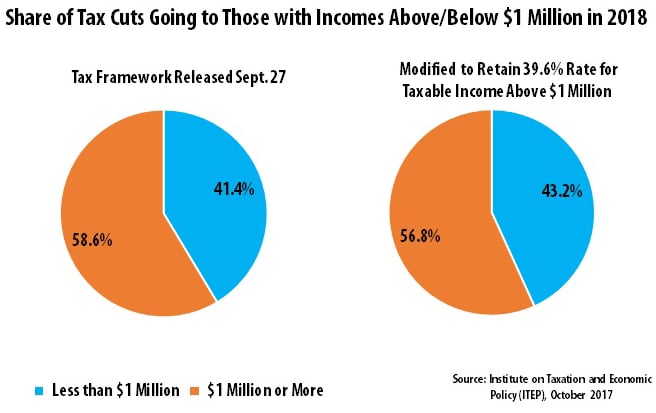

The Trump-GOP taxframework would reduce the top personal income tax rate from 39.6 percent to 35 percent, but now lawmakers are discussing keeping the top personal income tax rate at 39.6 percent for those with taxable income of more than $1 million. This modification would barely change the proposal’s overall impact.

The Jig Is Up: Republican Budget Resolution Finally Admits That Deficit Will Soar Under GOP Tax Plan

October 20, 2017 • By Alan Essig

For some lawmakers, annual deficits matter a lot—unless the nation is paying for tax cuts for the wealthy via deficit spending. Last night, Republican lawmakers demonstrated that previous grandstanding about the nation’s debt is much ado about nothing. The Senate approved a budget resolution on a party-line vote that would 1. fast-track legislation adding $1.5 trillion to the deficit over 10 years by cutting taxes, and 2. make it easy to enact this measure without a single Democratic vote.

Real tax reform would mean raising more revenue to make public investments and increasing the progressivity of the tax code. Many conservatives strongly disagree with this and insist that a substantial tax cut for the wealthiest Americans will grow the economy. Rather than engage in this policy debate based on policy ideals and principles, President Trump, other White House officials and GOP leaders have peppered their sales pitch for tax cuts with false claims about the amount of taxes that Americans pay and the effect the current GOP tax proposal would have on the tax system.

The Corporate Tax Code is in Dire Shape, But Trump-GOP Plan Would Make It Worse

October 18, 2017 • By Richard Phillips

Just how bad has the corporate tax code gotten? The newest edition of Offshore Shell Games, a joint report by the Institute on Taxation and Economic Policy (ITEP) and U.S. PIRG, outlines the massive scale of the offshore tax avoidance undertaken by U.S. multinationals. It’s well known that Fortune 500 companies have accumulated a stash of $2.6 trillion in earnings offshore, which has allowed them to avoid an estimated $752 billion in taxes.

State Rundown 10/18: Ballot Initiative Efforts Being Finalized

October 18, 2017 • By ITEP Staff

Ballot initiatives relating to taxes made news around the country this week, with Oregon voters to consider reversing new health care taxes, Washingtonians to vote on improving education funding, and Nebraskans to potentially vote on a state tax credit for school property taxes. Meanwhile, multiple states are finalizing their proposals to lure Amazon to build a new headquarters in their state, often through the use of massive tax subsidies. And in our "What We're Reading" section we have sobering news from Moody's Investors Service on states' struggles to fund their infrastructure and save for the next recession.

Tax Foundation Updates Its Problematic Wishlist for State Tax Policy

October 18, 2017 • By Carl Davis

This week the Tax Foundation published its 2018 State Business Tax Climate Index, or as University of Iowa economist Peter Fisher has nicknamed it, the “Waste of Time Index.”

State Rundown 10/13: Soda Taxes, Business Subsidies, and Gas Taxes Considered in Several States

October 13, 2017 • By ITEP Staff

A comprehensive tax study is underway in Arkansas this week as other states hone in on more specific issues. Soda taxes hit setbacks in Illinois and Michigan, business tax subsidies faced scrutiny in Iowa and Missouri, and gas tax update efforts are underway in Mississippi and North Dakota.

Middle-Income More Likely Than the Rich to Pay More Under Trump-GOP Tax Plan

October 11, 2017 • By Jenice Robinson

The Trump Administration and GOP leaders continue to wrap their multi-trillion tax cut gift to the wealthy in easily refutable rhetoric about boosting the nation’s middle class. Later today, trucks and truck drivers will serve as a backdrop for a Pennsylvania speech in which Trump is anticipated to talk about how proposed tax changes that […]

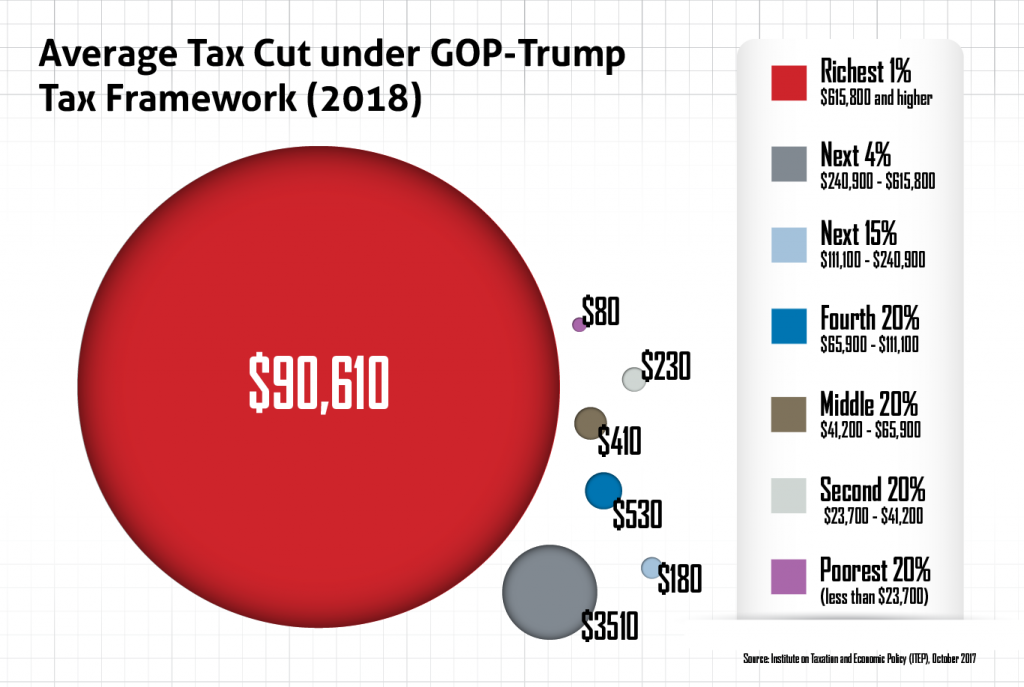

The Trump-GOP tax plan is touted as plan for the middle-class but delivers a boon to the wealthy, throws a comparative pittance to everyone else and even includes a dose of tax increases for some middle- and upper-middle-income taxpayers. The data belie the rhetoric.

State Rundown 10/4: Wildfires in Montana and Tax Cuts in Kansas Wreak Budget Havoc

October 4, 2017 • By ITEP Staff

This week, Kansas's school funding was again ruled unconstitutionally low and unfair, while Montana lawmakers indicated they'd rather let historic wildfires burn a hole through their budget than raise revenues to meet their funding needs. Meanwhile, a struggling agricultural sector continues to cause problems for Iowa and Nebraska, but legalized recreational marijuana is bringing good economic news to both California and Nevada.

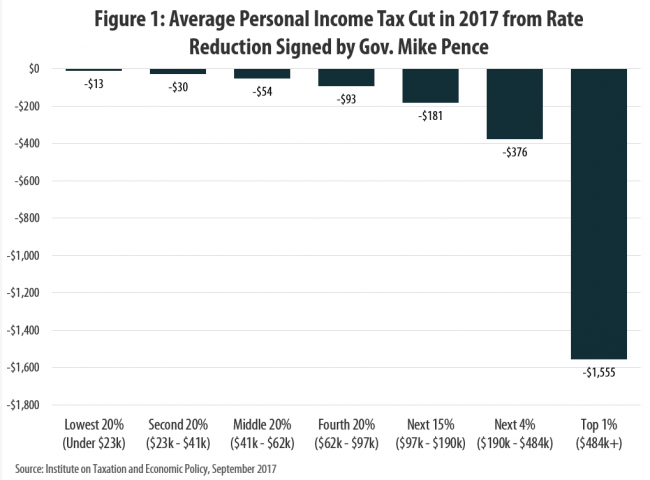

Indiana’s Tax Cuts Under Mike Pence Are Not a Model for the Nation

September 29, 2017 • By Carl Davis

In announcing a new tax cut framework this week in Indianapolis that was negotiated with House and Senate leaders, President Trump claimed that “Indiana is a tremendous example of the prosperity that is unleashed when we cut taxes and set free the dreams of our citizens …. In Indiana, you have seen firsthand that cutting taxes on businesses makes your state more competitive and leads to more jobs and higher paychecks for your workers.”

State Rundown 9/28: Wisconsin Budget Finalized, Oklahoma Special Session Underway

September 28, 2017 • By ITEP Staff

This week, Wisconsin's leaders finalized the state budget at last, while those in Oklahoma began a special session to close their state's revenue shortfall. Soda tax fights made news in Illinois and Pennsylvania. And New Jersey offered Amazon $5 billion in tax subsidies.

State Rundown 9/25: No Rest for the Weary as State Tax and Budget Debates Wind Down, Ramp Up

September 25, 2017 • By ITEP Staff

Last week, Wisconsin leaders finally came to agreement on a state budget, while their peers in Connecticut appear to be close behind them. Iowa lawmakers avoided a special session with a short-term fix and will have to return to their structural deficit issues next session, as will those in Louisiana who will face a $1 billion shortfall. Meanwhile, District of Columbia leaders have already resumed meeting and discussing tax and budget issues there.

Poverty is Down, But State Tax Codes Could Bring It Even Lower

September 15, 2017 • By Misha Hill

The U.S. Census Bureau released its annual data on income, poverty and health insurance coverage this week. For the second consecutive year, the national poverty rate declined and the well-being of America’s most economically vulnerable has generally improved. In 2016, the year of the latest available data, 40.6 million (or nearly 1 in 8) Americans were living in poverty.

Census Data Reveal Modest Gains for Working People; GOP Tax Overhaul Could Reverse These Gains

September 14, 2017 • By Jenice Robinson

On the surface, census poverty and income data released Tuesday reveal the nation’s economic conditions are improving for working families. The federal poverty rate declined for the second consecutive year and is now on par with the pre-recession rate. For the first time, median household income surpassed the peak it reached in 1999 and is […]

State Rundown 9/13: The Year of Unprecedented State Budget Impasses Continues

September 13, 2017 • By ITEP Staff

This week, Pennsylvania lawmakers risk defaulting on payments due to their extremely overdue budget and Illinois legislators will borrow billions to start paying their backlog of unpaid bills. Governing delves into why there were more such budget impasses this year than in any year in recent memory. And Oklahoma got closure from its Supreme Court on whether closing special tax exemptions counts as "raising taxes" (it doesn't).

Census Data Shows Importance of Refundable Tax Credits in Reducing Poverty, But Lawmakers Move to Restrict Them

September 12, 2017 • By Steve Wamhoff

The annual poverty data released by the Census Bureau today continues to show that federal refundable tax credits are the second most important anti-poverty program after Social Security. But this could change if the House Republicans have their way. The budget resolution approved by Republicans on the House Budget Committee in July would place new […]

State Rundown 9/6: Most Statehouses Quiet, Many Pondering Harvey’s Impacts

September 7, 2017 • By ITEP Staff

It's been a quiet week for tax policy in most states, though lawmakers are still making noise in Pennsylvania, where a budget agreement is still needed, and in Wisconsin, where legislators are searching for the will to raise revenue for the state's ailing transportation infrastructure. In our "What We're Reading" section you'll find interesting reading on the fiscal fallout of Hurricane Harvey, as well as an in-depth series on how states' disaster response needs are likely to continue to increase.

New ITEP Report: Trump’s Proposed Territorial Tax System Would Increase Corporate Tax Dodging

September 6, 2017 • By Steve Wamhoff

While promoting his ideas for overhauling our tax code today in North Dakota, President Trump said that Congress should adopt a territorial tax system which, he argued, would result in more investment in the United States. You’re not alone if you’re not sure what “territorial” means in this context. It’s a euphemism used by some politicians to describe a proposal that will be wildly unpopular once voters understand what it really means.

Tax Reform Principles Released by GOP in August Raise More Questions Than They Answer

August 31, 2017 • By Steve Wamhoff

Before Wednesday, you may have forgotten about tax reform given that President Trump’s remarks on the Charlottesville white supremacist rally, as well as the first U.S. solar eclipse since 1979, and Hurricane Harvey, overshadowed most other news. But Republicans on the House Ways and Means Committee, which in theory is the starting place for any tax legislation, certainly tried to get the public to focus on their vision for tax reform. They released a “reason for tax reform” each day in August. Unfortunately, these “reasons” are a combination of ideas that their proposals fail to address and misleading assertions.