Blog

1298 posts

Trump (Sort of) Used Our Data on Corporate Tax Avoidance, But He Missed the Point

August 31, 2017 • By Matthew Gardner

On Wednesday, reporters waiting to write about President Trump’s much-ballyhooed tax reform speech in Missouri received a fact sheet from the White House informing them that, “Fortune 500 corporations are holding more than $2.6 trillion in profits offshore to avoid $767 billion in Federal taxes, according to the Institute on Taxation and Economic Policy.”

State Rundown 8/31: Modernizing Taxes is Sometimes a Sprint, Sometimes a Marathon

August 31, 2017 • By ITEP Staff

Tax and budget debates are progressing at different paces in different parts of the country this week. In Connecticut and Wisconsin, lawmakers hope to finally settle their budget and tax differences soon. In South Dakota, a court case that could finally enable states to enforce their sales taxes on online retailers inches slowly closer to the U.S. Supreme Court.

Sorting Through the Fallacies in Trump’s Missouri Tax Speech

August 30, 2017 • By Steve Wamhoff

President Donald Trump spoke in Springfield, Missouri today about the need for a tax reform that provides “more jobs and higher wages for America” and “tax relief for middle-class families.” But the proposals the Trump administration has released so far would cut taxes for companies moving investment offshore and would provide most tax cuts to the richest one percent of taxpayers.

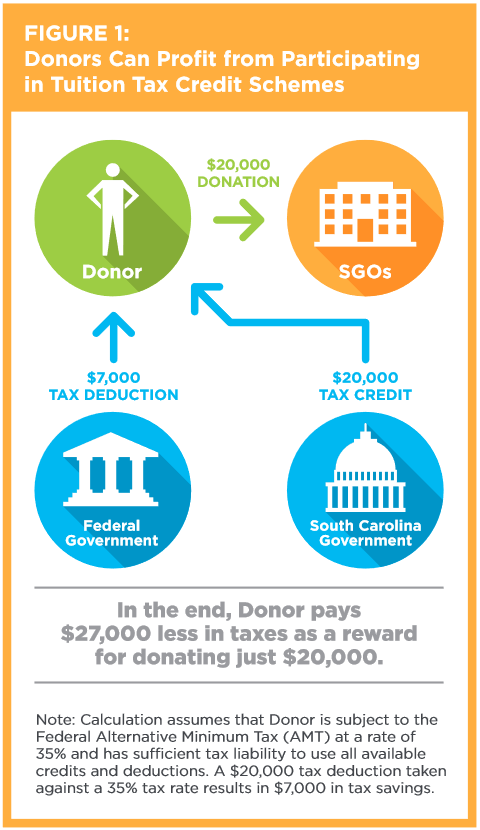

Private School Voucher Credits Offer a Windfall to Wealthy Investors in Some States

August 30, 2017 • By Carl Davis

State lawmakers who want to send public dollars to private schools have devised a shrewd tactic for getting around political and constitutional obstacles that make it difficult to do so. These lawmakers found a way to pay high-income taxpayers to fund those schools on states’ behalf, sometimes even offering those taxpayers a tidy profit in […]

State Rundown 8/23: Few Lingering Budget Debates Cannot Linger Much Longer

August 23, 2017 • By ITEP Staff

This week, Oklahoma lawmakers learned they'll need to enter a special session to balance their budget and that they'll likely face a lawsuit over their low funding of public education. Pennsylvania's budget stalemate is also coming to a head as the state literally runs out of funds to pay its bills. And Amazon's tax practices are in the news again as the company has been sued in South Carolina.

GOP Leaders Tout Corporate Tax Cuts at Boeing and AT&T, Companies that Already Have Single-Digit Tax Rates

August 23, 2017 • By Matthew Gardner

House Speaker Paul Ryan plans to visit a Boeing factory in Washington State tomorrow to promote the GOP’s ideas for tax reform, which include a deep cut in the corporate tax rate, while House Ways and Means Chairman Kevin Brady is bringing the same message today to employees of AT&T in Dallas. What is unclear is how much lower taxes for these companies can possibly go.

Inaccuracies Pile Up During Speaker Ryan’s Town Hall Meeting

August 22, 2017 • By Steve Wamhoff

On Monday, House Speaker Paul Ryan participated in a live-broadcast town hall meeting in his district in Wisconsin where he discussed tax reform, among other issues. One could credit Ryan for holding such a meeting, but sadly, anyone wishing to learn about the rationale for Ryan’s ideas on taxes would have been disappointed.

Today, the economic climate is starkly different, but it seems GOP leaders are relying on messaging and luck to push through the biggest tax package since 1986. The White House, Republican leaders and anti-tax advocates all have been toeing the same erroneous line: their plans to cut individual and corporate taxes will benefit middle class families and grow the economy. This is, of course, baloney.

A month ago, the Seattle City Council passed an income tax measure, which has garnered a lot of attention as well as volumes of supportive and opposition commentary. Haven’t had a chance to dive into the details yet? We’ve got you covered. What is the new income tax law and who does it impact? The […]

This week, Rhode Island lawmakers agreed on a budget, leaving only three states – Connecticut, Pennsylvania, and Wisconsin – without complete budgets. Texas, however, remains in special session and West Virginia could go back into another special session over tax issues. And in New York City, the mayor proposes a tax on the wealthy to […]

It’s a Fact: Voucher Tax Credits Offer Profits for Some “Donors”

August 9, 2017 • By Carl Davis

In nine states, tax rewards gained by donating to fund private K-12 vouchers are so oversized that “donors” can turn a profit. This is the shocking but true finding of a pair of studies released by ITEP over the last year.

How to Think About the Problem of Corporate Offshore Cash: Lessons from Microsoft

August 4, 2017 • By Matthew Gardner

For a corporation with deeply American roots, Microsoft seems remarkably unable to turn a profit here. Against all odds, the Redmond, Washington-based company continues to claim that virtually all its earnings are in foreign countries. Microsoft’s latest annual report, released earlier this week, shows that over the past two years, the company enjoyed worldwide income of almost $43 billion. It claims to have earned just 0.3 percent of that—$128 million—in the United States.

Trump Administration May Make Corporate Inversions Great Again

August 4, 2017 • By Richard Phillips

During the presidential campaign, Donald Trump called out companies engaging in corporate inversions saying that one proposed inversion was “disgusting” and that “politicians should be ashamed” for allowing it to happen. Despite this rhetoric, the Trump Administration is considering rolling back critical anti-inversion rules as part of its broad regulatory review of recently issued Treasury Department regulations.

State Rundown 8/2: Legislative Tax Debates Wind Down as Ballot Initiative Efforts Ramp Up

August 2, 2017 • By ITEP Staff

Budget deliberations continue in earnest this week in Alaska, Connecticut, Pennsylvania, and Rhode Island. In South Dakota and Utah, the focus is on gearing up for ballot initiative efforts to raise needed revenue, though be sure to read about legislators nullifying voter-approved initiatives in Maine and elsewhere in our "what we're reading" section.

The Problems with the Multi-Million-Dollar Effort to Secure Millionaire and Corporate Tax Cuts

July 31, 2017 • By Alan Essig

Until GOP leaders put forth a detailed tax proposal, we will not know for certain whether the plan will focus on the middle-class and create jobs. But what we do know is that unless the plan is a radical departure from the principles outlined by President Trump earlier this year or laid out by Paul Ryan last year in his “Better Way,” plan, GOP-led tax “reform” efforts will be a tax break bonanza for the wealthiest Americans while delivering a pittance to working people.

Art Laffer and Stephen Moore’s Misleading Case for the Trump Tax Cuts

July 28, 2017 • By Nick Buffie

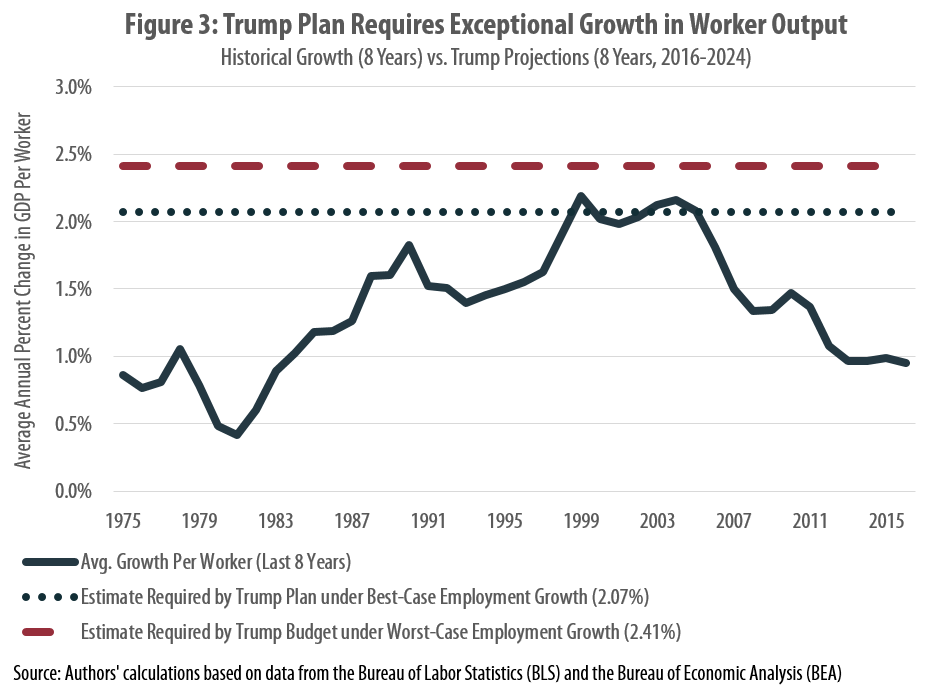

Art Laffer and Stephen Moore recently penned an op-ed in the Wall Street Journal in which they called on state and local policymakers to support the Trump tax cuts. They claimed that the Trump plan would provide a significant boost to state and local tax revenues, thereby allowing states with large budget deficits to “regain fiscal health.” State and local lawmakers should not be fooled by these claims. The reality is that Trump’s tax cuts are more likely to worsen state and local fiscal health than improve it.

State Rundown 7/27: State Legislative Debates Winding Down but Tax Talk Continues

July 27, 2017 • By ITEP Staff

While only a few states still remain mired in overtime budget debates, there is plenty of budget and tax news from around the country this week. Efforts are underway to repeal gas tax increases in California and challenge a local income tax in Seattle, Washington. And New Jersey legislators' law to modernize its tax code to tax Airbnb rentals has been vetoed for now.

GOP Leaders in Congress and the White House Set Out Goals for Tax Reform that Their Plans Fail to Meet

July 27, 2017 • By Alan Essig

Today Republican leaders in Congress and officials from the White House released a joint statement on tax reform, claiming that “the single most important action we can take to grow our economy and help the middle class get ahead is to fix our broken tax code for families, small business, and American job creators competing at home and around the globe.” Unfortunately, the proposals they have put forward so far do not address any such goals.

Reviving U.S. Manufacturing, One Cheesecake Factory at a Time

July 27, 2017 • By Matthew Gardner

In the latest example of how the tax code has been abused and distorted, the Cheesecake Factory is claiming the manufacturing tax deduction, apparently for manufacturing cheesecakes, burgers, and other treats.

Trump Touts Tax Cuts for the Wealthy as a Plan for Working People

July 26, 2017 • By Steve Wamhoff

Unless the administration takes a radically different direction on tax reform from what it has already proposed, its tax plan would be a monumental giveaway to the top 1 percent. The wealthiest one percent of households would receive 61 percent of all the Trump tax breaks, and would receive an average of $145,400 in 2018 alone.

2017 marked a sea change in state tax policy and a stark departure from the current federal tax debate as dubious supply-side economic theories began to lose their grip on statehouses. Compared to the predominant trend in recent years of emphasizing top-heavy income tax cuts and shifting to more regressive consumption taxes in the hopes […]

Tax Avoidance: Nike “Just Did It” Again, Moving $1.5 Billion Offshore Last Year

July 21, 2017 • By Matthew Gardner

The Nike Corporation’s annual financial disclosure of income tax payments is always notable for two recurring trends: the Oregon-based company’s steady shifting of profits into offshore tax havens, and Nike’s apparent effort to conceal how it’s achieving this tax avoidance. This year’s report, released earlier this week, is no exception.

States May Be Finally Learning Their Lesson on Back-To-School Sales Tax Holidays

July 21, 2017 • By Dylan Grundman O'Neill

State lawmakers face a dilemma when it comes to sales tax holidays, an attractive and popular policy that nonetheless proves to be a poor choice compared to developing thoughtful, targeted tax policies or investing in well-executed public services. Luckily, word seems to be getting out that the costs associated with these holidays far outweigh their purported benefits.

State Rundown 7/19: Handful of States Still Have Their Hands Full with Tax and Budget Debates

July 19, 2017 • By ITEP Staff

Tax and budget debates drag on in several states this week, as lawmakers continue to work in Alaska, Connecticut, Rhode Island, Pennsylvania, Texas, and Wisconsin. And a showdown is brewing in Kentucky between a regressive tax shift effort and a progressive tax reform plan. Be sure to also check out our "What We're Reading" section for a historical perspective on federal tax reform, a podcast on lessons learned from Kansas and California, and more!

FedEx Pays Just 7.5% of Its Profits in Taxes While Pushing for a Lower Corporate Tax Rate

July 18, 2017 • By Matthew Gardner

The latest annual financial report released by shipping giant FedEx is yet another reminder that where you stand often depends on where you sit. The report shows that last year FedEx paid a 7.5 percent federal income tax rate on nearly $3.6 billion of U.S. pretax income and this low rate is due in part to accelerated depreciation, a provision in the tax code that allows the company to write off capital investments faster than they wear out. It’s not surprising, then, that FedEx’s leadership is currently promoting a tax plan that would drop the company’s statutory tax rate even…