Personal Income Taxes

Many States Move Toward Higher Taxes on the Rich; Lower Taxes on Poor People

July 18, 2019 • By Meg Wiehe

Several states this year proposed or enacted tax policies that would require high-income households and/or businesses to pay more in taxes. After years of policymaking that slashed taxes for wealthy households and deprived states of revenue to adequately fund public services, this is a necessary and welcome reversal.

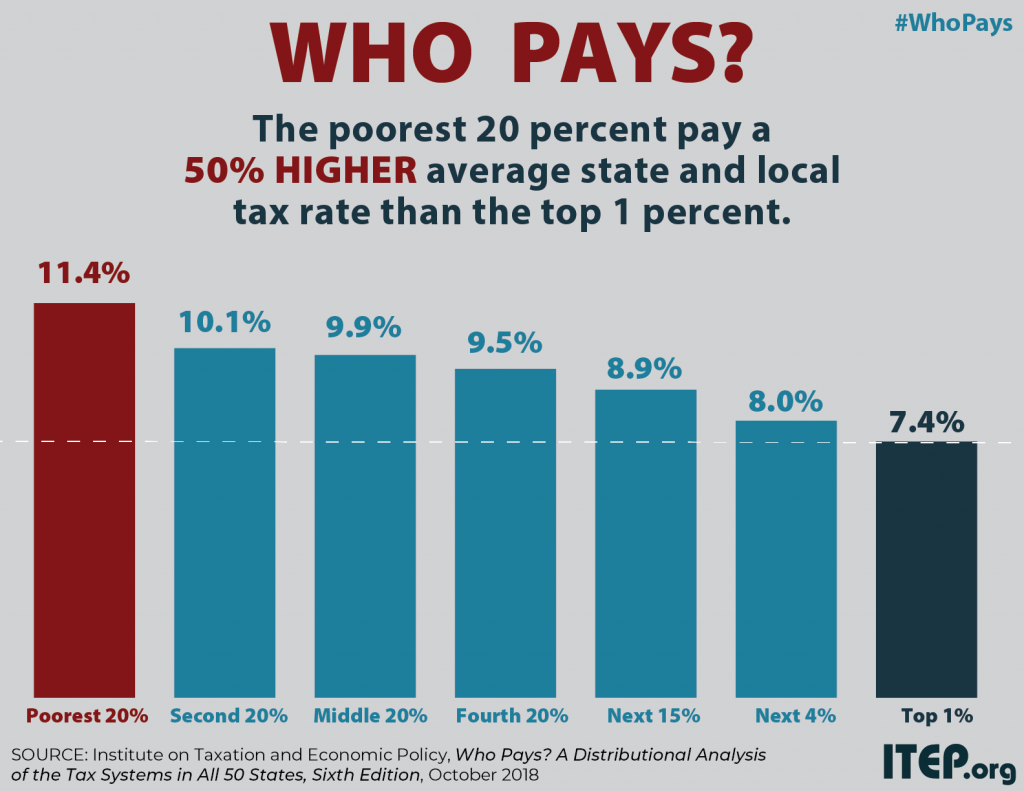

New Report Finds that Upside-down State and Local Tax Systems Persist, Contributing to Inequality in Most States

October 17, 2018 • By Aidan Davis

State and local tax systems in 45 states worsen income inequality by making incomes more unequal after taxes. The worst among these are identified in ITEP’s Terrible 10. Washington, Texas, Florida, South Dakota, Nevada, Tennessee, Pennsylvania, Illinois, Oklahoma, and Wyoming hold the dubious honor of having the most regressive state and local tax systems in the nation. These states ask far more of their lower- and middle-income residents than of their wealthiest taxpayers.

BTC Report: Income tax rate cap amendment is costly for taxpayers, communities

September 28, 2018

Imposing an arbitrary income tax cap in the North Carolina Constitution could fundamentally compromise our state’s ability to fund our schools, roads, and public health, as well as raise the cost of borrowing. This could all happen even as the tax load shifts even further onto middle- and low-income taxpayers and the state’s highest income taxpayers — the top 1 percent — continue to benefit from recent tax changes since 2013.

State Tax Codes as Poverty Fighting Tools: 2018 Update on Four Key Policies in All 50 States

September 17, 2018 • By Aidan Davis, Misha Hill

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2018, and offers recommendations that every state should consider to help families rise out of poverty. States can jumpstart their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

Rewarding Work Through State Earned Income Tax Credits in 2018

September 17, 2018 • By ITEP Staff

The Earned Income Tax Credit (EITC) is a policy designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, providing the opportunity for struggling families to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits. The effectiveness of the EITC as an anti-poverty policy can be increased by expanding the credit at…

Reducing the Cost of Child Care Through State Tax Codes in 2018

September 17, 2018 • By Aidan Davis

Families in poverty contribute over 30 percent of their income to child care compared to about 6 percent for families at or above 200 percent of poverty. Most families with children need one or more incomes to make ends meet which means child care expenses are an increasingly unavoidable and unaffordable expense. This policy brief examines state tax policy tools that can be used to make child care more affordable: a dependent care tax credit modeled after the federal program and a deduction for child care expenses.

ITEP Testimony “Regarding the Final Report of the Arkansas Tax Reform and Relief Legislative Task Force”

August 23, 2018 • By Lisa Christensen Gee

Read the testimony in PDF WRITTEN TESTIMONY SUBMITTED TO: THE ARKANSAS TAX REFORM AND RELIEF TASK FORCE Lisa Christensen Gree, Senior State Tax Policy Analyst Institute on Taxation and Economic Policy Regarding the Final Report of the Arkansas Tax Reform and Relief Legislative Task Force August 22, 2018 Thank you for the opportunity to submit these […]

New Jersey’s new governor, Phil Murphy campaigned on a promise to raise state income taxes on millionaires, a proposal that is supported by 70 percent of the state and was, until recently, backed by New Jersey’s Senate President, Steve Sweeney. In recent months, Sweeney changed his position on the proposed millionaires tax and called for an increase in New Jersey’s corporate tax instead. The idea of hiking taxes on corporations is not a bad one, particularly since corporations received a windfall from the Tax Cuts and Jobs Act. But Sweeney’s new opposition to an income tax hike for the state’s…

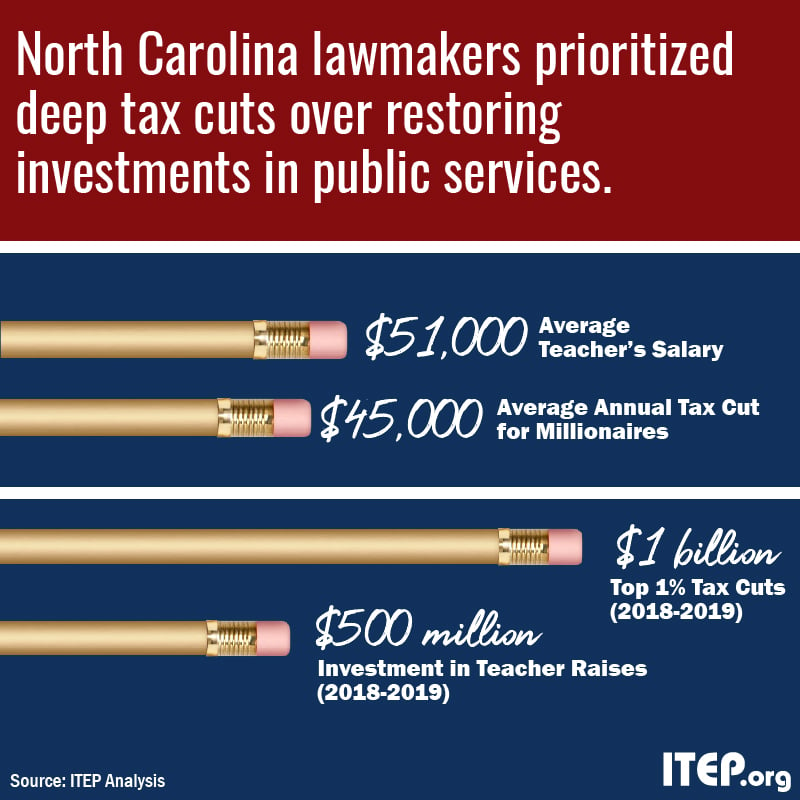

NC Teachers’ March on Raleigh and the Tax Cuts that Led Them There

May 15, 2018 • By Aidan Davis

Once again, public school teachers are taking a stand for education and against irresponsible, top-heavy tax cuts that deprive states of the revenue they need to sufficiently fund public services, including education.

Newly Unveiled Ballot Initiative Aims to Tax Arizona’s Top 1 Percent to Fund Education

May 1, 2018 • By Aidan Davis

Today marks Day 4 of the Arizona teachers’ walkout. After decades of tax cuts and underfunding of public education, education advocates are now driving the debate and urging lawmakers to act. Their newest proposal would raise taxes on incomes above half a million dollars for married couples, or above $250,000 for single taxpayers—that is, the same wealthy taxpayers that just received a generous tax cuts under last year’s federal tax overhaul.

Trickle-Down Dries Up: States without personal income taxes lag behind states with the highest top tax rates

October 26, 2017 • By Carl Davis, Nick Buffie

Lawmakers who support reducing or eliminating state personal income taxes typically claim that doing so will spur economic growth. Often, this claim is accompanied by the assertion that states without income taxes are booming, and that their success could be replicated by any state that abandons its income tax. To help evaluate these arguments, this study compares the economic performance of the nine states without broad-based personal income taxes to their mirror opposites—the nine states levying the highest top marginal personal income tax rates throughout the last decade.

Astonishingly, tax policies in virtually every state make it harder for those living in poverty to make ends meet. When all the taxes imposed by state and local governments are taken into account, every state imposes higher effective tax rates on poor families than on the richest taxpayers.

2017 marked a sea change in state tax policy and a stark departure from the current federal tax debate as dubious supply-side economic theories began to lose their grip on statehouses. Compared to the predominant trend in recent years of emphasizing top-heavy income tax cuts and shifting to more regressive consumption taxes in the hopes […]

Failed Tax-Cut Experiment (in North Carolina) Will Continue Under Final Budget Agreement, Pushes Fiscal Reckoning Down the Line

June 21, 2017

The final budget agreement from leaders of the House and Senate puts North Carolina on precarious fiscal footing, The tax changes that leaders agreed to—which were less a compromise and more of a decision to combine the tax cuts in both chambers’ proposals—make the cost of these tax cuts bigger than what either chamber proposed. Including the new tax cuts,approximately 80 percent of the net tax cut since 2013 will have gone to the top 20 percent. More than half of the net tax cut will go to the top 1 percent.

Gov. Sam Brownback’s tax experiment in Kansas was a failure. His radical tax cuts for the rich eventually had to be partly paid for through tax hikes on low- and middle-income families and also failed to deliver on promises of economic growth. Meanwhile, the tax cuts decimated the state’s budget, diminished its credit rating, and compromised its ability to meet the state’s constitutional standard of adequacy for public education.

The Cost Of Trickle-Down Economics For North Carolina

May 26, 2017

Since 2013, state lawmakers have passed significant income tax cuts that largely benefit the state’s highest income earners and profitable corporations. These costly tax cuts have made the state’s tax system more upside-down by delivering the greatest income tax cuts to the state’s highest income taxpayers, while maintaining a heavier tax load on low- and […]

Investors and Corporations Would Profit from a Federal Private School Voucher Tax Credit

May 17, 2017 • By Carl Davis

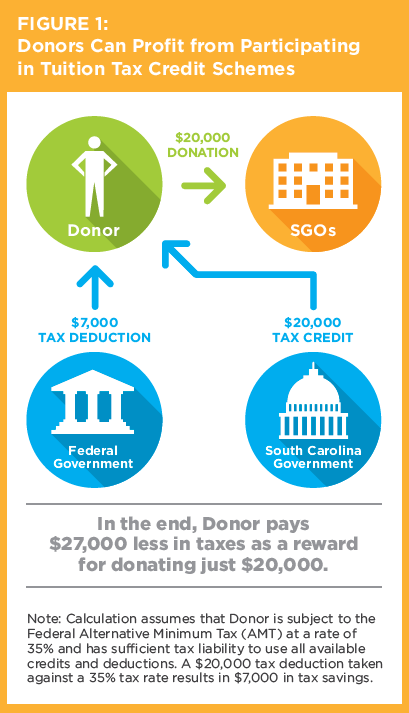

A new report by the Institute on Taxation and Economic Policy (ITEP) and AASA, the School Superintendents Association, details how tax subsidies that funnel money toward private schools are being used as profitable tax shelters by high-income taxpayers. By exploiting interactions between federal and state tax law, high-income taxpayers in nine states are currently able […]

Public Loss Private Gain: How School Voucher Tax Shelters Undermine Public Education

May 17, 2017 • By Carl Davis, Sasha Pudelski

One of the most important functions of government is to maintain a high-quality public education system. In many states, however, this objective is being undermined by tax policies that redirect public dollars for K-12 education toward private schools.

Nebraska Vote Is Latest Defeat for Tax-Cut “Trigger” Gimmick

May 4, 2017 • By Dylan Grundman O'Neill

Nebraska lawmakers had a long and contentious tax-cut debate this session but ultimately chose the wise path and rejected attempts to give a massive tax cut to the wealthy at the expense of the state’s schools, other public services, low- and middle-income families, and property tax payers. Tax cut efforts in Nebraska last year ended […]

Time to Repeal State Deductions for Federal Income Taxes

May 1, 2017 • By Dylan Grundman O'Neill

Three of the biggest needs facing state policymakers right now are new revenues to fund their priorities in the face of budget shortfalls and federal funding cuts, ways to insulate those revenue streams from unpredictable tax changes at the federal level, and approaches to meet these needs without leaning even more heavily on low- and […]

Why States That Offer the Deduction for Federal Income Taxes Paid Get It Wrong

May 1, 2017 • By Dylan Grundman O'Neill

With many states currently facing budget shortfalls—whether due to weak economic recovery after the Great Recession, struggling commodity prices, or self-inflicted tax cuts—and all states bracing for possible federal budget cuts in areas from education to health care to infrastructure, states are unlikely to be able to continue providing high-quality services to their residents without raising new revenue. In this context, states must find ways to generate additional revenue without increasing taxes on individuals and families who are already struggling to make ends meet and may bear the biggest brunt of federal funding cuts.

Earlier this month the Alaska House of Representatives voted 22-17 in favor of implementing a personal income tax for the first time in over 35 years. Gov. Bill Walker praised the bill shortly after passage, citing its ability to “provide a steady source of funding for essential services like public education and state troopers,” and […]

Dodging Tough Fiscal Decisions with State Tax Cut Triggers and Phase-Ins

February 6, 2017 • By Carl Davis

The most challenging problem that tax-cutting state lawmakers face is dealing with the budgetary tradeoffs that tax cuts require. Should education spending be reduced? Should investments in infrastructure be halted? Should the state cut back on transfers to local governments and require them to pick up the slack? Or should other taxes and fees be […]

What to Watch in the States: Further Attempts to Weaken or Eliminate Progressive Taxes

February 2, 2017 • By Aidan Davis

This is the third installment of our six-part series on 2017 state tax trends. The introduction to this series is available here. As we described last week, many states are gearing up for challenging budget debates this year. But the need to address revenue shortfalls has not stopped lawmakers in many states from pursuing harmful […]

State governments provide a wide array of tax breaks for their elderly residents. Almost every state that levies an income tax allows some form of income tax exemption or credit for citizens over age 65 that is unavailable to non-elderly taxpayers. Most states also provide special property tax breaks to the elderly. Unfortunately, too many of these breaks are poorly-targeted, unsustainable, and unfair. This policy brief surveys federal and state approaches to reducing taxes for older adults and suggests options for designing less costly and better targeted tax breaks.

The personal income tax is typically the fairest revenue source relied on by federal and state governments. A properly structured personal income tax could offer an important boost in progressivity to what are otherwise overwhelmingly regressive state tax structures.

Forty-one states and the District of Columbia levy broad-based personal income taxes. ITEP’s personal income tax resources provide both general and state-specific information about the impact as well as the mechanics and merits of personal income taxes.