Tax Reform Options and Challenges

Benefits of a Financial Transaction Tax

October 28, 2019 • By Jessica Schieder, Lorena Roque, Steve Wamhoff

A financial transaction tax (FTT) has the potential to curb inequality, reduce market inefficiencies, and raise hundreds of billions of dollars in revenue over the next decade. Presidential candidates have proposed using an FTT to fund expanding Medicare, education, child care, and investments in children’s health. Any of these public investments would be progressive, narrowing resource gaps between the most vulnerable families and the most fortunate.

Emmanuel Saez and Gabriel Zucman’s New Book Reminds Us that Tax Injustice Is a Choice

October 15, 2019 • By Steve Wamhoff

Cue Emmanuel Saez and Gabriel Zucman. In their new book, The Triumph of Injustice, the economists, who already jolted the world with their shocking data on exploding income inequality and wealth inequality, tell us to stop acting like we are paralyzed when it comes to tax policy. There are answers and solutions. And in about 200 surprisingly readable pages, they provide them.

A New York Times article explained that proponents of a federal wealth tax hope to address exploding inequality but then went on to list the fears of billionaires and economic policymakers, finding that “the idea of redistributing wealth by targeting billionaires is stirring fierce debates at the highest ranks of academia and business, with opponents arguing it would cripple economic growth, sap the motivation of entrepreneurs who aspire to be multimillionaires and set off a search for loopholes.” A wealth tax will not damage our economy and instead would likely improve it. Here’s why.

Sen. Wyden’s Anti-Deferral Accounting Proposal Could Be a Game-Changer

September 12, 2019 • By Steve Wamhoff

Today, Sen. Ron Wyden, the ranking Democrat on the Senate Finance Committee, fulfilled a promise he made several months ago to release a proposal that could fundamentally transform how the U.S. taxes capital gains of the wealthy. The paper he released today proposes “anti-deferral accounting” to ensure that wealthy people are taxed on all of […]

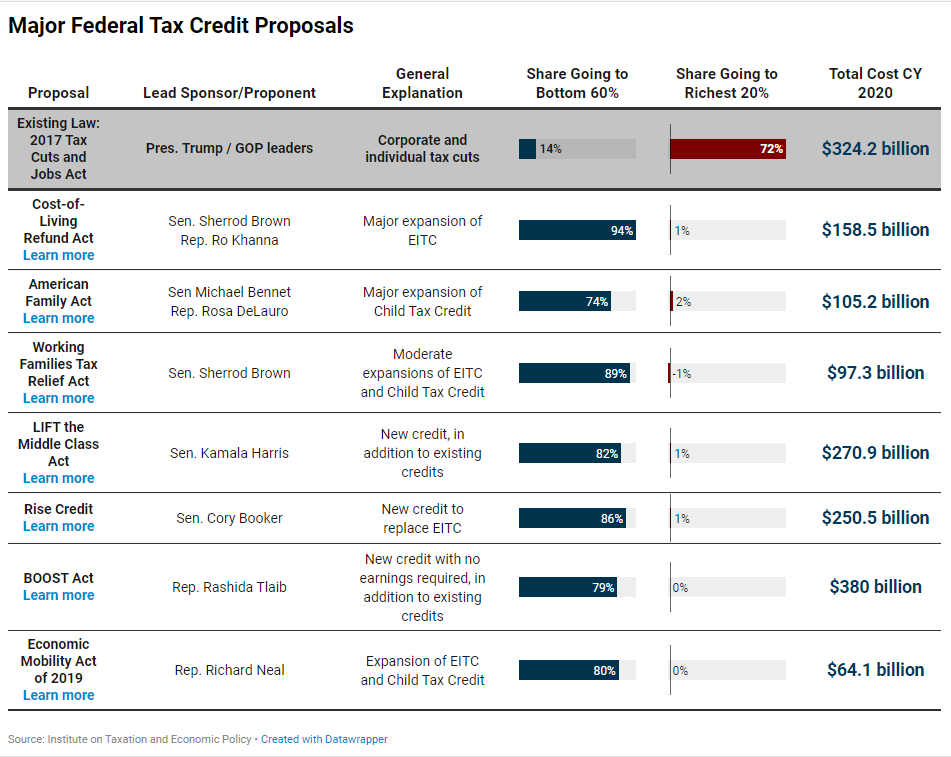

In 2019, several federal lawmakers have introduced tax credit proposals to significantly expand existing tax credits or create new ones to benefit low- and moderate-income people. While these proposals vary a great deal and take different approaches, all build off the success of the EITC and CTC and target their benefits to families in the bottom 60 percent of the income distribution who have an annual household income of $70,000 or less.

Updated Estimates from ITEP: Trump Tax Law Still Benefits the Rich No Matter How You Look at It

August 28, 2019 • By Steve Wamhoff

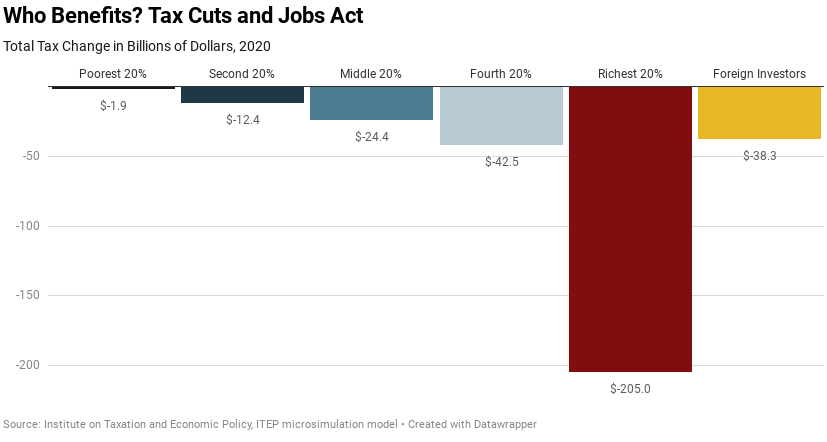

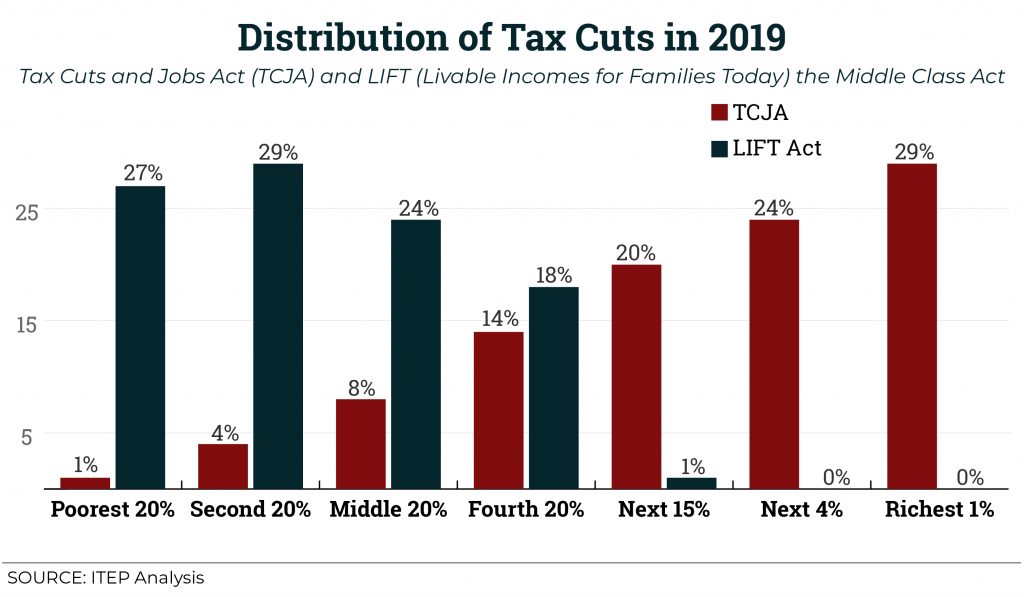

President Trump’s allies in Congress continue to defend their 2017 tax law in misleading ways. Just last week, Republicans on the House Ways and Means Committee stated that most “of the tax overhaul went into the pockets of working families and Main Street businesses who need it most, not Wall Street.” ITEP’s most recent analysis estimates that in 2020 the richest 5 percent of taxpayers will receive $145 billion in tax cuts, or half the law's benefits to U.S. taxpayers.

IRS’s SALT Workaround Regulations Should be Strengthened, Not Rejected

August 13, 2019 • By Carl Davis

Lawmakers are seeking to achieve a backdoor repeal of the $10,000 cap on deductions for state and local taxes paid (SALT) by invalidating recent IRS regulations that cracked down on schemes that let taxpayers dodge the cap. If successful, their efforts would drain tens of billions of dollars from federal coffers each year, with the vast majority of the benefits going to the nation’s wealthiest families.

A direct federal tax on wealth, as described in a January report from ITEP and proposed by Sen. Elizabeth Warren, could raise substantial revenue to make public investments, curb rising inequality, and is supported by a large majority of Americans. But would it work? Recent research highlighted in a new academic paper outlines approaches that would make it easier than you might think.

Wealth Tax Is Supported by Basically Everyone Who Is Not a Politician

June 27, 2019 • By Steve Wamhoff

A February survey found that 61 percent of registered voters supported a wealth tax proposal, including 51 percent of Republican voters. And it’s not just the non-rich wanting to tax the very rich. A June survey found that 60 percent of millionaires support the idea.

What to Watch for on Tax Policy During the Presidential Primary

June 25, 2019 • By Steve Wamhoff

America needs a new tax code. The Democratic presidential debates beginning this week present an opportunity for candidates to make clear how they would address inequality or to raise enough revenue to make public investments that make the economy work for everyone. Here are some of the big tax issues that we hope they will touch on.

The SALT Cap Isn’t Harming State and Local Revenues. Myths About It May Be.

June 24, 2019 • By Carl Davis

A House Ways and Means subcommittee hearing on Tuesday will explore a highly controversial provision of the Tax Cuts and Jobs Act (TCJA) that prevents individuals and families from writing off more than $10,000 in state and local tax (SALT) payments on their federal tax forms each year. The focus of the hearing will be whether the cap negatively affects state and local revenue streams that fund schools, firefighters, and other services. There are at least three ways this could happen though only one of those is plausible, and it’s not the one that the organizers of this hearing likely…

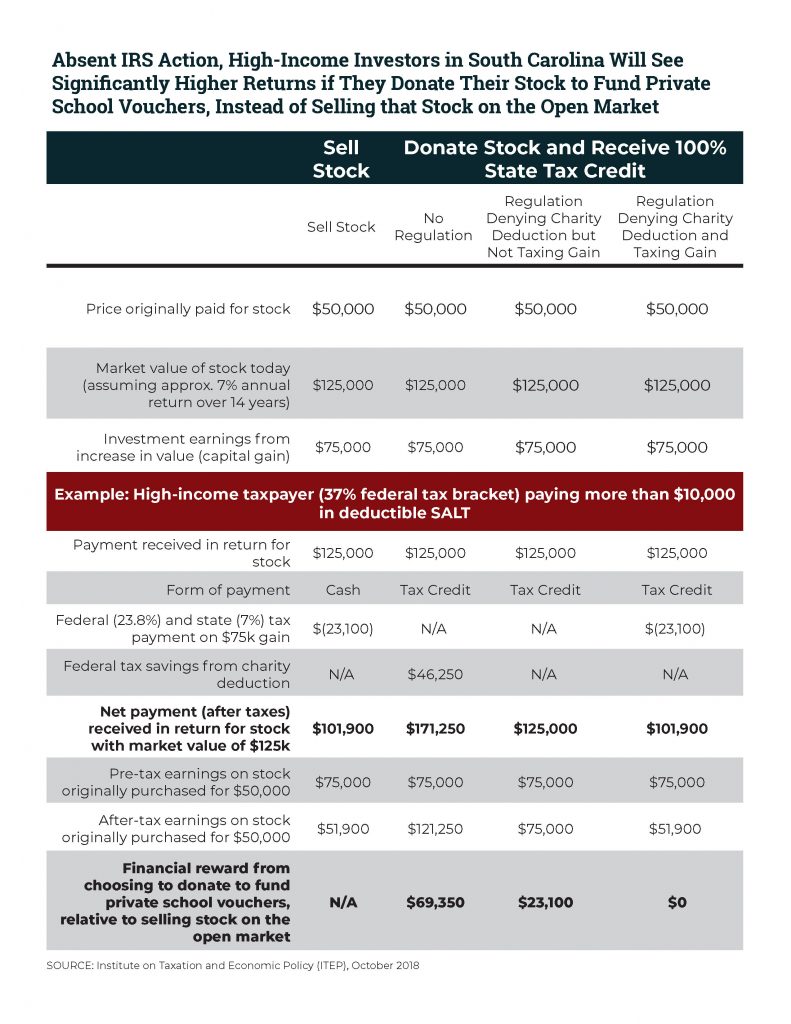

After states implemented laws that allow taxpayers to circumvent the new $10,000 cap on deductions for state and local taxes (SALT), the IRS has proposed regulations to address this practice. It’s a safe bet the IRS will try to crack down on the newest policies that provide tax credits for donations to public education and other public services, but it remains to be seen whether new regulations will put an end to a longer-running practice of exploiting tax loopholes in some states that allow public money to be funneled to private schools.

The Tax Cuts and Jobs Act (TCJA), enacted by President Trump and Congressional Republicans at the end of 2017, has caused quite a bit of confusion, and a recent “Fact Checker” column by the Washington Post’s Glenn Kessler does not help. TCJA created real problems that can't be resolved without real tax reform. To begin that process fact checkers, lawmakers, and everyone else need to be clear about what TCJA did, and did not, do to our tax system.

New ITEP Report Shows How Congress Can Meet Public Demand for Progressive Taxes

February 5, 2019 • By Steve Wamhoff

A recent headline tells us that bold tax plans proposed by lawmakers today reflect a “profound shift in public mood.” But, in fact, the public’s mood has not changed at all. Americans have long wanted progressive taxes but few, if any, lawmakers publicly backed this view. What’s happening now isn’t a shift in public opinion, rather it’s Washington finally catching up with the American people.

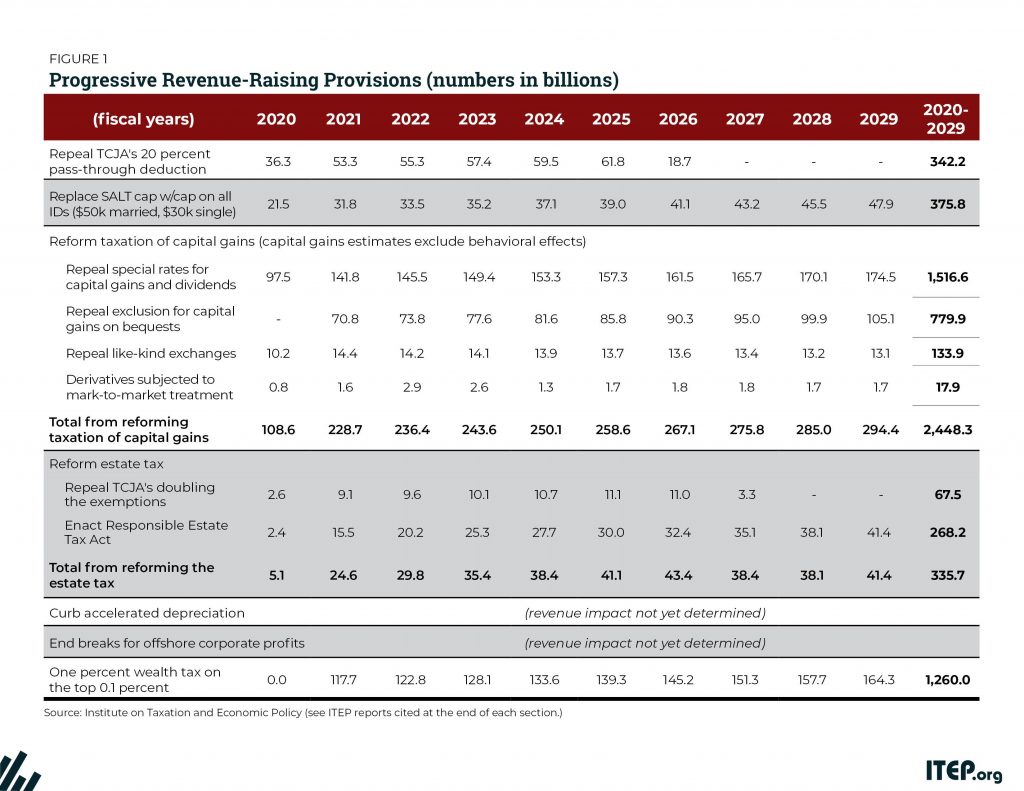

America has long needed a more equitable tax code that raises enough revenue to invest in building shared prosperity. The Tax Cuts and Jobs Act (TCJA), enacted at the end of 2017, moved the federal tax code in the opposite direction, reducing revenue by $1.9 trillion over a decade, opening new loopholes, and providing its most significant benefits to the well-off. The law cut taxes on the wealthy directly by reducing their personal income taxes and estate taxes, and indirectly by reducing corporate taxes.

Progressive tax proposals are finally being discussed with the urgency and seriousness they deserve. Following Rep. Alexandria Ocasio-Cortez’s call for a much higher marginal tax rate for multi-millionaires and Sen. Elizabeth Warren’s proposal to introduce a wealth tax for those at the very top, Sen. Bernie Sanders has introduced a revised version of his proposal to reform the federal estate tax.

How to Think About the 70% Top Tax Rate Proposed by Ocasio-Cortez (and Multiple Scholars)

January 8, 2019 • By Steve Wamhoff

The uproar deliberately steers clear of any real policy discussion about what a significantly higher marginal tax rate would mean. Her critics are mostly the same lawmakers who enacted a massive tax cut for the rich last year that was not debated seriously or supported by serious research. Meanwhile, multiple scholarly studies conclude a 70 percent top tax rate would be an optimal way to tax the very rich. Ocasio-Cortez has brought more attention to the very real need to raise revenue and do it in a progressive way.

Five Things to Know on the One-Year Anniversary of the Tax Cuts and Jobs Act

December 17, 2018 • By Richard Phillips

While it has only been a year since passage of the Tax Cuts and Jobs Act (TCJA), it’s clear the law largely is both a debacle and a boondoggle. Below are the five takeaways about the legacy and continuing effect of the TCJA. 1. The Tax Cuts and Jobs Act will substantially increase income, wealth, and racial inequality. 2. The Tax Cuts and Jobs Act will continue to substantially increase the deficit. 3. The Tax Cuts and Jobs Act is not significantly boosting growth or jobs. 4. The Tax Cuts and Jobs Act continues to be very unpopular. 5. Despite…

End-of-Year Tax Measure Would Give Deficit-Financed Tax Cuts to Wealthy Families and Corporations

December 12, 2018 • By ITEP Staff

Outgoing Ways and Means Chairman Rep. Kevin Brady (R-TX) today introduced legislation that includes $80 billion in tax cuts that are unpaid for and largely benefit the wealthy. The bill would, among its numerous provisions, expand retirement and education savings programs that offer very little value to low-income families, delay the Health Insurance Tax for an additional two years, and delay the Medical Device Tax for an additional five years.

The Federal Estate Tax: An Important Progressive Revenue Source

December 6, 2018 • By ITEP Staff

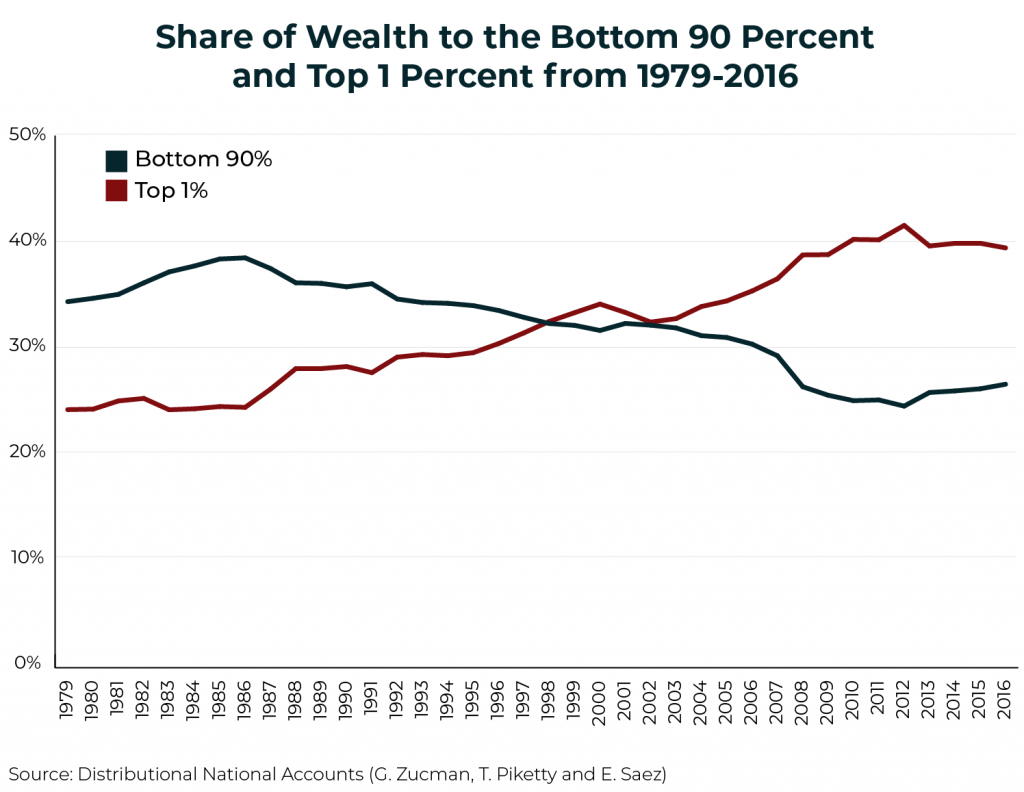

For years, wealth and income inequality have been widening at a troubling pace. One study estimated that the wealthiest 1 percent of Americans held 42 percent of the nation’s wealth in 2012, up from 28 percent in 1989. Lawmakers have exacerbated this trend by dramatically cutting federal taxes on inherited wealth, most recently by doubling the estate tax exemption as part of the 2017 Tax Cuts and Jobs Act. Further, lawmakers have done little to stop aggressive accounting schemes designed to avoid the estate tax altogether. This report explains how the percentage of estates subject to the federal estate tax…

The cap on federal tax deductions for state and local taxes (SALT) that is in effect now under the Tax Cuts and Jobs Act (TCJA) is a flawed provision but repealing it outright would be costly and provide a windfall to the rich. Congress should consider replacing the SALT cap with a different type of limit on deductions that would avoid both of these outcomes. Using the ITEP microsimulation tax model, this report provides revenue estimates and distributional estimates for several such options, assuming they would be in effect in 2019.

The Post-Midterms Tax Policy Outlook: Small Ball and Real Tax Reform Debate

November 8, 2018 • By Richard Phillips

With most of the results of the 2018 midterm elections in, the broad landscape for federal tax policy over the next couple years is coming into view. Democratic control of the House and Republican control of the Senate means a significant tax overhaul is unlikely, but minor tax changes may happen. And the run-up to the 2020 presidential election will force more robust debate over the impact of the Tax Cuts and Jobs Act (TCJA) and what aspects of the legislation should be repealed, reformed, or built upon.

Shaking up TCJA: How a Proposed New Credit Could Shift Federal Tax Cuts from the Wealthy and Corporations to Working People

October 24, 2018 • By Aidan Davis

A new federal proposal, the Livable Incomes for Families Today (LIFT) the Middle Class Act, would create a new refundable tax credit for low- and middle-income working families who were little more than an afterthought in last year’s federal tax overhaul. This proposal would take the place of TCJA, providing tax cuts similar in cost to the recent federal tax law but targeted toward working people rather than the wealthy. ITEP analyzed the bill, proposed by California Senator Kamala Harris, and compared its potential impact to TCJA.

Tax Policies Have Increased Inequality, and So Would Entitlement Cuts

October 23, 2018 • By Steve Wamhoff

Conversations about economics often take place on different planets, it seems. Economists and analysts note rising inequality in America. And it’s not just lefty analysts. The credit ratings firm Moody’s chimed in earlier this month, warning that inequality “is a key social consideration that will impact the U.S.’ credit profile through multiple rating factors, including economic, institutional and fiscal strength.”

ITEP Comments and Recommendations on Proposed Section 170 Regulation (REG-112176-18)

October 11, 2018 • By Carl Davis

The IRS recently proposed a commonsense improvement to the federal charitable deduction. If finalized, the regulation would prevent not just the newest workarounds to the $10,000 deduction for state and local taxes (SALT), but also a longer-running tax shelter abused by wealthy donors to private K-12 school voucher programs. ITEP has submitted official comments outlining four key recommendations related to the proposed regulation.

In addition to distributional analyses of existing and proposed tax law, ITEP provides policy recommendations for lawmakers to build a more equitable tax code, from progressive revenue-raising options to corporate tax reform to establishing a model for a wealth tax.