Corporate Tax Watch

Top Republican Tax-Writer Falsely Claims that Minimum Tax for Huge Corporations Is a Tax Hike on Middle-Class

August 2, 2022 • By Steve Wamhoff

Opponents of requiring corporations to pay even a minimum amount of taxes hold an unpopular position. But Sen. Mike Crapo, the top Republican on the Senate Finance Committee and a leader of that opposition, is using a one-sided and incomplete analysis to claim that the corporate minimum tax would raise taxes on low- and middle-income people.

Most Senate Democrats Join Republicans in Calling for Corporate Tax Break

May 6, 2022 • By Steve Wamhoff

The vast majority of Senate Democrats joined their Republican colleagues in approving a new corporate tax break related to research in legislation that contains no offsetting corporate tax increases.

Amazon Avoids More Than $5 Billion in Corporate Income Taxes, Reports 6 Percent Tax Rate on $35 Billion of US Income

February 7, 2022 • By Matthew Gardner

Amazon avoided about $5.2 billion of federal income tax on its record $36 billion in U.S. pretax income for fiscal year 2021.

Netflix Posts a Record $5.3 Billion in Profits and a Federal Tax Rate of Just 1.1 Percent

February 1, 2022 • By Matthew Gardner

Netflix's 2021 financial report shows it doubled its profits to $5.3 billion from the previous year and reported an effective federal corporate income tax rate of 1.1 percent.

Report Illustrates How 70 Corporations Could Be Affected by Minimum Tax Proposal in the Build Back Better Act

November 18, 2021 • By Matthew Gardner

Amazon, Bank of America, Facebook, FedEx, General Motors, Google, Netflix, PayPal, T-Mobile and Verizon are just a few of the 70 corporations that would have paid more taxes under the Democrats’ proposed Corporate Profits Minimum Tax (CPMT) if it had been in effect in 2020 according to a new report from Sen. Elizabeth Warren’s office with estimates verified by the Institute on Taxation and Economic Policy.

An important reform in the bill before Congress would tax stock buybacks in a way that is more comparable to how dividends are taxed. Corporations would be required to pay a tax equal to 1 percent of their stock repurchases, ensuring that profits shifted to shareholders in this way are subject to some federal tax.

Senate Democrats’ Corporate Minimum Tax Could Address the Worst Corporate Tax Dodging

October 27, 2021 • By Steve Wamhoff

There is no reason corporations reporting hundreds of millions, but not billions, of dollars in profits to their shareholders should be allowed to avoid paying taxes. Nonetheless, the corporate minimum tax is a huge step forward and a valuable component of the Build Back Better plan.

Why Congress Should Reform the Federal Corporate Income Tax

September 17, 2021 • By Joe Hughes, Steve Wamhoff

It is reasonable for corporations (and, indirectly, their shareholders) to pay taxes to support the government investments that make their profits possible, such as the highways that facilitate the movement of goods and people, the education and health care systems that provide a productive workforce, the legal system and the protection of property, all of which are vital to commerce. Corporate tax avoidance allows wealthy and powerful individuals to reap enormous benefits from these investments without contributing their fair share to support them.

Congress is proving that there does not need to be a trade-off between good climate policy and good economic policy. Direct hires aside, an even bolder government-backed effort to secure the future of our planet could create as many as 25 million net new jobs at its peak, as well as 5 million permanent jobs, many of which deal directly with domestic infrastructure and cannot be outsourced. With the U.S. economy still down 5.7 million jobs from pre-pandemic levels, climate legislation can be a critical investment for jumpstarting our economic recovery.

Corporate Tax Avoidance Under the Tax Cuts and Jobs Act

July 29, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

Thirty-nine profitable corporations in the S&P 500 or Fortune 500 paid no federal income tax from 2018 through 2020, the first three years that the Tax Cuts and Jobs Act (TCJA) was in effect. Besides the 39 companies that paid nothing over three years, an additional 73 profitable corporations paid less than half the statutory corporate income tax rate of 21 percent established under TCJA. As a group, these 73 corporations paid an effective federal income tax rate of just 5.3 percent during these three years.

Opposition to Biden’s Tax Plan Has Nothing to Do with Small Businesses or Family Farms

July 16, 2021 • By Steve Wamhoff

Special interests lobbying against President Joe Biden’s tax agenda claim that his proposed corporate income tax rate hike will harm small businesses and that his proposed capital gains tax reforms will hurt family farms. Both claims are absurd attempts by powerful interests to pretend they are defending the little guy.

Washington Post Confirms that Corporations Are Bolder than Ever in Claiming Dubious Tax Breaks

July 16, 2021 • By Steve Wamhoff

IRS budget cuts starting in 2010 have forced the agency to reduce its audit rate for corporations with $20 billion or more in assets from 98 percent to 50 percent. The Washington Post found that during the decade, the amount of “uncertain tax benefits” claimed by corporations increased 43 percent, from $164 billion in 2010 to $235 billion in 2020.

U.S. Should Pursue Biden’s Tax Legislation and International Tax Agreement on Separate Tracks

June 9, 2021 • By Steve Wamhoff

The agreement announced over the weekend from the finance leaders of the Group of 7 (G7) countries to allow governments to tax some corporate profits based on the location of sales and to implement a 15 percent global minimum tax is a major step forward—but in no way changes the need for Congress to enact President Joe Biden’s tax reforms right now.

IRS Clock Runs Out, Saving 14 Large Companies $1.3 Billion

May 18, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

Each year, corporations publicly state that some of the tax breaks they claim are unlikely to withstand scrutiny from tax authorities. And each year, corporations report that they will keep some of the dubious tax breaks they declared in previous years simply because the statute of limitations ran out before tax authorities made any conclusions. This suggests that, perhaps because of cuts to its enforcement budget, the IRS is not even investigating corporations that publicly announce they have claimed tax breaks that tax authorities would likely find illegal.

Nike’s Tax Avoidance Response Does not Dispute It Paid $0 in Federal Income Tax

April 19, 2021 • By Matthew Gardner

It was (allegedly) P.T. Barnum who first said “there’s no such thing as bad publicity.” But the public relations professionals at the Nike Corporation clearly disagree with this maxim. Last week, after multiple media outlets, including the New York Times, wrote about ITEP’s conclusion that Nike avoided federal corporate income taxes under the Trump tax law, the company contacted these news organizations to… change the subject.

The High Cost of Corporate Tax Avoidance (Webinar)

April 8, 2021 • By Amy Hanauer, ITEP Staff, Matthew Gardner

When communities thrive, so do corporations. But when profitable corporations build their empires by exploiting the tax code, it is workers, the environment and our communities—not CEOs or shareholders—that are harmed. Amazon posted its highest U.S. profit ever for 2020, an unprecedented year defined by a pandemic. Yet the company sheltered more than half its profits from corporate taxes—legally. While the company may be one of the most recognizable tax avoiders, it's not an outlier.

55 Corporations Paid $0 in Federal Taxes on 2020 Profits

April 2, 2021 • By Matthew Gardner, Steve Wamhoff

At least 55 of the largest corporations in America paid no federal corporate income taxes in their most recent fiscal year despite enjoying substantial pretax profits in the United States. This continues a decades-long trend of corporate tax avoidance by the biggest U.S. corporations, and it appears to be the product of long-standing tax breaks preserved or expanded by the 2017 tax law as well as the CARES Act tax breaks enacted in the spring of 2020.

Read as PDF Note: This report is adapted from written testimony submitted by Amy Hanauer before testifying in person to the Senate Budget Committee on March 25, 2021. In 2020, the pandemic killed hundreds of thousands of Americans and unemployment soared to levels not seen since the Bureau of Labor Statistics started collecting data in […]

The corporate tax plan put forth on Wednesday by President Joe Biden to offset the cost of his infrastructure priorities would be the most significant corporate tax reform in a generation if enacted.

We all need the things that the public sector provides. When corporate taxes go unpaid, the American people have less for the things that would help our communities. That means less repair of our failing infrastructure, less investment in greening our economy, less funding to help young people attend college.

Testimony to Senate Budget Committee on Ending a Rigged Tax Code: The Need To Make the Wealthiest People and Largest Corporations Pay their Fair Share of Taxes

March 25, 2021 • By Amy Hanauer

Following is testimony of ITEP Executive Director Amy Hanauer before the Senate Budget Committee to consider “Ending a Rigged Tax Code: The Need To Make the Wealthiest People and Largest Corporations Pay their Fair Share of Taxes” “Chairman Sanders and Ranking Member Graham, thank you for the opportunity to speak to this committee. My name […]

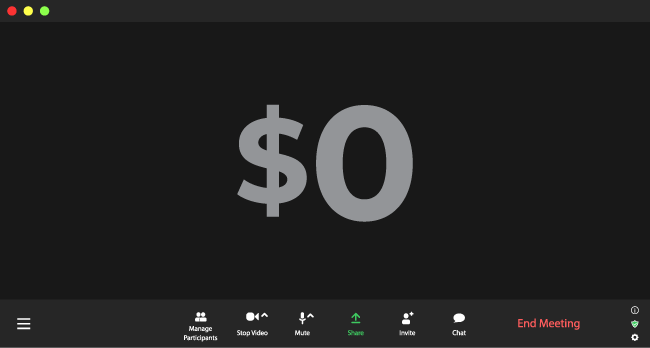

Zoom Video Communications, the company providing a platform used by remote workers and school children across the country during the pandemic, saw its profits increase by more than 4,000 percent last year but paid no federal corporate income tax on those profits.

Rep. Doggett and Sen. Whitehouse Introduce Bill to Crack Down on Offshore Corporate Tax-Dodging

March 11, 2021 • By Steve Wamhoff

The 2017 tax law simply replaced one set of loophole-ridden rules that favored offshore profits over domestic profits with a new set of loophole-ridden rules doing the same thing. A bill introduced today by Rep. Lloyd Doggett and Sen. Sheldon Whitehouse would finally fix this to follow a simple principle: we should tax the offshore profits and domestic profits of our corporations the same way.

The federal minimum wage is almost comically low. At $7.25 an hour, it is 29 percent below its inflation-adjusted peak in the 1960s. Raising the minimum wage to $15 an hour would lift 900,000 Americans out of poverty. A solid 61 percent of voters support the idea. A majority of lawmakers in both the House and Senate support at least some version of a minimum wage hike. The popular $1.9 trillion American Rescue Plan includes a measure that would raise the minimum wage over the next few years to $15. So, what is the problem? And why are lawmakers now…

CARES Act Helps Create $4.6 Billion Tax Cut for Health Care Companies Paying Opioid Settlements

February 12, 2021 • By Matthew Gardner

Talk about a one-two punch. A new report from the Washington Post reveals that the U.S. public is set to pay for the opioid crisis again. Already, communities across the country have paid a heavy price via the devastating public health toll. Now, it appears taxpayers will be on the hook for billions in corporate tax breaks as four pharmaceutical companies exploit a loophole in the Trump-GOP tax law and a CARES Act tax provision meant for companies facing pandemic-related profit losses.