Tax Reform

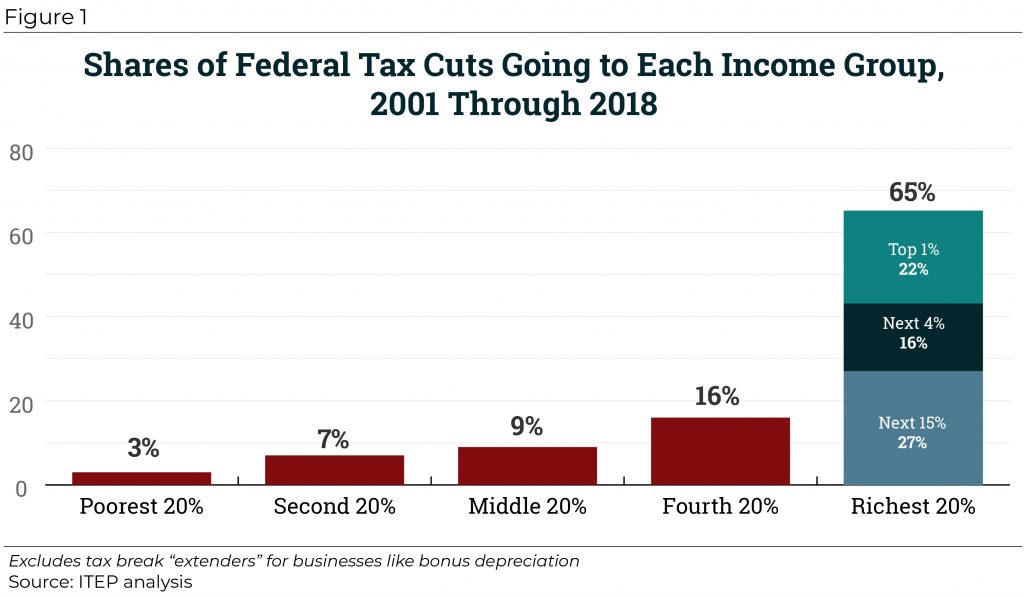

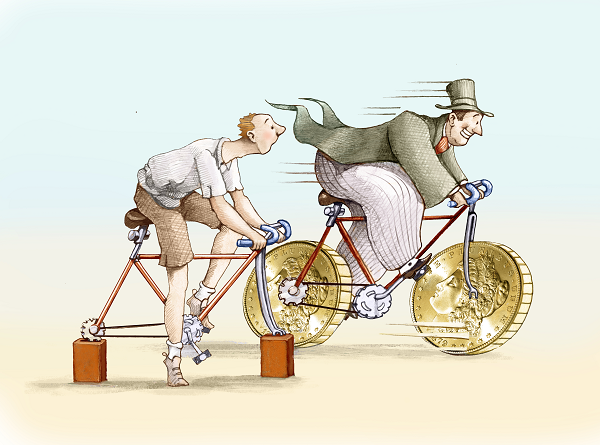

Since 2000, tax cuts have reduced federal revenue by trillions of dollars and disproportionately benefited well-off households. From 2001 through 2018, significant federal tax changes have reduced revenue by $5.1 trillion, with nearly two-thirds of that flowing to the richest fifth of Americans.

Rigging the System and Poor Shaming (Rightly) Are Incompatible Political Strategies

June 27, 2018 • By Jenice Robinson

The absurdity of blaming poor and moderate-income people for their circumstances is close to running its course as an effective political tool, particularly as some elected officials more boldly assert their intent to cater to the whims of the wealthy. Take last year’s GOP-led drive to eliminate the Affordable Care Act (ACA), for example. House […]

No Need for the MythBusters, the Millionaire Tax Flight Myth is Busted Again

May 1, 2018 • By Dacey Anechiarico

One of the most repeated myths in state tax policy is called “millionaire tax flight,” where millionaires are allegedly fleeing states with high income tax rates for states with lower rates. This myth has been used as an argument in state tax debates for years but Cristobal Young argues in his book, “The Myth of the Millionaire Tax Flight,” that both Democrats and Republicans are “searching for a crisis that does not really exist,” and that there is no evidence to support this myth.

A Paul Ryan Retrospective: A Decade of Regressive Budget and Tax Plans

April 11, 2018 • By ITEP Staff

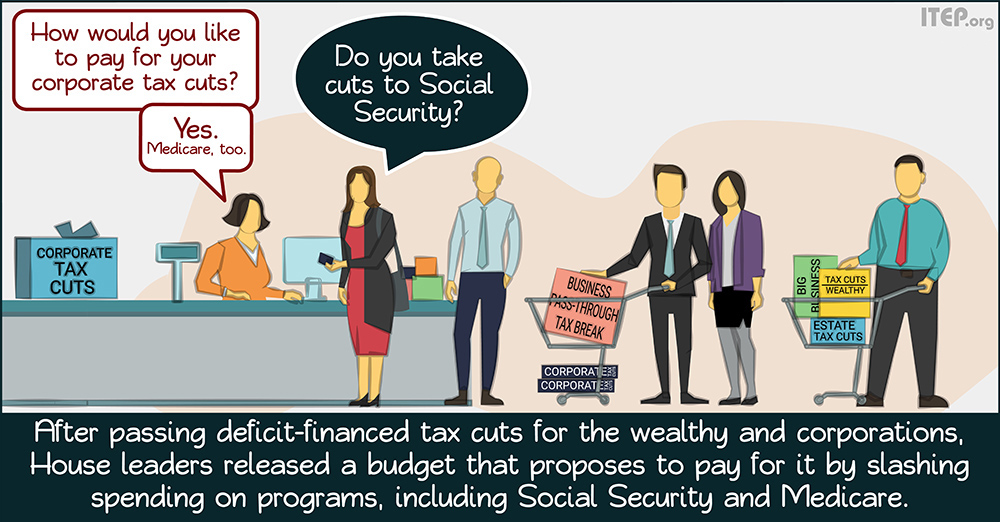

As Speaker of the House, Rep. Paul Ryan pushed through the Tax Cuts and Jobs Act that will cost at least $1.5 trillion and provide around half of its benefits to the richest five percent of households. He then announced that Congress needs to cut entitlements to get the budget deficit under control. Before becoming Speaker, Ryan spent several years running the Budget Committee and the Ways and Means Committee, where he issued budget and tax plans each year to carry out his goals (lower taxes for the rich and cuts in entitlement spending), which are described in the reports…

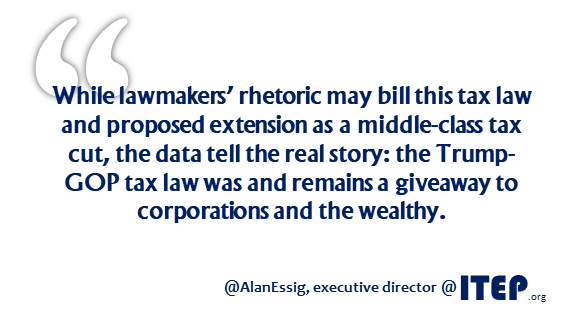

Same Old Same: 50-State Analysis Finds Extending the New Tax Law’s Temporary Provisions Would Mainly Benefit the Wealthy

April 10, 2018 • By ITEP Staff

While rhetoric may bill this tax law and proposed extension as a middle-class tax cut, the data tell the real story: the Trump-GOP tax law was and remains a giveaway to corporations and the wealthy.

Teachers’ Strikes Are Emblematic of Larger Tax Challenges for States

March 30, 2018 • By Meg Wiehe

As other researchers as well as journalists have noted, teachers striking or threatening to strike over low wages and overall lack of investment isn’t simply a narrative about schools and public workers’ pay. It is illustrative of a broader conflict over tax laws and how states and local jurisdictions fund critical public services that range from K-12 education, public safety, roads and bridges, health care, parks, to higher education.

Unintended Consequences of the New Tax Bill Keep Cropping Up

March 23, 2018 • By Dacey Anechiarico

Due to its rushed passage in a matter of weeks, without public hearings or enough time even for basic proofreading, the Tax Cuts and Jobs Act (TCJA) contains numerous unintended consequences that Congress is now scrambling to fix. The authors of the new law have openly admitted that the law includes major mistakes. One of the most prominent drafting errors is what is now known as the “grain glitch,” which temporarily created a huge incentive for farmers to sell their products to cooperatives over businesses taking other forms.

The Heritage Foundation, the Institute on Taxation and Economic Policy (ITEP), and the Committee for a Responsible Federal Budget (CRFB) routinely disagree on a wide range of policy issues, but a recent Ways and Means Tax Policy Subcommittee hearing revealed they all agree that the continual and unpaid-for extension of temporary tax breaks needs to end.

ITEP Testimony on “Post Tax Reform Evaluation of Recently Expired Tax Provisions”

March 14, 2018 • By Richard Phillips

Statement of Richard Phillips, Senior Policy Analyst Institute on Taxation and Economic Policy Before the Committee on Ways and Means Subcommittee on Tax Policy Hearing on “Post Tax Reform Evaluation of Recently Expired Tax Provisions”

Mnuchin’s Not So Grand Stand on the Carried Interest Loophole Explained

February 15, 2018 • By Matthew Gardner

When President Trump released the initial outline of his tax reform plan in April, carried interest repeal was nowhere to be found. And when Congress hammered out a tax plan in late December, lawmakers agreed to reduce the cost of the carried interest tax provision by about 5 percent. (Full repeal would have raised $20 billion over a decade; the enacted provision raises about $1 billion.)

How the Latest Budget Deals Expose the Failure of “Tax Reform”

February 9, 2018 • By Richard Phillips

If there was one thing that tax reform legislation was supposed to accomplish, it was to put an end to the scandalous semiannual ritual of extending and expanding the list of the temporary provisions in the tax code, known as tax extenders. During the passage of the last tax extenders bill at the end of December 2015, lawmakers on both sides of the aisle agreed that it was critical to have a tax code that provides “permanency and certainty” and to move forward with comprehensive tax reform that would decide the fate of the extenders once and for all. Unfortunately,…

Sometimes, ranking near No. 1 in the world is not a badge of pride. According to the Financial Secrecy Index released by the Tax Justice Network (TJN), the United States is the second largest contributor to financial secrecy in the world, placing it in the company of infamous tax havens such as Switzerland (ranked No. 1) and the Cayman Islands (ranked No. 3). Financial secrecy is enabling people to hide income from the authorities to evade taxes or financial regulation, launder profits from crime, finance terrorism, or otherwise break the law.

Federal Tax Law Will Have Mixed Effect on Taxpayers’ State Tax Bills and States’ Revenue

January 26, 2018 • By Meg Wiehe

Most states piggyback on federal law to some extent for their own taxes, especially personal and corporate income taxes. These states in particular must understand what the federal changes mean for their own tax codes and decide whether to remain “coupled” to changes in the tax bill, decouple from them or take other action in response.

The Problems with State Workarounds to the Federal SALT Deduction

January 12, 2018 • By Alan Essig

From the outset, states—particularly wealthier states—objected to the GOP’s proposal to limit SALT deductions in part because it reduces the amount of state and local taxes that the federal government essentially picks up for taxpayers (by allowing a SALT deduction, the federal government is, in effect, paying part of taxpayers’ state and local tax bill), which could hinder states’ ability to raise revenue. Simply focusing on SALT, though, misses the bigger picture. The fact remains that the overall tax bill disproportionately benefits higher-income taxpayers even with the $10,000 SALT cap in place. Responding to federal tax cuts that disproportionately benefit…

New Tax Breaks for Craft Beer Are a Drop in the Barrel: 76 percent of Tax Bill’s Beer Tax Cut Goes to a Handful of the Biggest Producers

January 10, 2018 • By Matthew Gardner

The $1.5 trillion tax cut that took effect on Jan.1 was never really going to be about small businesses, despite President Trump’s transparently false claims to the contrary. However, one economic sector still appears happy, for now, to hoist a mug to Congress’s successful sleight of hand: craft breweries.

New Tax Law Allows Affluent Taxpayers to Write off K-12 Private School Tuition

January 9, 2018 • By Matthew Gardner

Taxpayers are still learning about the intended and unintended consequences of the major tax overhaul that Republican leaders ramrodded through late last year. One little-noted provision subverts state laws that prohibit the use of public dollars for private schools by allowing taxpayers to use 529 plans to pay for K-12 tuition. Until last year, the […]

The Trump-GOP’s Big Giveaway to Multinational Corporations

December 19, 2017 • By Richard Phillips

The tax bill just approved by Congress was a golden opportunity to solve these problems for good—but turned out to be a colossal missed opportunity. Instead of addressing the hundreds of billions in lost federal tax revenue due to offshore tax avoidance schemes, the Trump-GOP tax bill would forgive most of the taxes owed on the profits held offshore right now and open the floodgates to even more offshore profit-shifting in the future.

Corporations and the Rich Get Everything They Want in Pending Tax Bill, Working People, Not So Much

December 15, 2017 • By Alan Essig

Nearly 30 years ago, Trump was well connected enough that he was able to go to Congress and testify about how tax changes affected his business. Ordinary working people are rarely lucky enough to talk about their personal experiences in front of a congressional committee. So if they want to make their views known about the catastrophe of 2017, it will have to be in election of 2018.

ITEP researchers have produced new reports and analyses that look at various pieces of the tax bill, including: the share of tax cuts that will go to foreign investors; how the plans would affect the number of taxpayers that take the mortgage interest deduction or write off charitable contributions, and remaining problems with the bill in spite of proposed compromises on state and local tax deductions.

“Compromises” Under Discussion for the State and Local Tax Deduction Do Not Fix Flawed Tax Bills

December 10, 2017 • By Meg Wiehe, Steve Wamhoff

Republicans in Congress are reported to be considering two versions of a change they claim would “improve” the current bills by making them more generous to residents of higher-taxed states. As illustrated by these estimates, the reality is that these proposals would make little difference on those states and taxpayers hit hardest.

Even with Potential SALT Compromises, Senate Bill Forces California and New York to Shoulder a Larger Share of Federal Taxes While Texas, Florida, and Other States Will Pay Less

December 10, 2017 • By Meg Wiehe, Steve Wamhoff

The Senate tax bill, with or without either of the compromises that could be added to it, would shift personal income taxes away from Florida and Texas to states like California and New York, which are already paying a high share relative to their populations.

They Can’t Help Themselves: GOP Leaders Reveal True Intent Behind Tax Overhaul

December 4, 2017 • By Jenice Robinson

The hand-written scrawls in the margins of the hastily written 500-page Senate tax bill had barely dried when lawmakers began to reveal the true motivation behind their rush to fundamentally overhaul the nation’s tax code.

Senate Okays Unpopular Plan to Widen Income Inequality, Make the Rich Richer

December 2, 2017 • By Alan Essig

But so far, Republican leaders have demonstrated that, for them, the only voices that matter in this debate are those that fund their campaigns.

New ITEP Report Explains How Tax Reform Should Eliminate Breaks for Real Estate Investors Like Trump

December 1, 2017 • By Steve Wamhoff

A new report from ITEP provides more details on the many breaks and loopholes for wealthy real estate investors like Trump and what a true tax reform would do to close them.

How True Tax Reform Would Eliminate Breaks for Real Estate Investors Like Donald Trump

December 1, 2017 • By ITEP Staff

The federal tax code includes several loopholes and special breaks that advantage wealthy real estate investors like President Donald Trump. Under current law, real estate investors can claim losses much more quickly and easily than other taxpayers, but they also have several methods to delay or avoid reporting any profits to the IRS.