Trump-GOP Tax Law

A Distributional Analysis of Donald Trump’s Tax Plan

October 7, 2024 • By Carl Davis, Erika Frankel, Galen Hendricks, Joe Hughes, Matthew Gardner, Michael Ettlinger, Steve Wamhoff

Former President Donald Trump has proposed a wide variety of tax policy changes. Taken together, these proposals would, on average, lead to a tax cut for the richest 5 percent of Americans and a tax increase for all other income groups.

Extending Temporary Provisions of the 2017 Trump Tax Law: Updated National and State-by-State Estimates

September 13, 2024 • By Steve Wamhoff

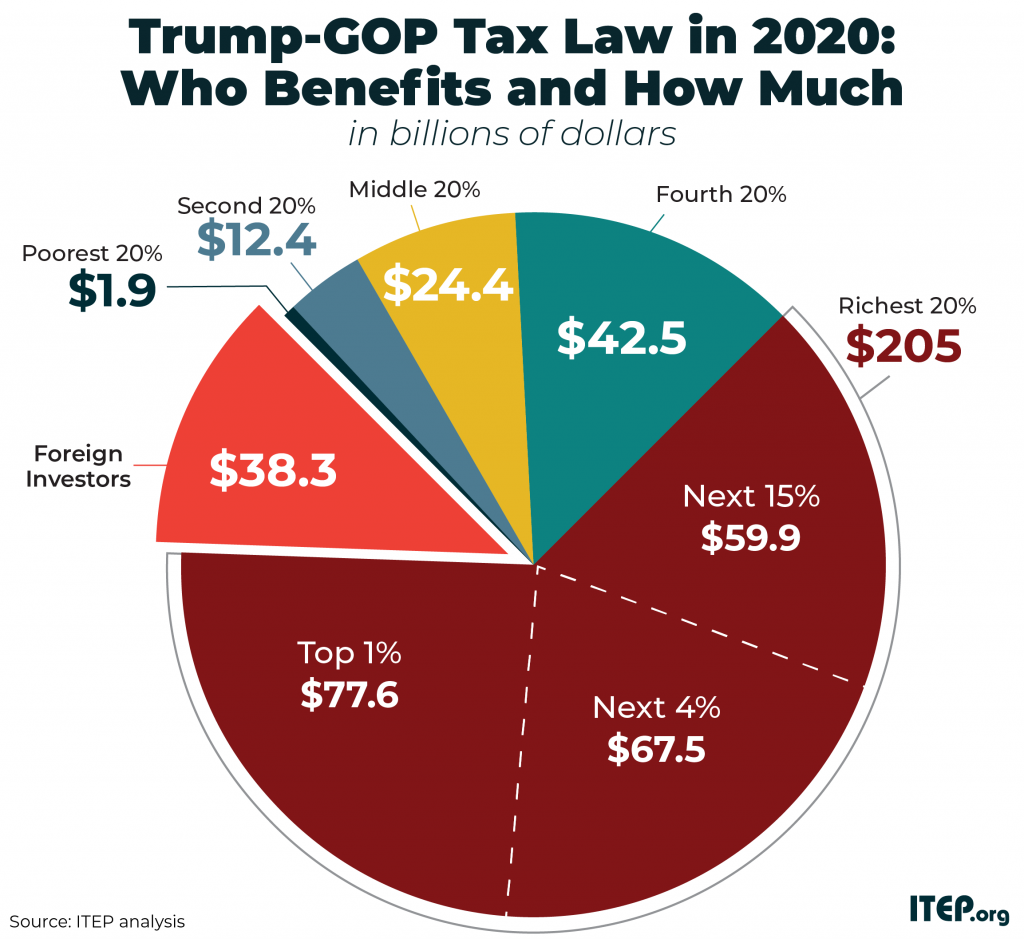

The TCJA Permanency Act would make permanent the provisions of the Tax Cuts and Jobs Act of 2017 that are set to expire at the end of 2025. The legislation would disproportionately benefit the richest Americans. Below are graphics for each state that show the effects of making TCJA permanent across income groups. See ITEP’s […]

After the dust settles on this year’s election, one of the most pressing issues confronting the next Congress and President will be how to deal with the expiration of the 2017 Trump tax cuts and, more specifically, who will pay for the cost of extending some or all of those cuts. Among the more widely accepted ideas circulating on the right is to raise income taxes on single parents, more than four in five of whom are women and a disproportionate share of whom are people of color.

Corporate Taxes Before and After the Trump Tax Law

May 2, 2024 • By Matthew Gardner, Michael Ettlinger, Spandan Marasini, Steve Wamhoff

The Trump tax law slashed taxes for America’s largest, consistently profitable corporations. These companies saw their effective tax rates fall from an average of 22.0 percent to an average of 12.8 percent after the Trump tax law went into effect in 2018.

Biden Is Right: Corporate Tax Avoidance Has Big Problems That We Can Fix

April 1, 2024 • By Jon Whiten

Sensible reforms to the corporate tax system can help both crack down on corporate tax avoidance and ensure companies that are flourishing are paying their share for the public infrastructure that forms the building blocks of their success.

Revenue-Raising Proposals in President Biden’s Fiscal Year 2025 Budget Plan

March 12, 2024 • By Steve Wamhoff

President Biden’s most recent budget plan includes proposals that would raise more than $5 trillion from high-income individuals and corporations over a decade. Like the budget plan he submitted to Congress last year, it would partly reverse the Trump tax cuts for corporations and high-income individuals, clamp down on corporate tax avoidance, and require the wealthiest individuals to pay taxes on their capital gains income just as they are required to for other types of income, among other reforms.

Corporate Tax Avoidance in the First Five Years of the Trump Tax Law

February 29, 2024 • By Matthew Gardner, Spandan Marasini, Steve Wamhoff

The Trump tax law overhaul cut the federal corporate income tax rate from 35 percent to 21 percent, but during the first five years it has been in effect, most profitable corporations paid considerably less than that.

The House’s Debt Ceiling Smoke Screen: The GOP Budget Plan Gives Cover for Tax Cuts for the Rich

May 9, 2023 • By Joe Hughes

While it isn’t reasonable in the first place for Congress to debate whether it will pay the bills it has already incurred, some of the same lawmakers who are holding the economy hostage to exact budget cuts have decided to make the conversation even more irrational by proposing to increase deficits with tax cuts that enrich the already rich.

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates

May 4, 2023 • By Joe Hughes, Matthew Gardner, Steve Wamhoff

The push by Congressional Republicans to make the provisions of the 2017 Tax Cuts and Jobs Act permanent would cost nearly $300 billion in the first year and deliver the bulk of the tax benefits to the wealthiest Americans.

Reversing the Stricter Limit on Interest Deductions: Another Huge Tax Break for Private Equity

December 6, 2022 • By Steve Wamhoff

Private equity is doing fine on its own and does not need another tax break. Congress should keep the stricter limit on deductions for interest payments —one of the few provisions in the 2017 tax law that asked large businesses to pay a little bit more.

Corporate Tax Avoidance Under the Tax Cuts and Jobs Act

July 29, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

Thirty-nine profitable corporations in the S&P 500 or Fortune 500 paid no federal income tax from 2018 through 2020, the first three years that the Tax Cuts and Jobs Act (TCJA) was in effect. Besides the 39 companies that paid nothing over three years, an additional 73 profitable corporations paid less than half the statutory corporate income tax rate of 21 percent established under TCJA. As a group, these 73 corporations paid an effective federal income tax rate of just 5.3 percent during these three years.

Faulty Fact Check on Tax Breaks for the Rich and Corporations

February 5, 2021 • By Amy Hanauer

When it comes to tax policy, the details are complicated, but the story is often simple. For example, President Trump’s so-called Tax Cuts and Jobs Act (TCJA) disproportionately benefits the rich. This is not controversial. Yet some opinion makers with large megaphones get lost in the details and come to conclusions that only create more confusion.

Trump Says Taxes Will Be Too High on the 2% Who Pay More Under Biden’s Plan

October 22, 2020 • By Steve Wamhoff

The Trump campaign has failed to convince the public that large numbers of Americans would face tax hikes under Democratic presidential nominee Joe Biden’s tax plan. The claim has been widely discredited. For example, ITEP found that the federal taxes that people pay directly would rise for just 1.9 percent of taxpayers in the U.S., and that number does not vary much by state. So, Fox News and other conservative voices are trying out a new argument: Biden’s tax plan would be too burdensome for that 1.9 percent.

It’s Time to Change the Tax Laws to Make Donald Trump and Corporate Giants Pay Up

September 29, 2020 • By Amy Hanauer

It’s time for a new approach. Trump’s egregious tax avoidance further exposes a system that preserves an enormous and growing economic divide. Congress has gutted IRS funding so that we don’t have the resources to audit wealthy tax avoiders. And lobbyists continue to secure giveaways for corporate clients that do nothing for our communities.

Missed Opportunity: Flimsy Paper Touts Flawed Program

August 25, 2020 • By Amy Hanauer, ITEP Staff, Lorena Roque

Republicans continue to tout Opportunity Zones as their main vehicle to assist poor people, most recently with a deeply flawed report from President Trump’s White House Council of Economic Advisors and a mention from Donald Trump Jr. in his opening night convention speech. The report purports to compare—as a way of cutting poverty—tax breaks for investors vs food, cash or health insurance coverage for struggling families.

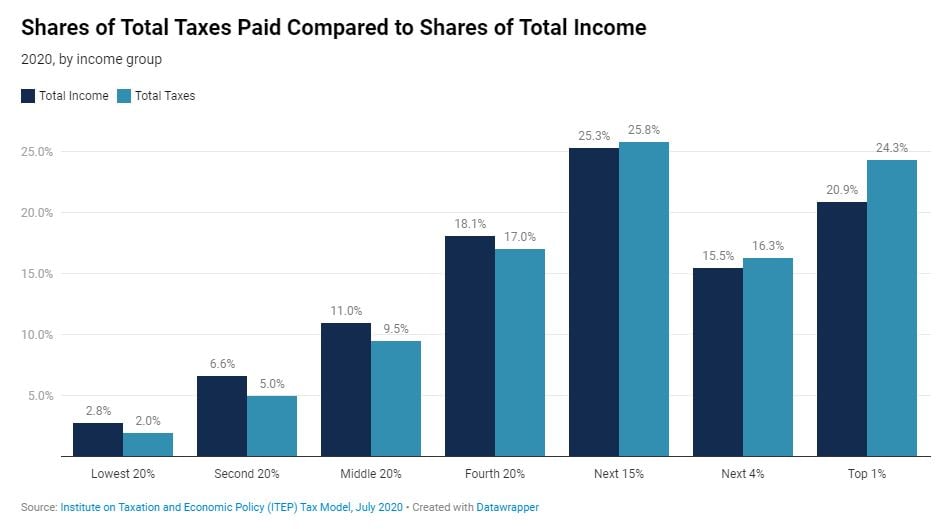

Who Pays Taxes in America in 2020?

July 14, 2020 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

Having a sound understanding of who pays taxes and how much is a particularly relevant question now as the nation grapples with a health and economic crisis that is devastating lower-income families and requiring all levels of government to invest more in keeping individuals, families and communities afloat. This year, the share of all taxes paid by the richest 1 percent of Americans (24.3 percent) will be just a bit higher than the share of all income going to this group (20.9 percent). The share of all taxes paid by the poorest fifth of Americans (2 percent) will be just…

Trump-GOP Tax Law Encourages Companies to Move Jobs Offshore–and New Tax Cuts Won’t Change That

June 2, 2020 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

New tax cuts to incentivize bringing jobs back to the United States will fail. No new tax provisions can be more generous than the zero percent rate the 2017 law provides for many offshore profits or the loopholes that allow corporations to shift profits to countries with minimal or no corporate income taxes.

ITEP: Tax Cuts for Millionaires in the CARES Act Violate Public Trust

April 14, 2020 • By Amy Hanauer

“Public trust and the broad agreement that families and communities needed immediate relief from the economic crisis allowed the $2.2 trillion economic relief package to move quickly through Congress. Yet during a crisis in which thousands have lost their lives and millions are losing their jobs, their health care and their retirement security, some of our lawmakers snuck in tax benefits for the nation’s richest families."

Addressing the COVID-19 Economic Crisis: Advice for the Next Round

April 7, 2020 • By Steve Wamhoff

Americans need many things right now beyond tax cuts or cash payments. But for people whose incomes have declined or evaporated, money is the obvious, immediate need to prevent missed rent or mortgage payments, skipped hospital visits and other cascading catastrophes. So, what should Congress do next to get money to those who need it?

Updated Estimates from ITEP: Trump Tax Law Still Benefits the Rich No Matter How You Look at It

August 28, 2019 • By Steve Wamhoff

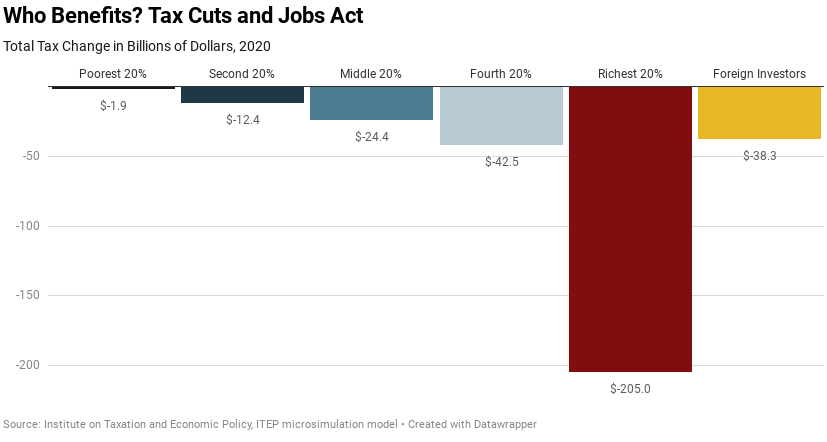

President Trump’s allies in Congress continue to defend their 2017 tax law in misleading ways. Just last week, Republicans on the House Ways and Means Committee stated that most “of the tax overhaul went into the pockets of working families and Main Street businesses who need it most, not Wall Street.” ITEP’s most recent analysis estimates that in 2020 the richest 5 percent of taxpayers will receive $145 billion in tax cuts, or half the law's benefits to U.S. taxpayers.

The Tax Cuts and Jobs Act (TCJA), signed into law by President Trump at the end of 2017, includes provisions that dramatically cut taxes and provisions that offset a fraction of the revenue loss by eliminating or limiting certain tax breaks. This page includes estimates of TCJA’s impacts in 2020.

Congressional Research Service Calls Three Strikes on the Trump Tax Cuts

May 30, 2019 • By Matthew Gardner

This new report is the most comprehensive assessment yet undertaken by the CRS, which has an unimpeachable reputation as an impartial arbiter of policy disputes. So, when it says that the TCJA doesn’t appear to have grown wages or the economy and has made our long-term budget deficits even worse, it’s a judgment that will last.

Policymakers and the public widely agree that economic inequality is the social policy problem of our age. It threatens the livelihoods of millions of children and adults, and it even threatens our democracy. Although some say Americans could fix it themselves by simply rolling up their sleeves, as a sub-headline in a March U.S. News and World Report column implied, the reality is different.

The Trump Tax Law Further Tilted an Already Uneven Playing Field

March 27, 2019 • By Jessica Schieder

Proponents sold the Tax Cuts and Jobs Act (TCJA) as a way to spur new investment, increase workers’ paychecks, and reverse the off-shoring of jobs. Testimony presented during a House Ways and Means hearing held today reflected on how—more than a year after the law’s passage—each of those pitches ring hollow.

Data released Friday by the U.S. Treasury Department should give great pause to all who care about the federal government’s ability to raise revenue in a fair, sustainable way. In the wake of the 2017 corporate tax overhaul, corporate tax collections have fallen at a rate never seen during a period of economic growth.