ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

How the Revised Senate Tax Bill Would Affect South Dakota Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In South Dakota, 54 percent of the federal tax cuts would go to the richest 5 percent of residents, and 5 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect South Carolina Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In South Carolina, 51 percent of the federal tax cuts would go to the richest 5 percent of residents, and 11 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect Mississippi Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Mississippi, 45 percent of the federal tax cuts would go to the richest 5 percent of residents, and 10 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect Hawaii Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Hawaii, 40 percent of the federal tax cuts would go to the richest 5 percent of residents, and 16 percent of households would face a tax increase, once the bill is fully implemented.

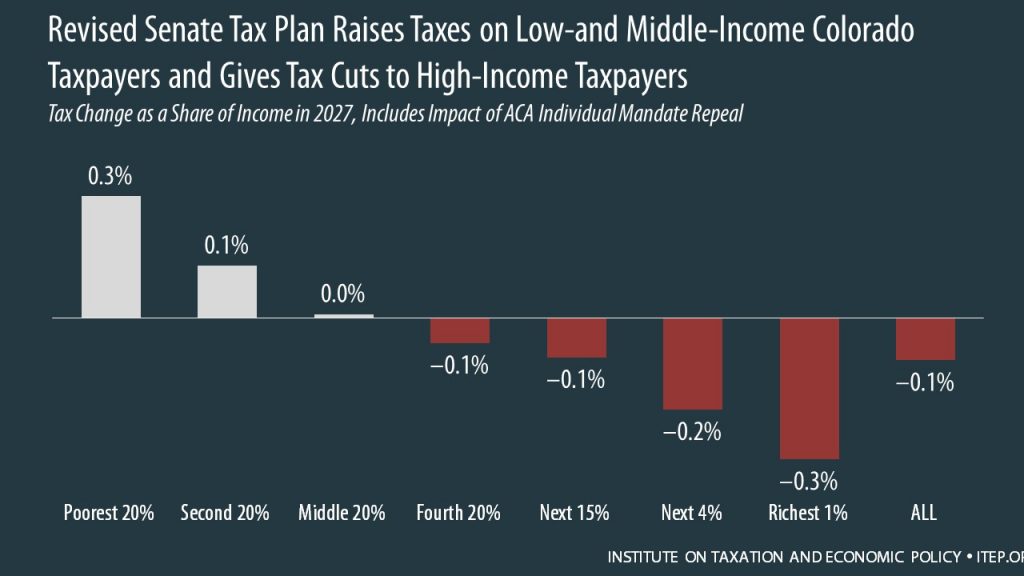

How the Revised Senate Tax Bill Would Affect Colorado Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Colorado, 53 percent of the federal tax cuts would go to the richest 5 percent of residents, and 14 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect Minnesota Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Minnesota, 47 percent of the federal tax cuts would go to the richest 5 percent of residents, and 15 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect Rhode Island Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Rhode Island, 47 percent of the federal tax cuts would go to the richest 5 percent of residents, and 15 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect Pennsylvania Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Pennsylvania, 50 percent of the federal tax cuts would go to the richest 5 percent of residents, and 12 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect Oregon Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Oregon, 41 percent of the federal tax cuts would go to the richest 5 percent of residents, and 16 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect Oklahoma Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Oklahoma, 44 percent of the federal tax cuts would go to the richest 5 percent of residents, and 6 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect Ohio Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Ohio, 45 percent of the federal tax cuts would go to the richest 5 percent of residents, and 11 percent of households would face a tax increase, once the bill is fully implemented.

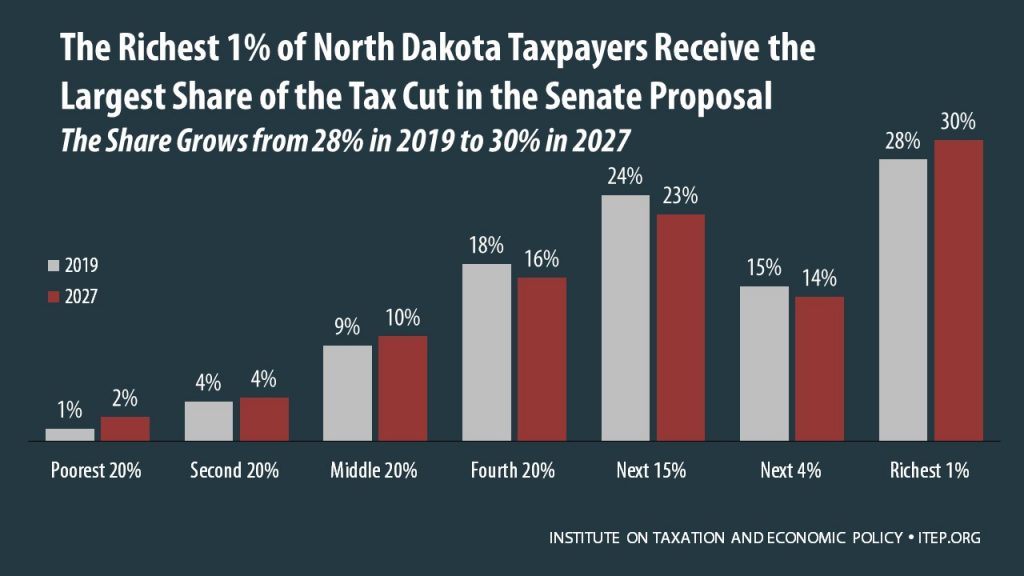

How the Senate Tax Bill Would Affect North Dakota Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In North Dakota, 44 percent of the federal tax cuts would go to the richest 5 percent of residents, and 2 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect North Carolina Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In North Carolina, 50 percent of the federal tax cuts would go to the richest 5 percent of residents, and 13 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect New York Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In New York, 38 percent of the federal tax cuts would go to the richest 5 percent of residents, and 19 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect New Mexico Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In New Mexico, 37 percent of the federal tax cuts would go to the richest 5 percent of residents, and 7 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect New Jersey Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In New Jersey, 50 percent of the federal tax cuts would go to the richest 5 percent of residents, and 22 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect New Hampshire Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In New Hampshire, 44 percent of the federal tax cuts would go to the richest 5 percent of residents, and 14 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect Nevada Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Nevada, 57 percent of the federal tax cuts would go to the richest 5 percent of residents, and 9 percent of households would face a tax increase, once the bill is fully implemented.

How the Senate Tax Bill Would Affect Nebraska Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Nebraska, 40 percent of the federal tax cuts would go to the richest 5 percent of residents, and 9 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect Montana Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Montana, 52 percent of the federal tax cuts would go to the richest 5 percent of residents, and 9 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect Kansas Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Kansas, 46 percent of the federal tax cuts would go to the richest 5 percent of residents, and 8 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect Arkansas Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Arkansas, 42 percent of the federal tax cuts would go to the richest 5 percent of residents, and 9 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect Alaska Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Alaska, 43 percent of the federal tax cuts would go to the richest 5 percent of residents, and 4 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect Alabama Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Alabama, 48 percent of the federal tax cuts would go to the richest 5 percent of residents, and 12 percent of households would face a tax increase, once the bill is fully implemented.

How the Revised Senate Tax Bill Would Affect Connecticut Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Connecticut, 57 percent of the federal tax cuts would go to the richest 5 percent of residents, and 22 percent of households would face a tax increase, once the bill is fully implemented.