ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

House Committee on Education & Workforce Democrats: Ranking Member Scott Statement on the 2025 Nation’s Report Card

September 10, 2025

An analysis by the Institute on Taxation and Economic Policy found that this new private school voucher program could cost $56 billion per year—more than all current federal K-12 spending combined.

Making the Wealthy Pay their Fair Share is the Way to Preserve Vacation Towns

September 10, 2025 • By Rita Jefferson

Rhode Island lawmakers created a new surcharge on second homes worth more than $1 million as part of the budget enacted this spring.

The Telegraph: Trump has Turned America’s Taxman into a Weapon against Migrants

September 9, 2025

The US president appears to be trying to turn the IRS into a new weapon as he presses ahead with his promise to deliver “the single largest mass deportation programme in history”.

Houston Chronicle: Texas Oil Companies Forecast Billions in Tax Breaks from Trump’s ‘Big Beautiful Bill’

September 9, 2025

The Houston oil-company Occidental Petroleum reported last month it was expecting a large tax break from President Donald Trump's tax and spending cut package known as the One Big Beautiful Bill — to the tune of $700 to $800 million over the next two years.

Quartz: The $40,000 SALT Goldmine Only the Wealthy Will Actually Get

September 8, 2025

Despite all the political fanfare about helping homeowners, the most hyped tax break in decades is actually a mirage that doesn’t help the vast majority of Americans. Instead, experts say it’s a gift to high-income earners in high-tax blue states.

Who Can Make a Billion Dollar Mistake and Not Lose Their Jobs? Congress

September 5, 2025 • By Matthew Gardner

A drafting error in the 2017 tax law will cost U.S. taxpayers over $1 billion in unintended tax cuts for big multinationals.

House Committee on Education & Workforce Democrats: Ranking Member Bonamici Opening Remarks at ECESE Subcommittee Hearing on Reading and Math in K-12 Schools

September 4, 2025

An analysis by the Institute on Taxation and Economic Policy found that this new private school voucher program could cost $56 billion per year—more than all current federal K-12 spending combined.

State Rundown 9/4: Colorado Tackles Offshore Corporate Tax Avoidance, Paves Way for State Conformity Best Practices

September 4, 2025 • By ITEP Staff

Despite an increasingly bleak state revenue outlook, state lawmakers across the country continue to prioritize regressive tax cuts.

SALT in the Wound: New Tax Law’s Limit on State Tax Deductions Exempts Some of the Very Wealthiest

August 21, 2025 • By ITEP Staff

The new tax law enacted last month found a temporary compromise on the level of the cap, boosting it to $40,000 through 2029, but failed to fix a loophole that allows some rich taxpayers with good accountants to completely avoid the cap

State Rundown 8/20: States to Face Serious Conformity, Revenue Issues as Summer Ends

August 20, 2025 • By ITEP Staff

While tax news has slowed as summer comes to an end, there are rumblings beneath the surface that could be an inauspicious sign of the times ahead for states and state budgets.

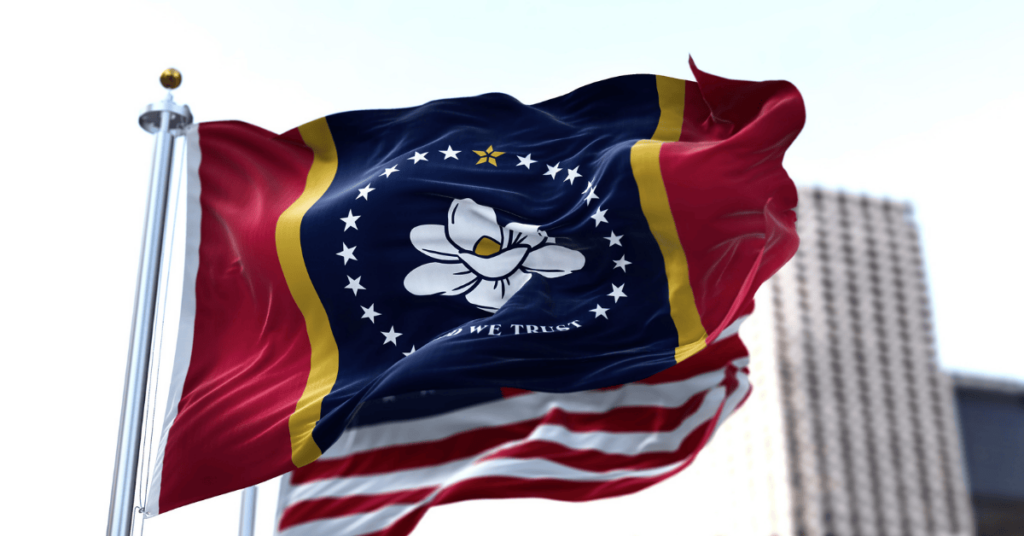

Mississippi’s Path to Income Tax Elimination Hinders Racial and Economic Equity

August 7, 2025 • By Vanessa Woods

Mississippi policymakers this year took a big step to worsen the state’s racial income and wealth divides by passing a radical plan to eventually eliminate the state’s income tax.

As states prepare for the revenue loss and disruption resulting from the federal tax bill, tax policy is being considered in legislatures across the country.

Nobody should be too excited and think this means our country is headed toward lower deficits - especially when the administration recently signed one of the most expensive budget reconciliation bills in history.

10 Crazy Comparisons Showing How Much Trump and Congress Just Cut Taxes for the Rich

July 10, 2025 • By ITEP Staff

$117 billion is a big number, so we thought it could use a little context.

State Rundown 7/8: State Tax Cuts Continue Despite Federal Megabill Passing

July 8, 2025 • By ITEP Staff

The last states are wrapping up legislative sessions, and some are crossing the finish line with major income tax cuts.

With Fiscal Uncertainty Looming, Louisiana Senate Did the Right Thing on Tax Bills

June 27, 2025 • By Neva Butkus

If you find yourself in a hole, stop digging. This is exactly what Louisiana Senators did when they rejected two tax-cut bills that would have created a billion-dollar shortfall in the coming fiscal years.

Many states are reaching their end-of-June budget deadlines, and major tax policy changes look to have big implications as states are forced, per federal policy, to do more with less.

Senate Republicans Rig the Rules to Make Their Tax Bill Look Responsible. It’s Not.

June 24, 2025 • By Jon Whiten, Steve Wamhoff

No matter how much Senate leadership bends the rules to make their tax cuts look better on paper, the cost and impact on the deficit remains the same under a current policy baseline. It’s a move meant to mask the true cost and push a reckless bill through.

State Rundown 6/20: Federal tax policy heats up, states wrap sessions and weigh impacts

June 18, 2025 • By ITEP Staff

As state legislative sessions come to a close, decisions on tax policy are being made. Several southern states have cut taxes, while the northeast is making some more measured reforms.

Testimony: ITEP’s Amy Hanauer Discusses the House Reconciliation Bill During a Senate Spotlight Forum

June 18, 2025

Thank you for including me today and you can find research that I reference today on the website of the Institute on Taxation and Economic Policy at www.itep.org. The One Big Beautiful Bill Act (OBBBA) would cut services to poor and middle-class families, reduce revenue available for public needs, and provide large tax cuts primarily to the richest Americans, while also providing tax cuts to foreign investors.

Hand in Hand: The Domestic Employers Network: We Can’t Solve the Care Crisis Without Immigrants

June 13, 2025

We are in the midst of a care crisis, caused by a rapidly aging population and an increased need for long-term care that the current workforce just can’t keep up with. Immigrants play a vital role to fill that gap. Without immigrants, our already broken care system would collapse.

Policy Matters Ohio: A Budget for Ohio’s Millionaires

June 13, 2025

The Ohio Senate has passed its state budget bill. Policy Matters Ohio Tax Policy Researcher Bailey Williams issued the following statement:

DC Fiscal Policy Institute: Undocumented Immigrants Make DC’s Tax Base More Resillient

June 12, 2025

As she and the federal government escalate attacks on immigrants, DC should not overlook the many ways these residents contribute to the communities they live in and the local economy, including through their tax contributions toward DC’s shared resources.

USA Today: Los Angeles is Grappling with ‘Collective Grief and Frustration’ Amid Protests

June 12, 2025

In a year that's already been punctuated by the devastating wildfires that will take years to rebuild, an emotionally weary Los Angeles County is back in an unwanted spotlight due to nearly a week of anti-ICE protests that are testing its character.

State legislatures are enjoying a relatively quiet period right now, though it is merely a temporary calm before the storm of the federal tax and budget debate begins raging again.