Blog

1298 posts

State Rundown 10/28: Anti-Tax Horror Stories Proving Less Spooky in 2020

October 28, 2020 • By ITEP Staff

Even with Halloween coming up this weekend, months of dealing with the horrors of the Covid-19 pandemic have made it hard to scare anyone in the closing months of 2020, which state lawmakers and residents are showing by voting in droves and supporting policies they had been more trepidatious about in recent years.

An Underfunded IRS Allows Corporations to Get Away with Probably Illegal Tax Dodges

October 28, 2020 • By Matthew Gardner

A new look at S&P 500 annual financial reports for 2019 shows that five companies—Chevron, Dell, Eli Lilly, ExxonMobil and General Electric—kept $1 billion in tax breaks they admitted were probably illegal because tax authorities failed to come to a final determination before the statute of limitations ran out.

Trump Says Taxes Will Be Too High on the 2% Who Pay More Under Biden’s Plan

October 22, 2020 • By Steve Wamhoff

The Trump campaign has failed to convince the public that large numbers of Americans would face tax hikes under Democratic presidential nominee Joe Biden’s tax plan. The claim has been widely discredited. For example, ITEP found that the federal taxes that people pay directly would rise for just 1.9 percent of taxpayers in the U.S., and that number does not vary much by state. So, Fox News and other conservative voices are trying out a new argument: Biden’s tax plan would be too burdensome for that 1.9 percent.

Voters Have the Chance in 2020 to Increase Tax Equity in Arizona, Illinois, and California, And They Should

October 22, 2020 • By Marco Guzman

There’s a lot at stake in this election cycle: the nation and our economy are reeling from the effects brought on by the coronavirus pandemic and states remain in limbo as they weigh deep budget cuts and rush to address projected revenue shortfalls.

State Rundown 10/21: States Preparing Ingredients for 2021 Fiscal Debates

October 21, 2020 • By ITEP Staff

State lawmakers around the nation are already looking well past the upcoming election to the legislative debates they’ll be cooking up in 2021. In Iowa and Nebraska, anti-tax groups are thawing out regressive tax shift ideas they had put on ice earlier in the pandemic. In Delaware, a lawsuit and recent settlement have put educational and property tax inequities on the menu for the upcoming session. Meanwhile New Jersey and New York are both looking to add stock to their revenue mixes with progressive taxes on stock trades.

A Conservative Supermajority on the Supreme Court Could Be a Boon to Wealthy Tax Cheats

October 14, 2020 • By Carl Davis

By early next year, the Supreme Court could be operating under a 6-3 conservative supermajority that may unwind hard-fought progressive reforms across every area imaginable. While reproductive rights and health care are at the forefront of public discourse, the Court’s impact will extend far beyond these two areas. Voting rights, the battle against climate change, anti-discrimination laws, the separation of church and state and yes, even progressive taxation, are all at risk.

Supreme Court Would Provide Massive Tax Cut for the Rich if It Strikes Down Affordable Care Act

October 13, 2020 • By Steve Wamhoff

If the Supreme Court strikes down the Affordable Care Act (ACA), as argued for by the Trump administration and the president’s nominee to the court, Amy Coney Barrett, one under-appreciated result will be a tax break of roughly $40 billion annually for about 3 percent of Americans, who all have incomes of more than $200,000.

Californians are voting now on Proposition 15, which would require commercial and industrial property worth $3 million or more to be taxed based on an up-to-date assessment of full market value. Proposition 15 is sound tax policy that would raise much needed revenue and help to advance racial and economic justice.

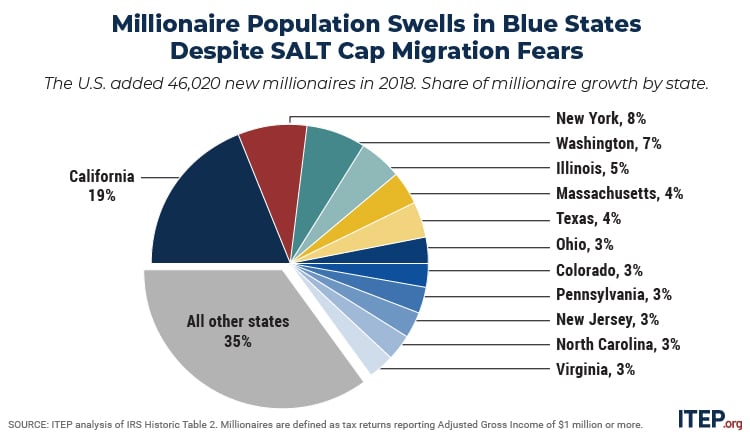

The biggest news for state and local fiscal debates this week was that federal fiscal relief to help with their pandemic-induced revenue crises is effectively off the table for at least another month. But if there is a silver lining to this federal inaction, it may be that it coincides with New Jersey’s success filling part of its own revenue shortfall through a millionaires tax, as well as with prominent wealth managers admitting that their rich clients don’t flee to other states in response to such taxes (see “What We’re Reading”). Combined, these three developments could encourage state leaders elsewhere…

New ITEP Report Shows Few Taxpayers in Each State Paying More Under Biden’s Tax Plan

October 7, 2020 • By Steve Wamhoff

An ITEP report finds that taxes that people pay directly would stay the same or go down in 2022 for 98.1 percent of Americans under President-elect Joe Biden’s tax plan.

Donald Trump and Taxes: Fast and Loose with Loopholes or Fraud?

September 30, 2020 • By Matthew Gardner

The president’s apparent abuse of everything from hair-care deductions to consulting fees for family members raises questions about whether Trump was fast and loose with tax loopholes or whether the IRS simply wasn’t enforcing the law. Either way, Trump successfully flouting or pushing the limits of the law shouldn’t come as a surprise: Congress has cut IRS funding, in real terms in each of the last 10 years.

A 2017 Tax Provision Could Have Restrained Trump’s Tax Dodging, But Congress Just Weakened It

September 29, 2020 • By Steve Wamhoff

President Trump and Republicans in Congress passed up almost every opportunity to shut down special tax breaks and loopholes for real estate investors when they enacted their 2017 tax law. They did, however, include some welcome provisions to limit how business owners use losses to avoid taxes, and these provisions could potentially limit the sort of tax dodging perfected by Trump. Unfortunately, Congress temporarily reversed these limits with some provisions tucked into the CARES Act that was enacted in March, and this may help Trump and others like him to continue avoiding taxes.

Congress is certainly to blame both for providing a ridiculously lenient tax code for the super-wealthy and for preventing the IRS from enforcing even the existing weak limits in the law on tax avoidance. But make no mistake, one person is primarily responsible for the farce that is Donald Trump’s tax dodging, and that is Donald Trump. For years, he has actively and loudly supported special tax breaks and tax shelters, making him anything but a passive bystander to their creation.

It’s Time to Change the Tax Laws to Make Donald Trump and Corporate Giants Pay Up

September 29, 2020 • By Amy Hanauer

It’s time for a new approach. Trump’s egregious tax avoidance further exposes a system that preserves an enormous and growing economic divide. Congress has gutted IRS funding so that we don’t have the resources to audit wealthy tax avoiders. And lobbyists continue to secure giveaways for corporate clients that do nothing for our communities.

It’s No Secret—To Save State Budgets End Preferential Treatment of Capital Gains

September 25, 2020 • By Marco Guzman

In an updated policy brief, ITEP explores the flaws in state capital gains tax breaks and highlights how ending special tax breaks provides one of the simplest ways to raise additional revenue and increase equity in the tax system.

While the moneyed elite were dangling shiny objects, scapegoating Black and brown people, denigrating immigrants, and financing studies to convince us that poor people are the problem, they were concurrently securing policies that cut taxes primarily for the rich and profitable corporations, deregulated industry, weakened unions and attacked voting rights. This and more allowed the rich to amass even more wealth and power.

State Rundown 9/23: Tax Justice Advanced in New Jersey, On the Ballot in Illinois

September 23, 2020 • By ITEP Staff

New Jersey leaders grabbed the biggest headlines of the week by finally agreeing to implement a much-needed and long-discussed millionaires tax to shore up the budget and improve tax fairness. And Illinois residents can begin voting tomorrow to enact a graduated income tax there. Relatedly, ITEP Research Director Carl Davis updated our research debunking the myth that progressive taxes interfere with economic growth. Cannabis legalization and taxation was a hot topic as well, as lawmakers in Vermont reached an agreement to move forward on the matter and others in Connecticut, Kansas, and New Hampshire worked toward the same.

Another Reason to Tax the Rich? States with High Top Tax Rates Doing as Well, if Not Better, than States Without Income Taxes

September 23, 2020 • By Carl Davis

ITEP updated a 2017 study that examined the economic performance of the nine states with the highest top marginal tax rates compared to the nine states with no state income tax. Economies in states with the highest top marginal rates grew faster. States facing budget shortfalls should first look at raising taxes on those most able to pay (incomes at the top have grown during this economic crisis) before considering harmful budget cuts.

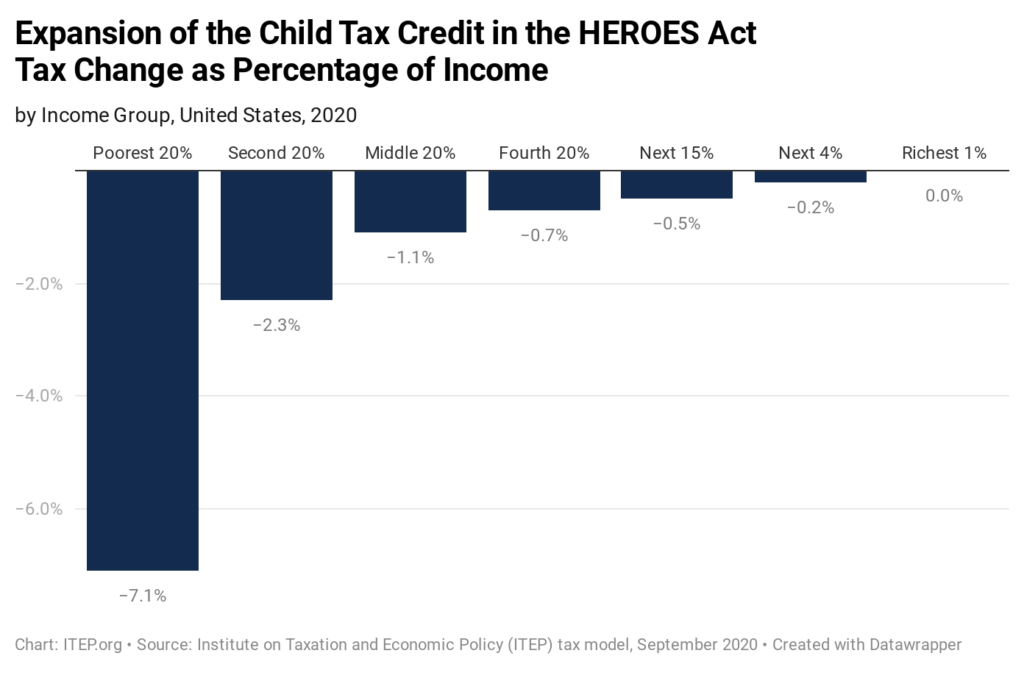

New ITEP Estimates on Biden’s Proposal to Expand the Child Tax Credit

September 18, 2020 • By Steve Wamhoff

On Thursday, former Vice President Joe Biden announced that his tax plan would include a provision passed by House Democrats to temporarily expand the Child Tax Credit (CTC), potentially lifting millions of children out of poverty. Estimates from ITEP show that this change would benefit most families with children—more than 83 million children live in households that would benefit if this was in effect in 2020—but the most dramatic boost would go to low-income families.

Illinois’s Flat Income Tax Amounts to a Tax Subsidy for the Wealthiest Illinoisans that Compounds Income and Wealth Inequalities

September 17, 2020 • By Lisa Christensen Gee

This November, Illinoisans will decide whether to amend the state constitution to allow a graduated income tax. A “yes” vote on the Illinois Fair Tax constitutional amendment will make effective legislation that will replace the current flat tax rate of 4.95 percent with graduated rates that cut taxes for those with taxable income less than $250,000 and institute higher marginal rates on taxable incomes greater than $250,000.

The Vital Role of Public Programs in Moving People and Families Out of Poverty

September 15, 2020 • By Aidan Davis

More families across our nation are struggling to meet their most basic needs. High unemployment, the struggle to put enough food on the table, and an inability to make rent or mortgage payments are widespread. Absent federal intervention, outcomes would have been worse. Over the past few months, federal and state relief measures have mitigated hardship. By putting cash in the hands of those who need it most, lawmakers were able to stabilize some families’ budgets and prop up our fragile economy. With time we will surely glean many lessons from 2020. But the sheer power of targeted assistance is already apparent.

State Rundown 9/11: Benefits of Progressive Taxation Getting Well-Deserved Attention

September 11, 2020 • By ITEP Staff

Readers may want to start with our “What We’re Reading” section this week, which is full of good reading on how progressive taxation is needed to fund vital public services, helpful for state and local economic growth, and popular among voters as well. In that spirit, leaders in both New Jersey and New York are looking at small taxes on stock trades to help improve their budgets and tax codes. These last couple of weeks have also featured more state fiscal action than is typical this time of year, for example in North Carolina, where lawmakers decided to use federal…

Millionaire Population Swells in Blue States Despite Migration Fearmongering

September 3, 2020 • By Carl Davis

Although the 2017 Tax Cuts and Jobs Act has created a slew of problems, it is now clear that a mass migration of top earners out of higher-tax blue states is not one of them.

The Rich Are Weathering the Pandemic Just Fine: Tax Them

September 3, 2020 • By Carl Davis, ITEP Staff, Meg Wiehe

Reductions in critical state and local investments, including health care and education, would only exacerbate the economic crisis brought on by COVID-19 and worsen racial and income inequality for years to come. Higher taxes on top earners are among the best options for addressing pandemic-related state revenue shortfalls in the coming months.

State Rundown 8/26: Progressive Revenue Ideas Featured in Many States’ Fiscal Debates

August 26, 2020 • By ITEP Staff

Voters could significantly change the tax landscape through ballot measures this November regarding oil taxes in Alaska and a high-income surcharge for education funding in Arizona. Legislators are doing their part to bring progressive tax ideas to the fore as well, including a possible wealth tax in California, a millionaires tax in New Jersey, and a pied-a-terre proposal in New York. And Nebraska lawmakers reached a property tax and business tax subsidy compromise before closing out their session, but did not identify progressive revenue sources to fund it and will likely be back at the bargaining table before long.