Tax Reform Options and Challenges

U.S. House Advances More Unpopular Tax Cuts That Primarily Benefit the Wealthy

September 28, 2018 • By Alan Essig

The U.S. House this week voted on so-called Tax Cuts 2.0, a package of three tax bills that, among other things, would make permanent temporary provisions in the Tax Cuts and Jobs Act. Alan Essig, ITEP’s executive director, said the following: “While top-heavy tax cuts and their inevitable effect of decimating public investments may seem peripheral to today’s news cycle, they are emblematic of the governing philosophy of those in power today.”

We Crunched Some Numbers to Show What Tax Reform for Working People Really Looks Like

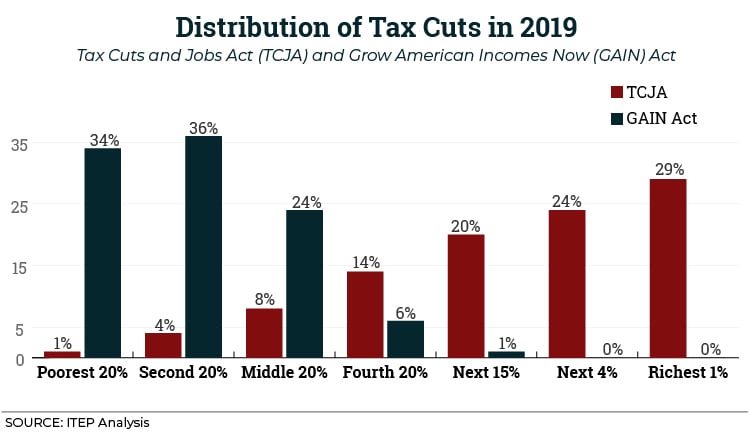

September 12, 2018 • By ITEP Staff

Throughout President’s Trump’s presidential campaign and from his first day in office until now, his administration has favored and promoted policies that benefit the wealthy and corporations even as it claims to be the working people’s champion. If more recent economic data are a reflection of what we’ll see in the long-term due to the Trump Administration’s recent tax cuts, wealth will continue to accrue at the top while income remains stagnant or barely budges for low- and moderate-income families. Policy can make a difference: ITEP Staff shows how the Grow American Incomes Now (GAIN) Act would help millions of…

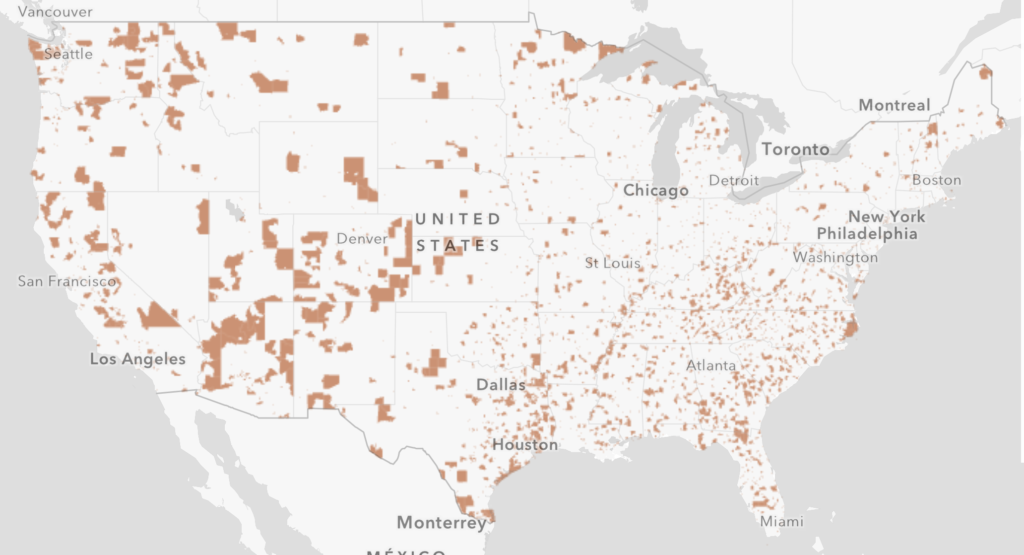

How Opportunity Zones Benefit Investors and Promote Displacement

August 10, 2018 • By ITEP Staff

The idea behind the new tax break is to provide an incentive for wealthy individuals to invest in the economies of struggling communities. Despite alleged intentions, it appears opportunity zones are turning into yet another windfall for wealthy investors and may encourage displacement of people in low-income areas, working against the provision’s intended goal.

The Preferential Tax Treatment of Capital Gains Income Should Be Curbed, Not Substantially Expanded

August 1, 2018 • By Richard Phillips

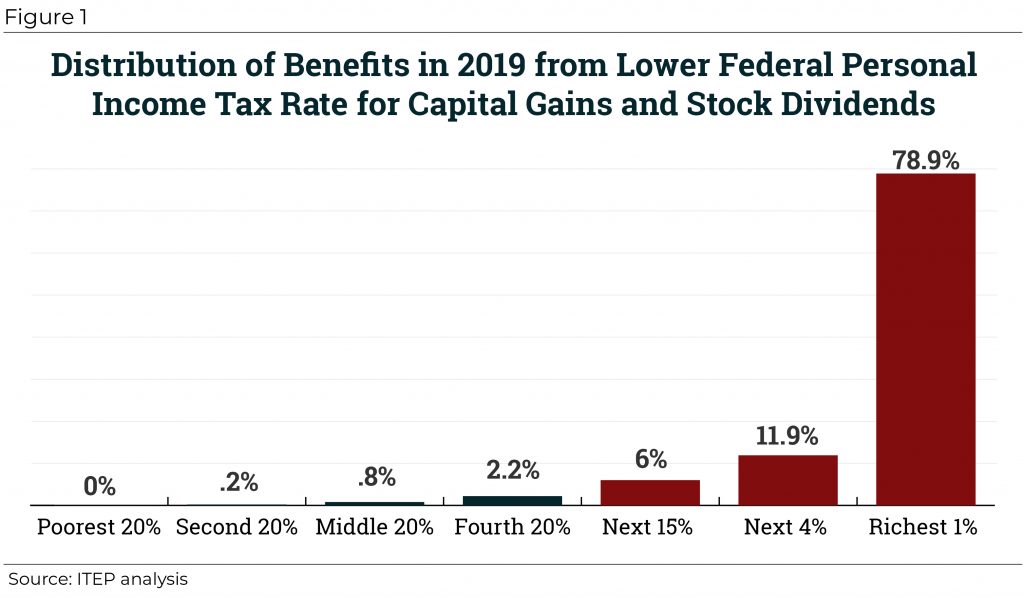

For true believers in supply-side economics, however, one major flaw of the TCJA is that it did not further cut taxes for the wealthy by reducing capital gains tax rates. But now the Trump Administration is considering using executive action to remedy this by indexing capital gains to inflation for tax purposes.

Understanding and Fixing the New International Corporate Tax System

July 17, 2018 • By Richard Phillips

The Tax Cuts and Jobs Act (TCJA) radically changed the international tax system. It slashed taxes on corporate income, both domestic and foreign. It encouraged U.S. multinational corporations to shift jobs, profits, and tangible property abroad, and keep intangibles home. This report describes the new international tax system—and its many gaps—and also provides a road map for how to fix these gaps and surveys recent legislative approaches.

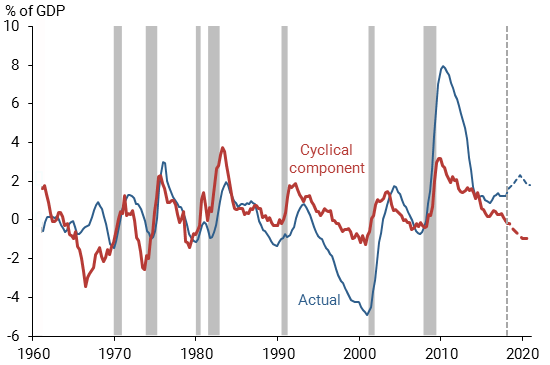

The Immediate Economic Impact of the Tax Cuts and Jobs Act Could be Even Less Than Expected

July 11, 2018 • By Richard Phillips

Now, new research from the Federal Reserve Bank of San Francisco finds that the Tax Cuts and Jobs Act may not be so much of a stimulus after all. In other words, lawmakers have left themselves with few options should the country face an economic recession, and the country may not receive a substantive economic benefit in the short term.

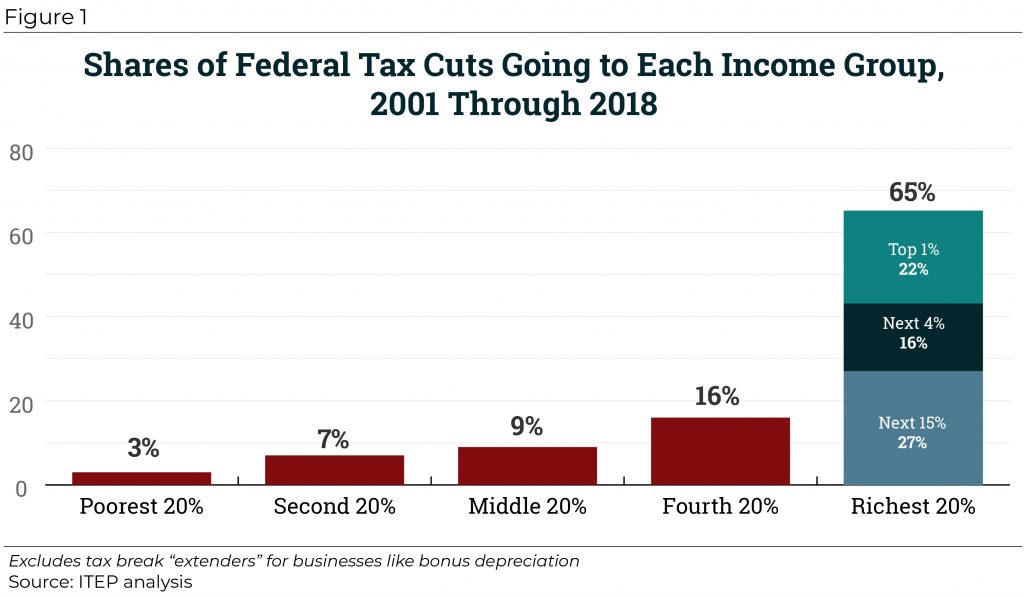

Since 2000, tax cuts have reduced federal revenue by trillions of dollars and disproportionately benefited well-off households. From 2001 through 2018, significant federal tax changes have reduced revenue by $5.1 trillion, with nearly two-thirds of that flowing to the richest fifth of Americans.

New Legislation Would Close Significant Offshore Loopholes in the Tax Cuts and Jobs Act

June 6, 2018 • By Richard Phillips

One simple rule should drive the nation’s international tax policies: tax the offshore profits of American companies the same way their domestic profits are taxed. The latest legislation to approach that ideal is the Per-Country Minimum Act (H.R. 6015), from Rep. Peter DeFazio (D-OR). The DeFazio bill closes the loophole that allows corporations to use foreign tax credits to shelter profits in tax havens from U.S. taxes. No other bill addresses this.

New Jersey’s new governor, Phil Murphy campaigned on a promise to raise state income taxes on millionaires, a proposal that is supported by 70 percent of the state and was, until recently, backed by New Jersey’s Senate President, Steve Sweeney. In recent months, Sweeney changed his position on the proposed millionaires tax and called for an increase in New Jersey’s corporate tax instead. The idea of hiking taxes on corporations is not a bad one, particularly since corporations received a windfall from the Tax Cuts and Jobs Act. But Sweeney’s new opposition to an income tax hike for the state’s…

There Is No Evidence That the New Tax Law Is Growing Our Economy or Creating Jobs

May 15, 2018 • By Steve Wamhoff

The House Ways and Means Committee will hold a hearing on the Tax Cuts and Jobs Act (TCJA) Wednesday. Proponents of the law likely will use the occasion to tout its alleged economic benefits and argue that its temporary provisions should be made permanent. The title of the hearing is “Growing Our Economy and Creating Jobs,” but there is little evidence that the law does either of these things.

No Work Requirements for the Richest 1 Percent — Most of Their Tax Cuts Are for Unearned Income

May 10, 2018 • By Steve Wamhoff

The Trump Administration is pushing to add or strengthen work requirements for programs that benefit low- and middle-income people but holds a different view when it comes to the wealthy. Most tax cuts enjoyed by the richest 1 percent of households under the recently enacted Tax Cuts and Job Act (TCJA) are tax cuts for unearned income.

New UK Law May Shut Down the Biggest Tax Havens — Aside from the U.S.

May 2, 2018 • By Steve Wamhoff

The United Kingdom’s parliament has enacted a new law requiring its overseas territories — which include notorious tax havens like Bermuda, the Cayman Islands, and the British Virgin Islands — to start disclosing by 2020 the owners of corporations they register. This could shut down a huge amount of offshore tax evasion and other financial crimes because individuals from anywhere in the world, including the United States. have long been able to set up secret corporations in these tax havens to stash their money.

Trump Administration’s Spending Priorities Echo Tax Cut Priorities: Punish the Poor and Lavish the Rich

April 27, 2018 • By ITEP Staff, Jenice Robinson, Misha Hill

In 2017, the Trump Administration released a budget proposal filled with loaded language about “welfare reform” and moving able-bodied people from welfare to work. This narrative is designed to perpetuate the pernicious idea that poor people have personal shortcomings and are taking something that rightly belongs to others.

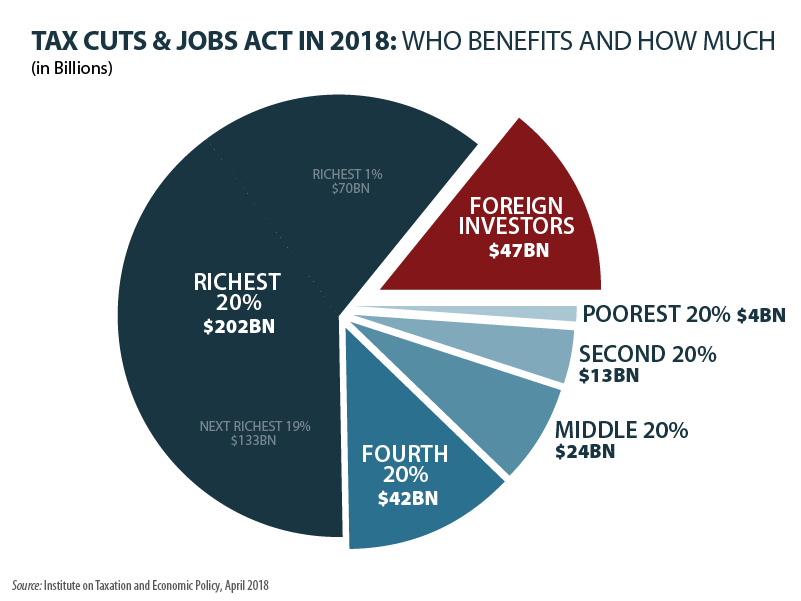

Congressional Budget Office: New Tax Law Helps Foreign Investors Even More than You Thought

April 19, 2018 • By Steve Wamhoff

President Trump and his allies in Congress have made many wild claims about economic growth that would result from the Tax Cuts and Jobs Act. And the Congressional Budget Office just released a report revealing the TCJA will, in fact, create economic growth — for foreign investors.

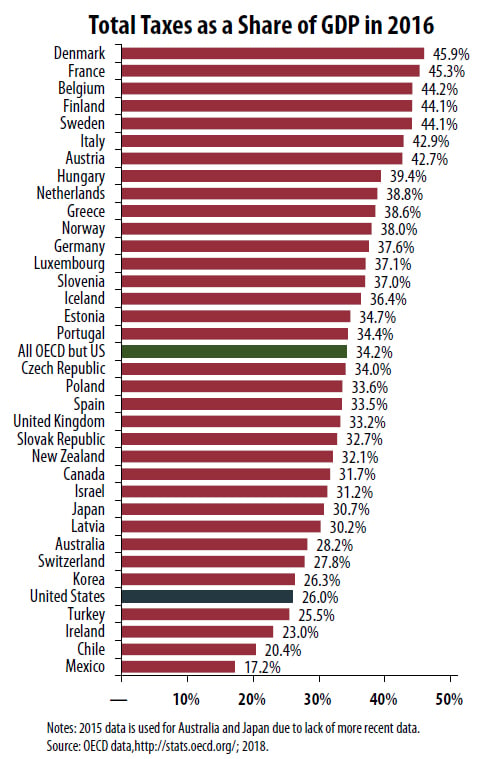

The most recent data from the Organization for Economic Cooperation and Development (OECD) show that the United States is one of the least taxed of the developed nations.

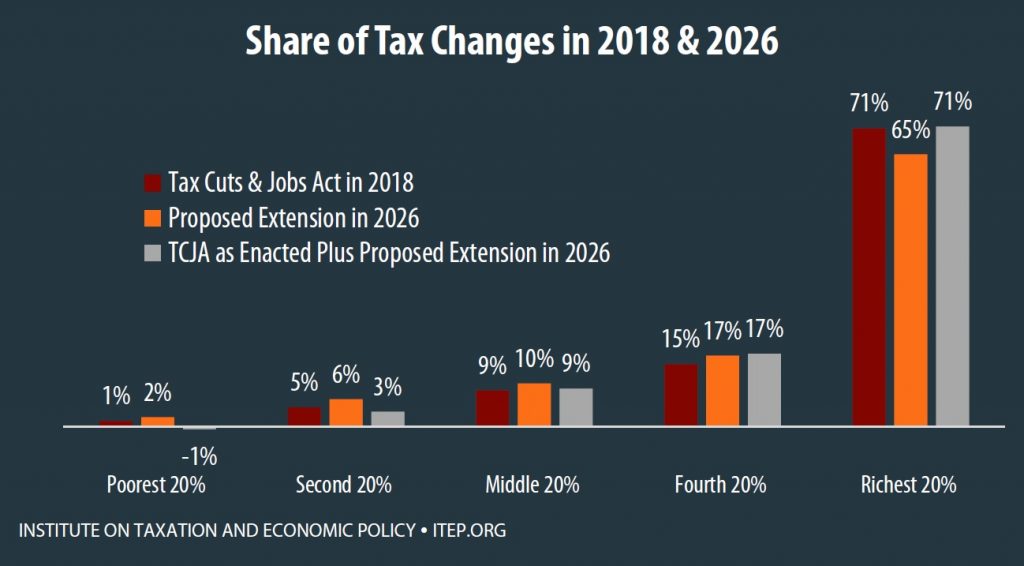

New ITEP Report: Extension of the Temporary TCJA Provisions Would Be Just as Regressive as TCJA Itself

April 10, 2018 • By Steve Wamhoff

A new ITEP report estimates the impacts in every state of the much-discussed idea of extending the temporary provisions in the Tax Cuts and Jobs Act, which will expire after 2025 without further action from Congress. The report concludes that extending or making permanent these provisions would be just as skewed to the wealthy as the original law.

Extensions of the New Tax Law’s Temporary Provisions Would Mainly Benefit the Wealthy

April 10, 2018 • By Matthew Gardner, Steve Wamhoff

This analysis finds that extending the temporary tax provisions in 2026 would not be aimed at helping the middle-class any more than TCJA as enacted helps the middle-class in 2018.

Passing the Buck: Forcing Spending Cuts through a Balanced Budget Amendment

April 5, 2018 • By Ronald Mak

House leaders are preparing a vote on a balanced budget amendment next week that could force massive spending cuts and restrict the ability of lawmakers to raise revenue. Although a balanced budget amendment will likely be pitched as a way to address our nation’s long-term fiscal challenges, such proposals are economically harmful, ineffective, and one-sided.

Unintended Consequences of the New Tax Bill Keep Cropping Up

March 23, 2018 • By Dacey Anechiarico

Due to its rushed passage in a matter of weeks, without public hearings or enough time even for basic proofreading, the Tax Cuts and Jobs Act (TCJA) contains numerous unintended consequences that Congress is now scrambling to fix. The authors of the new law have openly admitted that the law includes major mistakes. One of the most prominent drafting errors is what is now known as the “grain glitch,” which temporarily created a huge incentive for farmers to sell their products to cooperatives over businesses taking other forms.

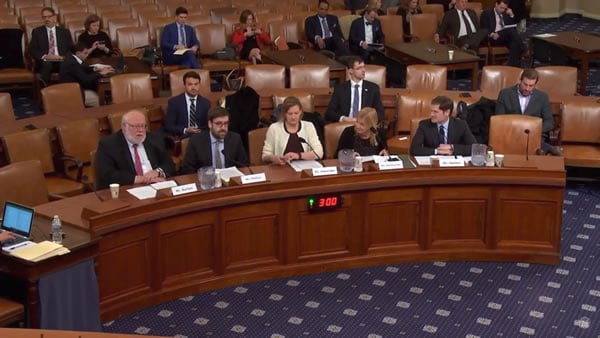

The Heritage Foundation, the Institute on Taxation and Economic Policy (ITEP), and the Committee for a Responsible Federal Budget (CRFB) routinely disagree on a wide range of policy issues, but a recent Ways and Means Tax Policy Subcommittee hearing revealed they all agree that the continual and unpaid-for extension of temporary tax breaks needs to end.

ITEP Testimony on “Post Tax Reform Evaluation of Recently Expired Tax Provisions”

March 14, 2018 • By Richard Phillips

Statement of Richard Phillips, Senior Policy Analyst Institute on Taxation and Economic Policy Before the Committee on Ways and Means Subcommittee on Tax Policy Hearing on “Post Tax Reform Evaluation of Recently Expired Tax Provisions”

Why the Minute Federal 529 Provision Has Huge Consequences for States

February 23, 2018 • By Ronald Mak

When Republican leaders rushed through an overhaul to the federal tax code over a seven-week legislative period, they failed to acknowledge that many provisions in their bill would have negative consequences for states. One such provision of the Tax Cuts and Jobs Act that undermines state laws is the expansion of federal tax breaks that now allows taxpayers to use 529 savings plans to pay for private K-12 education.

Mnuchin’s Not So Grand Stand on the Carried Interest Loophole Explained

February 15, 2018 • By Matthew Gardner

When President Trump released the initial outline of his tax reform plan in April, carried interest repeal was nowhere to be found. And when Congress hammered out a tax plan in late December, lawmakers agreed to reduce the cost of the carried interest tax provision by about 5 percent. (Full repeal would have raised $20 billion over a decade; the enacted provision raises about $1 billion.)

How the Latest Budget Deals Expose the Failure of “Tax Reform”

February 9, 2018 • By Richard Phillips

If there was one thing that tax reform legislation was supposed to accomplish, it was to put an end to the scandalous semiannual ritual of extending and expanding the list of the temporary provisions in the tax code, known as tax extenders. During the passage of the last tax extenders bill at the end of December 2015, lawmakers on both sides of the aisle agreed that it was critical to have a tax code that provides “permanency and certainty” and to move forward with comprehensive tax reform that would decide the fate of the extenders once and for all. Unfortunately,…

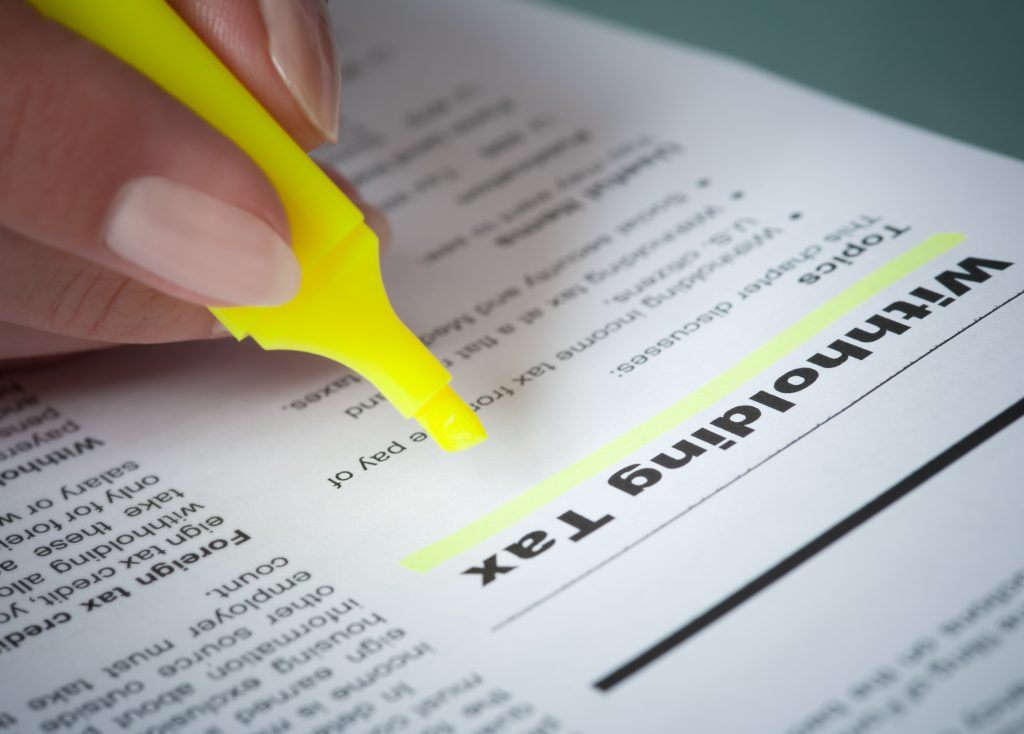

How Much Will Typical Middle-Class Workers Really See Their Paychecks Change?

February 3, 2018 • By Steve Wamhoff

The campaign by Republican leaders in Congress to promote their new tax law has two prongs. One is the claim that corporate income tax cuts are already trickling down to workers, which, as we have explained, is believed by basically no economists anywhere. The other prong of their campaign is to argue that the personal income tax cuts will provide a noticeable decline in withholding from paychecks that middle-class people will notice soon. At this point, it’s helpful to look at some actual data and see how small the boost in take-home pay will really be for most Americans.

In addition to distributional analyses of existing and proposed tax law, ITEP provides policy recommendations for lawmakers to build a more equitable tax code, from progressive revenue-raising options to corporate tax reform to establishing a model for a wealth tax.