Inequality

With the onslaught of news about billionaire wealth soaring while low- and moderate-income families have trouble making ends meet, a federal wealth tax makes good economic and fiscal sense—and the public supports it. One poll found that 64 percent of respondents favor the idea, including a majority of Republicans.

An Unequal Recession Will Breed Unequal Recovery Without Bold Investments

February 26, 2021 • By Stephanie Clegg

Without bold investments now, experts predict a longer, more unequal recovery. President Biden's American Rescue Plan, the framework for legislation expected to pass this week in the House, would boost economic well-being for those whose livelihoods were most affected by the pandemic-induced economic crisis.

Should lawmakers enact laws that they believe are sensible and constitutional, or should they shape their legislative agenda around what they believe ideological Supreme Court justices will allow? This is a dilemma facing Americans who support a federal wealth tax.

President Biden’s Child Tax Credit Proposal Could Right a Historical Wrong

February 2, 2021 • By ITEP Staff, Jenice Robinson, Meg Wiehe

Many 1990s policies were grounded in harmful, erroneous ideas such as financial struggles are due to personal shortcomings and less government is better. Lawmakers didn’t apply these ideas consistently, however. For example, there was no drive to reduce corporate welfare even as policymakers slashed the safety net and disinvested in lower-income communities. So, it’s not surprising that a bipartisan group of lawmakers concluded during that era that the CTC was an appropriate vehicle to give higher-income households a tax break while leaving out poor children.

Disaggregating Data Illuminates a Path to Equitable Policy

January 27, 2021 • By Jessica Schieder

The Biden administration’s move last week to establish an interagency working group to examine how well data is broken down, or disaggregated, within public sector data sources is welcome news. The executive order specifically names the limited availability of datasets disaggregated “by race, ethnicity, gender, disability, income, veteran status, [and] other key demographic variables.”

A Second Round of Direct Cash Payments Could Provide an Average $1,550 to the Poorest Families

December 8, 2020 • By Jenice Robinson

It will not magically become easier for families to put food on the table or make their next rent payment. Policymakers must act. People are struggling because they are either out of work, involuntarily working part-time, trying to financially catch up after being out of work for a spell, or squeaking by because we live in a wealthy democracy that fails to guarantee basics such as access to affordable housing, health care, food, and jobs that pay living wages.

Connecticut Voices for Children: Advancing Economic Justice Through Tax Reform

December 8, 2020

Connecticut Voices for Children released a new report, “Advancing Economic Justice Through Tax Reform,” which proposes a tax restructure so that the system is fair for all residents. The report provides an overview of economic injustice in Connecticut, Connecticut’s regressive tax system and shows that it is a key contributor to the economic injustice in the state, […]

After the Dust Has Settled: How Progressive Tax Policy Fared in the General Election

November 30, 2020 • By Marco Guzman

While the results of the 2020 presidential election are all but set in stone—and a sign of life for progressive policy—the results of state tax ballot initiatives are more of a mixed bag. However, the overall fight for tax equity and raising more revenue to invest in people and communities is trending in the right direction.

Better tax policies will help communities emerge from the current staggering fiscal crisis with tax structures that reduce inequality at a time when rich people are thriving and public services are under siege. Preserving public spending will boost the economy and improve lives–and cutting these essentials will not only hurt people but also deepen the downturn, a lesson we learned in the Great Recession’s slow recovery. Other states should take note.

Biden’s Economic Policy Agenda Deserves Serious Debate, Not Obstruction

November 12, 2020 • By Jenice Robinson

Obstructing policies that improve economic well-being should not be on any party’s legislative agenda, especially when so many are barely keeping their heads above water.

Donald Trump and Taxes: Fast and Loose with Loopholes or Fraud?

September 30, 2020 • By Matthew Gardner

The president’s apparent abuse of everything from hair-care deductions to consulting fees for family members raises questions about whether Trump was fast and loose with tax loopholes or whether the IRS simply wasn’t enforcing the law. Either way, Trump successfully flouting or pushing the limits of the law shouldn’t come as a surprise: Congress has cut IRS funding, in real terms in each of the last 10 years.

It’s Time to Change the Tax Laws to Make Donald Trump and Corporate Giants Pay Up

September 29, 2020 • By Amy Hanauer

It’s time for a new approach. Trump’s egregious tax avoidance further exposes a system that preserves an enormous and growing economic divide. Congress has gutted IRS funding so that we don’t have the resources to audit wealthy tax avoiders. And lobbyists continue to secure giveaways for corporate clients that do nothing for our communities.

While the moneyed elite were dangling shiny objects, scapegoating Black and brown people, denigrating immigrants, and financing studies to convince us that poor people are the problem, they were concurrently securing policies that cut taxes primarily for the rich and profitable corporations, deregulated industry, weakened unions and attacked voting rights. This and more allowed the rich to amass even more wealth and power.

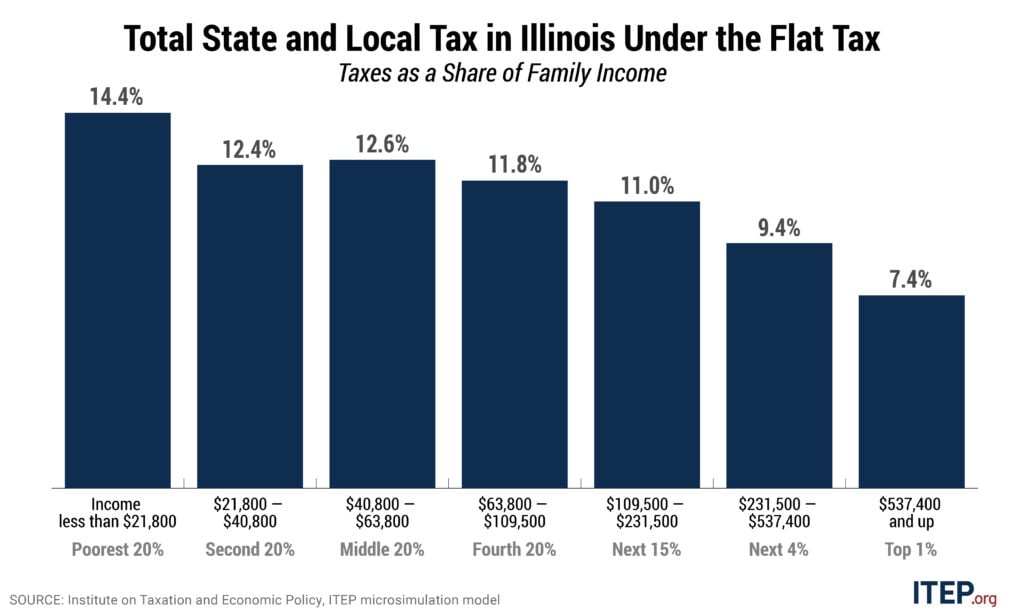

Illinois’s Flat Income Tax Amounts to a Tax Subsidy for the Wealthiest Illinoisans that Compounds Income and Wealth Inequalities

September 17, 2020 • By Lisa Christensen Gee

This November, Illinoisans will decide whether to amend the state constitution to allow a graduated income tax. A “yes” vote on the Illinois Fair Tax constitutional amendment will make effective legislation that will replace the current flat tax rate of 4.95 percent with graduated rates that cut taxes for those with taxable income less than $250,000 and institute higher marginal rates on taxable incomes greater than $250,000.

New 20-Year Study Provides Insight on How State Tax Systems Worsen Inequality and the Racial Wealth Gap

September 17, 2020 • By ITEP Staff, Lisa Christensen Gee

A new study finds that over the last 20 years, Illinois’s tax system has effectively sapped $4 billion more from Black and Hispanic communities than it would have under a graduated income tax while also allowing the state’s highest-income (mostly white) households to pay $27 billion less in taxes, the Institute on Taxation and Economic Policy (ITEP) said today.

Illinois’s Flat Tax Exacerbates Income Inequality and Racial Wealth Gaps

September 17, 2020 • By Lisa Christensen Gee

Flat or graduated personal income taxes have varying effects on the annual individual tax liabilities of taxpayers at different income levels. Less examined is how tax structures affect income inequality and racial wealth gaps. This brief illustrates how Illinois’s historic flat income tax structure compares to the proposed Fair Tax through a multi-year retrospective analysis. It shows that Illinois’s flat income tax in lieu of a graduated rate tax used by most states amounts to a tax subsidy for the wealthiest Illinoisans that compounds income inequality and racial wealth gaps.

The Vital Role of Public Programs in Moving People and Families Out of Poverty

September 15, 2020 • By Aidan Davis

More families across our nation are struggling to meet their most basic needs. High unemployment, the struggle to put enough food on the table, and an inability to make rent or mortgage payments are widespread. Absent federal intervention, outcomes would have been worse. Over the past few months, federal and state relief measures have mitigated hardship. By putting cash in the hands of those who need it most, lawmakers were able to stabilize some families’ budgets and prop up our fragile economy. With time we will surely glean many lessons from 2020. But the sheer power of targeted assistance is already apparent.

Racial justice requires tax justice. Economic justice requires tax justice. Climate and health justice require, yes, tax justice.

The Rich Are Weathering the Pandemic Just Fine: Tax Them

September 3, 2020 • By Carl Davis, ITEP Staff, Meg Wiehe

Reductions in critical state and local investments, including health care and education, would only exacerbate the economic crisis brought on by COVID-19 and worsen racial and income inequality for years to come. Higher taxes on top earners are among the best options for addressing pandemic-related state revenue shortfalls in the coming months.

Action (lack thereof) on Economic Aid Reflects Longstanding Anti-Government Agenda

August 14, 2020 • By Amy Hanauer

The biggest danger we face right now is that politicians will fail to get this health crisis under control and Americans will continue to die. The second biggest danger is that elected officials will fail to help families and communities, leading to foreclosures, evictions, and impoverishment—and also torpedoing the economy. With their inaction this week, the Senate seems determined to do both. Hold on everyone, we’re in for a sickening ride.

Treasury Secretary Mnuchin to Unemployed Workers: Don’t Worry, Get a Bank Loan

July 24, 2020 • By Jenice Robinson

In an explanation that can only be called richsplaining, Treasury Secretary Steve Mnuchin on Thursday suggested that Congress’s delay in approving expanded unemployment benefits was no problem because banks would extend loans to people in the meantime.

Adequately Funding the IRS Would Be One Small Step Toward Racial Equity in the Tax Code

July 10, 2020 • By Jenice Robinson

IRS Commissioner Charles Rettig vowed to work with Congress to explore how the federal tax system contributes to the racial wealth gap. There are at least two ways this can happen: tax policies enacted by Congress and IRS enforcement of these policies.

Beyond SCOTUS: States Recognize Need for More Inclusive Immigrant Policy

June 26, 2020 • By Marco Guzman

The U.S. Supreme Court last week halted an effort by the Trump administration that would have stripped DACA (Deferred Action for Childhood Arrivals) recipients of their lawful status in the country. The 5-4 ruling is a significant victory for immigrant rights advocates and over 643,000 Dreamers—as they’re known—who were brought here as children and have […]

McSally “Travel Tax Credit” Is an Invitation for Tax Avoidance

June 23, 2020 • By Matthew Gardner

Earlier this week, U.S. Sen. Martha McSally (R-AZ) introduced the “American TRIP Act,” a bill ostensibly designed to encourage Americans to boost the economy by traveling within the United States. The bill is certainly a trip in the colloquial sense of the word.

The Institute on Taxation and Economic Policy stands with activists who are guiding the movement to transform America, dismantle systemic racism in policing, and envision a better justice system. Committed protestors in big cities, small towns, and suburban enclaves have spurred a sea change in public opinion and policy possibility on policing and incarceration. Their work and activism builds on years of action by Black Lives Matter and other leaders.