Trump-GOP Tax Law

Five Things to Know on the One-Year Anniversary of the Tax Cuts and Jobs Act

December 17, 2018 • By Richard Phillips

While it has only been a year since passage of the Tax Cuts and Jobs Act (TCJA), it’s clear the law largely is both a debacle and a boondoggle. Below are the five takeaways about the legacy and continuing effect of the TCJA. 1. The Tax Cuts and Jobs Act will substantially increase income, wealth, and racial inequality. 2. The Tax Cuts and Jobs Act will continue to substantially increase the deficit. 3. The Tax Cuts and Jobs Act is not significantly boosting growth or jobs. 4. The Tax Cuts and Jobs Act continues to be very unpopular. 5. Despite…

GM Announcement Confirms Tax Cuts Don’t Prevent, May Encourage Layoffs

November 27, 2018 • By Matthew Gardner

GM’s most recent quarterly financial report reveals the company has saved more than $150 million so far this year due to last year’s corporate tax cuts. So the layoffs announcement may seem especially jarring to anyone who believed President Trump’s claim that his tax cuts would spur job creation—including the Ohio residents Trump told directly “don’t sell your homes” because lost auto-making jobs “are all coming back.”

House Democrats Falter with Proposed Rule to Restrict Tax Hikes

November 16, 2018 • By Alan Essig

Democratic leaders have proposed rules to be adopted in the next Congress, and many of them, such as eliminating the requirement for “dynamic scoring,” are very sensible. But one of the proposed rules is problematic because it would make it harder to raise revenue.

15 Companies Report an Average 10.4 Percentage Point Drop in Effective Tax Rates Since 2017

November 13, 2018 • By ITEP Staff

Comparing the year’s first three quarterly filings of 2018 with those of 2017, we find that 15 of the largest Fortune 500 companies reported worldwide effective income tax rates declining by an average of 10.4 percentage points and by as much as 16 percentage points. In total these companies owed $22.3 billion less in taxes than they would have under their 2017 effective rates, saving an average of $1.5 billion each.

Tax Cuts 2.0 Resources

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. GOP leaders wrote the bill this way to adhere to their own rule that limits how much a piece of legislation can add to the federal debt. But it’s clear that proponents planned all along to make those provisions permanent. Less than a month after the law passed, the White House and Republican leaders began calling for a second round of tax cuts. Now, they have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which…

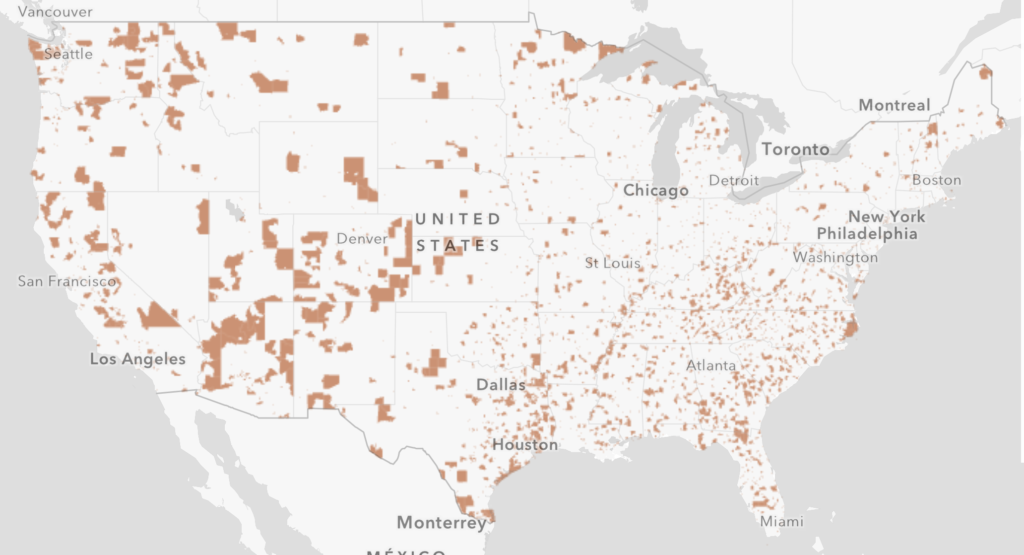

How Opportunity Zones Benefit Investors and Promote Displacement

August 10, 2018 • By ITEP Staff

The idea behind the new tax break is to provide an incentive for wealthy individuals to invest in the economies of struggling communities. Despite alleged intentions, it appears opportunity zones are turning into yet another windfall for wealthy investors and may encourage displacement of people in low-income areas, working against the provision’s intended goal.

House Republicans’ Not-So-New Tax Plan: Crumbs for Working People 2.0

July 24, 2018 • By ITEP Staff

Media Contact Rep. Kevin Brady, the top tax-writer in the House of Representatives, today called on his colleagues to make permanent the temporary provisions that were enacted as part of the Tax Cuts and Jobs Act (TCJA). These provisions, which will otherwise expire at the end of 2025, mostly benefit the richest households. As illustrated […]

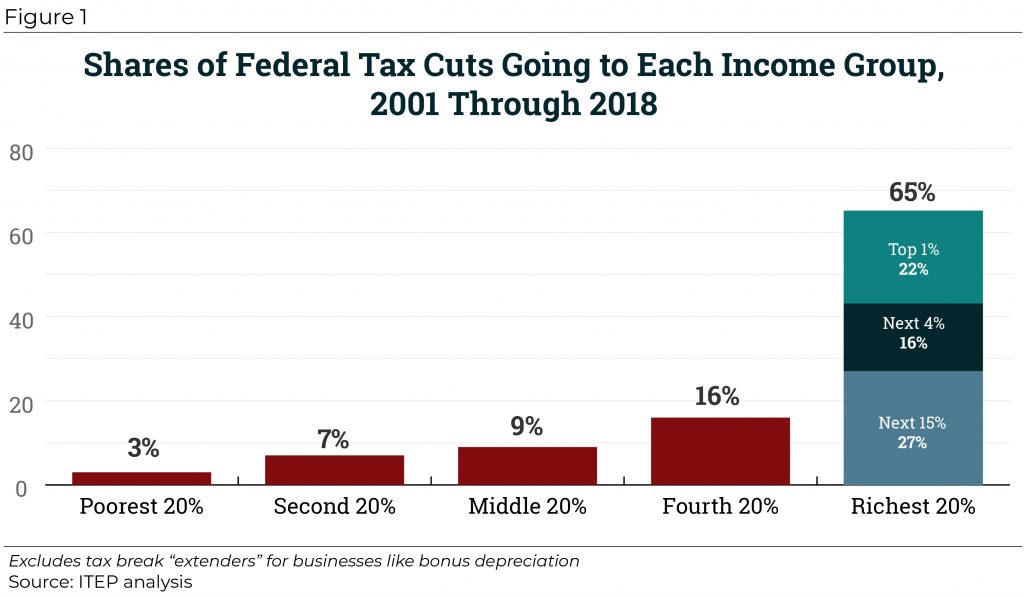

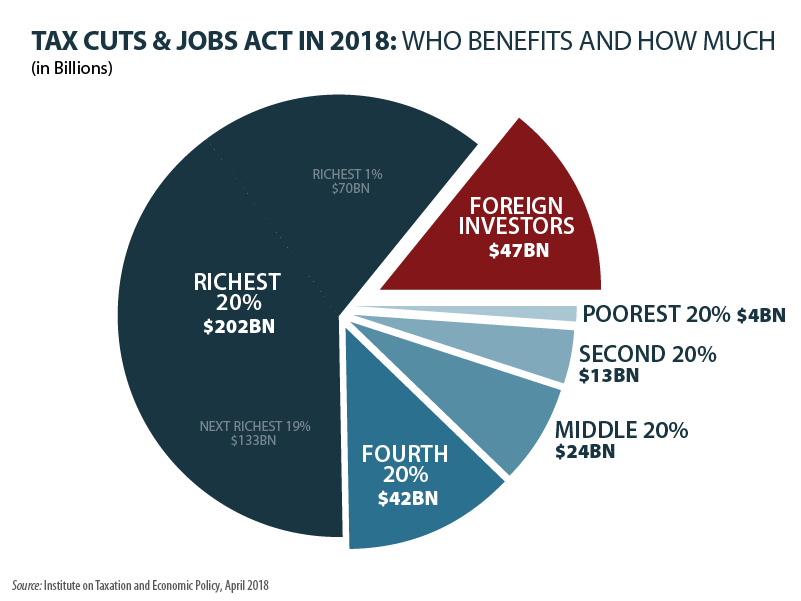

Since 2000, tax cuts have reduced federal revenue by trillions of dollars and disproportionately benefited well-off households. From 2001 through 2018, significant federal tax changes have reduced revenue by $5.1 trillion, with nearly two-thirds of that flowing to the richest fifth of Americans.

Rigging the System and Poor Shaming (Rightly) Are Incompatible Political Strategies

June 27, 2018 • By Jenice Robinson

The absurdity of blaming poor and moderate-income people for their circumstances is close to running its course as an effective political tool, particularly as some elected officials more boldly assert their intent to cater to the whims of the wealthy. Take last year’s GOP-led drive to eliminate the Affordable Care Act (ACA), for example. House […]

The New International Corporate Tax Rules: Problems and Solutions

June 6, 2018 • By Steve Wamhoff

The nation’s corporate tax system has been dysfunctional for decades. Unfortunately, the recently enacted Tax Cuts and Jobs Act (TCJA) fails to solve fundamental problems facing the corporate tax and, in some ways, makes these problems even worse.

Why Proponents of the Trump-GOP Tax Law Can’t Get their Story Straight

May 16, 2018 • By Steve Wamhoff

If you listened closely to today’s House Ways and Means Committee hearing on the Tax Cuts and Jobs Act (TCJA), you could sense that the witnesses speaking in favor of the new tax law were not 100 percent on the same page. This has been apparent ever since the law was enacted at the end of last year. The economists who speak in favor of the law (including Douglas Holtz-Eakin at today’s hearing) tend to focus on other indicators of its success. They know that the talk of bonuses and raises is nothing more than a desperate corporate PR campaign…

There Is No Evidence That the New Tax Law Is Growing Our Economy or Creating Jobs

May 15, 2018 • By Steve Wamhoff

The House Ways and Means Committee will hold a hearing on the Tax Cuts and Jobs Act (TCJA) Wednesday. Proponents of the law likely will use the occasion to tout its alleged economic benefits and argue that its temporary provisions should be made permanent. The title of the hearing is “Growing Our Economy and Creating Jobs,” but there is little evidence that the law does either of these things.

No Work Requirements for the Richest 1 Percent — Most of Their Tax Cuts Are for Unearned Income

May 10, 2018 • By Steve Wamhoff

The Trump Administration is pushing to add or strengthen work requirements for programs that benefit low- and middle-income people but holds a different view when it comes to the wealthy. Most tax cuts enjoyed by the richest 1 percent of households under the recently enacted Tax Cuts and Job Act (TCJA) are tax cuts for unearned income.

Apple’s Three-Month Tax Savings under President Trump’s New Tax Law: $1.68 Billion

May 2, 2018 • By Matthew Gardner

By now, it should come as no shock that profitable Fortune 500 corporations are reaping huge benefits from the corporate tax cuts enacted last December. But as first quarter earnings reports are released, we’re learning just how big.

Trump Administration’s Spending Priorities Echo Tax Cut Priorities: Punish the Poor and Lavish the Rich

April 27, 2018 • By ITEP Staff, Jenice Robinson, Misha Hill

In 2017, the Trump Administration released a budget proposal filled with loaded language about “welfare reform” and moving able-bodied people from welfare to work. This narrative is designed to perpetuate the pernicious idea that poor people have personal shortcomings and are taking something that rightly belongs to others.

Congressional Budget Office: New Tax Law Helps Foreign Investors Even More than You Thought

April 19, 2018 • By Steve Wamhoff

President Trump and his allies in Congress have made many wild claims about economic growth that would result from the Tax Cuts and Jobs Act. And the Congressional Budget Office just released a report revealing the TCJA will, in fact, create economic growth — for foreign investors.

Everyone pays taxes, including those who earn the least. Our collective federal, state, and local tax system includes income taxes, payroll taxes (Social Security, Medicare), property taxes, sales and other excise taxes. The total share of taxes (federal, state, and local) that Americans across the economic spectrum will pay in 2018 is roughly equal to their total share of income.

New ITEP Report: Extension of the Temporary TCJA Provisions Would Be Just as Regressive as TCJA Itself

April 10, 2018 • By Steve Wamhoff

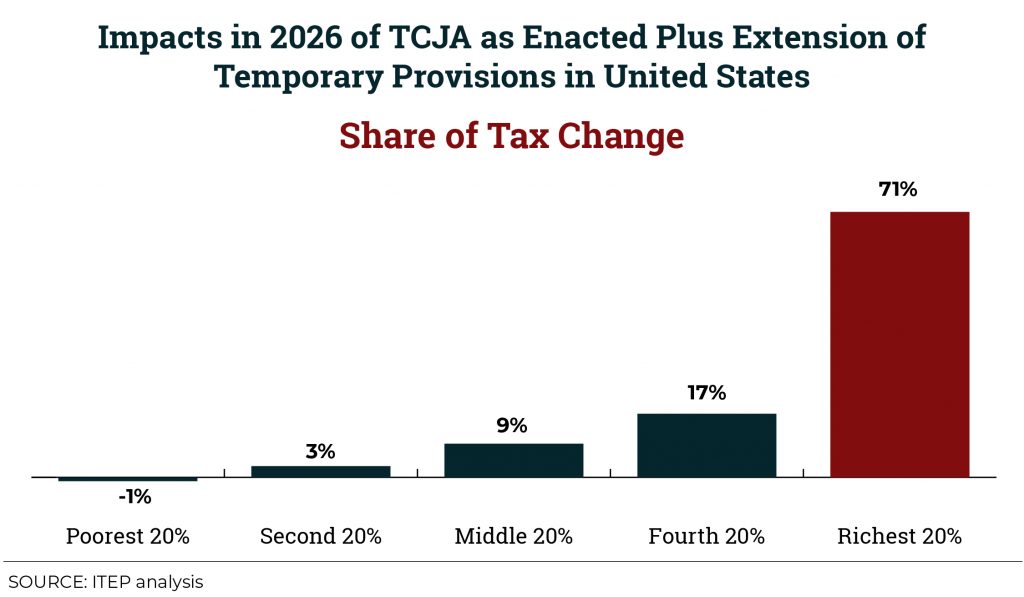

A new ITEP report estimates the impacts in every state of the much-discussed idea of extending the temporary provisions in the Tax Cuts and Jobs Act, which will expire after 2025 without further action from Congress. The report concludes that extending or making permanent these provisions would be just as skewed to the wealthy as the original law.

Same Old Same: 50-State Analysis Finds Extending the New Tax Law’s Temporary Provisions Would Mainly Benefit the Wealthy

April 10, 2018 • By ITEP Staff

While rhetoric may bill this tax law and proposed extension as a middle-class tax cut, the data tell the real story: the Trump-GOP tax law was and remains a giveaway to corporations and the wealthy.

Extensions of the New Tax Law’s Temporary Provisions Would Mainly Benefit the Wealthy

April 10, 2018 • By Matthew Gardner, Steve Wamhoff

This analysis finds that extending the temporary tax provisions in 2026 would not be aimed at helping the middle-class any more than TCJA as enacted helps the middle-class in 2018.

Is the Trump Organization’s Sales Tax Avoidance More Aggressive Than Amazon’s?

April 6, 2018 • By Carl Davis

In recent weeks, President Trump has been raking Amazon over the coals for failing to collect state and local sales taxes on many of the company’s sales—a criticism that has some merit. But a new story first reported by James Kosur at RedStateDisaster, and then picked up today by the Wall Street Journal, provides fascinating insight into the sales tax collection habits of the Trump Organization’s “official retail website,” TrumpStore.com.

How Much Will Typical Middle-Class Workers Really See Their Paychecks Change?

February 3, 2018 • By Steve Wamhoff

The campaign by Republican leaders in Congress to promote their new tax law has two prongs. One is the claim that corporate income tax cuts are already trickling down to workers, which, as we have explained, is believed by basically no economists anywhere. The other prong of their campaign is to argue that the personal income tax cuts will provide a noticeable decline in withholding from paychecks that middle-class people will notice soon. At this point, it’s helpful to look at some actual data and see how small the boost in take-home pay will really be for most Americans.

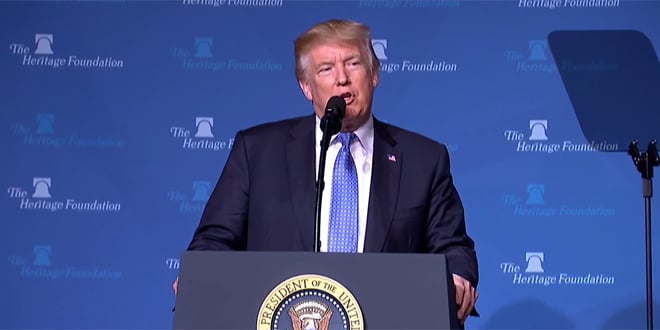

How Exxon’s Empty $50 Billion Promise Made Its Way into Trump’s SOTU

January 31, 2018 • By Matthew Gardner

Never one to let the truth get in the way of a good story, House Speaker Paul Ryan immediately published a press release with the headline, “ExxonMobil to Invest an Additional $50 Billion in the U.S. Due to Tax Reform.” The statement was completely faithful to ExxonMobil’s statement, except for the words “additional” and “due to tax reform.” Not to be outdone, President Trump implied during his State of the Union address that the company was investing $50 billion in response to the new tax law. But a closer examination of ExxonMobil’s recent history of domestic spending finds that the…

Fact-Checking Trump’s State of the Union Address on Tax Issues

January 31, 2018 • By Steve Wamhoff

Here are some claims the President made during his State of the Union address, along with the facts.

Moody’s and Conservative Economists Agree: The Trump Corporate Tax Cut Is Not Helping Workers

January 26, 2018 • By Steve Wamhoff

Moody’s does not believe that corporate tax cuts are trickling down to working people as bonuses and pay raises. The real problem with the corporate PR campaign is that even those economists who supported Trump’s corporate tax cut and claimed it would help workers do not believe that it works this way.