ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

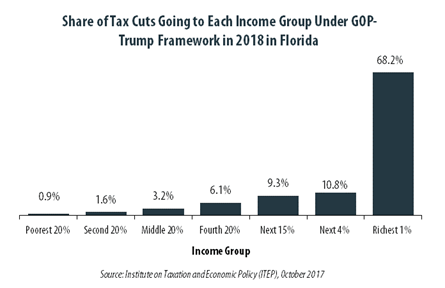

GOP-Trump Tax Framework Would Provide Richest One Percent in Florida with 68.2 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Florida equally. The richest one percent of Florida residents would receive 68.2 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $620,400 next year. The framework would provide them an average tax cut of $130,300 in 2018, which would increase their income by an average of 4.7 percent.

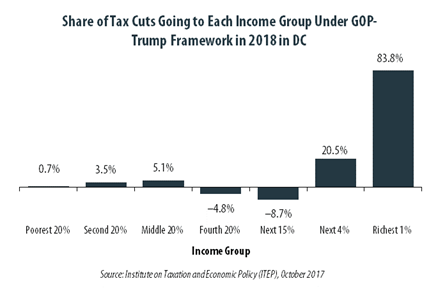

GOP-Trump Tax Framework Would Provide Richest One Percent in The District of Columbia with 83.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in the District equally. The richest one percent of District of Columbia residents would receive 83.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $1,022,000 next year. The framework would provide them an average tax cut of $147,500 in 2018, which would increase their income by an average of 4.9 percent.

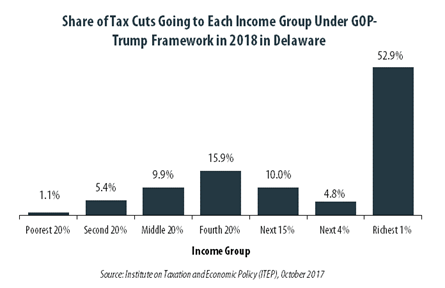

GOP-Trump Tax Framework Would Provide Richest One Percent in Delaware with 52.9 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Delaware equally. The richest one percent of Delaware residents would receive 52.9 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $497,100 next year. The framework would provide them an average tax cut of $49,370 in 2018, which would increase their income by an average of 2.7 percent.

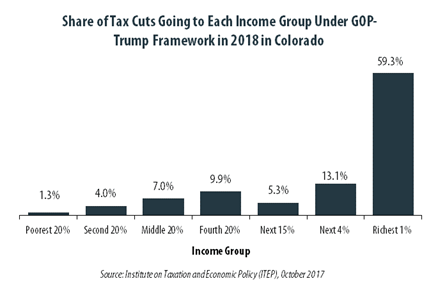

GOP-Trump Tax Framework Would Provide Richest One Percent in Colorado with 59.3 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Colorado equally. The richest one percent of Colorado residents would receive 59.3 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $637,800 next year. The framework would provide them an average tax cut of $86,480 in 2018, which would increase their income by an average of 4.7 percent.

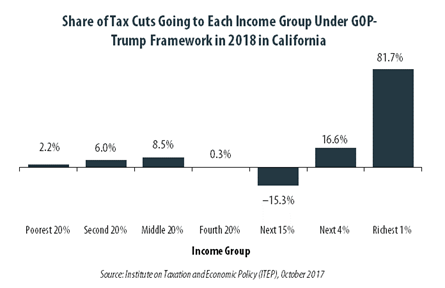

GOP-Trump Tax Framework Would Provide Richest One Percent in California with 81.7 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in California equally. The richest one percent of California residents would receive 81.7 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $864,900 next year. The framework would provide them an average tax cut of $90,160 in 2018, which would increase their income by an average of 3.3 percent.

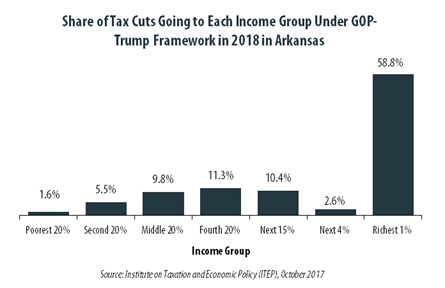

GOP-Trump Tax Framework Would Provide Richest One Percent in Arkansas with 58.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Arkansas equally. The richest one percent of Arkansas residents would receive 58.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $490,000 next year. The framework would provide them an average tax cut of $51,370 in 2018, which would increase their income by an average of 3.8 percent.

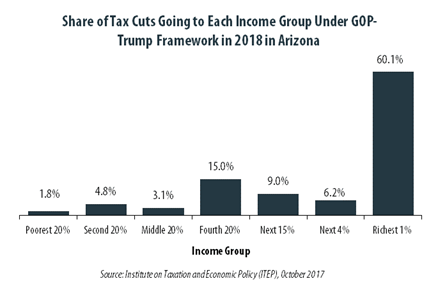

GOP-Trump Tax Framework Would Provide Richest One Percent in Arizona with 60.1 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Arizona equally. The richest one percent of Arizona residents would receive 60.1 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $470,200 next year. The framework would provide them an average tax cut of $59,210 in 2018, which would increase their income by an average of 4.4 percent.

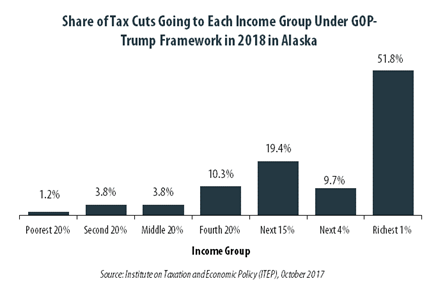

GOP-Trump Tax Framework Would Provide Richest One Percent in Alaska with 51.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Alaska equally. The richest one percent of Alaska residents would receive 51.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $615,800 next year. The framework would provide them an average tax cut of $77,880 in 2018, which would increase their income by an average of 5.5 percent.

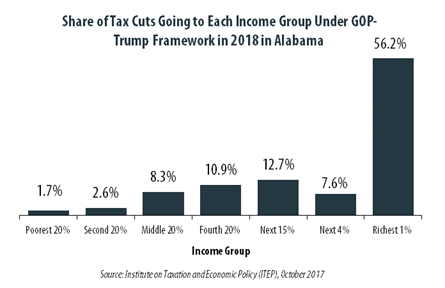

GOP-Trump Tax Framework Would Provide Richest One Percent in Alabama with 56.2 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Alabama equally. The richest one percent of Alabama residents would receive 56.2 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $501,800 next year. The framework would provide them an average tax cut of $49,830 in 2018, which would increase their income by an average of 3.5 percent.

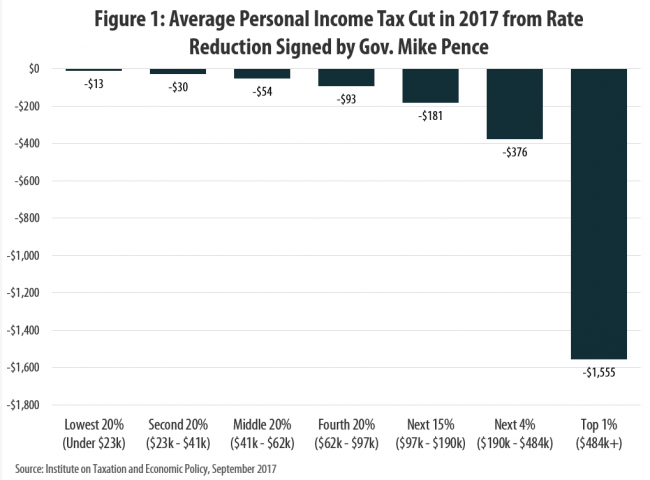

Indiana’s Tax Cuts Under Mike Pence Are Not a Model for the Nation

September 29, 2017 • By Carl Davis

In announcing a new tax cut framework this week in Indianapolis that was negotiated with House and Senate leaders, President Trump claimed that “Indiana is a tremendous example of the prosperity that is unleashed when we cut taxes and set free the dreams of our citizens …. In Indiana, you have seen firsthand that cutting taxes on businesses makes your state more competitive and leads to more jobs and higher paychecks for your workers.”

State Rundown 9/28: Wisconsin Budget Finalized, Oklahoma Special Session Underway

September 28, 2017 • By ITEP Staff

This week, Wisconsin's leaders finalized the state budget at last, while those in Oklahoma began a special session to close their state's revenue shortfall. Soda tax fights made news in Illinois and Pennsylvania. And New Jersey offered Amazon $5 billion in tax subsidies.

Dallas Fed: Texas Taxes: Who Bears the Burden?

September 26, 2017

...Overall, the state’s tax system is less equal across income quintiles than the national average. A key reason is the state’s reliance on the sales tax, which as a share of income is 8.6 percent for those in the bottom quintile but only 2.2 percent in the top quintile...

State Rundown 9/25: No Rest for the Weary as State Tax and Budget Debates Wind Down, Ramp Up

September 25, 2017 • By ITEP Staff

Last week, Wisconsin leaders finally came to agreement on a state budget, while their peers in Connecticut appear to be close behind them. Iowa lawmakers avoided a special session with a short-term fix and will have to return to their structural deficit issues next session, as will those in Louisiana who will face a $1 billion shortfall. Meanwhile, District of Columbia leaders have already resumed meeting and discussing tax and budget issues there.

New Jersey Policy Perspective: Reforming New Jersey’s Income Tax Would Help Build Shared Prosperity

September 15, 2017

Today, the most well-off New Jerseyans hold a greater share of the state’s income than they have in nearly a century, thanks to decades of unequal economic growth, creating an off-balance economy in which many middle- and lower-income New Jerseyans face barriers to economic opportunity. Recent tax policy changes have exacerbated this trend.

The Commonwealth Institute: We Need More than Wishful Thinking: A Closer Look at the Candidates’ Tax Plans

September 15, 2017

Issue platforms by the current candidates for Virginia governor, including Republican candidate Ed Gillespie, Libertarian candidate Cliff Hyra, and Democratic candidate Ralph Northam, include proposals to modify or eliminate Virginia’s local business taxes, modify Virginia’s individual income tax, and eliminate the state portion of Virginia’s sales tax on groceries. All of these proposals would reduce local or state revenue collections.

State Rundown 9/13: The Year of Unprecedented State Budget Impasses Continues

September 13, 2017 • By ITEP Staff

This week, Pennsylvania lawmakers risk defaulting on payments due to their extremely overdue budget and Illinois legislators will borrow billions to start paying their backlog of unpaid bills. Governing delves into why there were more such budget impasses this year than in any year in recent memory. And Oklahoma got closure from its Supreme Court on whether closing special tax exemptions counts as "raising taxes" (it doesn't).

State Rundown 9/6: Most Statehouses Quiet, Many Pondering Harvey’s Impacts

September 7, 2017 • By ITEP Staff

It's been a quiet week for tax policy in most states, though lawmakers are still making noise in Pennsylvania, where a budget agreement is still needed, and in Wisconsin, where legislators are searching for the will to raise revenue for the state's ailing transportation infrastructure. In our "What We're Reading" section you'll find interesting reading on the fiscal fallout of Hurricane Harvey, as well as an in-depth series on how states' disaster response needs are likely to continue to increase.

State Rundown 8/31: Modernizing Taxes is Sometimes a Sprint, Sometimes a Marathon

August 31, 2017 • By ITEP Staff

Tax and budget debates are progressing at different paces in different parts of the country this week. In Connecticut and Wisconsin, lawmakers hope to finally settle their budget and tax differences soon. In South Dakota, a court case that could finally enable states to enforce their sales taxes on online retailers inches slowly closer to the U.S. Supreme Court.

Private School Voucher Credits Offer a Windfall to Wealthy Investors in Some States

August 30, 2017 • By Carl Davis

State lawmakers who want to send public dollars to private schools have devised a shrewd tactic for getting around political and constitutional obstacles that make it difficult to do so. These lawmakers found a way to pay high-income taxpayers to fund those schools on states’ behalf, sometimes even offering those taxpayers a tidy profit in […]

Washington Post: Ahead of regional summit, left-leaning policy groups say ‘No’ to a sales tax for Metro

August 28, 2017

A regionwide one-cent sales tax to fund Metro would have a disproportionate impact on poor families, taking five times the share of income from the bottom 20 percent of earners when compared with those in the top 1 percent, according to a new analysis from a trio of left-leaning think tanks representing the District, Maryland and Virginia.

DC Fiscal Policy Institute, Maryland Center on Economic Policy, and The Commonwealth Institute: Triple Whammy: A Regional Sales Tax for Metro, Like Fare Hikes and Service Cuts, Would Fall Hardest on Struggling Families

August 28, 2017

A strong Metro system is important to all of us in the Washington region. And everyone agrees that the Metro system needs new resources to rebuild its health. But a regional sales tax—a widely discussed option—would be an unfair way to pay for it.

NC Policy Watch: In N.C., 42% of Trump’s proposed tax cuts would go to the few making more than $1 million

August 25, 2017

A newly released report confirms that the White House is not really interested in tax reform that helps “ordinary Americans”. Instead, under President Trump’s proposed tax cut plan, “ordinary Americans” will hardly benefit at all, as nearly half of Trump’s proposed tax cuts would go to people making more than $1 million annually.

State Rundown 8/23: Few Lingering Budget Debates Cannot Linger Much Longer

August 23, 2017 • By ITEP Staff

This week, Oklahoma lawmakers learned they'll need to enter a special session to balance their budget and that they'll likely face a lawsuit over their low funding of public education. Pennsylvania's budget stalemate is also coming to a head as the state literally runs out of funds to pay its bills. And Amazon's tax practices are in the news again as the company has been sued in South Carolina.

In North Carolina 42.4 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the North Carolina population (0.5 percent) earns more than $1 million annually. But this elite group would receive 42.4 percent of the tax cuts that go to North Carolina residents under the tax proposals from the Trump administration. A much larger group, 50.8 percent of the state, earns less than $45,000, but would receive just 5.9 percent of the tax cuts.

In North Dakota 44.5 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the North Dakota population (0.5 percent) earns more than $1 million annually. But this elite group would receive 44.5 percent of the tax cuts that go to North Dakota residents under the tax proposals from the Trump administration. A much larger group, 42.2 percent of the state, earns less than $45,000, but would receive just 3.9 percent of the tax cuts.