ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Trump Administration’s Decision to End Direct File is Another Gift to Big Corporations

April 16, 2025 • By ITEP Staff

Contact: Jon Whiten ([email protected]) According to multiple reports, the Trump administration plans to eliminate the IRS Direct File program, a free electronic system for filing tax returns directly to the agency. Statement from ITEP Executive Director Amy Hanauer “The tax preparation industry has for years lobbied to prevent the IRS from providing a tool to […]

Sharp Turn in Federal Policy Brings Significant Risks for State Tax Revenues

April 9, 2025 • By Carl Davis

Summary The new presidential administration and Congress have indicated that they intend to bring about a dramatic federal retreat in funding for health care, food assistance, education, and other services that will push more of the responsibility for providing these essential services to the states. Meeting these new obligations would be a challenging task for […]

A Windfall for the Wealthy: A Distributional Analysis of Mississippi HB 1

April 8, 2025 • By Aidan Davis, Dylan Grundman O'Neill, Neva Butkus

Mississippi lawmakers have approved the most radical and costly change to the state’s personal income tax system to date. House Bill 1 ultimately eliminates the state's personal income tax and cuts state revenues by nearly $2.7 billion a year when fully implemented. This deeply regressive legislation will create a windfall for the wealthiest residents of the poorest state in the nation while simultaneously jeopardizing the state’s ability to fund public services that support Mississippians and the state’s economy.

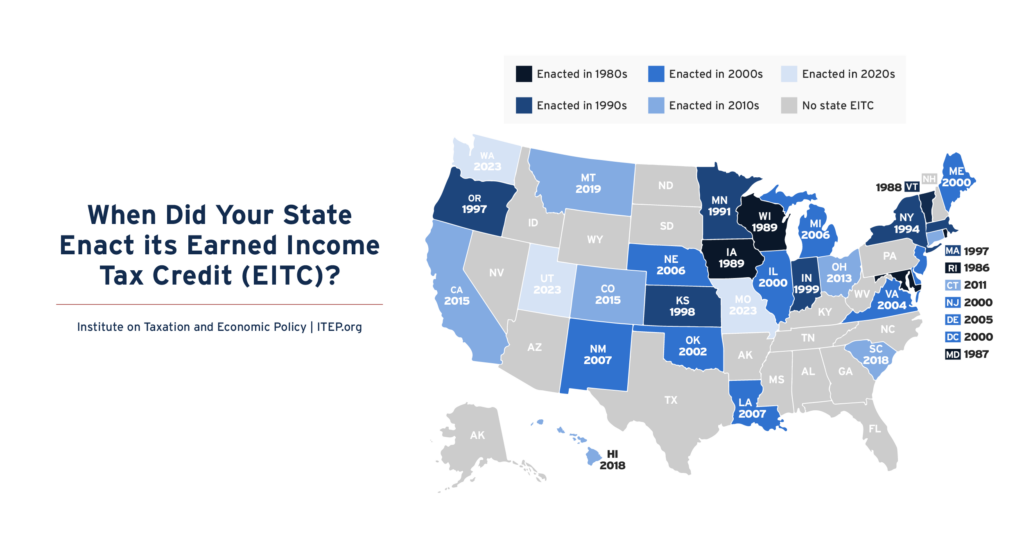

The Earned Income Tax Credit (EITC) supports millions of workers and families and continues to grow in states and localities across the country. Today, 31 states plus the District of Columbia and Puerto Rico offer EITCs. Local EITCs can also now be found in Montgomery County, Maryland, New York City, and San Francisco, where they benefited 700,000 households in 2023.

This week, we celebrate 50 years of the federal Earned Income Tax Credit (EITC) and the impact it's had on millions of workers and families. In 2023 alone, the latest year of available data, the federal EITC alongside the refundable portion of the Child Tax Credit lifted 6.4 million people and 3.4 million children out of poverty.

Advantaging Affluence: A Distributional Analysis of Missouri HB 798’s Uneven Tax Cuts for Wealth and Work

March 28, 2025 • By Aidan Davis, Carl Davis, Dylan Grundman O'Neill, Eli Byerly-Duke, Matthew Gardner

Missouri House Bill 798 would reduce personal and corporate income tax rates, fully eliminate taxes on capital gains income from sale of assets, and eliminates the state’s modest Earned Income Tax Credit that assists many working people in lower-paid jobs. HB 798 would radically transform Missouri’s income tax code into a system that privileges income from wealth over income from work, leaving many middle-income families to pay a higher income tax rate than wealthy people living off their investments.

Ben Coll

March 28, 2025 • By ITEP Staff

Ben joined ITEP as a developer in 2025 and builds internal and external tools to advance ITEP’s mission. Prior to joining ITEP, Ben spent over 10 years working as the web and IT project manager for a national non-profit in the health and beauty industry.

The U.S. needs a tax code that is more adequate, meaning any major tax legislation should increase revenue, not reduce it. The U.S. also needs a tax code that is more progressive, meaning any significant tax legislation should require more, not less, from those most able to pay.

Jessica Vela

March 24, 2025 • By ITEP Staff

Jessica is a Federal Policy Analyst who supports ITEP with research and analysis of progressive tax priorities. Prior to joining ITEP in 2025, Jessica worked for the Center for American Progress, where she researched federal tax and budget policies. She graduated from Middlebury College with a degree in International Politics and Economics.

Shelter Skelter: How the Educational Choice for Children Act Would Use Tax Avoidance to Fuel School Privatization

March 18, 2025 • By Carl Davis

The Educational Choice for Children Act of 2025 would ostensibly provide a tax break on charitable donations to organizations that give out private K-12 school vouchers. Most of the so-called “contributions,” however, would be made by wealthy people solely for the tax savings, as those savings would typically be larger than their contributions.

A Revenue Impact Analysis of the Educational Choice for Children Act of 2025

March 18, 2025 • By Carl Davis

The Educational Choice for Children Act of 2025 would provide donors to nonprofit groups that distribute private K-12 school vouchers with a dollar-for-dollar federal tax credit in exchange for their contributions. In total, the ECCA would reduce federal and state tax revenues by $10.6 billion in 2026 and by $136.3 billion over the next 10 years. Federal tax revenues would decline by $134 billion over 10 years while state revenues would decline by $2.3 billion.

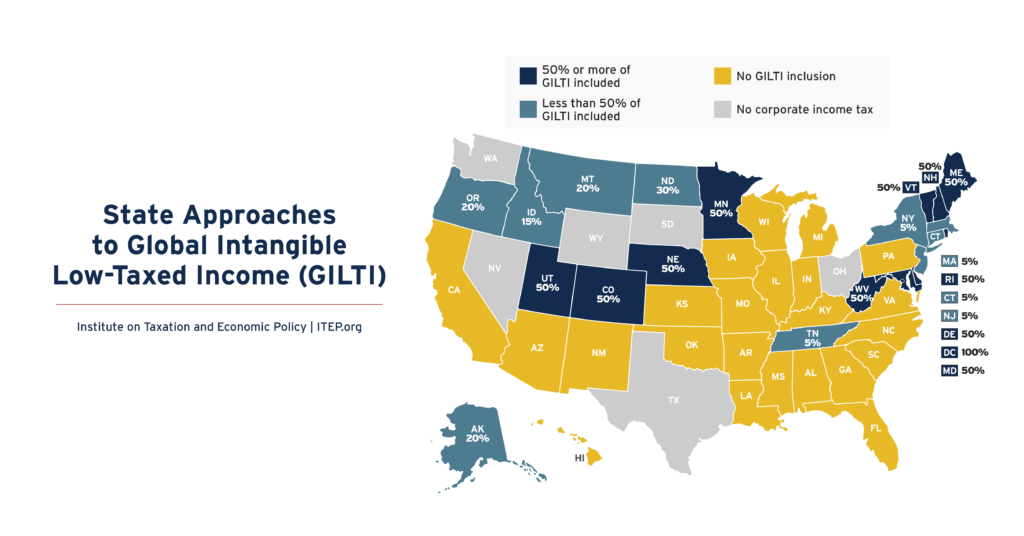

Many states with corporate income taxes include some amount of federally defined Global Intangible Low-Taxed Income (GILTI) in their tax bases. Twenty-one states plus D.C. include some amount of GILTI in their tax calculations in 2025.

Proposed Missouri Tax Shelter Would Aid the Wealthy, Anti-Abortion Centers Alike

March 6, 2025 • By Carl Davis

In Missouri, donations to anti-abortion pregnancy resource centers come with state tax credits valued at 70 cents on the dollar. One bill currently being debated in the state would increase that matching rate to 100 percent—that is a full, state-funded reimbursement of gifts to anti-abortion groups.

In last night’s address to Congress, President Trump spent more time insulting Americans, lying, and bragging than he did talking about taxes. But regardless of what President Trump and Elon Musk talk about most loudly and angrily, there is one clear policy that they and the corporations and billionaires that support them will try hardest […]

The budget resolution passed by House Republicans will enrich the richest, blow up the deficit, and decimate vital public services. The budget resolution allows Congress to pass reconciliation legislation with $4.5 trillion in tax cuts that would mostly flow to the wealthiest families in the country. Congressional Republicans have no way to pay for the massive tax cuts promised by President Trump during his campaign other than to dismantle fundamental parts of the government and increase the federal budget deficit.

Sarah Austin

February 24, 2025 • By ITEP Staff

Sarah is a Senior Analyst at ITEP. She focuses her research on progressive revenue-raising options for states. Before joining ITEP in 2025, Sarah served as senior policy advisor to the Speaker of the Maine House of Representatives. Prior to that, she served as the research and policy director at the Maine Center for Economic Policy […]

Revenue Effect of Mandatory Worldwide Combined Reporting by State

February 21, 2025 • By ITEP Staff

Universal adoption of mandatory worldwide combined reporting (WWCR) in states with corporate income taxes would boost state tax revenue by $18.7 billion per year. The revenue effects of mandatory WWCR would vary across states. We estimate that 38 states and the District of Columbia would experience revenue increases totaling $19.1 billion. The top 10 states […]

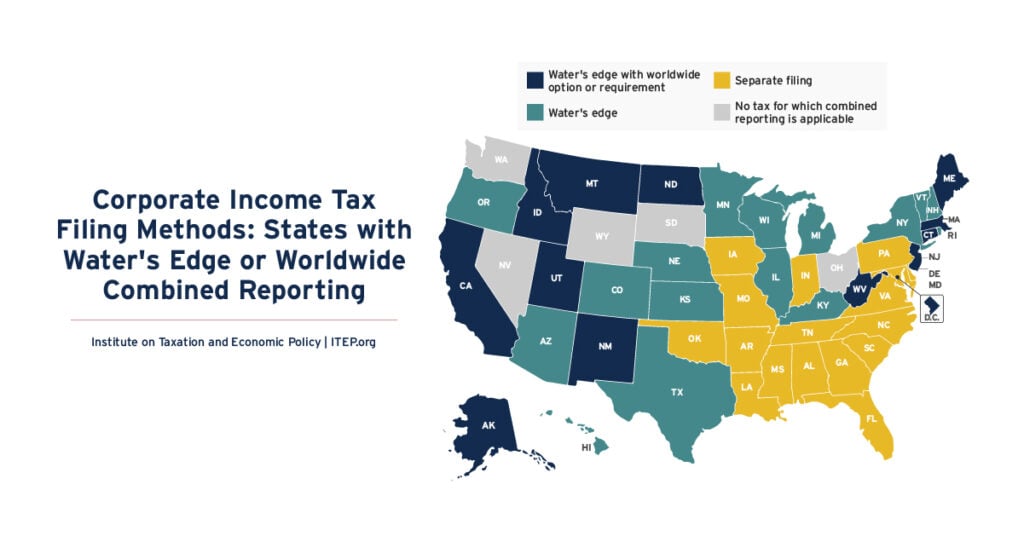

Corporate Income Tax Filing Methods: States with Water’s Edge or Worldwide Combined Reporting

February 21, 2025 • By ITEP Staff

The purpose of state corporate income taxes is to tax the profit, or net income, an incorporated business earns in each state. Ascertaining the state where profits are earned is, however, complicated for companies that conduct business in multiple jurisdictions. Twenty-eight states plus D.C. now require a limited version of combined reporting called “water’s edge” […]

Michael Mazerov

February 20, 2025 • By ITEP Staff

Michael Mazerov is a member of ITEP’s Board of Directors. He previously served as a Senior Fellow at the Center on Budget and Policy Priorities and as Director of Policy Research at the Multistate Tax Commission.

A Revenue Analysis of Worldwide Combined Reporting in the States

February 20, 2025 • By Carl Davis, Matthew Gardner, Michael Mazerov

Universal adoption of mandatory worldwide combined reporting would boost state corporate income tax revenues by roughly 14 percent. Thirty-eight states and the District of Columbia would experience revenue increases totaling $19.1 billion.

Turning IRS Agents to Deportation Will Reduce Public Revenues

February 11, 2025 • By Carl Davis, Jon Whiten

The Trump Administration’s plan to turn IRS agents into deportation agents will result in lower tax collections in addition to the harm done to the families and communities directly affected by deportations.

The Five Biggest Corporations Represented at Trump’s Inauguration Could Save $75 Billion from One Tax Break Before Congress

February 11, 2025 • By Matthew Gardner, Spandan Marasini

New financial reports indicate five of America’s biggest corporations—Alphabet, Amazon, Apple, Meta, and Tesla—could win $75 billion in tax breaks if Congress and the President satisfy demands from corporate lobbyists to reinstate a provision repealed under the 2017 Trump tax law.

Local income taxes can be an important progressive revenue raiser, as they ask more of higher-income households and are connected to ability to pay. They can raise substantial revenue to fund key public services to make cities and regions better off.

Maryland Gov. Wes Moore’s Tax Plan Boosts Revenue, Increases Fairness

January 30, 2025 • By Miles Trinidad, Nick Johnson

Maryland’s Gov. Wes Moore put forward a tax reform plan that would make the tax system fairer, simpler, and better able to meet the state’s needs. The proposed changes to the income tax ask more of those at the top and provide an average tax cut for those earning less.

Tesla Reported Zero Federal Income Tax on $2 Billion of U.S. Income in 2024

January 30, 2025 • By Matthew Gardner

Tesla reported $2.3 billion of U.S. income in 2024 but paid zero federal income tax. Over the past three years, the Elon Musk-led company reports $10.8 billion of U.S. income on which its current federal tax was just $48 million.