ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

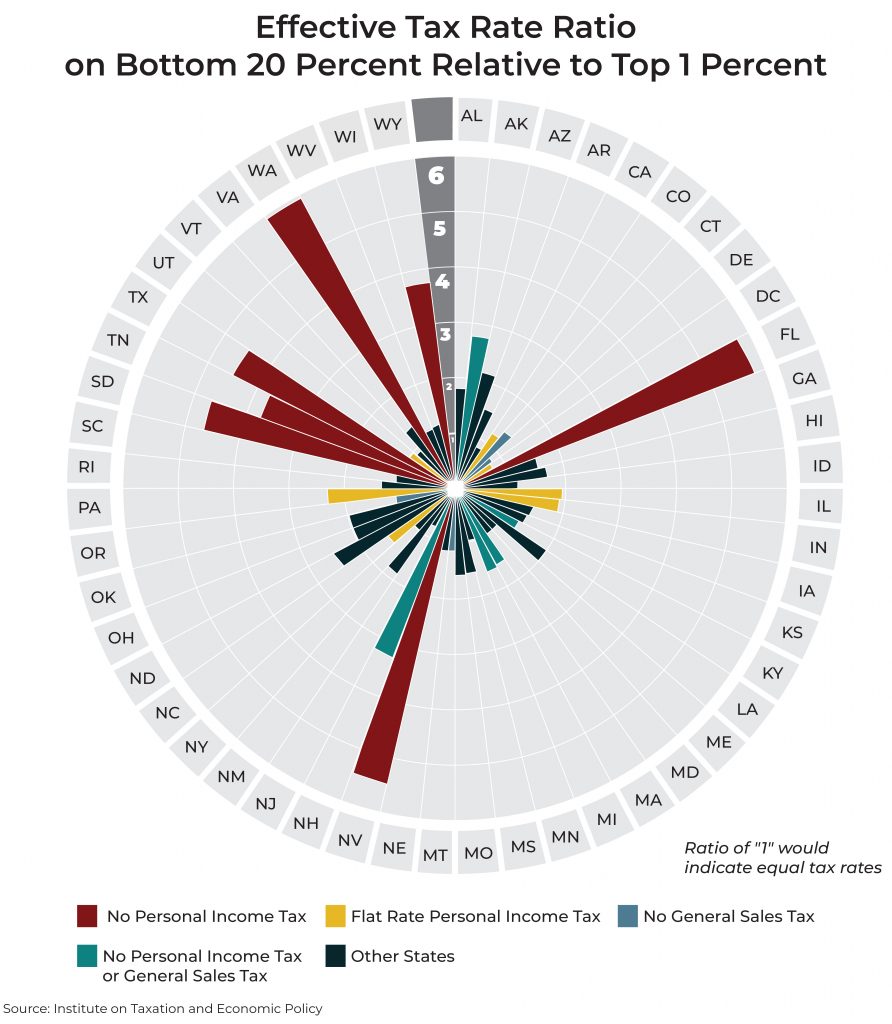

- Who Pays?

Fairness Matters: A Chart Book on Who Pays State and Local Taxes

March 6, 2019 • By ITEP Staff

There is significant room for improvement in state and local tax codes. State tax codes are filled with top-heavy exemptions and deductions and often fail to tax higher incomes at higher rates. States and localities have come to rely too heavily on regressive sales taxes that fail to reflect the modern economy. And overall tax collections are often inadequate in the short-run and unsustainable in the long-run. These types of shortcomings provide compelling reason to pursue state and local tax reforms to make these systems more equitable, adequate, and sustainable.

Georgia Budget and Policy Institute: Georgia Work Credit Grows the Middle Class

March 5, 2019

A non-refundable Georgia Work Credit would cut state taxes for more than 700,000 lower and middle-income households by up to $475. The Institute on Taxation and Economic Policy estimates that adopting this policy would be equivalent to investing $130 million annually in Georgia families. Read more here

Education Department Tax Credit Proposal Would Undermine Public Schools

February 28, 2019 • By Carl Davis

The Education Department today announced a proposed new federal tax credit for so-called school choice. The $5 billion proposal would give those who donate to private school voucher programs a tax credit. Following is a statement by Carl Davis, research director at the Institute on Taxation and Economic Policy.

Public News Service: Could Fast-Moving Tax-Cut Proposal Blow WV Budget?

February 27, 2019

House Bill 3137 would create a fund where new money, including out-of-state online sales taxes, would go. Then, each time that fund reached a certain level, it would trigger compounding cuts in state income taxes. Ted Boettner, executive director of the West Virginia Center on Budget and Policy, said some lawmakers may not realize they […]

State tax policy can be a contentious topic, but one issue on which lawmakers largely agree is that higher gas tax rates are necessary to keep our nation’s infrastructure operating safely and efficiently. Lawmakers in 27 states have approved gas tax increases since 2013.

Chicago Resilient Families Task Force: Big Shoulders, Bold Solutions: Economic Security for Chicagoans

February 25, 2019

People with low and middle-incomes are financially savvy in ways that are often underestimated, but despite this are on thin ice financially. Despite doing all the right things, they are caught in a trap that is very hard to escape. Wages are falling behind and jobs are increasingly structured in ways that foster precariousness instead […]

West Virginia Center on Budget & Policy: House Income Tax Cut Plan Mostly Benefits Wealthy and Puts Large Holes in the State Budget (HB 3137)

February 25, 2019

According to the Institute on Taxation and Economic Policy, a one-percentage reduction in each personal income tax rate would give a West Virginian with an income between $36,000 and $56,000 an average tax cut of $231 compared to $6,044 for someone in the top 1 percent with an income of above $451,000. This means someone […]

Bloomberg: Amazon Doesn’t Plan to Pay the IRS Anything This Tax Season

February 22, 2019

The fact that Amazon can legally reduce its tax bill to nothing calls into question the effectiveness of the code, said Matthew Gardner, a senior fellow at the Institute of Taxation and Economic Policy. While those breaks have the backing of Congress and were implemented for some social or economic policy goal, they might be […]

InsideSources: Amazon Paid Zero Corporate Taxes Last Year. Why Aren’t 2020 Democrats Talking About It?

February 22, 2019

“I blame Congress,” says Matt Gardner, a senior fellow at the Institute on Taxation and Economic Policy which first released the news of Amazon’s zero corporate tax bill. “Unless we see the actual tax returns, nobody can say exactly how Amazon avoided paying any corporate income taxes, but the available information makes it clear that […]

Financial Post: Lawrence Solomon: Amazon Is Fleecing Taxpayers. Strangely, Socialists Are the Ones Saving Us

February 22, 2019

According to the non-partisan Institute on Taxation and Economic Policy, while profitable major corporations have paid an average of over 21 per cent in federal taxes, over the last 10 years Amazon’s use of tax loopholes has lowered its average to just three per cent. In the last two years, during which it earned US$16.8 billion in profits, it paid no federal income tax at all, thanks to its use of unspecified tax credits and executive stock options.

The Guardian: Why Didn’t Amazon Pay Federal Taxes for the Second Consecutive Year?

February 22, 2019

Amazon is already getting plenty of benefits from the federal government. The company nearly doubled its profits to $11.2bn in 2018 from $5.6bn the year before and, for the second year running didn’t pay a single cent of federal income tax. In fact, Amazon reported a federal income tax rebate for the past two years totalling almost $270m according to the Institute on Taxation and Economic Policy analysis of Securities and Exchange Commission filings. Netflix also paid no federal or income tax on profits of $845m last year.

Irish Examiner: New EU Competition Commissioner Must Take on US Tech Giants, Says ISME

February 21, 2019

“The Institute on Taxation and Economic Policy report in Washington DC has noted that Amazon enjoyed a negative tax rate in the US in 2018. That is not a misprint. “On $10.8bn of US profits in 2018, Amazon got a tax rebate of $130m, equivalent to an effective tax rate of -1.2%.” Mr McDonnell concluded: […]

Think Progress: U.S. Banks Raked in Record Profits Thanks to GOP Tax Bill

February 21, 2019

Because of the corporate tax cut, massive corporations like Amazon, which is valued at nearly $800 billion, will pay $0 in federal taxes this year. In fact, the company is expecting a federal refund of nearly $129 billion. This essentially puts Amazon at a federal income tax rate of -1 percent this year, after paying a federal rate of more than 11 percent from 2011 to 2016. This is the second year in a row that Amazon has not paid any federal taxes. The Institute on Taxation and Economic Policy (ITEP) suggests that this is due to a combination of…

Truck-Only State Tolls Roil Industry That Favors Fuel-Tax Hike

February 20, 2019

Two dozen states have raised fuel taxes since 2013, according to the Institute on Taxation and Economic Policy, which encourages states to take the lead in fixing their roads. All but 11 have raised fuel taxes since the last increase in the federal fuel tax in 1993, according to the American Transportation Research Institute, the ATA’s research […]

The Columbian: In Our View: Amazon HQ2 Outcome Leaves Much to Unpack

February 20, 2019

But at the same time, growing wealth disparity throughout the United States is fueling mistrust of large corporations. The Institute on Taxation and Economic Policy last week reported that Amazon has paid no federal tax the past two years, rather than the statutory 21 percent. Following profits of $11.2 billion in 2018, the company received […]

Hawai’i Public Radio: Corporate Tax Loophole Costs Hawaii $38 Million Annually

February 20, 2019

Hawaii lawmakers are missing out on millions in potential tax revenue. That is the conclusion of a report from the Institute on Taxation and Economic Policy. The ITEP found that a loophole in Hawaii’s tax code allows multinational corporations to avoid paying state corporate income taxes, resulting in a loss of $38 million in revenue annually. Read […]

New York Observer: Amazon Paid $0 in Federal Taxes Despite Making $11 Billion in 2018—And No One Knows Why

February 20, 2019

You may feel like a champion financial planner after filing last year’s income taxes, even though you did pay a hefty fee to an accountant or some tax software. But don’t even think about beating Amazon, which paid a whopping $0 in federal taxes last year—despite earning $11.2 billion in U.S. profits—according to a report from the […]

Vox: Amazon’s $0 Corporate Income Tax Bill Last Year, Explained

February 20, 2019

For starters, Jeff Bezos is rich because of the value of Amazon stock, but for years, Wall Street loved the company even though it was a curiously unprofitable retail and technology giant. But more recently, Amazon has emerged recently as a consistently profitable firm, reporting nearly $11 billion in earnings last year. Yet during this surge into profitability — the company’s earnings doubled between 2017 and 2018 — Amazon’s tax bill has actually gone down. The company paid $0 in corporate income tax last year, according to an analysis from the Institute on Taxation and Economic Policy, an astonishing figure…

The Columbian: In Our View: Amazon HQ2 Outcome Leaves Much to Unpack

February 20, 2019

But at the same time, growing wealth disparity throughout the United States is fueling mistrust of large corporations. The Institute on Taxation and Economic Policy last week reported that Amazon has paid no federal tax the past two years, rather than the statutory 21 percent.

Axios: 1 Big Thing: Filthy Rich, Owing No Tax

February 19, 2019

Amazon is not a passive player in tax law, says ITEP's Matthew Gardner, who researched and wrote the Amazon report. "Amazon in particular has shaped tax law in its own image. They made the laws by lobbying so persistently and effectively," Gardner tells Axios.

Forbes: Amazon Paid $0 In Federal Income Taxes Last Year [Infographic]

February 19, 2019

Despite doubling its profits, Amazon has paid zero dollars in federal taxes for the second successive year. A recent report from the Institute on Taxation and Economic Policy has raised huge questions about the tax-paying habits of the tech giant, given that its profits soared from $5.6 billion in 2017 to $11.2 billion last year. […]

Fox Business, Bulls & Bears: Amazon, Netflix Did Not Pay Any Federal Taxes in the US in 2018: Report

February 18, 2019

ITEP senior fellow Matthew Gardner discusses how big tech companies are taking advantage of tax loopholes in the U.S. Watch the video

The Leaf Online: Cannabis Revenue Catching Up With Alcohol

February 17, 2019

State and local excise tax collections on retail adult-use cannabis sales surpassed $1 billion in 2018 nationally. That is a 57 percent increase over 2017 levels, according to data compiled by the Institute on Taxation and Economic Policy. Read more

The Hill: Tech Looks for Lessons From Amazon HQ2 Fight

February 17, 2019

Amazon's decision to scrap its plans for a second headquarters in New York City, dubbed HQ2, stunned both the tech world and its critics this week, raising new questions about the industry's ambitious expansion plans and their dealings with state and local governments.