ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Bridge Michigan: Michigan GOP tax cut plan helps wealthy at expense of equity

March 11, 2022

Following is an excerpt from an opEd co-authored by ITEP policy analyst Neva Butkus in Bridge Michigan: At the beginning of 2022, the national Institute on Taxation and Economic Policy (ITEP) forecasted the “tax cut fever” that has been sweeping through state legislatures across the nation — including here in Michigan, with the Legislature’s passage […]

Truthout: GOP’s Tax Plan Would Raise Taxes by Over $1,000 Annually for Poorest Americans

March 9, 2022

In a report released on Monday, the Institute on Taxation and Economic Policy (ITEP) estimated that the poorest Americans would be the most affected by Scott’s plan — meaning that the GOP’s tax plan would essentially be to tax the poor. The poorest 20 percent of Americans, who make $12,300 a year on average, would […]

Pennsylvania Capital Star: GOP plan would be a tax hike for 35% of Pa. residents

March 9, 2022

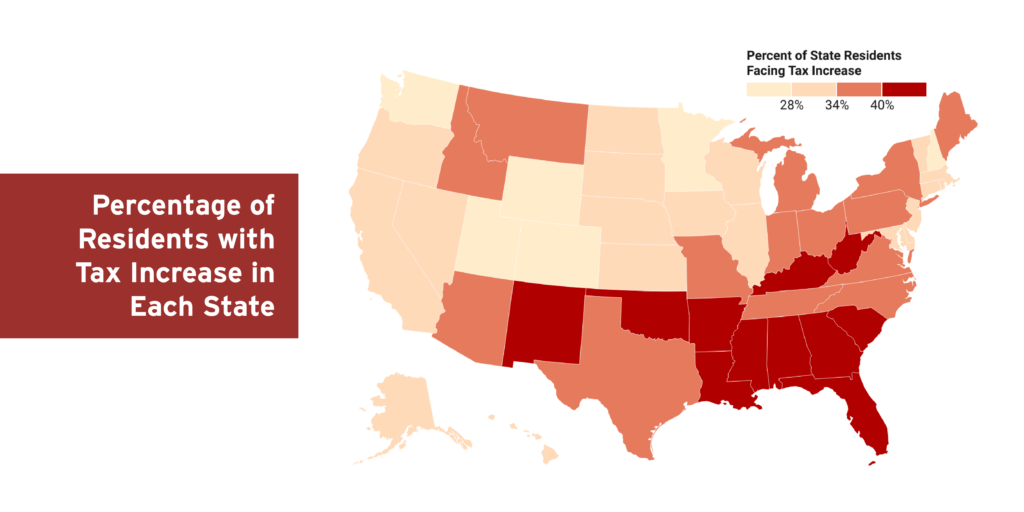

The share of households facing tax hikes would vary across states, according to an analysis by the Institute on Taxation and Economic Policy, ranging from a low of about 24 percent in Washington State to high of roughly 50 percent in Mississippi, which is among the poorest states in the country. Read more

Associated Press-Georgia: Tax cut sails through House; findings show big boost to rich

March 9, 2022

But an analysis by the liberal-leaning Georgia Budget & Policy Institute, using modeling by the Institute on Taxation and Economic Policy, shows that 62% of the benefits would go to the top 20% of Georgia tax filers. While the top 1% of Georgia taxpayers, earning more than $575,000 a year, would get 18% of all […]

New 50-State Analysis: Poorest Two-Fifths Would Bear the Brunt of Sen. Rick Scott’s Proposed Tax Increase

March 7, 2022 • By ITEP Staff

“Billionaires are getting richer, and some of them are altogether avoiding taxes or paying a tiny percentage relative to their income and wealth. The 2017 tax law further worsened inequality by giving huge tax breaks to the rich. It’s inconceivable that a lawmaker would propose to single out the most vulnerable households for higher taxes.” --Steve Wamhoff

Reality Check: Drastic Income Tax Cuts Are Dangerous Despite What Anti-Tax Supporters Say

March 3, 2022 • By Brakeyshia Samms

Income taxes are the backbone of most state budgets, but you wouldn't gather this fact based on the current trend to cut or eliminate them. A recent, cheerful Wall Street Journal op-ed from anti-government advocate Grover Norquist offers a clear sign that tax-cutting states are taking the wrong approach. The long-time proponent of anti-tax pledges wrote favorably about the legislative and gubernatorial plans to cut income tax cuts across the country. As usual, he failed to address that income taxes support state investments in education, infrastructure, health care and other important public services.

CNN: Fact-checking Biden’s 2022 State of the Union address

March 2, 2022

Facts First: This needs context. Biden left out a significant word from the prepared text of his speech. The prepared text, which the White House emailed to journalists just before Biden spoke, said that the 55 Fortune 500 companies paid zero dollars last year in federal income taxes. That was indeed the conclusion of a […]

SOTU and GOP Response Highlight Dramatic Difference in Parties’ Tax Policy Approach

March 2, 2022 • By Aidan Davis, ITEP Staff, Jenice Robinson

Since last year, multiple states across the country have proposed or are pursuing costly income and other tax cuts that are heavily tilted toward the highest-income households. State advocates have worked to beat back these proposals and sounded the alarm about the long-term consequences of tax cuts, but legislatures (most GOP-led) continue to introduce and approve top-heavy and permanent tax cuts. This state tax-cut fervor took center stage last night when Gov. Kim Reynolds of Iowa gave the Republican response to President Biden's SOTU address.

CBS News: Fact check: Joe Biden’s State of the Union address

March 1, 2022

President Biden: “Last year, 55 of the Fortune 500 companies earned $40 billion in profit and paid zero in federal taxes.” Fact check: True. This statistic comes from the Institute on Taxation and Economic Policy (ITEP), a liberal think tank. Across several different industries, the ITEP states there are at least 55 of the “largest corporations in […]

Politifact: States’ Pursuit of Top-Heavy Tax Cuts Is Disconnected from Reality

February 25, 2022

Steve Wamhoff, the director of federal tax policy at the Institute on Taxation and Economic Policy, said that group includes many retirees or people with disabilities who are collecting Social Security benefits, low-income working families, and people who qualify for tax credits or make less than the standard deduction ($12,550 for single filers in 2021, and $25,100 […]

The Guardian: ‘A really bad deal’: Michigan awards GM $1bn in incentives for new electric cars

February 25, 2022

Meanwhile, GM has recorded $70bn in profits since 2010 while taking $8bn in subsidies in recent decades – more than all but one company nationwide. The idea that it needed incentives to invest in Michigan “is absurd”, said Matt Gardner, a senior fellow at the progressive-leaning Institute on Taxation and Economic Policy (ITEP). Businesses report that tax subsidies infrequently […]

Yahoo! Finance: Young workers may see $800 more in their tax refunds this year

February 18, 2022

Many young workers may get an extra $820 in their tax refund this year because of the expansion of a key poverty-fighting credit, a new analysis found. The expanded Earned Income Tax Credit (EITC) will reach more than 1 in 3 young adults this year, according to the report from the Institute on Taxation and Economic […]

American Prospect: The Year of the Tax Cut

February 17, 2022

State lawmakers are also pointing to substantial, but temporary, budget surpluses to justify tax cuts, but these surpluses are “deceptive and fleeting,” says Neva Butkus of the Institute on Taxation and Economic Policy (ITEP), a Washington think tank. Twenty-three states lowered their revenue estimates compared to pre-pandemic levels, and 19 states counted delayed fiscal year […]

USA Today: New rules for 2021 taxes may mean bigger refund for young workers, retirees with side jobs

February 16, 2022

More than 1 in 3 young adults – or more than 5 million people – would benefit from this change in the earned income tax credit, seeing an average of benefit $820, according to the Institute on Taxation and Economic Policy, a progressive think tank, which is advocating for a permanent change in the age restrictions. […]

Democracy Now!: Alabama Amazon Workers Vote in 2nd Union Election as Amazon Dodges $5 Billion in Taxes

February 10, 2022

Meanwhile, a new report found Amazon was able to dodge over $5 billion in federal income taxes in 2021. Amazon reported record revenue of $35 billion last year but benefited from a federal income tax rate of just 6%, thanks to corporate tax breaks. The report was issued by the Institute on Taxation and Economic […]

CNBC: 1 in 3 young adults will see an average $800 tax credit boost this year

February 10, 2022

For the 37% of workers 19 to 24 who are now eligible to receive the credit, the expansion will mean an average boost of $820, according to a study from the Institute on Taxation and Economic Policy. If an individual has no other tax liability, that money will be sent to them in their refund […]

More Than One in Three Young Workers Would Benefit from EITC Reforms in Build Back Better Plan

February 8, 2022 • By Aidan Davis

Although the EITC expansion did not receive as much attention as the expanded Child Tax Credit, a new ITEP report shows the positive impact of allowing young workers without children in the home to maintain access to one of the nation’s most significant and effective anti-poverty programs.

Newsweek: States’ Pursuit of Top-Heavy Tax Cuts Is Disconnected from Reality

February 4, 2022

The following is an excerpt of an opEd by Aidan Davis, ITEP senior policy analyst, and Neva Butkus, policy analyst, published on Feb. 4 in Newsweek: One report after another in recent months revealed that the nation’s richest individuals gained wealth during the pandemic while ordinary families financially stood still or faced impossible decisions—such as […]

CBS News: Millions of low-income Americans eligible for tax refund boost this year

February 3, 2022

Meanwhile, the bigger credit comes at a welcome time for many Americans, as roaring inflation consumes most of low-wage workers’ pay gains. “While these folks without dependent children may not be faced with the cost of childcare, they’re definitely paying more for food, for gas, for rent. For these folks, these necessities may be out […]

Northern Kentucky Tribune: General Assembly’s proposed ‘shift and shaft’ tax policy no way for Kentucky to prosper

January 25, 2022

If Kentucky were to cut its income tax rate to 4%, it would have to raise the sales tax rate from 6% to 7.4% to make up the lost revenue, according to the Institute on Taxation and Economic Policy. That would give our state the highest state sales tax in the country. The bottom 60% […]

Inequality.org: Two Sides, Same Coin: Suppressing Votes, Cutting Rich People’s Taxes

January 24, 2022

But those surpluses, points out Institute on Taxation and Economic Policy analyst Neva Butkus, reflect a set of special circumstances that range from billions in federal Covid aid to changes in tax-filing deadlines during the pandemic that have left many 2020 and 2021 tax payments getting collected in the same fiscal year. Using the surpluses these special […]

The Street: The Top Corporate Tax Havens and Global Tax Reform

January 24, 2022

According to the Institute on Taxation and Economic Policy: FedEx (FDX) – Get FedEx Corporation Report zeroed out its federal income tax on $1.2 billion of U.S. pretax income and received a rebate of $230 million, Nike (NKE) – Get NIKE, Inc. Class B Report paid no federal income tax on almost $2.9 billion of […]

Idaho Press-Tribune: Who gets rebates, tax cuts under House bill

January 20, 2022

Idaho’s corporate income tax rate is a single rate of 6.5%; the bill would lower it to 6%. Necochea called that “throwing money out of the state,” citing figures from the Institute on Taxation and Economic Policy estimating that 81% of the benefit from that cut would flow out of state. “Corporate owners can live […]

Quad City Times: Record $600M Idaho tax cut clears House, heads to Senate

January 20, 2022

An analysis by the Institute on Taxation and Economic Policy, a nonprofit, nonpartisan tax policy organization based in Washington, D.C., found that the total tax benefits of the package for a person in the top 1% of Idaho income earners making $557,000 or more annually would benefit by $13,254. Read more

Exposed: Bradley and Koch Cash Fuels Push to Eliminate Wisconsin Income Tax

January 10, 2022

In addition, “sales taxes inevitably take a larger share of income from low- and middle-income families than from rich families because sales taxes are levied at a flat rate and spending as a share of income falls as income rises,” according to the Institute on Taxation and Economic Policy. Read more