Blog - Taxing Wealth and Income from Wealth

49 posts

Federal Tax Reform Would be a Step in the Right Direction for Millennials of Color

October 18, 2021 • By Brakeyshia Samms

Currently, millennials of color are worse off than their parents when it comes to wealth expectations. So, if one of the goals of federal policymakers is to reduce racial income and wealth disparities, the proposals outlined are a good start. Tax reforms included in the budget package making its way through Congress would help by boosting incomes and making raising children more affordable—two things that would help millennials of color thrive in today’s economy.

Limiting Tax Breaks for Capital Gains Would Mitigate the Racial Wealth Gap

October 14, 2021 • By Joe Hughes

The racial wealth and income gaps are the results of centuries of government policies favoring the accumulation of wealth among white communities while marginalizing communities of color. Policy solutions that are race-forward, meaning they remedy past and ongoing racial inequities, can also address broader social inequities.

The Billionaires’ Income Tax Is the Latest Proposal to Reform How We Tax Capital Gains

September 28, 2021 • By Steve Wamhoff

When people first hear about proposals to tax unrealized capital gains, they often ask, “Is this income, and if so, should we tax it?” The answers to those questions are “yes” and “yes, when we are talking about the very rich.”

Reforming Federal Capital Gains Taxes Would Benefit States, Too

September 28, 2021 • By Carl Davis

Congress’s action or inaction on federal tax changes under consideration in the Build Back Better plan could have important implications for states on many fronts. One critical area of note is at the foundation of income tax law: setting the definition of income that most states will use in administering their own income taxes.

House Ways and Means Provisions to Raise Revenue Would Significantly Improve Our Tax System But Fall Short of the President’s Plan

September 15, 2021 • By Steve Wamhoff

High-income people and corporations would pay more than they do today, which is a monumental change. But some wealthy billionaires like Jeff Bezos would continue to pay an effective rate of zero percent on most of their income, and American corporations would still have some incentives to shift profits offshore.

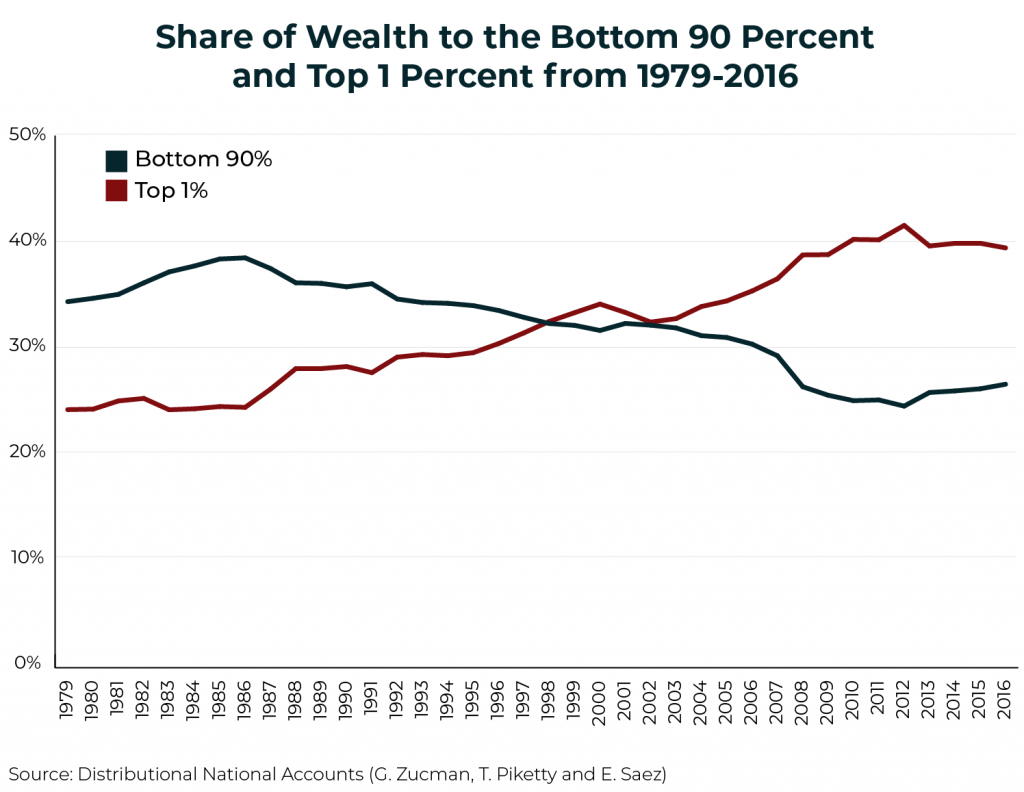

With the onslaught of news about billionaire wealth soaring while low- and moderate-income families have trouble making ends meet, a federal wealth tax makes good economic and fiscal sense—and the public supports it. One poll found that 64 percent of respondents favor the idea, including a majority of Republicans.

Should lawmakers enact laws that they believe are sensible and constitutional, or should they shape their legislative agenda around what they believe ideological Supreme Court justices will allow? This is a dilemma facing Americans who support a federal wealth tax.

Anti-tax activists’ convoluted claims that the rich pay too much in taxes broke new ground with an op-ed published last week in the Wall Street Journal. Penned by former Texas Sen. Phil Gramm and John Early, a former official of the Bureau of Labor Statistics, the piece is particularly misleading. The so-called evidence in support of their argument against raising taxes on the rich fails to correctly calculate effective tax rates.

How Democratic Presidential Candidates Would Raise Revenue

February 19, 2020 • By Steve Wamhoff

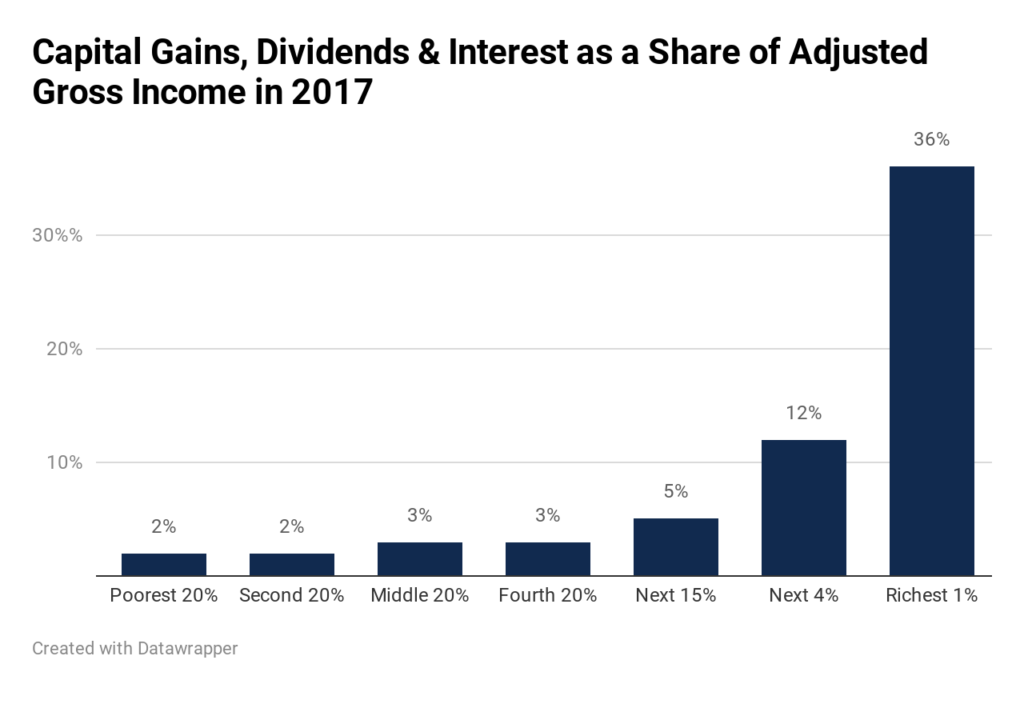

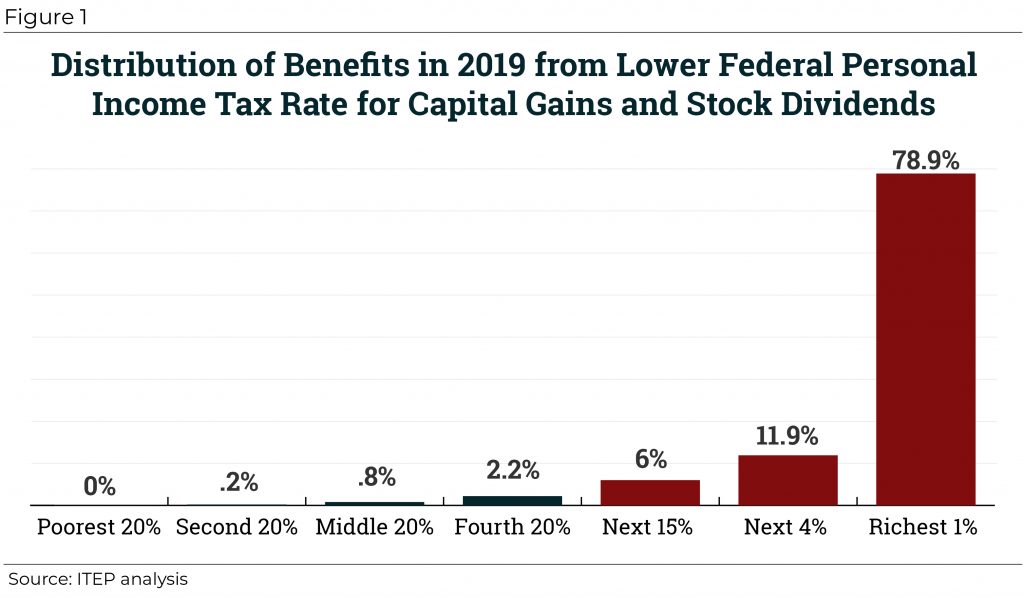

One of the biggest problems with the U.S. tax code in terms of fairness is that investment income, which mostly flows to the rich, is taxed less than the earned income that makes up all or almost all of the income that working people live on.

A basic understanding and idea of fairness is a trait we share with intelligent primates, which is precisely why more than two years ago as Congress was debating the Tax Cuts and Jobs Act, the American public disapproved of the tax bill.

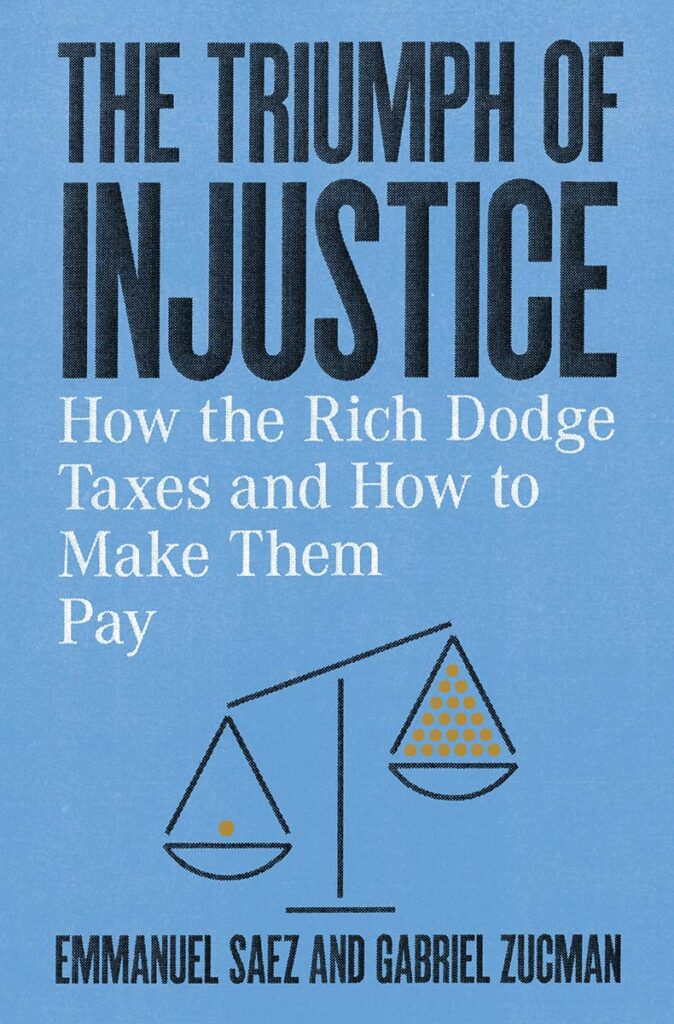

Emmanuel Saez and Gabriel Zucman’s New Book Reminds Us that Tax Injustice Is a Choice

October 15, 2019 • By Steve Wamhoff

Cue Emmanuel Saez and Gabriel Zucman. In their new book, The Triumph of Injustice, the economists, who already jolted the world with their shocking data on exploding income inequality and wealth inequality, tell us to stop acting like we are paralyzed when it comes to tax policy. There are answers and solutions. And in about 200 surprisingly readable pages, they provide them.

A New York Times article explained that proponents of a federal wealth tax hope to address exploding inequality but then went on to list the fears of billionaires and economic policymakers, finding that “the idea of redistributing wealth by targeting billionaires is stirring fierce debates at the highest ranks of academia and business, with opponents arguing it would cripple economic growth, sap the motivation of entrepreneurs who aspire to be multimillionaires and set off a search for loopholes.” A wealth tax will not damage our economy and instead would likely improve it. Here’s why.

Wealth Tax Proposals from Warren and Sanders: What You Should Know

September 25, 2019 • By Steve Wamhoff

Earlier this year, Sen. Elizabeth Warren proposed a federal wealth tax on a handful of U.S. households with the highest net worth. Sen. Bernie Sanders has just announced his own wealth tax proposal, which is similar to Warren’s. A few other presidential candidates say they support the concept although they have not provided any details. Here's what you need to know about the potential for a federal wealth tax.

One of the most glaring sources of unfairness in the federal tax code are rules that tax capital gains, which mostly go to the rich, less than wages and other types of income that most of us depend on. The capital gains tax breaks have for decades been comfortably ensconced behind trenches filled with special interests who would defend them until the end. But the end is now conceivable.

A federal wealth tax on the richest 0.1 percent of Americans is a viable approach for Congress to raise revenue and address economic inequality. This new video from ITEP makes the case for a federal wealth tax.

How Tax Policy Can Help Mitigate Poverty, Address Income Inequality

September 10, 2019 • By ITEP Staff

Analysts at the Institute on Taxation and Economic Policy have produced multiple recent briefs and reports that provide insight on how current and proposed tax policies affect family economic security and income inequality.

A direct federal tax on wealth, as described in a January report from ITEP and proposed by Sen. Elizabeth Warren, could raise substantial revenue to make public investments, curb rising inequality, and is supported by a large majority of Americans. But would it work? Recent research highlighted in a new academic paper outlines approaches that would make it easier than you might think.

Why Trump Administration’s Plan to Index Capital Gains to Inflation Is Just Another Giveaway to the Wealthy

June 28, 2019 • By Steve Wamhoff

The White House is reported to be planning to unilaterally adjust the way capital gains are assessed to benefit the wealthiest Americans. The proposal would adjust capital gains for inflation, reducing taxes disproportionately for the wealthiest households who own most assets by limiting their taxable gains to those above and beyond the inflation rate.

Wealth Tax Is Supported by Basically Everyone Who Is Not a Politician

June 27, 2019 • By Steve Wamhoff

A February survey found that 61 percent of registered voters supported a wealth tax proposal, including 51 percent of Republican voters. And it’s not just the non-rich wanting to tax the very rich. A June survey found that 60 percent of millionaires support the idea.

What to Watch for on Tax Policy During the Presidential Primary

June 25, 2019 • By Steve Wamhoff

America needs a new tax code. The Democratic presidential debates beginning this week present an opportunity for candidates to make clear how they would address inequality or to raise enough revenue to make public investments that make the economy work for everyone. Here are some of the big tax issues that we hope they will touch on.

File Under “No Surprise”: Wealthiest Taxpayers Use Offshore Tax Shelters More Than the Rest of Us, New Research Finds

June 4, 2019 • By Matthew Gardner

Tax evasion matters. It drains needed revenues from the public treasury, and saps public confidence in rules of the game. A recent Pew Research poll finds that 60 percent of Americans are bothered “a lot” by the feeling that the best-off don’t pay their fair share of taxes. And now, thanks to a new report, […]

Sen. Ron Wyden of Oregon, the ranking Democrat on the Senate Finance Committee, announced that he would soon release a proposal to eliminate massive tax breaks enjoyed by the wealthy on their capital gains income. If successful, the proposal would ensure that income from wealth is taxed just like income from work.

Why We Should Talk about Progressive Taxes Despite Billionaires’ Objections

January 30, 2019 • By Jenice Robinson

It was the tone-deaf remark heard ‘round the world. Last week on CNBC’s Squawk Box, Commerce Secretary Wilbur Ross suggested that furloughed government employees who hadn’t been paid in a month could go to a bank and get a loan to make ends meet. This was not a gaffe. It’s hard to fathom how a […]

The Preferential Tax Treatment of Capital Gains Income Should Be Curbed, Not Substantially Expanded

August 1, 2018 • By Richard Phillips

For true believers in supply-side economics, however, one major flaw of the TCJA is that it did not further cut taxes for the wealthy by reducing capital gains tax rates. But now the Trump Administration is considering using executive action to remedy this by indexing capital gains to inflation for tax purposes.