Blog - Trump Tax Policies

58 posts

White House Incredibly Still Believes Tax Cuts Are the Answer to America’s Problems

June 2, 2020 • By Steve Wamhoff

White House officials continue to discuss tax cuts in response to the COVID-19 pandemic. Steve Wamhoff provides a roundup of these terrible ideas that would do little to boost investment or reach those who need it most.

Trump-GOP Tax Law Encourages Companies to Move Jobs Offshore–and New Tax Cuts Won’t Change That

June 2, 2020 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

New tax cuts to incentivize bringing jobs back to the United States will fail. No new tax provisions can be more generous than the zero percent rate the 2017 law provides for many offshore profits or the loopholes that allow corporations to shift profits to countries with minimal or no corporate income taxes.

The Health Economic Recovery and Omnibus Emergency Solutions (HEROES) Act includes important changes to business tax provisions in the CARES Act, the most recent COVID-19 legislation enacted by Congress and the president. The House-passed plan would undo CARES Act changes that make it easy for businesses to claim losses to reduce or avoid all taxes. […]

The CARES Act Provision for High-Income Business Owners Looks Worse and Worse

April 24, 2020 • By Steve Wamhoff

A select group of millionaires will receive an average tax break of $1.6 million thanks to a CARES Act provision that is receiving delayed but well-deserved scrutiny. Wealthy business owners are receiving this windfall because the CARES Act provides tax breaks to people with losses from a business they own. This approach may seem sensible because businesses small and large are taking a hit from the economic recession, but on close inspection, these provisions benefit those least in need and can be easily abused.

Partying Like It’s 2017: How Congress Went Overboard on Helping Businesses with Losses

April 24, 2020 • By Steve Wamhoff

The Coronavirus Aid, Relief, and Economic Security (CARES) Act provides some needed relief for individuals and families, but two arcane tax provisions related to business losses will further enrich the wealthy and fail to boost our economy more broadly.

Addressing the COVID-19 Economic Crisis: Advice for the Next Round

April 7, 2020 • By Steve Wamhoff

Americans need many things right now beyond tax cuts or cash payments. But for people whose incomes have declined or evaporated, money is the obvious, immediate need to prevent missed rent or mortgage payments, skipped hospital visits and other cascading catastrophes. So, what should Congress do next to get money to those who need it?

Last week, President Trump destroyed everyone’s coronavirus press conference bingo card by announcing that a conversation he had with celebrity chef Wolfgang Puck inspired him to propose restoring a corporate tax deduction for business entertainment expenses. Trump’s own signature tax plan repealed this break two years ago.

Boeing “CARES” A Lot About its Shareholders—But What about the Rest of Us?

April 1, 2020 • By Matthew Gardner

The gigantic Coronavirus-related tax and spending bill enacted last week, the so-called “CARES Act,” sets aside $17 billion in loans for “businesses critical to maintaining national security.” It’s generally understood that the bill’s authors want much, if not all, of this $17 billion to go to a single company: Boeing. So it behooves us to ask whether Boeing benefits America and its economy in ways that merit this largesse.

House Democrats’ Suggestion of Retroactively Repealing SALT Cap is a Poor Emergency Relief Measure

March 31, 2020 • By Steve Wamhoff

The House Democrats have plenty of ideas to help workers and families and boost the economy, but Speaker Nancy Pelosi’s recent idea to repeal the cap on deductions for state and local taxes (SALT) is not one of them. The 2017 Trump-GOP tax law includes many provisions that should be repealed. Unfortunately, Congressional Democrats have long made it clear that they want to start by repealing the $10,000 cap on SALT deductions, which is one of the law's few provisions that restrict tax breaks for the rich.

Congress “CARES” for Wealthy with COVID-19 Tax Policy Provisions

March 31, 2020 • By Matthew Gardner

At a time when record numbers of Americans are facing unemployment, state and local governments are facing a perfect storm of growing public investment needs and vanishing tax revenues, and small business owners are struggling to avoid even more layoffs, lavishing tax breaks on the top 1 percent in this way shouldn’t be in anyone’s top 20 list of needed tax changes.

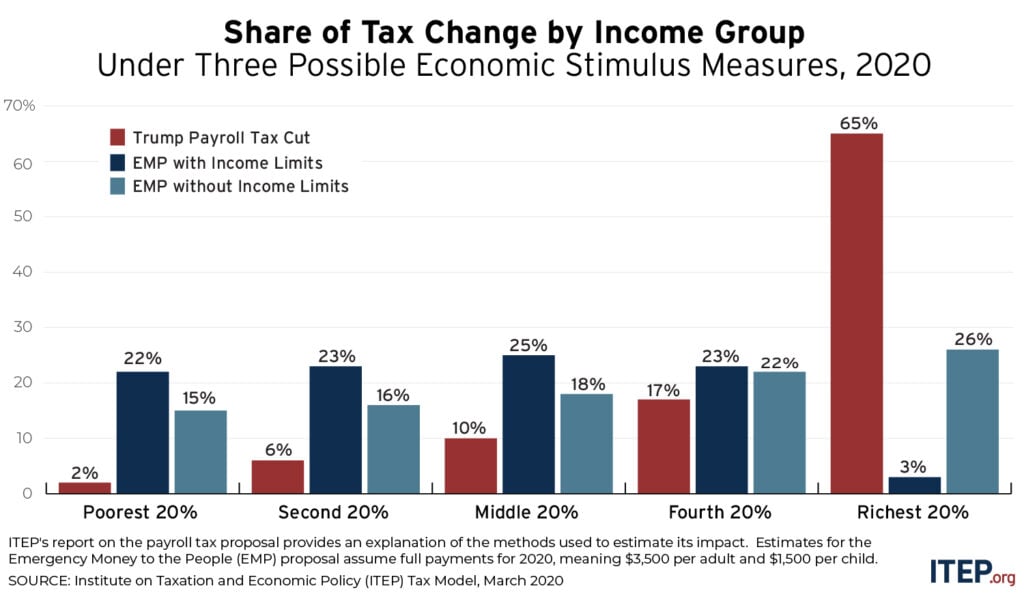

A payroll tax cut would help those lucky enough to keep their job and would provide a bigger break to those with more earnings. Sending checks to every household would be a far more effective economic stimulus because it would immediately put money in the hands of everyone who would likely spend it right away, pumping it back into the economy.

The Trump administration is floating a cut in the Social Security payroll tax as a measure to counteract a potential economic downturn related to the COVID-19 virus. It should go without saying that a public health crisis requires government interventions that have nothing to do with taxes. But even if policymakers want to find ways to stimulate the economy beyond solving the health crisis, the payroll tax cut is not likely to be very effective.

Some problems can only be solved when public officials have the resources to act. Today’s public health crisis is that kind of problem. Unfortunately, the Trump administration’s deep tax cuts leave our health infrastructure knee-capped, just when we need it most.

Tax Cuts Floated by White House Advisors Are an Attempt to Deflect from TCJA’s Failings

February 21, 2020 • By ITEP Staff, Jenice Robinson, Steve Wamhoff

Now that multiple data points reveal the current administration, which promised to look out for the common man, is, in fact, presiding over an upward redistribution of wealth, the public is being treated to pasta policymaking in which advisors are conducting informal public opinion polling by throwing tax-cut ideas against the wall to see if any stick. But the intent behind these ideas is as transparent as a glass noodle.

2021 Trump Budget Continues 40-Year Trickle-Down Economic Agenda

February 12, 2020 • By Jenice Robinson

The 2017 Tax Cuts and Jobs Act may as well have been called the Promise for Austerity Later Act.

Hearing Witness: Trump Administration Giving Tax Breaks Not Allowed by Law

February 12, 2020 • By Steve Wamhoff

The Treasury Department, tasked with issuing regulations to implement the hastily drafted Trump-GOP tax law, is concocting new tax breaks that are not provided in the law. This is the short version of what we learned while watching Tuesday’s House Ways and Means Committee hearing on “The Disappearing Corporate Income Tax.”

Guilty, Not GILTI: Unclear Whether Corps Continue to Lower Their Tax Bills Via Tax Haven Abuse

January 7, 2020 • By Matthew Gardner

President Trump and GOP lawmakers often cited corporations’ abuse of tax havens, e.g. shifting profits offshore to avoid taxes, as justification for dramatically lowering the federal corporate tax rate under the 2017 Tax Cuts and Jobs Act. By 2016, corporations’ offshore cash haul had grown to $2.6 trillion, representing hundreds of billions in lost federal tax […]

Corporate Tax Avoidance Is Mostly Legal—and That’s the Problem

December 19, 2019 • By Steve Wamhoff

As usual, corporate spokespersons and their allies are trying to push back against ITEP’s latest study showing that many corporations pay little or nothing in federal income taxes. One way they respond is by stating that everything they do is perfectly legal. This is an attempt by the corporate world to change the subject. The entire point of ITEP’s study is that Congress has allowed corporations to avoid paying taxes, and that this must change.

Census Numbers Show the Power of the Tax Code to Direct Resources to Low-Income Families

September 10, 2019 • By Jessica Schieder

Refundable federal tax credits, including the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC), lifted 7.9 million people out of poverty in 2018. This latest analysis from the U.S. Census Bureau demonstrates the power of federal programs to alleviate poverty and help low-income families keep up with the increasing cost of living.

How Tax Policy Can Help Mitigate Poverty, Address Income Inequality

September 10, 2019 • By ITEP Staff

Analysts at the Institute on Taxation and Economic Policy have produced multiple recent briefs and reports that provide insight on how current and proposed tax policies affect family economic security and income inequality.

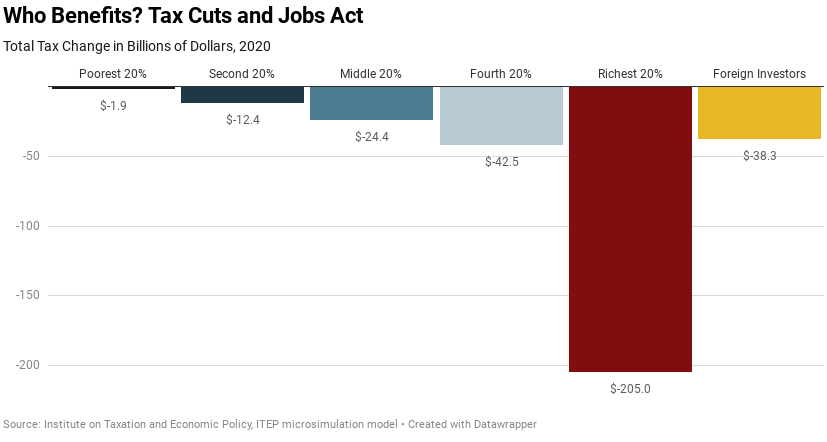

Updated Estimates from ITEP: Trump Tax Law Still Benefits the Rich No Matter How You Look at It

August 28, 2019 • By Steve Wamhoff

President Trump’s allies in Congress continue to defend their 2017 tax law in misleading ways. Just last week, Republicans on the House Ways and Means Committee stated that most “of the tax overhaul went into the pockets of working families and Main Street businesses who need it most, not Wall Street.” ITEP’s most recent analysis estimates that in 2020 the richest 5 percent of taxpayers will receive $145 billion in tax cuts, or half the law's benefits to U.S. taxpayers.

Given how much more exclusively this deduction now benefits the highest-income households, its continued existence is hard to justify. Even when the credit was available to a larger swath of families, it was ineffective at promoting homeownership.

Policymakers and the public widely agree that economic inequality is the social policy problem of our age. It threatens the livelihoods of millions of children and adults, and it even threatens our democracy. Although some say Americans could fix it themselves by simply rolling up their sleeves, as a sub-headline in a March U.S. News and World Report column implied, the reality is different.

In early April, a diverse but mostly black crowd took to the streets in the Shaw neighborhood of Washington D.C. to protest T-Mobile’s decision to order Metro PCS to cease playing gogo music. This tale is a shining example of why economic investment—especially taxpayer-incentivized investment—in underserved communities is fraught with controversy. Who ultimately benefits after developers pour millions of dollars into these communities? And, as this controversy reveals, are the usually black and brown denizens of these neighborhoods and businesses that may have catered to them no longer welcome once economic development reaches a critical mass?

$4.3 Billion in Rebates, Zero-Tax Bill for 60 Profitable Corps Directly Related to Loopholes

April 12, 2019 • By Matthew Gardner

Meet the new corporate tax system, same as the old corporate tax system. That’s the inescapable conclusion of a new ITEP report assessing the taxpaying behavior of America’s most profitable corporations. The report, Corporate Tax Avoidance Remains Rampant Under New Law, released earlier this week, finds that 60 Fortune 500 corporations disclose paying zero in federal income taxes in 2018 despite enjoying large profits.