Blog

1298 posts

New Fiscal Year Brings New Challenges and Opportunities in the States

July 1, 2020 • By Kamolika Das

July 1—the start of the new fiscal year in most states—typically marks a point when one can take a step back and reflect on the wins and disappointments of the past state legislative sessions. 2020 is markedly different. Nationwide business closures and stay-at-home orders in response to COVID-19 have led to unprecedented spikes in unemployment, decreased demand for consumer spending, and increased demand for vital public services. As a result, states face incredibly uncertain financial futures with little clarity regarding how their tax collections will fare over the next year.

State Rundown 6/26: States Take Varying Fiscal Approaches While Awaiting Federal Action

June 26, 2020 • By ITEP Staff

State policymakers this week took a variety of approaches to their fiscal situations amid the COVID-19 pandemic. Tennessee lawmakers chose to balance their budget through $1.5 billion in cuts to public services, but not before adding to those cuts by going forward with planned tax cuts. California legislators also passed a budget but relied on a number of temporary measures and delays to do so. Their counterparts in Massachusetts, New Jersey, and Rhode Island opted for interim budgets to tide them over for a few months while they continue to look for lasting solutions. Meanwhile, many states are debating whether…

Beyond SCOTUS: States Recognize Need for More Inclusive Immigrant Policy

June 26, 2020 • By Marco Guzman

The U.S. Supreme Court last week halted an effort by the Trump administration that would have stripped DACA (Deferred Action for Childhood Arrivals) recipients of their lawful status in the country. The 5-4 ruling is a significant victory for immigrant rights advocates and over 643,000 Dreamers—as they’re known—who were brought here as children and have […]

McSally “Travel Tax Credit” Is an Invitation for Tax Avoidance

June 23, 2020 • By Matthew Gardner

Earlier this week, U.S. Sen. Martha McSally (R-AZ) introduced the “American TRIP Act,” a bill ostensibly designed to encourage Americans to boost the economy by traveling within the United States. The bill is certainly a trip in the colloquial sense of the word.

The Institute on Taxation and Economic Policy stands with activists who are guiding the movement to transform America, dismantle systemic racism in policing, and envision a better justice system. Committed protestors in big cities, small towns, and suburban enclaves have spurred a sea change in public opinion and policy possibility on policing and incarceration. Their work and activism builds on years of action by Black Lives Matter and other leaders.

State Rundown 6/18: States Work to “Finalize” Budgets in Uncertain Times

June 18, 2020 • By ITEP Staff

Despite uncertainty all around the nation, a few states passed budgets this week and many more are negotiating to enact theirs before fiscal years close at the end of June. Colorado notably pared back some of its own tax breaks and limited the potential damage on its budget from new federal breaks. California also passed a budget but few in the state actually think the dealing is done. Iowa quietly enacted its budget too, though advocates in the state are making noise about non-fiscal bills that were added late in the game.

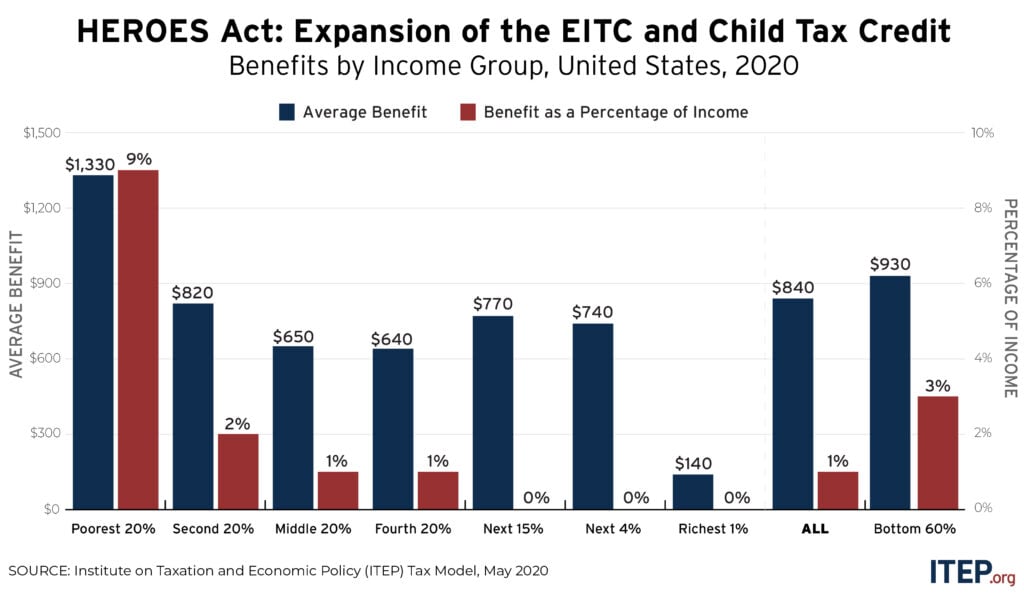

National and State-by-State Estimates of House-Passed Improvements in Tax Credits for Workers and Children

June 18, 2020 • By Steve Wamhoff

Among other important provisions, the HEROES Act includes reforms to the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) to make these tax credits more effective in helping working people and helping parents afford the costs of raising children.

Tax Justice and Racial Justice: Transformative Change Is Overdue

June 16, 2020 • By Amy Hanauer, ITEP Staff

Progressive tax policy can spur deep investments in communities, help families afford childcare and college, provide healthcare for everyone, re-imagine energy consumption to stop heating the planet, expand parks and bike lanes and public transit. Economic justice can give workers a greater voice than corporations in our democracy. People are protesting because the moment for transformative change in policing and our economy is long overdue.

As calls to defund the police demonstrate, state and local decisions about funding priorities and how those funds are raised are deeply embedded in racial justice issues. Tax justice is also a key component in advancing racial justice. Racial wealth disparities are the result of countless historic inequities and tax policy choices are certainly among […]

Most people assume that the federal government is the main—if not only—agent for ensuring economic stability and recovery in response to COVID. Yet, the fight for tax fairness at the state level will have a dramatic impact on economic recovery.

White House Incredibly Still Believes Tax Cuts Are the Answer to America’s Problems

June 2, 2020 • By Steve Wamhoff

White House officials continue to discuss tax cuts in response to the COVID-19 pandemic. Steve Wamhoff provides a roundup of these terrible ideas that would do little to boost investment or reach those who need it most.

Trump-GOP Tax Law Encourages Companies to Move Jobs Offshore–and New Tax Cuts Won’t Change That

June 2, 2020 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

New tax cuts to incentivize bringing jobs back to the United States will fail. No new tax provisions can be more generous than the zero percent rate the 2017 law provides for many offshore profits or the loopholes that allow corporations to shift profits to countries with minimal or no corporate income taxes.

Trump Administration Stops Pretending to Care About the Economy with Its Capital Gains Tax Proposal

May 28, 2020 • By Steve Wamhoff

Proponents of capital gains tax breaks have always offered a weak argument that they encourage investment and thereby grow the economy. But the Trump administration is now floating a temporary capital gains tax break, which is supported by no argument at all. It would only reward investments made in the past while doing nothing to encourage new investment.

State Rundown 5/27: Some States Finally Talking Revenue Solutions to Revenue Crisis

May 27, 2020 • By ITEP Staff

This week the immense scale and uneven distribution of economic and health damage from the COVID-19 pandemic continued to come into focus, hand in hand with greater clarity around pandemic-related revenue losses threatening state and local revenues and the priorities—such as health care, education, and public safety—they fund. Officials in many states, including Ohio and Tennessee, nonetheless rushed to declare their unwillingness to be part of any solution that includes raising the tax contributions of their highest-income residents. On the brighter side, some leaders are willing to do just that, for example through progressive tax increases proposed in New York…

What Biden Means By No Tax Increases on Anyone “Making Under $400,000”

May 22, 2020 • By Steve Wamhoff

Presidential candidate Joe Biden said on Friday that under his proposals, no one with income below $400,000 would pay higher taxes than they do now. Does this make sense? It is true that Congress and the next president have many options to raise trillions of dollars from people who have incomes even higher than that. […]

State Rundown 5/20: State Revenue Crisis Getting Clearer…and Scarier

May 20, 2020 • By ITEP Staff

State policymakers are navigating incredibly uncertain waters these days as they attempt to get a firmer grasp on the scale of their revenue crises, identify painful budget cuts they may have to make in response, and look for ways to raise tax revenues coming from the households and corporations still bringing in large incomes and profits amid the pandemic—all while hoping that additional federal aid and greater flexibility in how they can use federal CARES Act funds will help relieve some of these difficult decisions.

The Health Economic Recovery and Omnibus Emergency Solutions (HEROES) Act includes important changes to business tax provisions in the CARES Act, the most recent COVID-19 legislation enacted by Congress and the president. The House-passed plan would undo CARES Act changes that make it easy for businesses to claim losses to reduce or avoid all taxes. […]

JPMorgan Chase CEO Jamie Dimon, in a May 19 memo to employees, outlines steps the company is taking to help its customers, small businesses and communities stay afloat. The part of the public relations memo that has received the most attention, however, is Dimon’s call for “rebuilding a more inclusive economy.” “It is my fervent […]

House Democrats today introduced a proposal that responds to our staggering economic crisis with the right policies at the necessary scale. It’s a refreshing change from some of the misdirected ideas that have passed or been floated in these alarming economic times.

Which Workers Wouldn’t Be Helped by a Payroll Tax Cut?

May 8, 2020 • By Jessica Schieder, Lorena Roque

New data released today estimates 20.5 million jobs were lost in the month of April alone. Workers not currently receiving paychecks would be left out of any benefits provided by a payroll tax cut.

State Rundown 5/7: State Fiscal Responses to Pandemic Starting to Get Real

May 7, 2020 • By ITEP Staff

State lawmakers are starting to use fiscal policy levers to address the COVID-19 pandemic, but the actions vary greatly and are just a start. Mississippi, for example, is one state still clarifying who has authority to determine how federal aid dollars are spent. Colorado, Georgia, Missouri, and Ohio are among the many states identifying painful funding cuts they will likely make to shared priorities like health care. The Louisiana House and the Minnesota Senate each advanced tax cuts and credits that could dig their budget holes even deeper. Connecticut leaders are looking at one of the more comprehensive packages, which…

Trump’s Latest Tax Break Proposals Include Everything—Except Helping Regular People

May 6, 2020 • By Steve Wamhoff

None of the tax proposals considered by the administration would provide help to those who need it or do much, if anything, to boost investment.

Trump’s Payroll Tax Cut Makes Even Less Sense as Job Losses Mount

May 5, 2020 • By Steve Wamhoff

Last August, long before COVID-19 ravaged the U.S. economy, the Trump Administration began touting a payroll tax cut as a stimulus. Now, with more than 30 million official unemployment claims and projections that the jobless rate could grow to Depression-era levels, the White House is claiming that a payroll tax cut is the best way […]

There is every reason to believe that Amazon will continue its tax-avoidance ways in 2020. The entirely-legal tax avoidance tools the company used to zero out its federal income tax bills over the last three years remain entirely legal today. From accelerated depreciation to the research and development tax credit to the deduction for executive stock options, Amazon’s tax avoidance tools have been blessed by lawmakers, and presidents, of all stripes.

Intended Consequences: Deliberate Disinvestment Caused Florida’s Unemployment Disaster

May 4, 2020 • By Stephanie Clegg

Florida politicians deliberately rigged the unemployment system after the Great Recession to avoid raising taxes on businesses. Now, in a pandemic, some out-of-work residents are left waiting more than six weeks for unemployment benefits while more than 280,000 others have been inexplicably denied. What’s happening in Florida underscores deeper challenges with systems that should help those in need, but instead are designed to fail them.