Blog

1298 posts

States Can Lead on Making the EITC Benefit More Young and Older Workers

February 18, 2020 • By Aidan Davis

The federal Earned Income Tax Credit (or EITC) lifts millions out of poverty each year, but it is not created equal for everyone. Childless workers under 25 and over 64 receive no benefit from the existing federal credit. In the absence of immediate federal action, states have led–and continue to lead–the way.

State Rundown 2/13: What’s Trendy in State Tax Debates This Year

February 13, 2020 • By ITEP Staff

We wrote earlier this week about Trends We’re Watching in 2020, and this week’s Rundown includes news on several of those trends. Maine lawmakers are considering a refundable credit for caregivers. Efforts to tax high-income households made news in Maryland, Oregon, and Washington. Grocery taxes are receiving scrutiny in Alabama, Idaho, and Tennessee. Tax cuts or shifts are being discussed in Arizona, Nebraska, and West Virginia. And Arizona, Maryland, and Nevada continue to seek funding solutions for K-12 education as Alaska and Virginia do the same for transportation infrastructure.

2021 Trump Budget Continues 40-Year Trickle-Down Economic Agenda

February 12, 2020 • By Jenice Robinson

The 2017 Tax Cuts and Jobs Act may as well have been called the Promise for Austerity Later Act.

Hearing Witness: Trump Administration Giving Tax Breaks Not Allowed by Law

February 12, 2020 • By Steve Wamhoff

The Treasury Department, tasked with issuing regulations to implement the hastily drafted Trump-GOP tax law, is concocting new tax breaks that are not provided in the law. This is the short version of what we learned while watching Tuesday’s House Ways and Means Committee hearing on “The Disappearing Corporate Income Tax.”

State lawmakers have plenty to keep them busy on the tax policy front in 2020. Encouraging trends we’re watching this year include opportunities to enact and enhance refundable tax credits and increase the tax contributions of high-income households, each of which would improve tax equity and help to reduce income inequality.

Why Today’s Congressional Hearing on “The Disappearing Corporate Income Tax” Is Imperative

February 11, 2020 • By Steve Wamhoff

The United States is collecting a historically low level of tax revenue from corporations. In 2018, corporate tax revenue as a share of gross domestic product (the nation’s economic output) dipped to 1 percent and reached just 1.1 percent in 2019. The only other times in the last 40 years that tax collections were this […]

President Trump’s 2021 Budget: Promises Made, Promises Broken

February 10, 2020 • By Steve Wamhoff

President Trump has kept only one of his promises--his pledge to lower taxes for corporations and their investors. The budget plan he released today again breaks his promise to reject cuts in Medicaid that would affect millions of people. His budget once again fails to eliminate the deficit, much the less the national debt, during his presidency as he promised. It cuts trillions from safety net programs and student aid programs despite his pledge to stand for forgotten Americans.

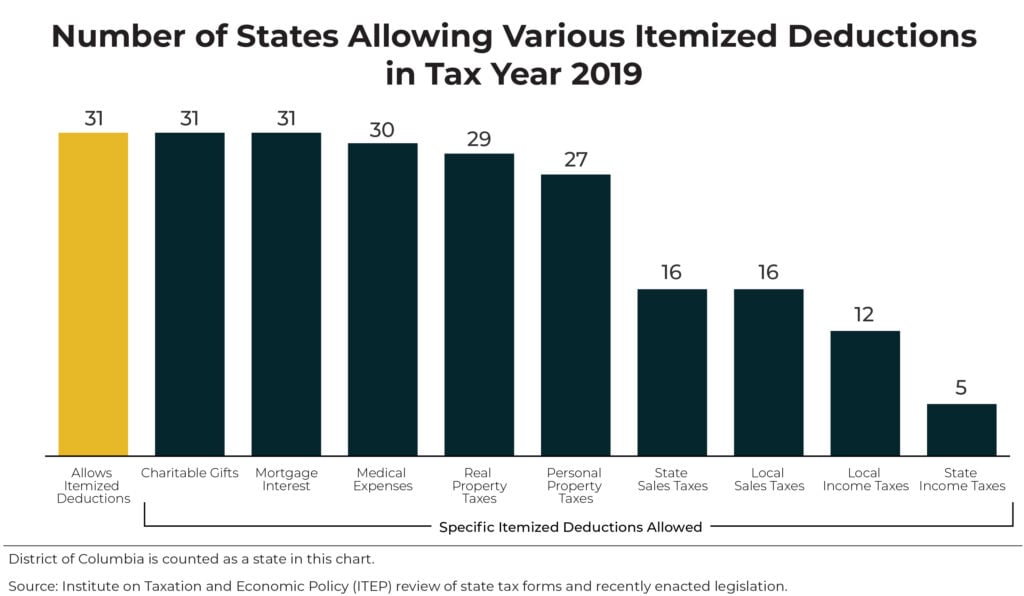

States Can Make Their Tax Systems Less Regressive by Reforming or Repealing Itemized Deductions

February 5, 2020 • By Carl Davis

Itemized deductions are problematic tax subsidies that need to close. The mortgage interest deduction, for instance, is often lauded as a way to help middle-class families afford homes and charitable deductions are touted as incentivizing gifts to charitable organizations. But the dirty little secret is that itemized deductions primarily benefit higher-income households while largely failing to achieve their purported goals.

If President Trump puts forth another tax proposal this year, as he is hinting, it will be his third. The second round, already costing the U.S. Treasury billions, was implemented largely out of the public’s view.

Washington Is Finally Having the Right Conversation about Taxes

February 4, 2020 • By Amy Hanauer

Presidential candidates and some elected officials are finally talking about bold tax policy ideas that would increase taxes and raise revenue. This is a dramatic shift from when a radical, right-wing narrative dominated the public debate. Republicans redefined “fiscal responsibility” as fewer taxes and less government, peddled supply-side economic theories, and denied the clear evidence that tax cuts were adding to our nation’s deficits.

From 0% to 1.2%: Amazon Lauds Its Minuscule Effective Federal Income Tax Rate

January 31, 2020 • By Matthew Gardner

If we focus on the taxes the company paid in 2019, we see an effective federal income tax rate of just 1.2 percent. And since the company enjoyed federal income tax rebates in 2017 and 2018, this means that over the last three years Amazon has paid zero on $29 billion of U.S. pretax income.

State Rundown 1/30: Flip-Flops and Steady Marches in State Tax Debates

January 30, 2020 • By ITEP Staff

State tax and budget debates can turn on a dime sometimes, as in Utah this past week, where lawmakers unanimously repealed a tax package they had just approved in a special session last month. Delaware lawmakers are hoping to avoid the similarly abrupt end to their last effort to improve their Earned Income Tax Credit (EITC) by crafting a bill that Gov. John Carney will have no reason to unexpectedly veto as he did two years ago. But at other times, these debates just can’t change fast enough, as in New Hampshire and Virginia, where leaders are searching for revenue to address long-standing transportation needs, and in Hawaii, Nebraska, and North Carolina, where education funding issues remain painfully unresolved.

A new IRS proposal could once again allow wealthy business owners to use state charitable tax credits–including tax credits for donating to support private and religious K-12 schools–to dodge the federal government’s $10,000 cap on state and local tax (SALT) deductions.

GOP Legacy on IRS Administration: Auditing Mississippi, not Microsoft

January 24, 2020 • By Matthew Gardner

Money doesn’t buy happiness—but it can buy immunity from the reach of Uncle Sam. The IRS is outgunned in cases against corporate giants because that’s how Republican leaders want it to be. They have systematically assaulted the agency’s enforcement capacity through decades of funding cuts. Instead of saving money, these cuts have cost billions: each dollar spent on the IRS results in several dollars of tax revenue collected.

This week as Americans celebrate Martin Luther King Jr.’s messages of resisting oppression and fighting for progress, state policymakers can look to some bright spots where tax and budget debates are bending toward justice. Among those highlights, Hawaii leaders are considering improvements to minimum wage policy, early childhood education, and affordable housing; Kansas Gov. Laura Kelly is seeking to reduce sales taxes applied to food and restore the state’s grocery tax credit; and advocates in Connecticut and Maryland are pushing for meaningful progressive tax reforms.

After years of watching tax policy increasingly leave communities behind, at ITEP I’ll have the chance to work with local, state and national partners on policy solutions. I’m prepared to push for a tax system that can better deliver economic, climate and racial justice; for a public sector that can prepare our kids and our grid for 2020 and beyond; and for an America that works for all of us, whether we were born in Nebraska or Hawaii, Detroit or Miami.

State tax and budget debates have arrived in a big way, with proposals from every part of the country and everywhere on the spectrum from good to bad tax policy. Just look to ARIZONA for a microcosm of nationwide debates, where education advocates have a plan to raise progressive taxes for school needs, Gov. Doug […]

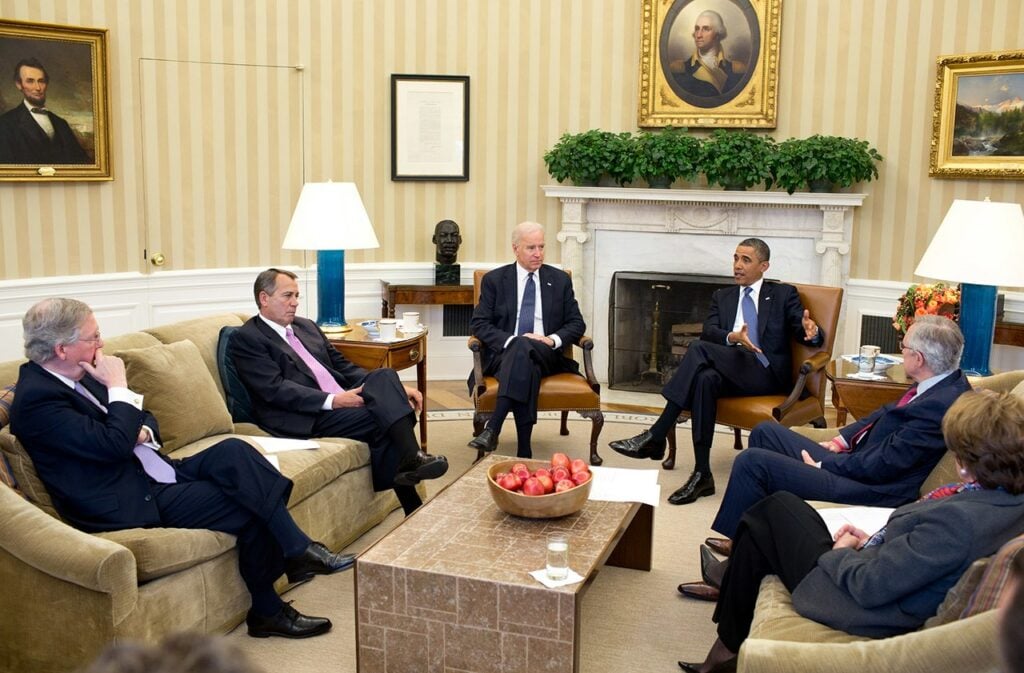

The 2013 Biden-McConnell “Fiscal Cliff” Deal Shows Why the Next President Needs a New Approach to Taxes

January 15, 2020 • By Steve Wamhoff

Americans have long wanted more progressive tax policies and have told pollsters for years that they want wealthy individuals and big corporations to pay more, not less, in taxes. The only way forward is for lawmakers and the next president to take a dramatically different approach to tax policy.

White House Council of Economic Advisers Crows about Lowest-Income Americans Being Infinitesimally “Wealthier”

January 14, 2020 • By Matthew Gardner

When the White House Council of Economic Advisors last week tweeted that the poorest 50 percent of Americans’ wealth is growing 3 times faster than the wealth of the top 1 percent, we were skeptical. As it turns out, the CEA’s tweet is a reminder that the poorest 50 percent wealth grew twice as fast during Barack Obama’s second term than it has under Trump, but to this day remains far below its pre-recession share and significantly less than what it was 30 years ago.

A basic understanding and idea of fairness is a trait we share with intelligent primates, which is precisely why more than two years ago as Congress was debating the Tax Cuts and Jobs Act, the American public disapproved of the tax bill.

State Rundown 1/8: States Need Clear Tax and Budget Policy Vision in 2020

January 8, 2020 • By ITEP Staff

Happy New Year readers! The Rundown is back to our usual weekly schedule as state legislative sessions and governors’ budgets and State of the State Addresses begin in earnest. Here’s to clear-eyed 20-20 vision guiding state tax and budget decisions in 2020! So far this year, the harm of Colorado’s TABOR policy and Alaska’s lack of an income tax are coming into focus in big ways. Utah advocates are hoping the benefit of hindsight will help convince voters to overturn a recently enacted tax overhaul. Lawmakers in states including Iowa, Maryland, and Virginia can clearly see a need for revenues,…

Guilty, Not GILTI: Unclear Whether Corps Continue to Lower Their Tax Bills Via Tax Haven Abuse

January 7, 2020 • By Matthew Gardner

President Trump and GOP lawmakers often cited corporations’ abuse of tax havens, e.g. shifting profits offshore to avoid taxes, as justification for dramatically lowering the federal corporate tax rate under the 2017 Tax Cuts and Jobs Act. By 2016, corporations’ offshore cash haul had grown to $2.6 trillion, representing hundreds of billions in lost federal tax […]

Corporate Tax Avoidance Is Mostly Legal—and That’s the Problem

December 19, 2019 • By Steve Wamhoff

As usual, corporate spokespersons and their allies are trying to push back against ITEP’s latest study showing that many corporations pay little or nothing in federal income taxes. One way they respond is by stating that everything they do is perfectly legal. This is an attempt by the corporate world to change the subject. The entire point of ITEP’s study is that Congress has allowed corporations to avoid paying taxes, and that this must change.

State Rundown 12/18: Utah’s Tax Fight Wraps Up As Other States’ Ramp Up

December 18, 2019 • By ITEP Staff

With the new year and many state legislative sessions just around the corner, most state tax and budget debates are just getting started. Arkansas will be among the states working to improve their roads and other infrastructure. Massachusetts will have to deal with revenue losses due to a misguided tax-cut trigger put in place in prior years. Maryland and South Dakota will be two of many states facing teacher pay shortages and other education funding needs. And debates over the legalization and taxation of cannabis will likely continue in California, Kentucky, New Jersey, and beyond. Utah lawmakers, on the other…

For the Holiday Wishlist: Child Tax Credit Improvements That Would Lift Millions Out of Poverty

December 18, 2019 • By Aidan Davis

A recent New York Times article serves as a stark reminder that child poverty remains a persistent problem in this country and that the policies we have in place to help this vulnerable population need immediate attention and improvement.