Corporate Taxes

Corporate Tax Avoidance Under the Tax Cuts and Jobs Act

July 29, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

Thirty-nine profitable corporations in the S&P 500 or Fortune 500 paid no federal income tax from 2018 through 2020, the first three years that the Tax Cuts and Jobs Act (TCJA) was in effect. Besides the 39 companies that paid nothing over three years, an additional 73 profitable corporations paid less than half the statutory corporate income tax rate of 21 percent established under TCJA. As a group, these 73 corporations paid an effective federal income tax rate of just 5.3 percent during these three years.

Opposition to Biden’s Tax Plan Has Nothing to Do with Small Businesses or Family Farms

July 16, 2021 • By Steve Wamhoff

Special interests lobbying against President Joe Biden’s tax agenda claim that his proposed corporate income tax rate hike will harm small businesses and that his proposed capital gains tax reforms will hurt family farms. Both claims are absurd attempts by powerful interests to pretend they are defending the little guy.

Washington Post Confirms that Corporations Are Bolder than Ever in Claiming Dubious Tax Breaks

July 16, 2021 • By Steve Wamhoff

IRS budget cuts starting in 2010 have forced the agency to reduce its audit rate for corporations with $20 billion or more in assets from 98 percent to 50 percent. The Washington Post found that during the decade, the amount of “uncertain tax benefits” claimed by corporations increased 43 percent, from $164 billion in 2010 to $235 billion in 2020.

U.S. Should Pursue Biden’s Tax Legislation and International Tax Agreement on Separate Tracks

June 9, 2021 • By Steve Wamhoff

The agreement announced over the weekend from the finance leaders of the Group of 7 (G7) countries to allow governments to tax some corporate profits based on the location of sales and to implement a 15 percent global minimum tax is a major step forward—but in no way changes the need for Congress to enact President Joe Biden’s tax reforms right now.

IRS Clock Runs Out, Saving 14 Large Companies $1.3 Billion

May 18, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

Each year, corporations publicly state that some of the tax breaks they claim are unlikely to withstand scrutiny from tax authorities. And each year, corporations report that they will keep some of the dubious tax breaks they declared in previous years simply because the statute of limitations ran out before tax authorities made any conclusions. This suggests that, perhaps because of cuts to its enforcement budget, the IRS is not even investigating corporations that publicly announce they have claimed tax breaks that tax authorities would likely find illegal.

Nike’s Tax Avoidance Response Does not Dispute It Paid $0 in Federal Income Tax

April 19, 2021 • By Matthew Gardner

It was (allegedly) P.T. Barnum who first said “there’s no such thing as bad publicity.” But the public relations professionals at the Nike Corporation clearly disagree with this maxim. Last week, after multiple media outlets, including the New York Times, wrote about ITEP’s conclusion that Nike avoided federal corporate income taxes under the Trump tax law, the company contacted these news organizations to… change the subject.

The High Cost of Corporate Tax Avoidance (Webinar)

April 8, 2021 • By Amy Hanauer, ITEP Staff, Matthew Gardner

When communities thrive, so do corporations. But when profitable corporations build their empires by exploiting the tax code, it is workers, the environment and our communities—not CEOs or shareholders—that are harmed. Amazon posted its highest U.S. profit ever for 2020, an unprecedented year defined by a pandemic. Yet the company sheltered more than half its profits from corporate taxes—legally. While the company may be one of the most recognizable tax avoiders, it's not an outlier.

55 Corporations Paid $0 in Federal Taxes on 2020 Profits

April 2, 2021 • By Matthew Gardner, Steve Wamhoff

At least 55 of the largest corporations in America paid no federal corporate income taxes in their most recent fiscal year despite enjoying substantial pretax profits in the United States. This continues a decades-long trend of corporate tax avoidance by the biggest U.S. corporations, and it appears to be the product of long-standing tax breaks preserved or expanded by the 2017 tax law as well as the CARES Act tax breaks enacted in the spring of 2020.

Read as PDF Note: This report is adapted from written testimony submitted by Amy Hanauer before testifying in person to the Senate Budget Committee on March 25, 2021. In 2020, the pandemic killed hundreds of thousands of Americans and unemployment soared to levels not seen since the Bureau of Labor Statistics started collecting data in […]

The corporate tax plan put forth on Wednesday by President Joe Biden to offset the cost of his infrastructure priorities would be the most significant corporate tax reform in a generation if enacted.

We all need the things that the public sector provides. When corporate taxes go unpaid, the American people have less for the things that would help our communities. That means less repair of our failing infrastructure, less investment in greening our economy, less funding to help young people attend college.

Testimony to Senate Budget Committee on Ending a Rigged Tax Code: The Need To Make the Wealthiest People and Largest Corporations Pay their Fair Share of Taxes

March 25, 2021 • By Amy Hanauer

Following is testimony of ITEP Executive Director Amy Hanauer before the Senate Budget Committee to consider “Ending a Rigged Tax Code: The Need To Make the Wealthiest People and Largest Corporations Pay their Fair Share of Taxes” “Chairman Sanders and Ranking Member Graham, thank you for the opportunity to speak to this committee. My name […]

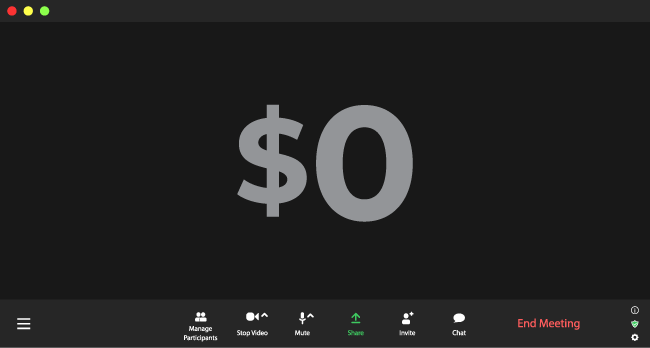

Zoom Video Communications, the company providing a platform used by remote workers and school children across the country during the pandemic, saw its profits increase by more than 4,000 percent last year but paid no federal corporate income tax on those profits.

Rep. Doggett and Sen. Whitehouse Introduce Bill to Crack Down on Offshore Corporate Tax-Dodging

March 11, 2021 • By Steve Wamhoff

The 2017 tax law simply replaced one set of loophole-ridden rules that favored offshore profits over domestic profits with a new set of loophole-ridden rules doing the same thing. A bill introduced today by Rep. Lloyd Doggett and Sen. Sheldon Whitehouse would finally fix this to follow a simple principle: we should tax the offshore profits and domestic profits of our corporations the same way.

CARES Act Helps Create $4.6 Billion Tax Cut for Health Care Companies Paying Opioid Settlements

February 12, 2021 • By Matthew Gardner

Talk about a one-two punch. A new report from the Washington Post reveals that the U.S. public is set to pay for the opioid crisis again. Already, communities across the country have paid a heavy price via the devastating public health toll. Now, it appears taxpayers will be on the hook for billions in corporate tax breaks as four pharmaceutical companies exploit a loophole in the Trump-GOP tax law and a CARES Act tax provision meant for companies facing pandemic-related profit losses.

Amazon Has Record-Breaking Profits in 2020, Avoids $2.3 Billion in Federal Income Taxes

February 3, 2021 • By Matthew Gardner

Amazon’s winning streak in its battle against the U.S. tax system remains intact. This week the retail giant announced record-breaking sales and income for 2020, and an effective federal income tax rate of just 9.4 percent, less than half the statutory corporate tax of 21 percent. If Amazon had paid 21 percent of its profits in federal income tax, that would have come to $4.1 billion. The company’s reported current tax of $1.8 billion was less than half that, meaning last year Amazon avoided $2.3 billion in taxes.

Pandemic Profits: Netflix Made Record Profits in 2020, Paid a Tax Rate of Less than 1 Percent

February 1, 2021 • By Matthew Gardner

Netflix’s “current” federal income tax for 2020 was $24 million, which equals just 0.9 percent of the company’s pretax income for the year. This is another way of saying Netflix paid an effective federal income tax rate of just 0.9 percent in 2020. If the company paid the statutory rate, its tax bill would be $572 million.

Between the Lines: Amazon Q2 Report Hints It Will Avoid Taxes on This Year’s Record Profit Haul

August 5, 2020 • By Matthew Gardner

The House Judiciary Committee last week held an antitrust hearing to scrutinize Amazon and other tech companies’ growing dominance. A look at the online retail giant’s new quarterly report and past tax avoidance reveals why lawmakers should be equally concerned about how the tax system allows dominant, profitable corporations to avoid most or all federal tax on their profits. Amazon, yet again, is poised to pay little or no federal income tax on its record profits, and it appears likely to do so using entirely legal tax breaks for stock options and research and development.

Biden’s Minimum Corporate Tax Proposal: Yes, Please Limit Amazon’s Tax Breaks

July 29, 2020 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

A large majority of Americans want corporations to pay more taxes and Democratic presidential candidate Joe Biden has several proposals to achieve that. The newest idea is to require corporations to pay a minimum tax equal to 15 percent of profits they report to shareholders and to the public if this is less than what they pay under regular corporate tax rules. A recent article in the Wall Street Journal quotes several critics of the proposal, but none of their points are convincing.

White House Incredibly Still Believes Tax Cuts Are the Answer to America’s Problems

June 2, 2020 • By Steve Wamhoff

White House officials continue to discuss tax cuts in response to the COVID-19 pandemic. Steve Wamhoff provides a roundup of these terrible ideas that would do little to boost investment or reach those who need it most.

Depreciation Breaks Have Saved 20 Major Corporations $26.5 Billion Over Past Two Years

June 2, 2020 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

The Trump administration and its congressional allies have proposed making permanent the expensing provision in the Trump-GOP tax law. Expensing is the most extreme form of accelerated depreciation, which allows businesses to deduct the cost of purchasing equipment more quickly than it wears out. But expensing and other types of accelerated depreciation already account for a very large share of corporate tax breaks and allows many companies to pay nothing at all.

Trump-GOP Tax Law Encourages Companies to Move Jobs Offshore–and New Tax Cuts Won’t Change That

June 2, 2020 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

New tax cuts to incentivize bringing jobs back to the United States will fail. No new tax provisions can be more generous than the zero percent rate the 2017 law provides for many offshore profits or the loopholes that allow corporations to shift profits to countries with minimal or no corporate income taxes.

The Health Economic Recovery and Omnibus Emergency Solutions (HEROES) Act includes important changes to business tax provisions in the CARES Act, the most recent COVID-19 legislation enacted by Congress and the president. The House-passed plan would undo CARES Act changes that make it easy for businesses to claim losses to reduce or avoid all taxes. […]

JPMorgan Chase CEO Jamie Dimon, in a May 19 memo to employees, outlines steps the company is taking to help its customers, small businesses and communities stay afloat. The part of the public relations memo that has received the most attention, however, is Dimon’s call for “rebuilding a more inclusive economy.” “It is my fervent […]

There is every reason to believe that Amazon will continue its tax-avoidance ways in 2020. The entirely-legal tax avoidance tools the company used to zero out its federal income tax bills over the last three years remain entirely legal today. From accelerated depreciation to the research and development tax credit to the deduction for executive stock options, Amazon’s tax avoidance tools have been blessed by lawmakers, and presidents, of all stripes.

ITEP’s corporate tax research examines the tax practices of major corporations. Besides its corporate study on average effective tax rates paid by the nation’s largest, most profitable corporations, throughout the year, ITEP produces research on subjects such as offshore cash holdings, tax haven abuse, executive stock options and other tax loopholes. See ITEP’s more recent study of profitable corporations’ tax rates.