Tax Reform

Better tax policies will help communities emerge from the current staggering fiscal crisis with tax structures that reduce inequality at a time when rich people are thriving and public services are under siege. Preserving public spending will boost the economy and improve lives–and cutting these essentials will not only hurt people but also deepen the downturn, a lesson we learned in the Great Recession’s slow recovery. Other states should take note.

New ITEP Report Shows Few Taxpayers in Each State Paying More Under Biden’s Tax Plan

October 7, 2020 • By Steve Wamhoff

An ITEP report finds that taxes that people pay directly would stay the same or go down in 2022 for 98.1 percent of Americans under President-elect Joe Biden’s tax plan.

New 50-State Analysis of Biden Revenue-Raising Tax Proposals

October 7, 2020 • By ITEP Staff

A state-by-state analysis of President-elect Joe Biden’s proposal to raise taxes for filers with income of more than $400,000 finds that in 2022, just 1.9 percent of all taxpayers would face a direct tax increase. This would vary only slightly by state. For example, in West Virginia, 0.6 percent of taxpayers would see an increase, and in Connecticut, 3.7 percent of taxpayers’ taxes would increase.

Donald Trump and Taxes: Fast and Loose with Loopholes or Fraud?

September 30, 2020 • By Matthew Gardner

The president’s apparent abuse of everything from hair-care deductions to consulting fees for family members raises questions about whether Trump was fast and loose with tax loopholes or whether the IRS simply wasn’t enforcing the law. Either way, Trump successfully flouting or pushing the limits of the law shouldn’t come as a surprise: Congress has cut IRS funding, in real terms in each of the last 10 years.

It’s Time to Change the Tax Laws to Make Donald Trump and Corporate Giants Pay Up

September 29, 2020 • By Amy Hanauer

It’s time for a new approach. Trump’s egregious tax avoidance further exposes a system that preserves an enormous and growing economic divide. Congress has gutted IRS funding so that we don’t have the resources to audit wealthy tax avoiders. And lobbyists continue to secure giveaways for corporate clients that do nothing for our communities.

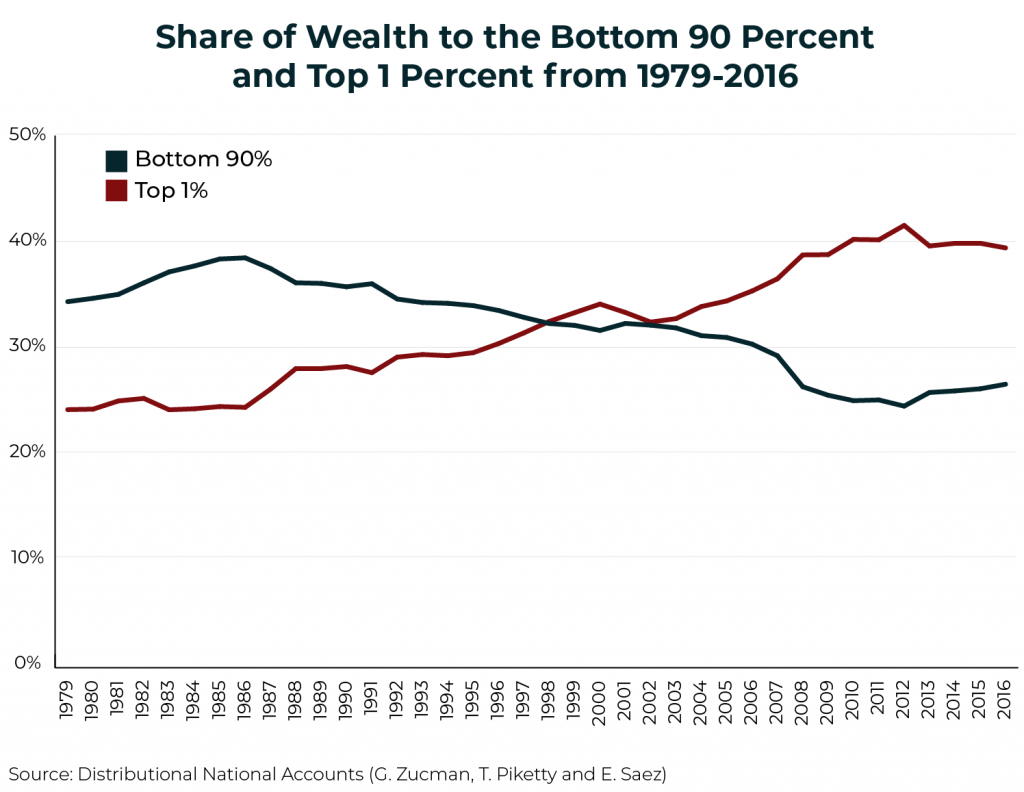

While the moneyed elite were dangling shiny objects, scapegoating Black and brown people, denigrating immigrants, and financing studies to convince us that poor people are the problem, they were concurrently securing policies that cut taxes primarily for the rich and profitable corporations, deregulated industry, weakened unions and attacked voting rights. This and more allowed the rich to amass even more wealth and power.

SALT Cap Repeal Has No Place in COVID-19 Legislation: National and State-by-State Data

July 17, 2020 • By Steve Wamhoff

The Trump-GOP tax law enacted at the end of 2017 includes a $10,000 cap on the amount of state and local taxes (SALT) that people can deduct on their federal tax returns, and this is one of the few limits the law places on tax breaks for high-income people. Unfortunately, it is also the provision that some Democrats are most determined to remove.

How Democratic Presidential Candidates Would Raise Revenue

February 19, 2020 • By Steve Wamhoff

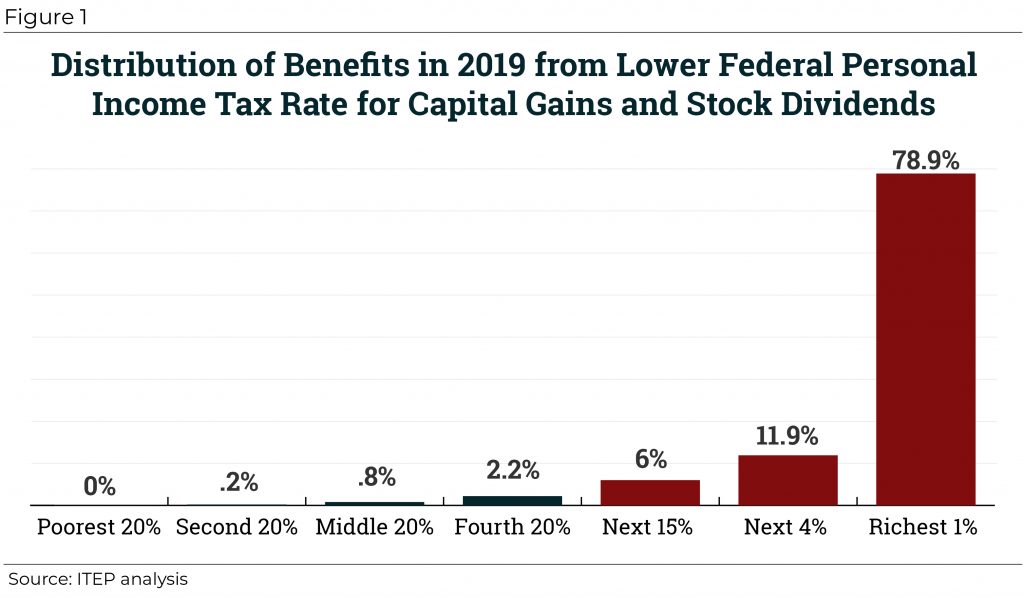

One of the biggest problems with the U.S. tax code in terms of fairness is that investment income, which mostly flows to the rich, is taxed less than the earned income that makes up all or almost all of the income that working people live on.

Washington Is Finally Having the Right Conversation about Taxes

February 4, 2020 • By Amy Hanauer

Presidential candidates and some elected officials are finally talking about bold tax policy ideas that would increase taxes and raise revenue. This is a dramatic shift from when a radical, right-wing narrative dominated the public debate. Republicans redefined “fiscal responsibility” as fewer taxes and less government, peddled supply-side economic theories, and denied the clear evidence that tax cuts were adding to our nation’s deficits.

GOP Legacy on IRS Administration: Auditing Mississippi, not Microsoft

January 24, 2020 • By Matthew Gardner

Money doesn’t buy happiness—but it can buy immunity from the reach of Uncle Sam. The IRS is outgunned in cases against corporate giants because that’s how Republican leaders want it to be. They have systematically assaulted the agency’s enforcement capacity through decades of funding cuts. Instead of saving money, these cuts have cost billions: each dollar spent on the IRS results in several dollars of tax revenue collected.

Corporate Tax Avoidance Is Mostly Legal—and That’s the Problem

December 19, 2019 • By Steve Wamhoff

As usual, corporate spokespersons and their allies are trying to push back against ITEP’s latest study showing that many corporations pay little or nothing in federal income taxes. One way they respond is by stating that everything they do is perfectly legal. This is an attempt by the corporate world to change the subject. The entire point of ITEP’s study is that Congress has allowed corporations to avoid paying taxes, and that this must change.

Benefits of a Financial Transaction Tax

October 28, 2019 • By Jessica Schieder, Lorena Roque, Steve Wamhoff

A financial transaction tax (FTT) has the potential to curb inequality, reduce market inefficiencies, and raise hundreds of billions of dollars in revenue over the next decade. Presidential candidates have proposed using an FTT to fund expanding Medicare, education, child care, and investments in children’s health. Any of these public investments would be progressive, narrowing resource gaps between the most vulnerable families and the most fortunate.

Emmanuel Saez and Gabriel Zucman’s New Book Reminds Us that Tax Injustice Is a Choice

October 15, 2019 • By Steve Wamhoff

Cue Emmanuel Saez and Gabriel Zucman. In their new book, The Triumph of Injustice, the economists, who already jolted the world with their shocking data on exploding income inequality and wealth inequality, tell us to stop acting like we are paralyzed when it comes to tax policy. There are answers and solutions. And in about 200 surprisingly readable pages, they provide them.

A New York Times article explained that proponents of a federal wealth tax hope to address exploding inequality but then went on to list the fears of billionaires and economic policymakers, finding that “the idea of redistributing wealth by targeting billionaires is stirring fierce debates at the highest ranks of academia and business, with opponents arguing it would cripple economic growth, sap the motivation of entrepreneurs who aspire to be multimillionaires and set off a search for loopholes.” A wealth tax will not damage our economy and instead would likely improve it. Here’s why.

One of the most glaring sources of unfairness in the federal tax code are rules that tax capital gains, which mostly go to the rich, less than wages and other types of income that most of us depend on. The capital gains tax breaks have for decades been comfortably ensconced behind trenches filled with special interests who would defend them until the end. But the end is now conceivable.

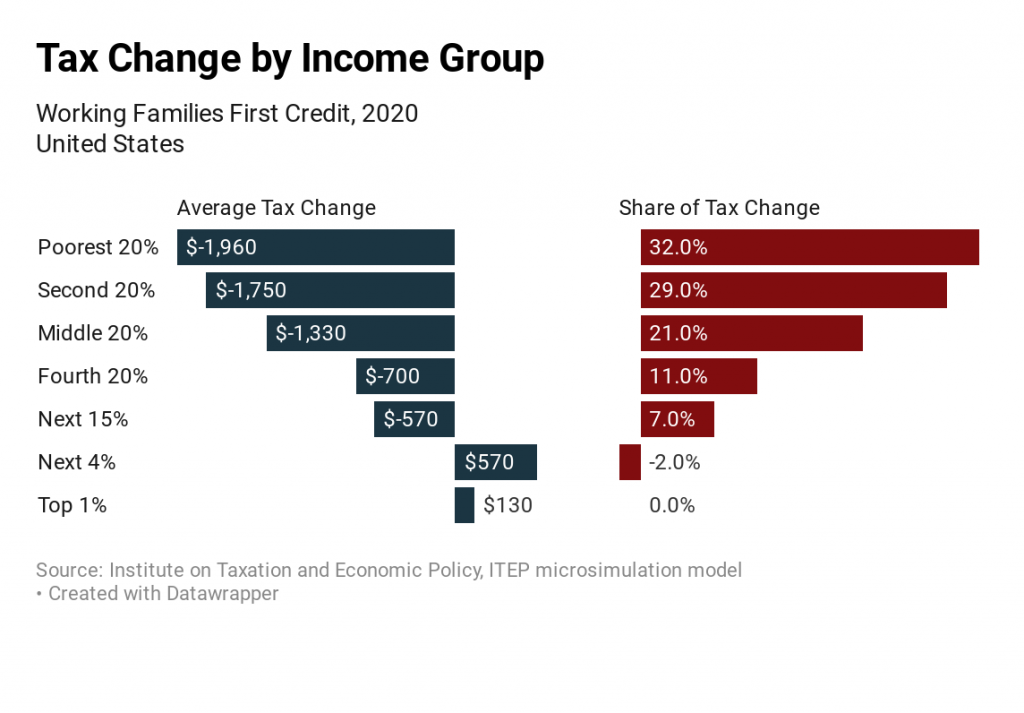

Julián Castro Provides the Latest Proposal to Expand Refundable Tax Credits

September 17, 2019 • By Steve Wamhoff

New estimates from ITEP show that Julián Castro’s refundable tax credit proposal would mostly benefit the bottom 60 percent of households and would have a cost ($195 billion in 2020) that places it roughly in the middle of the different tax credit proposals that Democrats have offered over the past several months.

Many States Move Toward Higher Taxes on the Rich; Lower Taxes on Poor People

July 18, 2019 • By Meg Wiehe

Several states this year proposed or enacted tax policies that would require high-income households and/or businesses to pay more in taxes. After years of policymaking that slashed taxes for wealthy households and deprived states of revenue to adequately fund public services, this is a necessary and welcome reversal.

What to Watch for on Tax Policy During the Presidential Primary

June 25, 2019 • By Steve Wamhoff

America needs a new tax code. The Democratic presidential debates beginning this week present an opportunity for candidates to make clear how they would address inequality or to raise enough revenue to make public investments that make the economy work for everyone. Here are some of the big tax issues that we hope they will touch on.

Calling Progressive Tax Proposals “Extreme” Are Taunts Meant to Distract

June 18, 2019 • By Steve Wamhoff

Dismissing calls for progressive taxes as “radical,” “extreme,” or “socialism” are taunts meant to distract from the real question: Why should we ignore the bottom half of Americans, whose share of the economic pie shrank and now have negative net worth, while allowing the wealthy and powerful, whose net worth more than tripled, to dictate our public policies?

New SALT Workaround Regulations Narrow a Tax Shelter, but Work Remains to Close it Entirely

June 11, 2019 • By Carl Davis

Today the Internal Revenue Service (IRS) released its final regulations cracking down on a tax shelter long favored by private and religious K-12 schools, and more recently adopted by some “blue state” lawmakers in the wake of the 2017 Trump tax cut. The regulations come more than a year after the IRS first announced the […]

Congress Should Reduce, Not Expand, Tax Breaks for Capital Gains

February 1, 2019 • By Steve Wamhoff

Even though income derived from capital gains receives a special lower tax rate and is therefore undertaxed, some proponents of lower taxes on the wealthy claim that capital gains are overtaxed due to the effects of inflation. But existing tax breaks for capital gains more than compensate for any problem related to inflation. Congress should repeal or restrict special tax provisions for capital gains rather than creating even more breaks.

Five Things to Know on the One-Year Anniversary of the Tax Cuts and Jobs Act

December 17, 2018 • By Richard Phillips

While it has only been a year since passage of the Tax Cuts and Jobs Act (TCJA), it’s clear the law largely is both a debacle and a boondoggle. Below are the five takeaways about the legacy and continuing effect of the TCJA. 1. The Tax Cuts and Jobs Act will substantially increase income, wealth, and racial inequality. 2. The Tax Cuts and Jobs Act will continue to substantially increase the deficit. 3. The Tax Cuts and Jobs Act is not significantly boosting growth or jobs. 4. The Tax Cuts and Jobs Act continues to be very unpopular. 5. Despite…

House Democrats Falter with Proposed Rule to Restrict Tax Hikes

November 16, 2018 • By Alan Essig

Democratic leaders have proposed rules to be adopted in the next Congress, and many of them, such as eliminating the requirement for “dynamic scoring,” are very sensible. But one of the proposed rules is problematic because it would make it harder to raise revenue.

The Post-Midterms Tax Policy Outlook: Small Ball and Real Tax Reform Debate

November 8, 2018 • By Richard Phillips

With most of the results of the 2018 midterm elections in, the broad landscape for federal tax policy over the next couple years is coming into view. Democratic control of the House and Republican control of the Senate means a significant tax overhaul is unlikely, but minor tax changes may happen. And the run-up to the 2020 presidential election will force more robust debate over the impact of the Tax Cuts and Jobs Act (TCJA) and what aspects of the legislation should be repealed, reformed, or built upon.

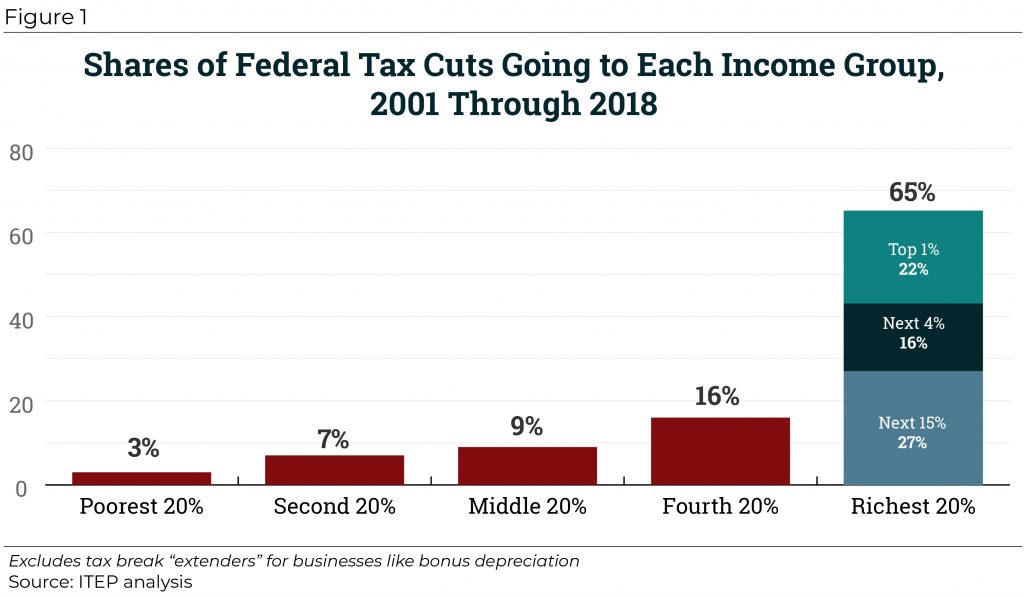

65 Percent of Federal Tax Cuts Since 2000 Have Gone to Richest 20 Percent

July 11, 2018 • By ITEP Staff

Since 2000, Congress has passed several rounds of tax cuts that have increased the federal deficit by nearly $6 trillion and disproportionately benefited the top 20 percent of households, which received nearly two-thirds (65 percent) of the value of all tax changes.