ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

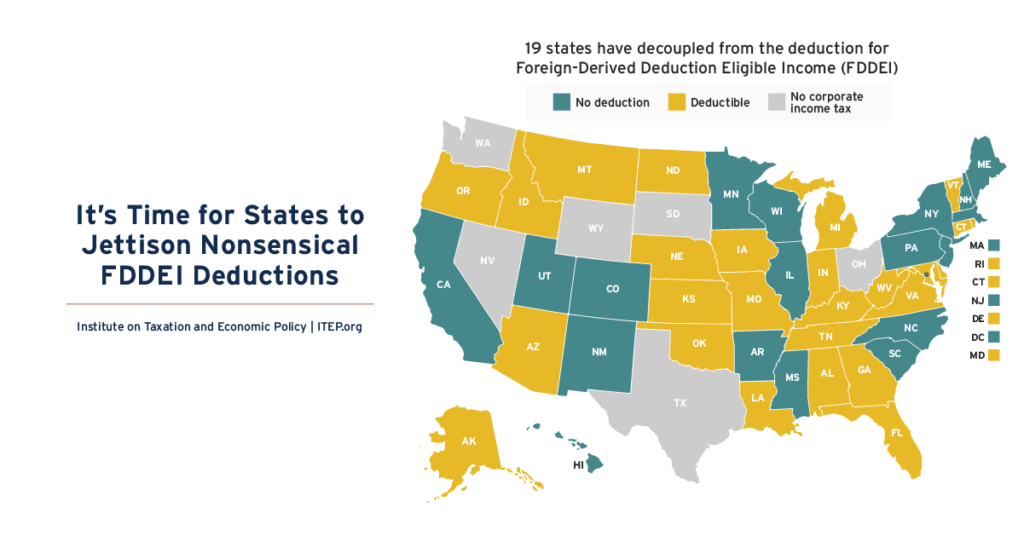

It’s Time for States to Jettison Nonsensical FDDEI Deductions

February 19, 2026 • By Carl Davis

States often link their tax laws to the federal code in significant ways. Many of these links are justified and can simplify tax administration for both taxpayers and state officials. But in other cases, something can get lost in translation, and states end up copying federal provisions that just don’t make sense at the state […]

Palantir Pays Zero Federal Income Tax Despite Explosive Growth, Largely Due to Trump Tax Law

February 17, 2026 • By Matthew Gardner

Palantir reported $1.5 billion of U.S. income but paid exactly zero federal income tax in 2025. Despite explosive growth, tax breaks from the Trump tax law helped Palantir avoid paying even a dime of federal income tax on its earnings.

State Tax Watch 2026

February 2, 2026 • By ITEP Staff

ITEP tracks tax discussions in legislatures across the country and uses our unique data capacity to analyze the revenue, distributional, and racial and ethnic impacts of many of these proposals. State Tax Watch offers the latest news and movement from each state.

ITEP Statement: President Trump Sues the American People for $10 Billion

January 30, 2026 • By ITEP Staff

The following is a statement by Amy Hanauer, executive director at the Institute on Taxation and Economic Policy, in response to yesterday’s announcement that President Trump and his family are suing the IRS over the leak of his tax returns by an IRS contractor: “Several years ago, an IRS contractor leaked confidential tax return data […]

An Anti-Affordability Agenda: Trump’s Advisors Call on States to Raise Taxes on the Working Class and Drastically Cut Taxes for the Rich

January 29, 2026 • By Carl Davis

The Trump administration’s Council of Economic Advisors suggests that states consider drastically raising sales taxes and using those new revenues to pay for repealing taxes on corporate and personal income. Working-class families would face dramatic tax increases while the nation’s wealthiest families would see their state tax bills plummet.

Tesla Reported Zero Federal Income Tax on $5.7 Billion of U.S. Income in 2025

January 29, 2026 • By Matthew Gardner

Tesla enjoyed almost $5.7 billion of U.S. income in 2025 but paid $0 in federal income tax. Over the past three years, the Elon Musk-led company reported $12.5 billion of U.S. income on which its current federal tax was just $48 million.

An Analysis of a Potential Reduction in Massachusetts’ Long-Term Capital Gains Tax Rate

January 26, 2026 • By Eli Byerly-Duke, Matthew Gardner

A ballot initiative in Massachusetts has proposed cutting the base rate for nearly all income sources from 5 to 4 percent. In 2026, this would cost the state about $5 billion per year of which $347 million would come from the reduced rate on long-term capital gains.

Show Me Where We’re Going: Missouri’s Fiscally Irresponsible Path Will Be Paid for by Everyday People

January 8, 2026 • By Logan Liguore

Missouri lawmakers have been pushing regressive and shortsighted tax policies that undermine everyday workers and sabotage the Show-Me State’s ability to raise revenue.

From Congressional discussions over the so-called "One Big Beautiful Bill Act" to debates on property taxes, ITEP kept busy this year analyzing tax proposals and showing Americans across the country how tax decisions affect them.

10 Reasons Why the U.S. Should Reform Its Corporate Income Tax

December 17, 2025 • By Steve Wamhoff

The U.S. needs a tax code that is more progressive and that raises more revenue than the one we have now. An important way to achieve this is to reform the taxation of business profits. These four key policy reforms would greatly strengthen the corporate tax system: Eliminating or restricting special breaks and loopholes that […]

Tax Haven Data Demonstrate Need for Global Minimum Tax Despite Opposition from Trump Administration

December 10, 2025 • By Steve Wamhoff

American corporations use accounting gimmicks to make profits appear to be earned in tax havens. This widespread problem could be fixed by Congress enacting legislation to implement a minimum tax on corporations that meets the standards of the global minimum tax that other countries have begun to implement.

Linking to Tipped and Overtime Income Deductions Would Worsen State Shortfalls, Do Little to Help Workers

December 8, 2025 • By Neva Butkus, Galen Hendricks

State deductions for tips and overtime are not only ineffective at supporting working-class people, it will come at a substantial cost to state budgets.

Not-So-Free Kick: How the 2026 FIFA World Cup Will Cost Cities Millions

December 5, 2025 • By Page Gray

FIFA demanded sales tax breaks on World Cup Tickets. That means millions in lost revenue for host cities already shouldering the costs on providing infrastructure, security and logistics.

Re-Examining 529 Plans: Stopping State Subsidies to Private Schools After New Trump Tax Law

November 20, 2025 • By Miles Trinidad, Nick Johnson

The 2025 federal tax law risks making 529 plans more costly for states by increasing tax avoidance and allowing wealthy families to use these funds for private and religious K-12 schools.

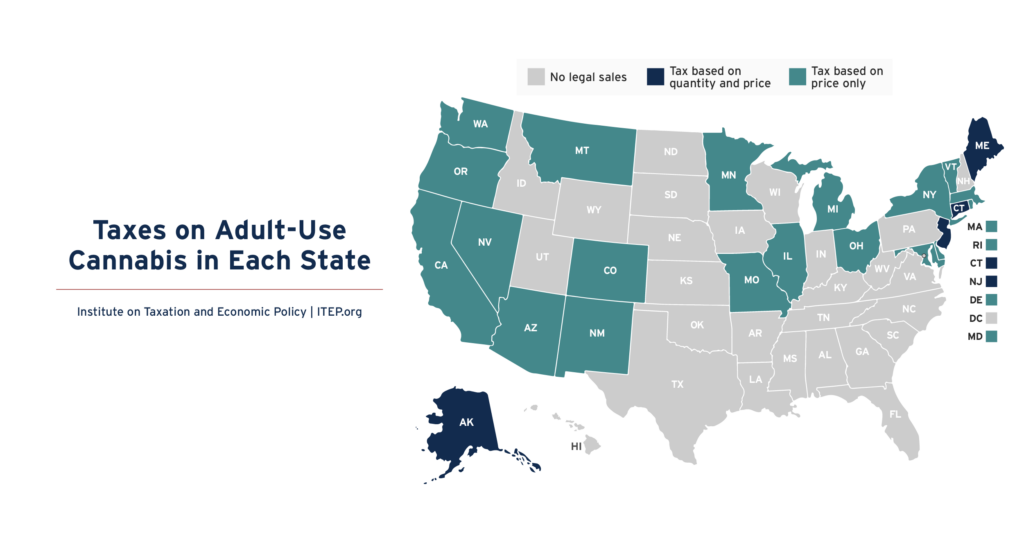

Twenty-three states have legalized the sale of cannabis for general adult use. Every state allowing legal sales applies an excise tax to cannabis based on the product’s quantity, its price, or both. Quantity taxes can be based on either overall product weight or the amount of THC sold. ITEP research indicates that taxes based on […]

State Earned Income Tax Credits Support Families and Workers in 2025

September 11, 2025 • By Neva Butkus

Nearly two-thirds of states now have an Earned Income Tax Credit (EITC). Momentum continues to build on these credits that boost low-paid workers’ incomes and offset some of the taxes they pay, helping lower-income families achieve greater economic security.

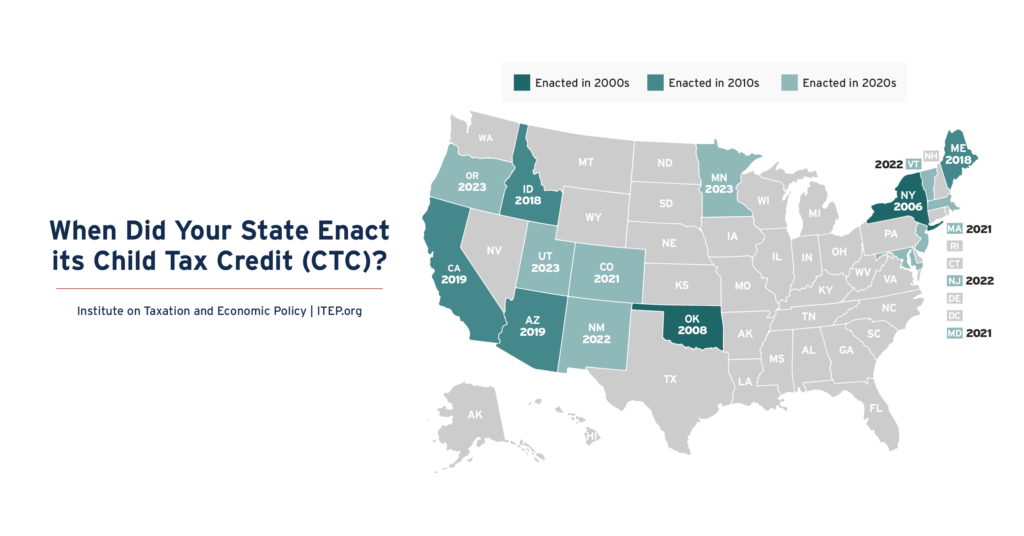

The Child Tax Credit (CTC) is an important tool to fight child poverty and help families make ends meet. When designed well, it can also make tax systems less regressive. As of 2020, only six states had CTCs. Today, 15 states have CTCs, with many credits exceeding $1,000 per qualifying child.

Excessive CEO Pay Makes Inequality Worse. Shareholders and the Public Deserve to Know About Compensation Disparities

July 30, 2025 • By Matthew Gardner

Huge executive pay packages are a prime driver of income inequality. Shareholders and the public deserve to know about how CEOs are compensated, but new SEC leadership seems to think otherwise.

State Tax Action in 2025: Amid Uncertainty, Tax Cuts and New Revenue

July 28, 2025 • By Aidan Davis, Neva Butkus, Marco Guzman

Federal policy choices on tariffs, taxes, and spending cuts will be deeply felt by all states, which will have less money available to fund key priorities. This year some states raised revenue to ensure that their coffers were well-funded, some proceeded with warranted caution, and many others passed large regressive tax cuts that pile on to the massive tax cuts the wealthiest just received under the federal megabill.

Refundable tax credits were a big part of state tax policy conversations this year. In 2025, nine states improved or created Child Tax Credits or Earned Income Tax Credits.

State Rundown 7/24: States Begin Preparing for Federal Megabill Fallout

July 24, 2025 • By ITEP Staff

All eyes in statehouses in recent weeks have been on federal budget negotiations, and now that the “megabill” has passed, they are focused in on their own budgets in search of ways to cope with the enormous consequences coming their way. All states will see fewer federal dollars flowing through their coffers, higher needs due […]

Americans Want to Know Which Corporations Aren’t Paying Taxes, but House Republicans Want to Keep this Information Secret

July 23, 2025 • By Matthew Gardner

The appropriations plan released by House Republicans this weekend threatens to withhold funding for an obscure but vital financial oversight board because that board now requires corporations to disclose basic information about their income tax payments (or lack thereof).

How Will the Trump Megabill Change Americans’ Taxes in 2026?

July 22, 2025 • By Steve Wamhoff, Michael Ettlinger, Carl Davis, Jon Whiten

The megabill will raise taxes on the poorest 40 percent of Americans, barely cut them for the middle 20 percent, and cut them tremendously for the wealthiest Americans next year.

Sales Tax Holidays Miss the Mark When it Comes to Effective Sales Tax Reform

July 17, 2025 • By Miles Trinidad

Sales tax holidays are often marketed as relief for everyday families, but they do little to address the deeper inequities of regressive sales taxes. In 2025, 18 states offer these holidays at a collective cost of $1.3 billion.

States Should Move Quickly to Chart Their Own Course on SALT Deductions

July 17, 2025 • By Dylan Grundman O'Neill, Nick Johnson

While a federal SALT cap is hotly debated, capping deductibility at $10,000 was an unambiguously good idea at the state level. States would be smart to stick with the current cap or, better yet, go even farther and repeal SALT deductions outright. Going along with a higher federal SALT cap would double down on a regressive tax cut that will mostly benefit a small number of relatively wealthy state residents and cost states significant revenue.