ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Tax Foundation’s ‘State Business Tax Climate Index’ Bears Little Connection to Business Reality

October 31, 2022 • By Carl Davis, Matthew Gardner

The big problem with the Index is that it peddles a solution that not only falls short of the goal of generating business investment, but one that actively harms state lawmakers’ ability to provide the kinds of public goods – like good schools and modern, efficient transportation networks – that businesses need and want.

Measures on the November Ballot Could Improve or Worsen State Tax Codes

October 26, 2022 • By Jon Whiten

In a couple of weeks, voters in a handful of states will weigh in on several tax-related ballot measures that could make state tax codes more equitable and raise money for public services, or take states in the opposite direction, making tax systems less fair and draining state coffers of dollars needed to maintain critical […]

Eli Byerly-Duke

October 19, 2022 • By ITEP Staff

Eli is a State Analyst who monitors trends in state tax policy and conducts long-term research. His focus is principally on the border South and California. Prior to joining ITEP in 2022, Eli researched spatial economic inequality and local budgets at Brookings Metro with particular attention to local use of federal funds.

Miles Trinidad

October 19, 2022 • By ITEP Staff

Miles provides research and monitors state tax policy to support state researchers and advocates. Before joining ITEP in 2022, Miles worked in the office of Rep. Peter DeFazio for more than three years. As a legislative assistant, his work included drafting a windfall profits tax on oil companies to prevent corporate profiteering from global crises […]

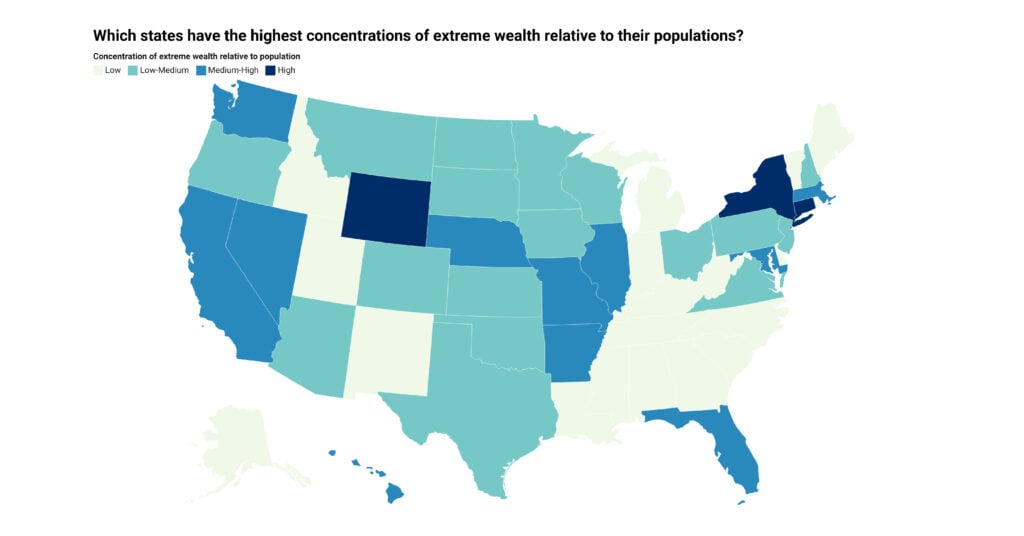

More than one in four dollars of wealth in the U.S. is held by a tiny fraction of households with net worth over $30 million. This extreme wealth is geographically concentrated, with the top 10 states accounting for more than 70 percent of nationwide extreme wealth and with New York and California alone accounting for nearly a third.

More than one in four dollars of wealth in the U.S. is held by a tiny fraction of households with net worth over $30 million. Nationally, we estimate that wealth over $30 million per household will reach $26 trillion in 2022 with roughly one-fifth of that amount ($4.5 trillion) held by billionaires.

While the Inflation Reduction Act's corporate minimum tax is a huge improvement in our tax system, implementing the global corporate minimum tax would improve it much more. And if other governments implement the global minimum tax, the United States will have an even stronger interest in joining them to ensure that new revenue collected from American corporations flows to the U.S. rather than to other countries.

Congress Should Not Leave Children Out of Possible Year-End Tax Deal

October 3, 2022 • By Steve Wamhoff

If lawmakers believe it’s worthwhile to extend corporate tax breaks, then it would be entirely unreasonable for them to not conclude the same about tax provisions that help low-income children.

How the Inflation Reduction Act’s Tax Reforms Can Help Close the Racial Wealth Gap

September 20, 2022 • By Brakeyshia Samms, Joe Hughes

Lawmakers have many opportunities to pass reforms that will make our tax code fairer and further reduce racial inequity in our economy. The Inflation Reduction Act is a great step forward; better taxing wealth and income from wealth and expanding targeted refundable tax credits would build on this progress.

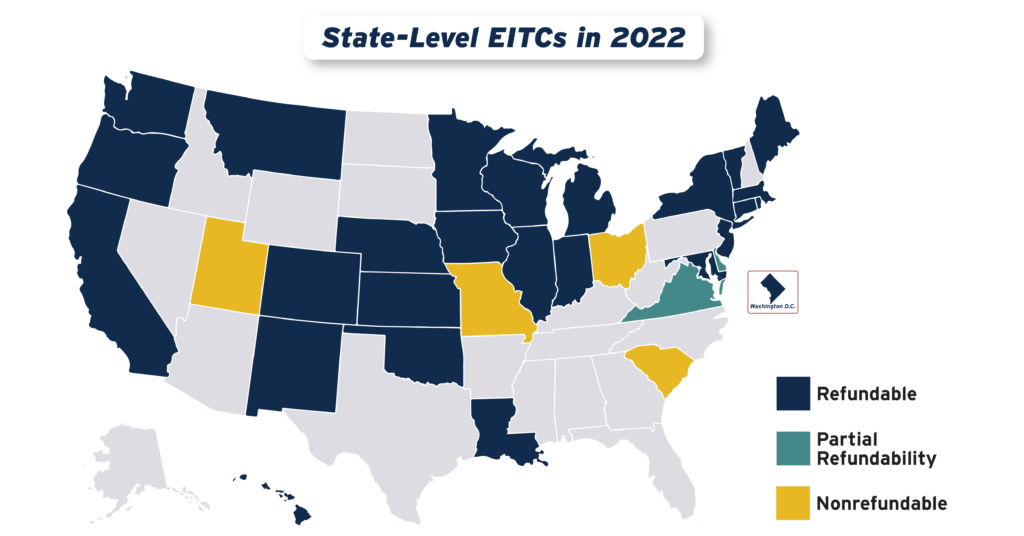

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2022

September 15, 2022 • By Aidan Davis

States continued their recent trend of advancing EITCs in 2022, with nine states plus the District of Columbia either creating or improving their credits. Utah enacted a 15 percent nonrefundable EITC, while the District of Columbia, Hawaii, Illinois, Maine, Vermont and Virginia expanded existing credits. Meanwhile, Connecticut, New York and Oregon provided one-time boosts to their EITC-eligible populations.

More States are Boosting Economic Security with Child Tax Credits in 2022

September 15, 2022 • By Aidan Davis

After years of being limited in reach, there is increasing momentum at the state level to adopt and expand Child Tax Credits. Today ten states are lifting the household incomes of families with children through yearly multi-million-dollar investments in the form of targeted, and usually refundable, CTCs.

Census Data Shows Need to Make 2021 Child Tax Credit Expansion Permanent

September 14, 2022 • By Joe Hughes

The Child Tax Credit expansion led to a 46 percent decline in childhood poverty. That it could be accomplished during the largest economic disruption in most of our lifetimes underscores a basic fact: thoughtful, decisive government action to combat poverty works.

Billionaires Should Pay Taxes on Their Income Every Year Like the Rest of Us

September 13, 2022 • By Steve Wamhoff

The Inflation Reduction Act signed by President Biden last month will crack down on corporate tax dodgers and strengthen enforcement of tax laws already on the books, raising hundreds of billions of dollars to be spent on climate, health and other priorities. But these reforms will not directly raise taxes on even the wealthiest individuals. […]

Romney Child Tax Credit Plan Would Leave Millions of Children Worse Off and Raise Taxes for the Average Black Family

September 7, 2022 • By Steve Wamhoff

Sen. Romney’s plan would expand the Child Tax Credit and offset the costs by scaling back other tax benefits. All told, it would raise taxes on a fourth of all kids in the U.S. This includes about a fourth of the children among the poorest fifth of U.S. families.

National and State-by-State Estimates of Two Approaches to Expanding the Child Tax Credit

September 7, 2022 • By Emma Sifre, Joe Hughes, Steve Wamhoff

The Romney Child Tax Credit plan would leave a quarter of children worse off compared to current law and help half as many low-income children as the 2021 expansion of the credit.

Everyone loves a deal, so it’s no surprise why the appeal of the state sales tax holiday continues to persist. This year, 20 states will forgo more than $1 billion in combined revenue to enact a variety of sales tax holidays that—like most things that are too good to be true—will do little to provide meaningful benefits and instead undermine funding for public services.

ITEP: Inflation Reduction Act is Biggest Corporate Tax Reform in Decades

August 12, 2022 • By Amy Hanauer

Amy Hanauer, Executive Director of the Institute on Taxation and Economic Policy, issued the following statement on “The Inflation Reduction Act (IRA) of 2022,” the reconciliation bill passed today by the House of Representatives. “Today Congress signed off on the biggest corporate tax reform in decades as part of a bill that will provide a […]

Lawmakers Must Choose Between Funding the IRS or Protecting Wealthy Tax Cheaters

August 12, 2022 • By Steve Wamhoff

Grasping for some way to criticize the popular Inflation Reduction Act as it approaches final passage, Congressional Republicans have decided to attack its provisions that will reverse a decade of budget cuts to the IRS and instruct the agency to crack down on tax evasion by big corporations and individuals making more than $400,000. Of […]

What Tax Provisions are in the Senate-Passed Inflation Reduction Act?

August 9, 2022 • By Steve Wamhoff

The Inflation Reduction Act approved by the Senate on Aug. 7 would raise more than $700 billion in new revenue over a decade by closing corporate tax loopholes, empowering the IRS to enforce the tax laws on the books, taxing stock buybacks, and extending a limitation on deductions for business losses. The IRA – if […]

Inflation Reduction Act Will Increase Tax Fairness, Reduce Inequality

August 7, 2022 • By Amy Hanauer

Amy Hanauer, Executive Director of the Institute on Taxation and Economic Policy, issued the following statement on “The Inflation Reduction Act (IRA) of 2022,” the reconciliation bill passed today by the Senate. “Today we made remarkable progress for America’s tax and climate policy. The IRA reduces corporate loopholes, collects revenue from those who defy tax […]

They Might Really Do It: The Senate Is About to Reform Our Tax Code

August 5, 2022 • By Steve Wamhoff

For now, the Senate is poised to reverse cuts to the IRS enforcement against wealthy tax evaders for the first time in a decade, crack down on tax-dodging by huge corporations for the first time since 1986, and finally address the method increasingly used by corporations to transfer income to shareholders to avoid federal taxes. The multi-decade winning streak of corporate lobbyists and special interests who have practically written many of our tax laws in recent years is about to come to an end.

Corporations are Shifting Profits to Wealthy Investors Tax-Free—Stock Buyback Tax Would Change That

August 5, 2022 • By Joe Hughes

Senate Democrats have announced an agreement on the Inflation Reduction Act that, among other changes to a previous version of the bill, would apply a 1 percent tax on corporations repurchasing their own stock. This proposal was included in the House-passed Build Back Better Act last year and was estimated at that time to raise $124 billion over 10 years. This measure would ensure that income transferred from corporations to wealthy shareholders does not continue to escape taxation.

Corporate Minimum Tax Examples: Apple Would Likely Pay More, 3M Would Not

August 5, 2022 • By Matthew Gardner

Apple, one of the largest corporations in the United States despite manufacturing most of its physical products offshore, would likely pay the corporate minimum tax that is included in the Inflation Reduction Act that the Senate is debating this week. 3M, a manufacturer that has about 40 percent of its workforce in the United States, likely would not pay the corporate minimum tax if current trends in the company’s profits and taxes continue, because it is already paying above 15 percent of its profits in taxes.

Jon Whiten

August 3, 2022 • By ITEP Staff

Jon leads ITEP’s work to shape the public debate around tax policy and ensure that policymakers, advocates, and other stakeholders are using ITEP’s data and analysis in order to make sound decisions.

Bloomberg Tax Op-Ed: Manchin-Schumer Deal Takes Sensible Aim at Corporate Tax Dodging

August 2, 2022

Revenue-raising provisions in the Inflation Reduction Act would bring long-overdue fairness to a tax system that for decades has been eroded by special breaks for the powerful and well-connected, says Steve Wamhoff of the Institute on Taxation and Economic Policy. Read more.