ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Why Local Governments Need an Anti-Racist Approach to Property Assessments

August 5, 2021 • By Ambika Sinha

Property taxes are among the oldest and most relied upon form of local taxes. Revenue raised from these taxes funds education, firefighting, law enforcement, street and infrastructure maintenance, and other essential services. Though all members of the community enjoy these public goods, homeowners of color, especially Black families, pay more as a share of home value in property taxes than their white counterparts.

Child Tax Credit Expansion Acknowledges There Is More We Can Do for Children “Decades of public policies have built inequities into our economic system, yet some political leaders and public figures continue to perpetuate the myth of a level playing field in which anyone who works hard enough can have it all.”

North Carolina Policy Watch: NC’s Tax Code Reinforces Racial Exclusion; Senate’s Proposed Budget Would Make Matters Worse

July 30, 2021

When one applies a unique tool developed by the Institute on Taxation and Economic Policy to assess the racial and ethnic impact of the budget proposal approved by the state Senate in June (SB 105), it becomes clear that the proposed income tax reductions will worsen the state’s exclusionary tax code. This analysis should serve […]

Fortune: Newsletters, Bull Sheet

July 29, 2021

39. That’s the number of profitable S&P 500 and/or Fortune 500 companies who paid no federal income tax from 2018 through 2020—the first three years that the Trump administration’s Tax Cuts and Jobs Act was in effect—per a new report from the Institute on Taxation and Economic Policy (ITEP) think tank. Read more

Common Dreams: 73 Major Corporations Paid Just 5.3% Federal Tax Rate Between 2018 and 2020: Report

July 29, 2021

Thirty-nine U.S. corporations reaping over $120 billion in profits between 2018 and 2020—the first three years of the so-called “GOP tax scam”—paid no net federal income tax, or claimed refunds during that period, a report published Thursday by the Institution on Taxation and Economic Policy revealed. Read more

Corporate Tax Avoidance Under the Tax Cuts and Jobs Act

July 29, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

Thirty-nine profitable corporations in the S&P 500 or Fortune 500 paid no federal income tax from 2018 through 2020, the first three years that the Tax Cuts and Jobs Act (TCJA) was in effect. Besides the 39 companies that paid nothing over three years, an additional 73 profitable corporations paid less than half the statutory corporate income tax rate of 21 percent established under TCJA. As a group, these 73 corporations paid an effective federal income tax rate of just 5.3 percent during these three years.

President Joe Biden’s “Build Back Better” plan is the most ambitious economic and social agenda since Lyndon B. Johnson’s Great Society. It would redirect policy priorities to create educational and economic opportunities for low- and middle-income people and require corporations and wealthy people to pay a fairer share of taxes.

Child Tax Credit Expansion Acknowledges There Is More We Can Do for Children

July 20, 2021 • By Aidan Davis

For the next six months, low-, middle- and upper-middle-income families with children are eligible to receive part of their 2021 Child Tax Credit (CTC) in advanced monthly payments. More than putting money in people’s pockets, this policy recognizes “the dignity of working-class families and middle-class families,” as President Biden said last week.

Opposition to Biden’s Tax Plan Has Nothing to Do with Small Businesses or Family Farms

July 16, 2021 • By Steve Wamhoff

Special interests lobbying against President Joe Biden’s tax agenda claim that his proposed corporate income tax rate hike will harm small businesses and that his proposed capital gains tax reforms will hurt family farms. Both claims are absurd attempts by powerful interests to pretend they are defending the little guy.

Washington Post Confirms that Corporations Are Bolder than Ever in Claiming Dubious Tax Breaks

July 16, 2021 • By Steve Wamhoff

IRS budget cuts starting in 2010 have forced the agency to reduce its audit rate for corporations with $20 billion or more in assets from 98 percent to 50 percent. The Washington Post found that during the decade, the amount of “uncertain tax benefits” claimed by corporations increased 43 percent, from $164 billion in 2010 to $235 billion in 2020.

Comparing athletes to inanimate objects, of course, is incredibly degrading. It’s also standard fare in the sports talk world to compare athletes to stocks in which you want to buy low and trade high to maximize your returns—the greatest return usually being championship trophies. It wasn’t until ProPublica released its latest report, The Billionaire Playbook: How Sports Owners Use Their Teams to Avoid Millions in Taxes, that we were able to see so clearly how the athlete as a stock is not just a dehumanizing concept in team sports at the individual level, but also how owners of sports teams…

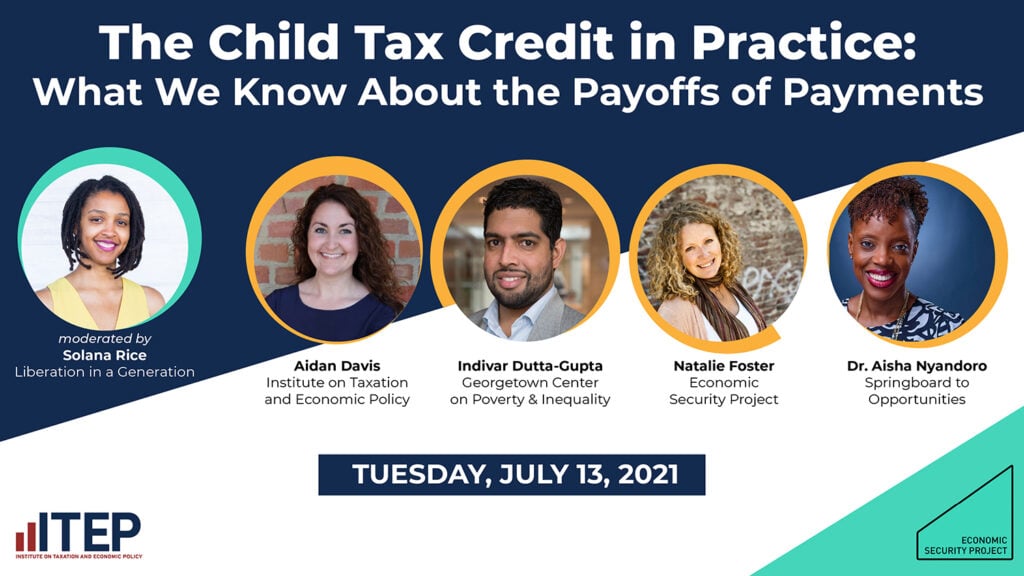

Experts Weigh in on the Payoffs of Advanced Child Tax Credit Payments

July 15, 2021 • By Jenice Robinson

During a Tuesday webinar (The Child Tax Credit in Practice: What We Know about the Payoffs of Payments) hosted by ITEP and the Economic Security Project, panelists explained why the expanded Child Tax Credit is a transformative policy that should be extended beyond 2021. They highlighted tax policy and anti-poverty research and discussed lessons learned from demonstration projects that have provided a guaranteed income to low-income families.

“It’s not just condominium buildings that are showing their age,” Peter Coy writes in a piece critiquing the condominium form of ownership for underinvesting in maintenance. Coy just as easily could have been describing American democracy that is showing its age in similar ways.

DC Fiscal Policy Institute: NEW VIDEOS: Why DC’s Wealthiest Should Pay their Fair Share

July 12, 2021

The highest income residents in DC pay less as a share of their income than the rest of us. At the same time, low-income Black and brown DC residents have been economically devastated by the pandemic. Watch videos

Washington State Budget & Policy Center: New Reforms Bring Balance and Equity to State’s Tax Code and Economy

July 9, 2021

People seeking a more equitable state tax code and stronger supports for parents scored major victories earlier this year in Washington state, after more than a decade of hard work and focused advocacy by community leaders. By enacting a new excise tax on extraordinary stock profits (capital gains) and an expansive new tax credit for […]

In Drive to Cut Taxes, States Blow an Opportunity to Invest in Underfunded Services

July 7, 2021 • By Marco Guzman

Many states find themselves in a peculiar fiscal situation right now: federal pandemic relief money has been dispersed to states and revenue projections have exceeded expectations set during the pandemic. Meanwhile, more and more workers are returning to jobs as vaccines roll out and typical economic activity resumes. Some states, however, have decided to squander their unexpected fiscal strength on tax cuts.

The Child Tax Credit in Practice: What We Know About the Payoffs of Payments (Webinar)

July 7, 2021 • By ITEP Staff

Join us for a discussion on why tax credits like the Child Tax Credit (CTC) expansion are good economic policy. You’ll hear from anti-poverty experts on why Congress should extend the policy beyond 2021 and what we can learn from an initiative providing low-income mothers in Jackson, Miss., $1,000 cash on a monthly basis, no strings attached. From theory to practice and what it means for American families, this CTC webinar will provide a unique angle through which to view this transformative policy.

President Joe Biden's American Families and Jobs plans intend to “build back better” and create a more inclusive economy. To fully live up to this ideal, the final plan must include undocumented people and their families.

Center for Migration Studies: Innovating Inclusion: A New Wave of State Activism to Include Immigrants in Social Safety Nets

July 1, 2021

States across the country are tackling an equity issue in the tax code by breaking from federal eligibility standards for their state Earned Income Tax Credits (EITCs). Specifically, states are taking it upon themselves to end the exclusion of taxpayers who file their taxes with an Individual Taxpayer Identification Number (ITIN). ITINs are personal tax […]

Policy Matters Ohio: Ohio Tax Cuts Would Go Mostly to the Very Affluent

June 29, 2021

Instead of using Ohio’s public resources to build strong, resilient communities, the General Assembly approved income-tax cuts that would favor the very wealthiest Ohioans, while providing only modest benefits for moderate-income Ohioans and nothing at all to the state’s poorest. Benefiting especially from the elimination of the top bracket of the tax, the most affluent […]

Policy Matters Ohio: Ohio Income-tax Cuts Would Reward the Wealthiest

June 29, 2021

Income-tax cuts approved by the General Assembly in the budget bill would favor the very wealthiest Ohioans, while providing only modest benefits for moderate-income Ohioans and nothing at all to the state’s poorest. Benefiting especially from the elimination of the top bracket of the tax, the most affluent 1% of Ohioans would see an average […]

A growing group of state lawmakers are recognizing the extent to which low- and middle-income Americans are struggling and the ways in which their state and local tax systems can do more to ensure the economic security of their residents over the long run. To that end, lawmakers across the country have made strides in enacting, increasing, or expanding tax credits that benefit low- and middle-income families. Here is a summary of those changes and a celebration of those successes.

When Tax Breaks for Retirement Savings Enrich the Already Rich

June 25, 2021 • By Steve Wamhoff

Members of Congress frequently claim they want to make it easier for working people to scrape together enough savings to have some financial security in retirement. But lawmakers’ preferred method to (ostensibly) achieve this goal is through tax breaks that have allowed the tech mogul Peter Thiel to avoid taxes on $5 billion. This is just one of the eye-popping revelations in the latest expose from ProPublica.

Oregon State Legislature: House Committee On Revenue 06/24/2021

June 24, 2021

Oregon lawmakers discuss a SALT-cap workaround provision. ITEP analysis found that in Oregon more than 91 percent of the tax cut benefits of repealing the SALT cap would go to those earning more than $200,000, and four of five households that benefit are white-led households. Watch here

North Carolina Justice Center: Five Takeaways from the Senate’s Budget Proposal

June 23, 2021

The Senate’s budget plan would bring the state’s investments to a new low while committing the state to untold losses in the form of revenue reductions by eliminating income taxes for profitable corporations by 2028 and lowering the already flat (read: regressive) personal income tax rate. Read more