ITEP's Research Priorities

- 2025 tax debate

- Blog

- Cannabis Taxes

- Corporate Taxes

- Corporate Taxes

- Earned Income Tax Credit

- Education Tax Breaks

- Estate Tax

- Federal Policy

- Fines and Fees

- Georgia

- Immigration

- Income & Profits

- Income Taxes

- Inequality and the Economy

- ITEP Work in Action

- Local Income Taxes

- Local Policy

- Local Property Taxes

- Local Refundable Tax Credits

- Local Sales Taxes

- Maps

- Media Quotes

- News Releases

- OBBBA

- Other Revenues

- Personal Income Taxes

- Property & Wealth

- Property Taxes

- Property Taxes

- Publications

- Refundable Tax Credits

- Sales & Excise

- Sales, Gas and Excise Taxes

- Sales, Gas and Excise Taxes

- SALT Deduction

- Select Media Mentions

- Social Media

- Staff

- Staff Quotes

- State Corporate Taxes

- State Policy

- State Reports

- States

- Tax Analyses

- Tax Basics

- Tax Credits for Workers and Families

- Tax Credits for Workers and Families

- Tax Guide

- Tax Principles

- Tax Reform Options and Challenges

- Taxing Wealth and Income from Wealth

- Toolkits

- Trump Tax Policies

- Video

- Webinar

- Who Pays?

Different Approaches to the Trump Tax Law’s Cap on Deductions for State and Local Taxes (SALT)

January 17, 2025 • By Steve Wamhoff

President Trump and the Republican majorities in the House and Senate may not extend the $10,000 cap on federal income tax deductions for state and local taxes (SALT), the one part of the 2017 law that significantly limits tax breaks for the rich. And, depending on which proposal they settle on, leaving out the existing cap on SALT deductions could add between $10 billion and over $100 billion each year to the total cost of their tax plan.

Congress Could — But Won’t — Pass a Tax Package That Pays for Itself

January 17, 2025 • By Joe Hughes

If Republican lawmakers were serious about deficit-neutral tax reform, they would focus on increasing taxes for the ultra-wealthy and large corporations. The absence of such proposals in their plan reveals their true priority: delivering enormous tax cuts to the wealthiest Americans while average working families receive crumbs.

Nick Johnson

January 15, 2025 • By ITEP Staff

Nick serves as a Senior Fellow with ITEP’s state and local policy teams. He brings three decades of expertise in state and local tax policy to advance economic justice and sustainable public finance. Most recently, he led the District of Columbia Tax Revision Commission as Executive Director, where he guided the independent, decennial commission’s comprehensive […]

It’s a new year, and state legislatures across the country are resolved to write new tax policy. Tax debates are heating up nearly everywhere in the early days of 2025, but states’ fiscal situations vary dramatically. New York is considering expanding the state’s Child Tax Credit following Gov. Hochul’s proposed expansion. On the other side […]

Trump’s Plan to Extend His 2017 Tax Provisions: Updated National and State-by-State Estimates

January 8, 2025 • By Steve Wamhoff

Trump’s plan to make most of the temporary provisions of his 2017 tax law permanent would disproportionately benefit the richest Americans. This includes all major provisions except the $10,000 cap on deductions for state and local taxes (SALT) paid.

While most states have a graduated rate income tax, some state lawmakers have recently become enamored with the idea of moving toward flat rate taxes instead. What’s the difference? And are states well served by the transition? In short: A flat tax is one where each taxpayer pays the same percentage of their income whereas […]

As we close out 2024, we want to lift up the tax charts we published this year that received the most engagement from readers. Covering federal, state, and local tax work, here are our top charts of 2024.

As Congress negotiates a bill for federal funding during the lame-duck session, lawmakers would be wise to remember that stripping funds from the IRS costs more than it saves. On the table in the appropriations bill is a $20 billion recission of funds to the nation’s tax administration. While this may look like a spending cut, it will increase deficits by $46 billion due to a drop in the agency’s capacity to enforce taxes on wealthy individuals owed under existing federal law.

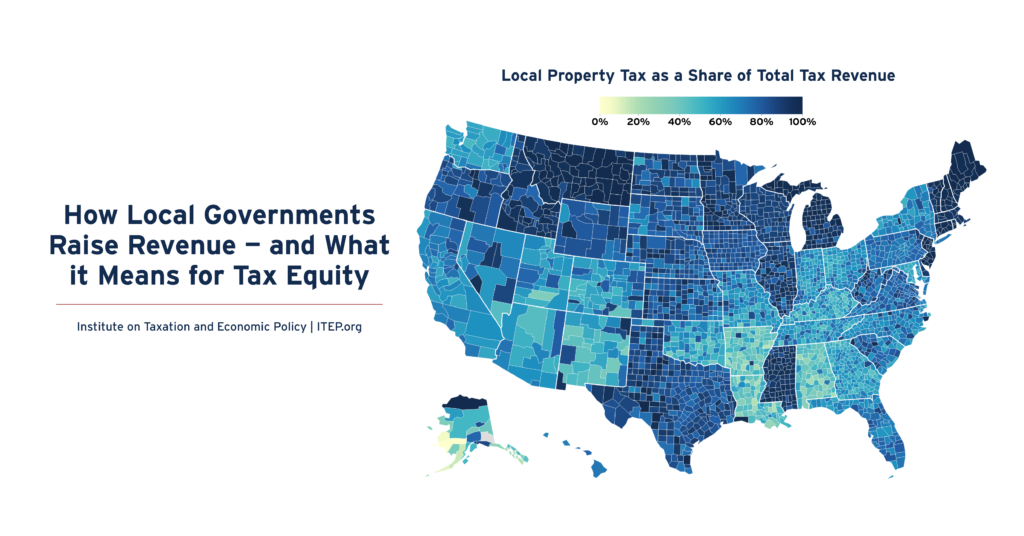

How Local Governments Raise Revenue — and What it Means for Tax Equity

December 5, 2024 • By Galen Hendricks, Rita Jefferson

Local taxes are key to thriving communities. One in seven tax dollars in the U.S.—about $886 billion annually—is levied by local governments in support of education, infrastructure, public health, and other priorities. Three fourths of this funding comes from property taxes, 18 percent comes from sales and excise taxes, and six percent comes from income taxes.

State Rundown 12/3: Some States Cast Away Fiscal Responsibility as They Plan for 2025

December 3, 2024 • By ITEP Staff

The 2025 legislative season will be here before we know it, and state lawmakers have begun unveiling their priorities and proposals. Unfortunately, despite stagnating revenue growth, many lawmakers continue to push for deep, regressive tax cuts - often before the full impact of previous tax cuts is felt.

Louisiana Gov. Jeff Landry called the legislature back to the capitol the day after the national election to take up his plan to overhaul the state’s tax system during a 20-day special session. Our analysis shows the tax overhaul would worsen the inequity already rampant in Louisiana’s tax system while potentially shortchanging essential services for families across the state.

State Rundown 11/20: Some Budgets and Tax Proposals Fail to Defy Gravity, Fall Short

November 20, 2024 • By ITEP Staff

This week, there are high-profile budget and tax debates at both the state and local levels. The Louisiana legislature continues to debate Gov. Jeff Landry’s deeply regressive tax package in a special session focused on replacing corporate and personal income tax revenue with additional sales taxes, but some efforts to find offsets for the cuts […]

On Election Day, Voters Across the Country Chose to Invest in Their States & Communities

November 19, 2024 • By Kamolika Das

On election day, voters across the country — in states red and blue and communities rural and urban — approved a wide range of state and local ballot measures on taxation and public investment. The success of these measures clearly shows that voters are willing to invest in public priorities that feel tangible and close to home.

Taxing Transportation Is One Great Way to Reduce Carbon Emissions

November 12, 2024 • By Amy Hanauer

Federal, state, and local tax codes are important but underused tools that can create a more climate-resilient, less carbon-emitting America. A modernized tax code would stop subsidizing emissions and instead encourage lower-carbon design. Because cars and trucks produce roughly one-fourth of US greenhouse gas emissions, transportation taxation is a great starting point.

Billionaires and businesses have too much power in Washington. Tax revenue is needed to pay for things we all need. If we want economic justice, racial justice and climate justice, we must have tax justice.

Tax policy results are mixed across the country as many voters weigh in on state and local ballot measures. For example, Washington state voted to maintain its new progressive tax on capital gains; Georgia voters capped growth in property tax assessments; Illinois voters approved a call for a millionaires’ tax; North Dakota voters rejected property […]

Louisiana Gov. Jeff Landry is proposing a regressive tax reform package that would enact a flat personal and corporate income tax while expanding the state’s sales tax base and eliminating certain exemptions to make up for a portion of the lost revenue. West Virginia continues to chip away at its personal income tax, one of the state’s few progressive revenue options. And advocates in New York are rallying around a package of progressive tax legislation that would tax capital gains at higher rates, enact higher income tax brackets on multi-millionaires, and tax unrealized capital gains of billionaires.

The tax proposals from Vice President Kamala Harris would, on average, lead to a tax increase for the richest 1 percent of Americans and a tax cut for all other income groups.

Fifteen Companies Each Avoided More than $1 Billion in Taxes from a Single Trump Tax Cut

October 10, 2024 • By Joe Hughes, Spandan Marasini

The deduction for Foreign-Derived Intangible Income (FDII), one of the tax cuts included in former President Trump’s signature 2017 tax law, provides a lower effective tax rate on income earned from intangible assets, such as patents, trademarks, and other forms of intellectual property. Since the law went into effect in 2018, 15 corporations have separately reported more than $1 billion in tax benefits. Alphabet (the parent company of Google) reported the most, at more than $11 billion in tax breaks from 2018 to 2023. Other beneficiaries include large tech firms such as Meta, Microsoft, Intel, and Qualcomm.

State Rundown 10/10: More Special Sessions, More Proposed Tax Cuts

October 10, 2024 • By ITEP Staff

This week several states are getting an early start at writing new tax policy in special sessions. In West Virginia, the legislature has come to an agreement with Gov. Justice on an additional tax cut—on top of already-planned cuts. The 2 percent cut will cost the state $49 million a year and come from spending […]

A Distributional Analysis of Donald Trump’s Tax Plan

October 7, 2024 • By Carl Davis, Erika Frankel, Galen Hendricks, Joe Hughes, Matthew Gardner, Michael Ettlinger, Steve Wamhoff

Former President Donald Trump has proposed a wide variety of tax policy changes. Taken together, these proposals would, on average, lead to a tax cut for the richest 5 percent of Americans and a tax increase for all other income groups.

Extending Temporary Provisions of the 2017 Trump Tax Law: Updated National and State-by-State Estimates

September 13, 2024 • By Steve Wamhoff

The TCJA Permanency Act would make permanent the provisions of the Tax Cuts and Jobs Act of 2017 that are set to expire at the end of 2025. The legislation would disproportionately benefit the richest Americans. Below are graphics for each state that show the effects of making TCJA permanent across income groups. See ITEP’s […]

Voucher Boondoggle: House Advances Plan to Give the Wealthy $1.20 for Every $1 They Steer to Private K-12 Schools

September 12, 2024 • By Carl Davis

The U.S. House Ways & Means Committee has advanced a new school voucher bill. H.R. 9462—the Educational Choice for Children Act of 2024—would create an unprecedented tax incentive designed to fund private, mostly religious, K-12 schools.

State Earned Income Tax Credits Support Families and Workers in 2024

September 12, 2024 • By Neva Butkus

Nearly two-thirds of states (31 plus the District of Columbia and Puerto Rico) have an Earned Income Tax Credit. These credits boost low-paid workers’ incomes and offset some of the taxes they pay, helping lower-income families achieve greater economic security.

State Child Tax Credits Boosted Financial Security for Families and Children in 2024

September 12, 2024 • By Neva Butkus

Fifteen states plus the District of Columbia provide Child Tax Credits to reduce poverty, boost economic security, and invest in children. This year alone, lawmakers in three states – Colorado, New York, and Utah – expanded their Child Tax Credits while lawmakers in the District of Columbia created a new credit that will take effect in 2025.