Blog - Sales, Gas and Excise Taxes

48 posts

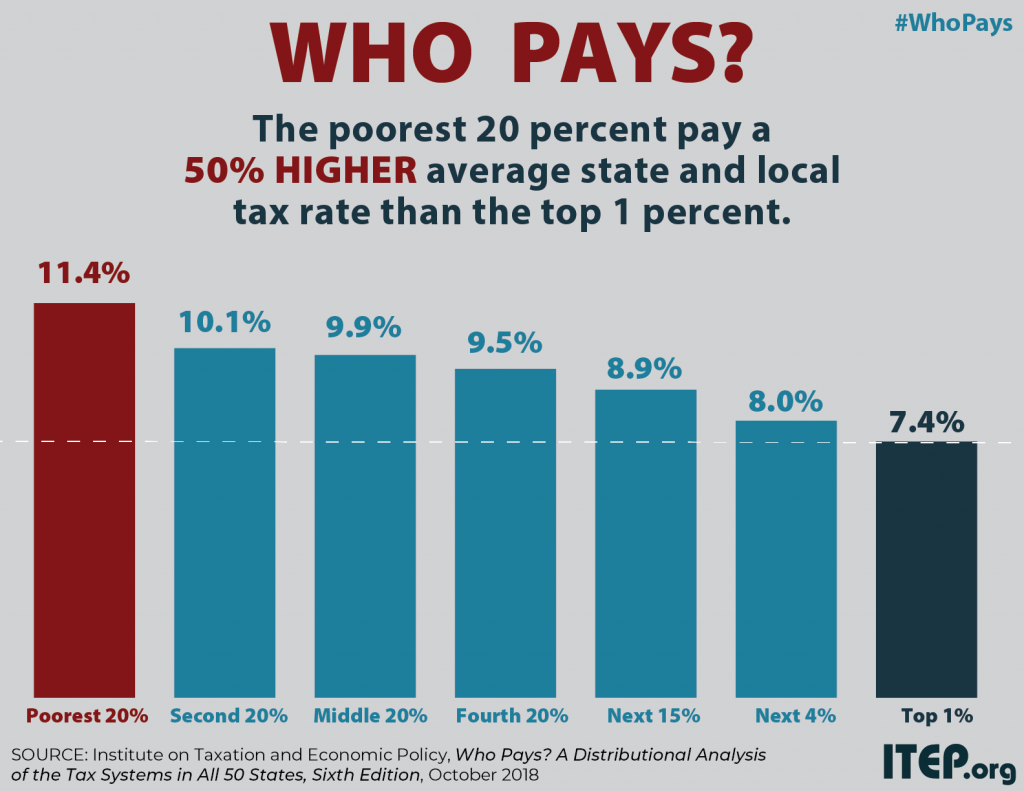

New Report Finds that Upside-down State and Local Tax Systems Persist, Contributing to Inequality in Most States

October 17, 2018 • By Aidan Davis

State and local tax systems in 45 states worsen income inequality by making incomes more unequal after taxes. The worst among these are identified in ITEP’s Terrible 10. Washington, Texas, Florida, South Dakota, Nevada, Tennessee, Pennsylvania, Illinois, Oklahoma, and Wyoming hold the dubious honor of having the most regressive state and local tax systems in the nation. These states ask far more of their lower- and middle-income residents than of their wealthiest taxpayers.

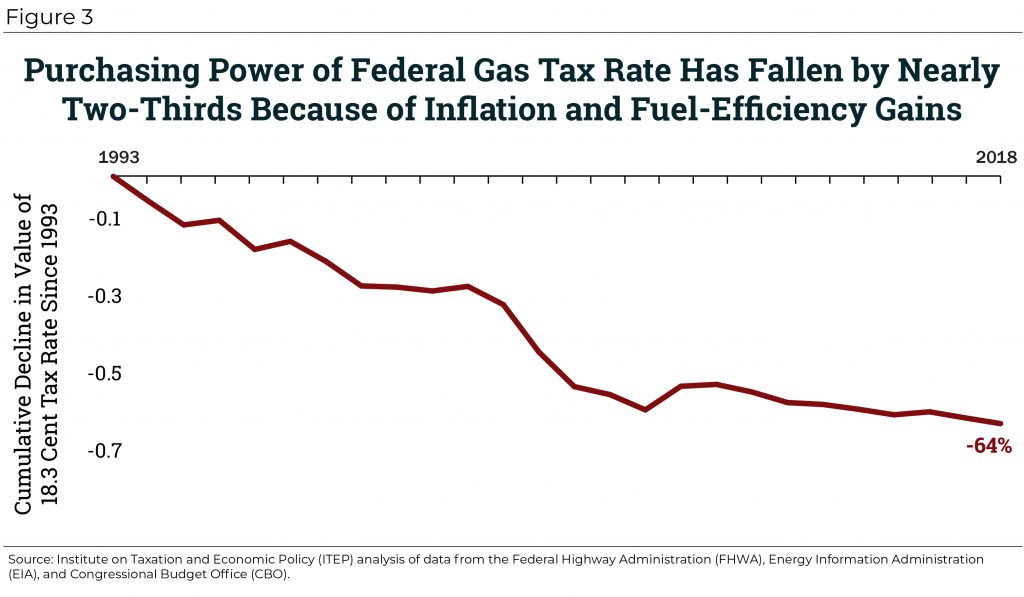

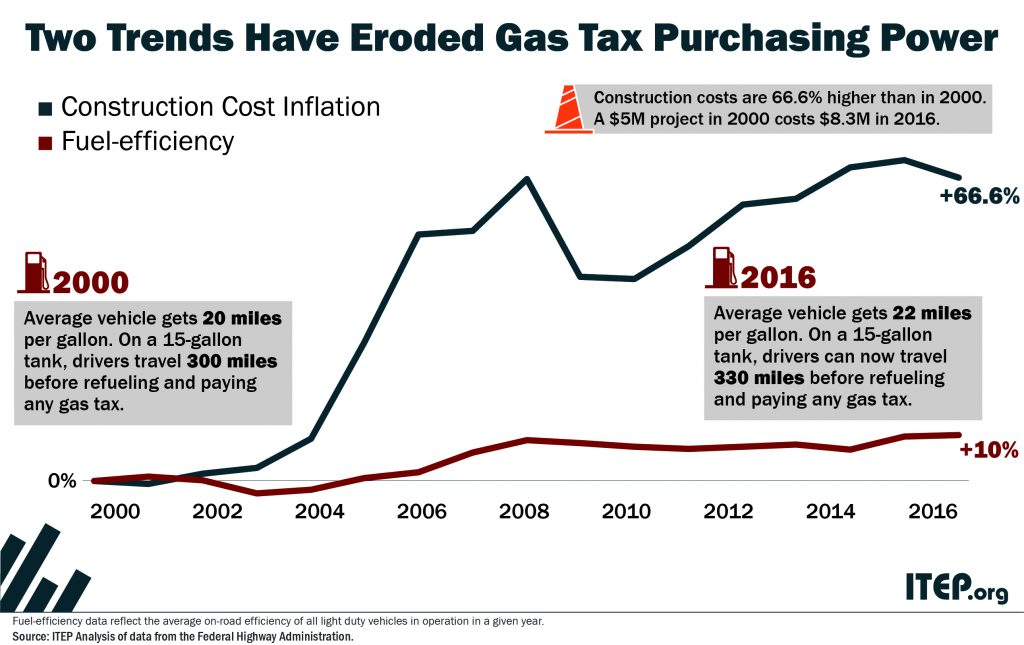

An Unhappy Anniversary: Federal Gas Tax Reaches 25 Years of Stagnation

September 25, 2018 • By Carl Davis

The federal gas tax was last raised on Oct. 1, 1993, the same year that the classic movie Groundhog Day was unveiled to the American public. In the film, Phil Connors (played by Bill Murray) gets caught in a time loop and spends decades reliving the same cold, February day in Punxsutawney, Penn. Those of us lamenting the 25-year stagnation of the federal gas tax can’t help but feel some of that same sense of repetition. Federal lawmakers occasionally discuss updating the gas tax, but top lawmakers have yet to put in the effort needed to shepherd such a change…

Consumers’ growing interest in online shopping and “gig economy” services like Uber and Airbnb has forced states and localities to revisit their sales taxes, for instance. Meanwhile new evidence on the dangers and causes of obesity has led to rising interest in soda taxes, but the soda industry is fighting back. Carbon taxes are being discussed as a tool for combatting climate change. And changing attitudes toward cannabis use have spurred some states to move away from outright prohibition in favor of legalization, regulation and taxation.

18 States Will Take Holidays from Sound Tax Policy This Year

July 12, 2018 • By Dylan Grundman O'Neill

State sales tax holidays, our newly updated policy brief shows, are the equivalent of the bad kind of holiday vacation: tax policy that sounds nice at first but ultimately cuts corners, wastes money, precludes better options, and leaves states worse off than they would be without them. Unfortunately, while several states have wised up about sales tax holidays in recent years, 18 states will fall for the superficial attraction of these tax policy gimmicks in 2018.

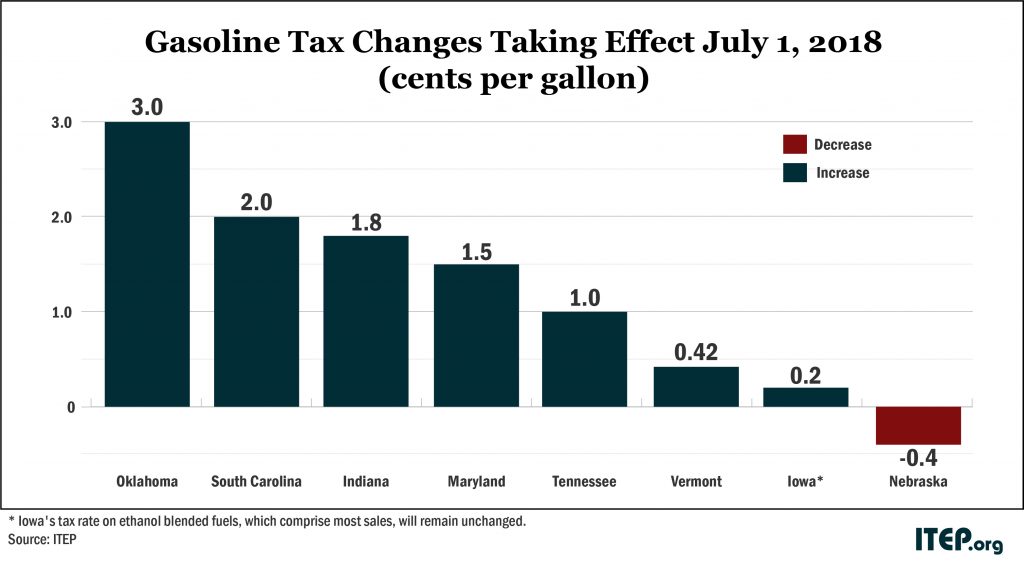

Gas Taxes Rise in Seven States, Including an Historic Increase in Oklahoma

June 26, 2018 • By Carl Davis

A rare sight is coming to Oklahoma. The last time the Sooner State raised its gas tax rate, the Berlin Wall was still standing, and Congress was debating whether to ban smoking on flights shorter than two hours. Fast forward 31 years, and Oklahoma is finally at it again. On Sunday, the state’s gas tax rate will rise by 3 cents and its diesel tax rate by 6 cents. Both taxes will now stand at 19 cents per gallon—still among the lowest in the country. But Oklahoma isn’t the only state where gas taxes will soon rise.

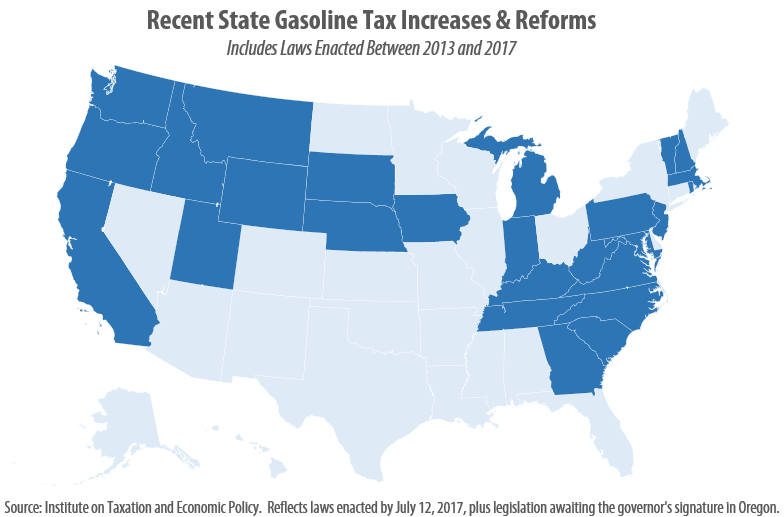

An updated version of this blog was published in April 2019. State tax policy can be a contentious topic, but in recent years there has been a remarkable level of agreement on one tax in particular: the gasoline tax. Increasingly, state lawmakers are deciding that outdated gas taxes need to be raised and reformed to fund infrastructure projects that are vital to their economies.

Under Pressure, Trump Organization Abandons Risky Sales Tax Avoidance Strategy in New York. Will It Face Penalties for Taxes it Did Not Collect?

May 3, 2018 • By Carl Davis

While President Trump was busy publicly shaming Amazon for failing to collect some state and local sales taxes, his own business’s online store was not only failing to collect the same taxes, but was arguably more aggressive than Amazon in refusing to do so. As of last month, TrumpStore.com was not even collecting sales tax in New York State despite having a “flagship retail store” inside Trump Tower, in Manhattan. As ITEP pointed out at that time: “It seems likely that the presence of a New York location should be enough to put TrumpStore.com within reach of New York’s sales…

Trends We’re Watching in 2018, Part 5: 21st Century Consumption Taxes

April 20, 2018 • By Misha Hill

We're highlighting the progress of a few newer trends in consumption taxation. This includes using the tax code to discourage consumption of everything from plastic bags to carbon and collecting revenue from emerging industries like ride sharing services and legalized cannabis sales.

The U.S. Supreme Court is scheduled to consider a case next week (South Dakota v. Wayfair, Inc.) that has the potential to significantly improve states and localities’ ability to enforce their sales tax laws on Internet purchases.

What to Expect if the Supreme Court Allows for Online Sales Tax Collection

April 11, 2018 • By Carl Davis

Online shopping is hardly a new phenomenon. And yet states and localities still lack the authority to require many Internet retailers to collect the sales taxes that their locally based, brick and mortar competitors have been collecting for decades.

President Trump’s latest Twitter target, the Amazon Corporation, is now under the microscope for its state and local tax avoidance. In a Thursday tweet, the President claimed that “[u]nlike others, they pay little or no taxes to state & local governments.” Such a statement is a startling reversal for a president who previously said his own ability to avoid paying income taxes “makes me smart.”

Amazon and Other E-Retailers Get a Free Pass from Some Local-Level Sales Taxes

March 26, 2018 • By Carl Davis

A new ITEP analysis reveals that in seven states (Alabama, Alaska, Idaho, Iowa, Mississippi, New Mexico, and Pennsylvania), the nation’s largest e-retailer, Amazon.com, is either not collecting local-level sales taxes or is charging a lower tax rate than local retailers. In other states, such as Colorado and Illinois, Amazon is collecting local tax because it has an in-state presence, but localities cannot collect taxes from other e-retailers based outside the state.

States May Be Finally Learning Their Lesson on Back-To-School Sales Tax Holidays

July 21, 2017 • By Dylan Grundman O'Neill

State lawmakers face a dilemma when it comes to sales tax holidays, an attractive and popular policy that nonetheless proves to be a poor choice compared to developing thoughtful, targeted tax policies or investing in well-executed public services. Luckily, word seems to be getting out that the costs associated with these holidays far outweigh their purported benefits.

Gas Taxes Will Rise in 7 States to Fund Transportation Improvements

June 28, 2017 • By Carl Davis

Summer gas prices are at their lowest level in twelve years, which makes right now a sensible time to ask drivers to pay a little more toward improving the transportation infrastructure they use every day. Seven states will be doing this on Saturday, July 1 when they raise their gasoline tax rates. At the same time, two states will be implementing small gas tax rate cuts.

South Carolina’s Gas Tax Deal: Could Have Been Worse, Could Have Been Better

May 12, 2017 • By Dylan Grundman O'Neill

South Carolina lawmakers this week raised the state’s gas tax for the first time in 28 years, a time period that tied for the third-longest in the nation. While the increase was meaningful and hard-fought, the final result remains flawed in ways that could have been easily remedied or avoided. The biggest positive of the […]

This post was updated July 12, 2017 to reflect recent gas tax increases in Oregon and West Virginia. As expected, 2017 has brought a flurry of action relating to state gasoline taxes. As of this writing, eight states (California, Indiana, Montana, Oregon, South Carolina, Tennessee, Utah, and West Virginia) have enacted gas tax increases this year, bringing the total number of states that have raised or reformed their gas taxes to 26 since 2013.

The April Fool’s Joke Is on Consumers: April 1 Marks Record-Breaking Procrastination on Federal Gas Tax Policy

March 29, 2017 • By Carl Davis

It’s only appropriate that April 1 will mark a new milestone in foolish federal transportation infrastructure policy. On Saturday, the nation’s federal gasoline tax rate will have been stuck at 18.3 cents per gallon for 8,584 days in a row—or more than 23.5 years. This surpasses the previous record of 8,583 days without an update […]

Our ever-changing economy demands that lawmakers update our tax laws to keep pace. Take, for example, the growth of online sales. As recently as six years ago, Amazon, the nation’s biggest online retailer, only collected sales tax on consumer purchases in five states. This meant that state treasuries were missing critical sales tax revenue, a […]

For decades, Amazon.com helped its customers dodge the sales taxes they owed to gain an advantage over its competitors. But as the company’s business strategy has changed, so has its tax collection. As recently as 2011, the nation’s largest e-retailer was collecting sales tax in just 5 states, home to 11 percent of the country’s […]

What to Watch in the States: Modernizing Sales Taxes for a 21st Century Economy

February 15, 2017 • By Misha Hill

This is the fourth installment of our six-part series on 2017 state tax trends. The introduction to this series is available here. State lawmakers often find themselves looking for ways to raise revenue to fund vital public services, fill budget gaps, or pay for the elimination or weakening of progressive taxes. Lately, that search has […]

This is the second installment of our six part series on 2017 state tax trends. The introduction to this series is available here. State tax policy can be a divisive issue, but no area has generated more agreement among lawmakers across the country than the need to raise new revenues to fund infrastructure improvements. The […]

And Then There Were Six: Amazon Expands Its Sales Tax Collection

January 30, 2017 • By Carl Davis

UPDATE: After this post was published, Amazon announced that it will begin collecting sales tax in Oklahoma on March 1. This post has been updated to reflect this development. The nation’s largest Internet retailer has made an about-face on its sales tax policy, making consumers’ ability to evade sales tax on online purchases a little […]

47 Years Later, Alaska Considers Playing Catch-Up with its Motor Fuel Tax

January 25, 2017 • By Carl Davis

Alaska Gov. Bill Walker recently proposed tripling the gasoline and diesel tax rates paid by Alaska motorists to generate funding for the state’s infrastructure. In a different state, tripling the motor fuel tax might be a radical policy change. But Alaska’s tax has not been updated since 1970 and because of those 47 years of […]